UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 under the Securities Exchange Act of 1934

For the month of June, 2020

Commission File Number: 001-36671

ATENTO

S.A.

(Translation of Registrant’s name into English)

1, rue Hildegard Von Bingen, L-1282, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes [ ] No [ X ]

Note: Regulation S-T Rule 101(b)(1) only permits

the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes [ ] No [ X ]

Note: Regulation S-T Rule 101(b)(7) only permits

the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private

issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally

organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s

securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed

to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K

submission or other Commission filing on EDGAR.

ATENTO S.A.

INDEX

Financial Information

For the Six Months Ended June 30, 2020

CAUTIONARY

NOTE REGARDING FORWARD LOOKING STATEMENTS

This Form 6-K

providing six-month information contains “forward-looking statements” within the meaning of Section 27A of the Securities

Act of 1933 (as amended), Section 21E of the Securities Exchange Act of 1934 (as amended) and the Private Securities Litigation

Reform Act of 1995, relating to our operations, expected financial position, results of operations, and other business matters

that are based on our current expectations, assumptions, and projections with respect to the future, and are not a guarantee of

performance. In this Form 6-K, when we use words such as “may,” “believe,” “plan,” “will,”

“anticipate,” “estimate,” “expect,” “intend,” “project,” “would,”

“could,” “target,” or similar expressions or their negatives, or when we discuss our strategy, plans, goals,

initiatives, objectives or response to the COVID-19 pandemic, we are making forward-looking statements.

We

caution you not to rely unduly on any forward-looking statements. Actual results may differ materially from what is expressed in

the forward-looking statements, and you should review and consider carefully the risks, uncertainties and other factors that affect

our business and may cause such differences.

The

forward-looking statements are based on information available as of the date that this Form 6-K was furnished with the United States

Securities and Exchange Commission (the “SEC”) and we undertake no obligation to update them. Such forward–looking

statements are based on numerous assumptions and developments that are not within our control. Although we believe that these forward-looking

statements are reasonable, we cannot assure you they will turn out to be correct.

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The

following discussion and analysis of our financial condition and the results of operations is based upon and should be read in

conjunction with the unaudited interim condensed consolidated financial information as of and for the six months ended June 30,

2020 of Atento S.A. (“Atento,” the “Company,” “we,” “us”

or “our”) and the notes thereto furnished to the SEC on Form 6-K on August 6, 2020.

Factors

which could cause or contribute to such differences, include, but are not limited to, those discussed under “Cautionary Note

Regarding Forward-Looking Statements” in this Form 6-K and the section entitled “Risk Factors” in Atento’s

Annual Report on Form 20-F for the year ended December 31, 2019 filed with the SEC on April 17, 2020 (the “2019 20-F”).

Overview

Atento

is the largest provider of customer relationship management and business process outsourcing (“CRM BPO”) services and

solutions in Latin America, and among the top five providers globally, each based on revenue. Our business was founded in 1999

as the CRM BPO provider to Telefónica and its subsidiaries (together, the “Telefónica Group”). Since

then, we have significantly diversified our client base, and we became an independent company in December 2012, when we were acquired

by funds affiliated with Bain Capital Partners, LLC. In October 2014, Atento became a publicly listed company on the New York Stock

Exchange under the ticker symbol “ATTO.” In May 2020, Bain Capital transferred substantially all of its remaining shares

to HPS Investment Partners, LLC, GIC and an investment fund affiliated with Farallon Capital Management, L.L.C.

The

potential for long-term growth in the markets where we operate is strong and is driven by a number of demographic and business

trends, including (i) sustained demand and growth driven by an improving macroeconomic environment over the long term, a rapidly

growing population and an emerging middle class, (ii) further outsourcing of CRM BPO operations, (iii) potential for

further penetration in existing markets, (iv) development of new industry vertical expertise, such as with healthcare and

born-digital companies (i.e., companies that have relied on digital products/services since inception, such as social networks

and Fintechs), and (v) North America’s continued offshoring trend as U.S.-based businesses continue to offshore call

center services to other geographies.

