UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934 (Amendment

No. ___)

Filed

by the Registrant x

Filed

by a Party other than the Registrant ¨

Check

the appropriate box:

|

|

¨

|

Preliminary Proxy Statement

|

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

¨

|

Definitive Proxy Statement

|

|

|

x

|

Definitive Additional Materials

|

|

|

¨

|

Soliciting Material Pursuant to Rule 14a-12

|

AMREP CORPORATION

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy Statement,

if Other Than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule

0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

¨

|

Fee paid previously with preliminary materials:

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify

the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or

the form or schedule and the date of its filing.

|

|

|

1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

July 31, 2020

To Our Owners:

AMREP Corporation ended fiscal year 2020

with a clear sense of purpose and a strong balance sheet. Despite the coronavirus pandemic and the economic problems that the country

currently faces, we expect fiscal year 2021 to be one of considerable progress in our business.

Our goal is to be a leading New Mexico

real estate company focused on sustainable long-term success and profitability. Our strategy is to leverage our talented and highly

dedicated team of employees to expand our operations through the monetization of our land inventory, acquisition of new land for

development, expansion of our new homebuilding business and growing related real estate capabilities in an opportunistic manner.

Our goal, strategy and operations are grounded in an overarching intent of generating strong returns on capital and maximizing

per share equity value on a long-term basis.

New Mexico, where we own more than 18,000

acres of land, is our primary operational focus. Our land development operations include land entitlement, installation of infrastructure

and sales of finished lots to homebuilders. During fiscal year 2020, we launched an organic expansion of our operations with our

new internal homebuilder, which will help monetize our land holdings, capture a greater share of the financial returns generated

from our subdivisions and enhance our negotiating position when selling lots to external homebuilders. We have retained various

mineral rights in New Mexico and Colorado, which are the subject of leases to third parties. We also own office and warehouse buildings

in Florida and raw land in Colorado, all of which we are seeking to monetize.

Over the past few years, our significant

cash flow and liquidation of non-real estate assets has allowed us to repay outstanding debt, reduce significantly the liability

to our frozen pension plan and pursue expanded real estate operations, including land acquisition and development and homebuilding

projects, all of which require substantial capital. We plan to continue to monetize our non-core assets and redeploy that capital

to increase per share equity value.

Now, as we look to the future, our sole

focus is on real estate. We have assembled a small entrepreneurial team with the ability to identify and effectively evaluate the

time adjusted risk and profitability of projects – whether in traditional land development or homebuilding, commercial build-to-suit

developments or other real estate activities. While still at an early stage, we are proud of their efforts to date and their demonstrated

ability to timely deliver on projects. We believe that we can leverage that ability to accelerate the monetization of our Rio Rancho

core asset and build a profitable, differentiated real estate company in the Rio Rancho/Albuquerque/Santa Fe area.

We remain grounded in our expectations

given our broad experience through many different real estate business cycles. We emphasize thoughtful advance planning and conservatism,

which will allow us to weather the inevitable business cycle downturns and provide us with a sound basis to make balanced decisions

for short-term results and long-term success. Our advance planning and conservative business principles will guide and inform how

we use our cash in these efforts. We regularly evaluate the best use of our funds, including borrowing for projects and capital

allocation alternatives. We try to maintain a reasonable level of cash to support our growth plans and new opportunities, and our

net cash after deducting outstanding amounts on traditional debt facilities has been stable over the past three years: $13,600,000

as of April 30, 2020, $11,950,000 as of April 30, 2019, $12,200,000 as of April 30, 2018 and $11,800,000 as of April 30, 2017.

We believe this stable net cash balance provides us with the optionality to engage in value creation when the right opportunities

arise.

For example, when a local builder in Albuquerque

was restructuring itself, we were able to invest some of our funds through land banking of finished lots on their behalf. We had

the expertise to quickly evaluate the investment and the funds to invest in a low-risk project with a significant percentage return

on capital. This process was repeated on a second land banking project. As a result of these investments, we have developed a strong

and mutually beneficial relationship with a top regional homebuilder through which we have sourced additional projects, including

Mariposa, Tierra Contenta and Lavender Fields as disclosed in our annual report.

AMREP

CORPORATION

620 West Germantown Pike, Suite 175 ● Plymouth Meeting, PA 19462

We are also aware that many of the projects

we evaluate may take several years to bring to fruition or grow into a significant part of our operation. In the land development

business, our historical experience has taught us patience – where acquisition, entitlement, development and sale of land

projects may take many years for even a mid-sized project. We factor this requirement for patience into our project evaluations

to ensure an appropriate return on capital is achieved for our shareholders. This conservatism makes for a highly selective process

so that only the best projects are ultimately pursued. For example, in 2020, we acquired 28 acres of land in Bernalillo County,

New Mexico following almost two years of diligence and obtaining of entitlements, and our patience will be further required as

we spend the next ten months constructing the subdivision before revenue from the first closing of finished lots will be realized.

Similarly, our internal homebuilding operation has been under development with a minimal cash investment for the past two years

after we realized that the acquisition of a local production homebuilder was not achievable in the near-term on terms that met

our risk/return hurdles – having capital available enabled us to pursue this operational expansion. Our start-up homebuilding

operation is well-positioned and we have high hopes for this business in fiscal year 2021 and beyond.

Successfully executing our strategy also

requires strong corporate governance. We have an active and informed Board of Directors that both oversees and provides guidance

to our management. Our directors own 22.6% of the outstanding shares of AMREP, which ensures alignment of shareholder interests

with the execution of our strategy. The Board regularly reviews our corporate governance to determine whether any changes are warranted.

For example, we reduced the size of the Board from seven directors in 2010, to six directors in 2011, to five directors in 2013

and to four directors in 2015 to better align the size of the Board with the smaller size of the company. We also reduced director

compensation during this period and converted a substantial portion of that compensation from cash to equity.

As we have learned from our evaluations

of various real estate projects, listening is one of the keys to resiliency in our business. To that end, we are always happy to

engage with our shareholders. Your ideas and viewpoints help to provide additional context for our decision-making and also point

out those areas where additional information in our public statements may be helpful to more effectively communicate our strategy

and execution plans.

We recognize that you as shareholders are

not privy to our project and operational evaluations, including their required cash investments. We can assure you, however, that

with our current Board and management team, we intend to use our human talent and financial resources to grow and increase the

value of our real estate business, both absolutely and on a per share basis. Our aim is not growth for growth’s sake; rather,

it is to build a business with high returns on the capital we employ. In so doing, we will be patient in executing on our strategy

but will act quickly when the right opportunities present themselves. We will continue to support a strong entrepreneurial management

team, we will evaluate our capital allocation in light of available and planned business opportunities and the possible return

of excess capital to shareholders and we will be good stewards of AMREP. We want this to be a business you are proud to own, whose

identity is clearly appreciated and which can help you achieve your investment goals as a long-term shareholder.

We appreciate your continued support.

Sincerely,

|

Christopher V. Vitale

President and Chief Executive Officer

|

Edward B. Cloues, II

Chairman of the Board

|

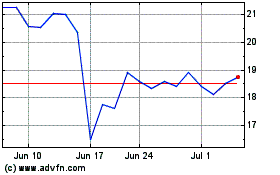

AMREP (NYSE:AXR)

Historical Stock Chart

From Mar 2024 to Apr 2024

AMREP (NYSE:AXR)

Historical Stock Chart

From Apr 2023 to Apr 2024