Current Report Filing (8-k)

July 06 2020 - 4:26PM

Edgar (US Regulatory)

false0000009984

0000009984

2020-06-29

2020-06-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 29, 2020

BARNES GROUP INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

|

|

|

|

|

|

|

|

|

|

|

1-4801

|

|

06-0247840

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

123 Main Street

|

|

|

|

Bristol

|

|

|

|

Connecticut

|

|

06010

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(860) 583-7070

Registrant's telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report)

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading Symbol

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, par value $0.01 per share

|

|

B

|

|

New York Stock Exchange

|

|

|

|

|

|

|

|

Item 2.05

|

|

Costs Associated with Exit or Disposal Activities.

|

|

|

|

On June 29, 2020, Barnes Group Inc. (the "Company") authorized restructuring and workforce reduction actions to be implemented across its businesses and functions. These actions were taken in response to the macroeconomic disruption in global industrial and aerospace end markets arising out of the COVID-19 pandemic. These actions are expected to be substantially completed in 2020 and reduce the Company’s global workforce by approximately 8%.

The pretax charges associated with restructuring and workforce reductions are estimated to approximate $20 million, with approximately $18 million of the charges being recorded in the second quarter of 2020. Of the aggregate amount, approximately $19 million relates to employee termination costs, primarily employee severance and other termination benefits, and are to be paid in cash. The Company anticipates annualized cost savings of approximately $30 million from these actions.

On July 6, 2020, a press release relating to the foregoing was issued by the Company and is attached as Exhibit 99.1 hereto and incorporated by reference herein.

|

|

|

|

|

|

|

|

Forward-Looking Statements. This Current Report on Form 8-K contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements often address our expected future operating and financial performance and financial condition, and often contain words such as "anticipate," "believe," "expect," "plan," "estimate," "project," and similar terms. These forward-looking statements do not constitute guarantees of future performance and are subject to a variety of risks and uncertainties that may cause actual results to differ materially from those expressed in the forward-looking statements. These include, among others: the ongoing impacts of the COVID-19 pandemic on our business, including on demand, supply chain and operations and the industries and customers that we serve; the failure to achieve anticipated cost savings associated with the workforce reductions and restructuring actions discussed herein (the “Plan”); the ability to successfully execute the Plan; higher than anticipated costs in implementing the Plan; the preliminary nature of our cost and savings estimates related to the Plan, including the timing of such charges and savings, which are subject to change as the Company makes decisions and refines estimates over time; timing delays in implementing the Plan; our ability to realize all of the cost savings and benefits anticipated in connection with the Plan; management and employee distraction resulting from the Plan; and other risks and uncertainties described in documents filed with or furnished to the Securities and Exchange Commission by the Company, including, among others, those in the Management's Discussion and Analysis of Financial Condition and Results of Operations and Risk Factors sections of the Company's filings. The Company assumes no obligation to update its forward-looking statements.

|

|

|

|

|

|

Item 9.01

|

|

Financial Statements and Exhibits.

|

|

(d) Exhibits.

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

Press Release dated July 6, 2020.

|

|

104

|

|

Cover page from this Current Report on Form 8-K, formatted in Inline XBRL.

|

SIGNATURES

|

|

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

BARNES GROUP INC.

|

|

|

(Registrant)

|

|

|

|

|

|

Date: July 6, 2020

|

By:

|

/s/ CHRISTOPHER J. STEPHENS, JR.

|

|

|

|

Christopher J. Stephens, Jr.

Senior Vice President, Finance and

Chief Financial Officer

|

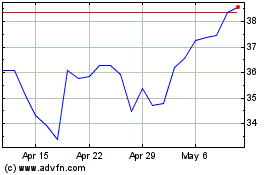

Barnes (NYSE:B)

Historical Stock Chart

From Mar 2024 to Apr 2024

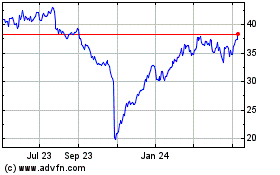

Barnes (NYSE:B)

Historical Stock Chart

From Apr 2023 to Apr 2024