We

operate in 13 countries worldwide, including Brazil, Spain, Mexico, Peru, Argentina, Chile, Colombia, the United States, El Salvador,

Guatemala, Puerto Rico, Panama and Uruguay. We organize our business into three geographic markets: (i) Brazil,

(ii) Americas, excluding Brazil (“Americas”) and (iii) Europe, Middle East and Africa (“EMEA”).

For the six months ended June 30, 2020, Brazil accounted for 44.5% of our revenue, Americas accounted for 40.2% of our revenue

and EMEA accounted for 15.7% of our revenue (in each case, before holding company level revenue and consolidation adjustments).

For the six months ended June 30, 2019, Brazil accounted for 48.8% of our revenue, Americas accounted for 38.0% of our revenue

and EMEA accounted for 14.0% of our revenue (in each case, before holding company level revenue and consolidation adjustments).

Our

number of workstations increased from 92,515 as of June 30, 2019 to 93,229 as of June 30, 2020 due to volatility within our operations.

Our number of service delivery centers decreased slightly over the same period.

The

following table shows the number of workstations and delivery centers in each of the jurisdictions in which we operated as of June

30, 2019 and 2020:

|

|

Number of

Workstations

|

Number of

Service Delivery Centers(1)

|

|

|

2019

|

2020

|

2019

|

2020

|

|

Brazil

|

49,592

|

49,211

|

34

|

31

|

|

Americas

|

37,579

|

38,847

|

50

|

48

|

|

Argentina(2)

|

4,474

|

4,358

|

12

|

12

|

|

Central America(3)

|

2,510

|

2,845

|

4

|

3

|

|

Chile

|

2,829

|

2,484

|

4

|

4

|

|

Colombia

|

8,731

|

9,133

|

9

|

9

|

|

Mexico

|

9,319

|

9,881

|

15

|

14

|

|

Peru

|

8,513

|

8,847

|

3

|

3

|

|

United States(4)

|

1,203

|

1,299

|

3

|

3

|

|

EMEA

|

5,344

|

5,171

|

15

|

14

|

|

Spain

|

5,344

|

5,171

|

15

|

14

|

|

Total

|

92,515

|

93,229

|

99

|

93

|

(1) Includes

service centers at facilities operated by us and those owned by our clients where we provide operations personnel and workstations.

(2) Includes Uruguay.

(3) Includes Guatemala and El Salvador.

(4) Includes Puerto Rico.

For

the six months ended June 30, 2020, revenue generated from our 15 largest client groups represented 68.4% of our revenue as compared

to 74.8% in the same period in the prior year. Excluding revenue generated from the Telefónica Group, for the six months

ended June 30, 2020, our next 15 largest client groups represented 37.6% of our revenue as compared to 37.7% in the same period

in the prior year. The decrease in client concentration reflects our strategy to improve our revenue mix, one of the pillars of

our Three Horizon Plan, which we announced in the second quarter of 2019 to improve the profitability of our existing operations,

accelerate the development of our next generation services and digital capabilities and strengthen our position in segments and

geographies which we believe have the potential for higher growth margins.

Our

vertical industry expertise in telecommunications, banking and financial services, and more recently, with born-digital companies

allows us to tailor our services and solutions for our customers, further embedding us into their value chain while delivering

meaningful business results. In 2019, as part of our Three Horizon Plan, we initiated the build-out of Next Generation Services

Portfolio and Digital Capabilities, a set of strategic initiatives designed to accelerate the development and expansion of our

value offering, with a focus on three next-generation services lines (namely, high value voice, integrated multichannel and automated

back office) and four next-generation capabilities (namely, AI/Cognitive, Analytics, Automation/RPA and CX consulting). During

the six months ended June 30, 2020, telecommunications, financial services and born-digital companies represented 38.4%, 34.9%

and 6.3% of our revenue, respectively, compared to 44.2%, 36.8% and 2.2% respectively, for the same period in 2019. Additionally,

during the six months ended June 30, 2019 and 2020 our sales by service were as follows:

|

|

For the

six months ended June 30,

|

|

|

2019

|

2020

|

|

Customer Service

|

50.9%

|

57.7%

|

|

Sales

|

17.3%

|

11.8%

|

|

Collection

|

8.1%

|

6.9%

|

|

Back Office

|

13.0%

|

12.8%

|

|

Technical Support

|

6.3%

|

5.8%

|

|

Others

|

4.4%

|

5.0%

|

|

Total

|

100.0%

|

100.0%

|

Average

headcount

Our

average headcount as of June 30, 2019 and 2020 was as follows:

|

|

As of June

30,

|

|

|

2019

|

2020

|

|

|

(unaudited)

|

|

|

|

|

|

Brazil

|

82,264

|

70,313

|

|

Central America

|

4,749

|

5,192

|

|

Chile

|

5,783

|

5,322

|

|

Colombia

|

8,834

|

8,654

|

|

Spain

|

12,051

|

11,597

|

|

Mexico

|

16,546

|

17,587

|

|

Peru

|

12,811

|

11,193

|

|

Puerto Rico

|

580

|

748

|

|

United States

|

443

|

355

|

|

Argentina and Uruguay

|

7,735

|

6,651

|

|

Corporate

|

73

|

85

|

|

Total

|

151,869

|

137,697

|

The reduction in our average

headcount reflects the implementation of two pillars of our Three Horizon Plan, namely:

|

|

·

|

operational excellence: we have taken a number of steps to improve our operations, such

as management of key operational performance indicators and shared services optimization. These initiatives are expected to generate

savings and eliminate redundant activities in operating areas such as quality, workforce management, reporting and training, and

customer value programs, in addition to other specific operating improvement actions being implemented at regional levels. The

focus of these initiatives is on increasing our contribution margins and improving the experience of our customers’ customers;

and

|

|

|

·

|

optimization initiatives to reduce selling, general and administrative expenses and other costs:

We are transforming our business support areas in order to generate savings and reduce costs. We have analyzed the major cost

components of our business in the human resources, technology, facilities and infrastructure areas, and we have developed specific

solutions to lower the cost of services in each category. One of the actions we are taking is the ongoing digitalization of human

resources processes. For example, our human resources team has recently implemented the use of digital tools for recruiting and

retaining the best talent in the market to support our customers’ operations.

|

Impact

of Recent COVID-19 Outbreak

Since

December 2019, a novel strain of coronavirus, or COVID-19, spread from China to other countries throughout the world leading to

a global pandemic. The COVID-19 pandemic prompted a global health crisis and led to a number of government actions at the federal,

state and local level across several countries in an effort to address the viral outbreak. Government measures included, among

other things, stay-at-home orders and the closure of businesses not deemed essential to the provision of the basic welfare of society.

The COVID-19 pandemic and government measures taken in response to it have disrupted regional and global economic activity, which

initially reduced the need for and our ability to deliver our services and, therefore, directly and adversely affected our business

operations, financial condition and results of operations for the first half of 2020 as a result of lower volumes during April

and May.

The

services offered by us or by our customers to the end-customers have been declared, in different countries, to be essential, as

many of our services allow citizens to remain in their homes while maintaining access to crucial services, such as healthcare,

emergency services and banking. One relevant example is Praxair in Mexico, for which we provide a service that helps both

hospitals and patients request oxygen supplies. Similarly, since March 24, 2020, Atento Guatemala is providing physical, technology

infrastructure and logistical support services for the government of Guatemala’s COVID-19 services.

To

address the needs of our customers, employees and society in light of the government measures to address the COVID-19 pandemic,

we are focused on maintaining a good level of service for our customers. To this end, our technology and operations teams are working

to provide remote work options to more of our employees throughout our operations. These teams are committed to continuing to optimize

our operations during the COVID-19 pandemic by overcoming technical and logistical limitations so we can fulfill our commitments

to our employees, customers and society. We endeavor to continue serving many of the more than 500 million people of Latin America,

the United States and Spain.

Traditionally,

we have endeavored to guarantee our services and to safeguard the health and safety of our employees. We have implemented a series

of measures intended to maintain this guarantee and safeguards during the COVID-19 pandemic, such as higher grade cleaning and

disinfection of our facilities, social distancing, limiting access to common areas, offering flexible work shifts to facilitate

the care of families, and the cancellation of all business travel and in-person meetings.

By

June 30, 2020, we had over 64,000 work-at-home agents (“WAHA”), or approximately 60% of our call center employees.

For agents still working at our facilities, distances between workstations have been increased and personal work equipment (individual

headset, keyboard, mouse, etc.) made available. With operating capacity at approximately 97%, we have a broad capacity to meet

the needs of all customers. The transition to a WAHA model by our employees has been facilitated by the digital transformation

process underway since 2019, under our Three Horizons Plan, which has included re-skilling as well as digital recruiting, onboarding

and training.

This

model as well as other enhanced digital capabilities are allowing us to capture medium- and long-term CRM and BPO opportunities

arising from dramatic shifts in consumer behaviors and related changes being implemented by emerging and established companies

seeking to attract and retain more customers in Latin America, the United States and Europe. The growing strength of our digital

capabilities, evolving portfolio of next generation services and journey orchestration, coupled with accelerated operational improvements

that are resulting in a more competitive cost structure, are allowing us to continue leading next generation customer experience

in the future.

While we believe we are now past the

most severe impacts of the COVID-19 pandemic, the extent to which COVID-19 will impact our business, financial condition, results

of operations and prospects will depend on future developments which are uncertain and cannot be predicted, including new information

which may emerge concerning the severity of COVID-19 or the actions of governments and other entities to contain COVID-19 in Brazil

and the other countries in which we operate. Therefore, it is not possible to reasonably estimate the extent of potential impacts

to our business, financial condition, results of operations and prospects. We are continuously monitoring the situation as closely

as possible and are actively evaluating potential impacts to our business and implementing measures to help mitigate existing and

potential risks.

Consolidated

Statements of Operations for the Six Months Ended June 30, 2019 and 2020

|

|

For the six months ended June 30,

|

|

|

|

($ in millions, except percentage changes)

|

2019

|

2020

|

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

Revenue

|

877.8

|

689.9

|

(21.4)

|

(7.3)

|

|

Other operating income

|

1.4

|

2.0

|

43.4

|

54.5

|

|

Other gains and own work capitalized

|

0.1

|

—

|

(95.1)

|

(95.1)

|

|

Operating expenses(1):

|

|

|

|

|

|

Supplies

|

(31.9)

|

(32.7)

|

2.6

|

20.1

|

|

Employee benefit expenses

|

(674.0)

|

(534.0)

|

(20.8)

|

(6.7)

|

|

Depreciation(2)

|

(41.7)

|

(37.6)

|

(9.8)

|

6.4

|

|

Amortization

|

(26.9)

|

(22.6)

|

(16.0)

|

(1.0)

|

|

Changes in trade provisions

|

(1.5)

|

(1.9)

|

31.7

|

71.9

|

|

Other operating expenses(1)

|

(87.3)

|

(60.3)

|

(30.9)

|

(19.4)

|

|

Total operating expenses

|

(863.2)

|

(689.1)

|

(20.2)

|

(6.0)

|

|

Operating profit

|

16.1

|

2.8

|

(82.5)

|

(76.7)

|

|

Finance income

|

4.4

|

11.0

|

147.5

|

N.M.

|

|

Finance costs(3)

|

(37.9)

|

(32.8)

|

(13.3)

|

(2.8)

|

|

Net foreign exchange loss

|

(3.0)

|

(9.3)

|

N.M.

|

N.M.

|

|

Net finance expense

|

(36.4)

|

(31.1)

|

(14.6)

|

3.8

|

|

Loss before income tax

|

(20.3)

|

(28.3)

|

39.0

|

57.7

|

|

Income tax (expense)/benefit

|

(31.9)

|

2.5

|

(107.9)

|

(107.9)

|

|

Loss for the period

|

(52.2)

|

(25.8)

|

(50.7)

|

(48.5)

|

|

Loss attributable to:

|

|

|

|

|

|

Owners of the parent

|

(52.8)

|

(25.8)

|

(51.2)

|

(49.0)

|

|

Non-controlling interest

|

0.6

|

—

|

(100.0)

|

(100.0)

|

|

Loss for the period

|

(52.2)

|

(25.8)

|

(50.7)

|

(48.5)

|

|

Other financial data:

|

|

|

|

|

|

EBITDA(4) (unaudited)

|

84.6

|

63.0

|

(25.6)

|

(10.2)

|

N.M.

means not meaningful.

|

|

(1)

|

The application of IFRS 16 from January 1, 2019 means that most of the rental payments for operating

leases are not recognized as operating expenses. For the six months ended June 30, 2019 and 2020, $29.7 million and $18.3 million,

respectively, of rental payments for operating leases were not recognized as operating expenses due to the application of IFRS

16.

|

|

|

(2)

|

For the six months ended June 30, 2019 and 2020, depreciation included $22.8 million and $22.3

million, respectively, for the amortization of right-of-use assets for leases capitalized because of IFRS 16 that would not otherwise

have been capitalized prior to the adoption of IFRS 16.

|

|

|

(3)

|

Finance costs includes $9.2 million and $6.8 million for the six months ended June 30, 2019 and

2020, respectively, on account of interest on liabilities for leases capitalized because of IFRS 16 that would not otherwise have

been capitalized prior to the adoption of IFRS 16.

|

|

|

(4)

|

In considering the financial performance of the business,

our management analyzes the financial performance measure of EBITDA at a company and operating segment level, to facilitate decision-making.

EBITDA is defined as profit/(loss) for the period from continuing operations before net finance expense, income taxes and depreciation

and amortization. EBITDA is not a measure defined by IFRS. The most directly comparable IFRS measure to EBITDA is profit/(loss)

for the year/period from continuing operations.

|

We

believe that EBITDA is a useful metric for investors to understand our results of continuing operations and profitability because

it permits investors to evaluate our recurring profitability from underlying operating activities. We also use this measure internally

to establish forecasts, budgets and operational goals to manage and monitor our business, as well as to evaluate our underlying

historical performance. We believe that EBITDA facilitates comparisons of operating performance between periods and among other

companies in industries similar to ours because it removes the effect of variances in capital structures, taxation, and non-cash

depreciation and amortization charges, which may differ between companies for reasons unrelated to operating performance.

EBITDA

is a measure that is frequently used by securities analysts, investors and other interested parties in their evaluation of companies

comparable to us, many of which present EBITDA-related performance measures when reporting their results.

EBITDA

has its limitations as an analytical tool. This measure is not a presentation made in accordance with IFRS, is not a measure of

financial condition or liquidity and should not be considered in isolation or as alternatives to profit or loss for the period

from continuing operations or other measures determined in accordance with IFRS. EBITDA is not necessarily comparable to similarly

titled measures used by other companies. This non-GAAP measure should be considered supplemental in nature and should not be construed

as being more important than comparable GAAP measures.

The application

of IFRS 16 from January 1, 2019 means EBITDA for the six months ended June 30, 2019 and 2020 is positively impacted by a decrease

in operating expenses relating to rental payments for leases capitalized under IFRS 16 that would not otherwise have been capitalized

prior to the application of IFRS 16.

EBITDA reported

are presented applying the accounting and disclosure standard in highly inflationary economies for our operations in Argentina.

See below for

a reconciliation of profit/(loss) for the period from continuing operations to EBITDA, including the impact of IFRS 16.

Reconciliation

of EBITDA to (loss)/profit:

|

|

For the six months

ended June 30,

|

|

|

($ in millions)

|

2019

|

2020

|

|

|

|

(unaudited)

|

|

|

|

|

|

|

Loss for the period

|

(52.2)

|

(25.8)

|

|

|

Net finance expense(a)

|

36.4

|

31.1

|

|

|

Income tax (expense)/benefit(b)

|

31.9

|

(2.5)

|

|

|

Depreciation and amortization

|

68.5

|

60.2

|

|

|

EBITDA (non-GAAP) (unaudited)(c)

|

84.6

|

63.0

|

|

|

|

(a)

|

Net finance expense includes finance income, finance costs and net

foreign exchange losses.

|

|

|

(b)

|

In the first quarter of 2019, in the context of a global Tax Audit

of the periods 2013-2016, Atento Spain, as the representative company of the tax group composed of the Spanish direct subsidiaries

of Atento S.A., signed a tax agreement with the Spanish tax authorities. The criteria adopted by the Tax Administration was in

connection with certain aspects, among others, of the deductibility of certain specific intercompany financing and operating expenses

originated during the acquisition of Atento Spain, which was different from the tax treatment applied by the Company. As a result of this discrepancy, the

amount of the tax credits of the Spanish tax group, together with the corresponding effects in subsequent tax periods, has been

reduced in an amount of $37.8 million. Accordingly, the tax credits for losses carryforward in our financial statements for the

first quarter of 2019, was negatively affected by $37.8 million.

|

|

|

(c)

|

For the six months ended June 30, 2019 and 2020, EBITDA included $29.7

million and $18.3 million, respectively, due to the application of IFRS 16. Excluding the IFRS 16 impact, EBITDA was $54.9 million

and $44.7 million for the six months ended June 30, 2019 and 2020, respectively. Depreciation and amortization and finance costs

for the six months ended June 30, 2019 included $22.8 million and $9.2 million, respectively, due to the application of IFRS 16.

Depreciation and amortization and finance costs for the six months ended June 30, 2020 included $22.3 million and $6.8 million,

respectively, due to the application of IFRS 16.

|

Consolidated

Statements of Operations by Segment for the Six Months Ended June 30, 2019 and 2020

|

|

For the six months ended June 30,

|

|

|

|

($ in millions, except percentage changes)

|

2019

|

2020

|

|

|

(unaudited)

|

|

|

|

Revenue:

|

|

|

|

|

|

Brazil

|

428.7

|

307.3

|

(28.3)

|

(9.2)

|

|

Americas

|

333.5

|

277.3

|

(16.9)

|

(5.2)

|

|

EMEA

|

123.3

|

108.0

|

(12.4)

|

(10.2)

|

|

Other and eliminations(1)

|

(7.7)

|

(2.6)

|

(66.1)

|

(63.6)

|

|

Total revenue

|

877.8

|

689.9

|

(21.4)

|

(7.3)

|

|

Operating expenses:

|

|

|

|

|

|

Brazil

|

(419.9)

|

(309.4)

|

(26.3)

|

(6.7)

|

|

Americas

|

(330.0)

|

(278.1)

|

(15.7)

|

(3.7)

|

|

EMEA

|

(121.4)

|

(112.7)

|

(7.2)

|

(4.8)

|

|

Other and eliminations(1)

|

8.0

|

11.2

|

39.2

|

99.7

|

|

Total operating expenses

|

(863.2)

|

(689.1)

|

(20.2)

|

(6.0)

|

|

Operating profit/(loss):

|

|

|

|

|

|

Brazil

|

9.0

|

(2.1)

|

(123.2)

|

(130.0)

|

|

Americas

|

4.1

|

0.5

|

(87.9)

|

(87.9)

|

|

EMEA

|

2.6

|

(4.2)

|

N.M.

|

N.M.

|

|

Other and eliminations(1)

|

0.4

|

8.6

|

N.M.

|

N.M.

|

|

Total operating profit

|

16.1

|

2.8

|

(82.5)

|

(76.7)

|

|

Net finance expense:

|

|

|

|

|

|

Brazil

|

(20.8)

|

(21.6)

|

3.6

|

31.1

|

|

Americas

|

(9.5)

|

(4.8)

|

(49.2)

|

(35.7)

|

|

EMEA

|

(0.8)

|

(0.5)

|

(41.3)

|

(39.4)

|

|

Other and eliminations(1)

|

(5.2)

|

(4.2)

|

(19.5)

|

(19.0)

|

|

Total net finance expense

|

(36.4)

|

(31.1)

|

(14.6)

|

3.8

|

|

Income tax benefit/(expense):

|

|

|

|

|

|

Brazil

|

3.0

|

7.5

|

148.6

|

N.M.

|

|

Americas

|

(1.8)

|

(2.8)

|

58.8

|

24.3

|

|

EMEA

|

(1.6)

|

0.7

|

(144.8)

|

(147.5)

|

|

Other and eliminations(1)(3)

|

(31.5)

|

(2.9)

|

(91.0)

|

(90.7)

|

|

Total income tax (expense)/benefit

|

(31.9)

|

2.5

|

(107.9)

|

(107.9)

|

|

Profit/(loss) for the period:

|

|

|

|

|

|

Brazil

|

(8.9)

|

(16.2)

|

83.1

|

129.8

|

|

Americas

|

(7.2)

|

(7.1)

|

(1.3)

|

24.6

|

|

EMEA

|

0.2

|

(3.9)

|

N.M.

|

N.M.

|

|

Other and eliminations(1)

|

(36.3)

|

1.5

|

(104.2)

|

(104.1)

|

|

Loss for the period

|

(52.2)

|

(25.8)

|

(50.7)

|

(48.5)

|

|

Loss attributable to:

|

|

|

|

|

|

Owners of the parent

|

(52.8)

|

(25.8)

|

(51.2)

|

(49.0)

|

|

Non-controlling interest

|

0.6

|

—

|

(100.0)

|

(100.0)

|

|

Other financial data:

|

|

|

|

|

|

EBITDA(2):

|

|

|

|

|

|

Brazil

|

46.3

|

29.8

|

(35.6)

|

(18.3)

|

|

Americas

|

28.6

|

22.8

|

(20.3)

|

(12.9)

|

|

EMEA

|

9.2

|

1.7

|

(81.4)

|

(80.8)

|

|

Other and eliminations(1)

|

0.5

|

8.7

|

N.M.

|

N.M.

|

|

Total EBITDA (unaudited)

|

84.6

|

63.0

|

(25.6)

|

(10.2)

|

|

Adjusted EBITDA(4):

|

|

|

|

|

|

Brazil

|

54.3

|

35.0

|

(35.6)

|

(18.0)

|

|

Americas

|

32.7

|

28.2

|

(13.8)

|

(5.2)

|

|

EMEA

|

11.8

|

3.5

|

(70.6)

|

(69.8)

|

|

Other and eliminations(1)

|

(14.2)

|

(3.7)

|

(74.1)

|

(73.3)

|

|

Total Adjusted EBITDA (unaudited)

|

84.6

|

63.0

|

(25.6)

|

(10.2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N.M.

means not meaningful.

|

|

(1)

|

Includes revenue and expenses at the holding-company level

(such as corporate expenses and acquisition-related expenses), as applicable, as well as consolidation adjustments.

|

|

|

(2)

|

For the reconciliation of these non-GAAP measures to the

closest comparable IFRS measure, see “Consolidated Statements of Operations for the Six Months Ended June 30, 2019 and 2020—Reconciliation

of EBITDA to (loss)/profit” above.

|

|

|

(3)

|

In first quarter of 2019, in the context of a global Tax Audit of the periods 2013-2016, Atento

Spain, as the representative company of the tax group composed of the Spanish direct subsidiaries of Atento S.A., signed a tax

agreement with the Spanish tax authorities. The criteria adopted by the Tax Administration was in connection with certain aspects,

among others, of the deductibility of certain specific intercompany financing and operating expenses originated during the acquisition

of Atento Spain, which was different from the tax treatment applied by the Company. As a result of this discrepancy, the amount

of the tax credits of the Spanish tax group, together with the corresponding effects in subsequent tax periods, has been reduced

in an amount of $37.8 million. Accordingly, the tax credits for losses carryforward in our financial statements for the first quarter

of 2019, was negatively affected by $37.8 million.

|

|

|

(4)

|

Adjusted EBITDA is defined as EBITDA adjusted to exclude restructuring

costs, site relocation costs and other items not related to our core results of operations. We believe that Adjusted EBITDA better

reflects our underlying operating performance because it excludes the impact of items which are not related to our core results

of continuing operations. Adjusted EBITDA is a measure that is frequently used by securities analysts, investors and other interested

parties in their evaluation of companies comparable to us, many of which present EBITDA-related performance measures when reporting

their results. The application of IFRS 16 from January 1, 2019 means Adjusted EBITDA for the six months ended June 30, 2019

and 2020 is positively impacted by a decrease in operating expenses relating to rental payments for leases capitalized under IFRS

16 that would not otherwise have been capitalized prior to the application of IFRS 16.

|

Six Months

Ended June 30, 2019 Compared to Six Months Ended June 30, 2020

Revenue

Revenue

decreased by $187.9 million, or 21.4%, from $877.8 million for the six months ended June 30, 2019 to $689.9 million for the six

months ended June 30, 2020. Excluding the impact of foreign exchange, revenue decreased 7.3%, primarily due to lower revenues from

Telefónica, partially offset by a 7.7% increase in revenue from multisector clients.

Revenue

from Telefónica decreased by $107.6 million, or 32.9%, contributing $219.1 million in revenue for the six months ended June

30, 2020, against $326.7 million in the six months ended June 30, 2019. Excluding the impact of foreign exchange, revenue from

Telefónica decreased by 28.6%, due to (i) the discontinuation of unprofitable programs in Brazil since the fourth quarter

of 2019 and (ii) lower volumes due to COVID-19’s impact in all regions during the second half of March, April and part of

May.

Multisector

clients presented a revenue decrease of $80.3 million, or 14.6%, from $551.1 million for the six months ended June 30, 2019 to

$470.9 million for the six months ended June 30, 2020. Excluding the impact of foreign exchange, revenue from multisector clients

increased 7.7%, supported by multisector growth across all regions. The increase in multisector customers despite the challenges

raised by the COVID-19 crisis reflects the effectiveness of the “sales excellence” pillar of our Three Horizon Plan.

Under the “sales excellence” pillar, we have transformed our sales model to accelerate profitable growth under

a “sell more, sell better, sell what we want” approach. We are highly focused on the relationships we have with our

customer base and consider these to be a key competitive advantage. We are implementing a new sales model that helps us manage

global customer accounts and strengthen our position in the born-digital area of the market. Our commercial team is responsible

for end-to-end customer life cycle, namely new sales to new customers, account development, changes in the scope of service we

provide, renewals and inflation pass-through negotiations, driving increases in sales through a War Room model and a compensation

model focused on profitable growth. We have also been prioritizing strategic product sales among current and future customers,

to ensure the right product portfolio at each of our customers, which we believe to be a key lever to drive healthy growth in future.

For

the six months ended June 30, 2020, revenue from multisector clients was 68.2% of total revenue, compared to 62.8% for the six

months ended June 30, 2019, an increase of 5.5 percentage points.

The

following chart sets forth a breakdown of revenue by geographical region for the six months ended June 30, 2019 and 2020 including

as a percentage of revenue and the percentage change between those periods (both with and excluding the effect of foreign exchange).

|

|

For the six months ended June 30,

|

|

($ in millions, except percentage changes)

|

2019

|

(%)

|

2020

|

(%)

|

Change (%)

|

Change excluding

FX (%)

|

|

|

(unaudited)

|

|

(unaudited)

|

|

|

|

|

Brazil

|

428.7

|

48.8

|

307.3

|

44.5

|

(28.3)

|

(9.2)

|

|

Americas

|

333.5

|

38.0

|

277.3

|

40.2

|

(16.9)

|

(5.2)

|

|

EMEA

|

123.3

|

14.0

|

108.0

|

15.7

|

(12.4)

|

(10.2)

|

|

Other and eliminations(1)

|

(7.7)

|

(0.8)

|

(2.6)

|

(0.4)

|

(66.1)

|

(63.6)

|

|

Total

|

877.8

|

100.0

|

689.9

|

100.0

|

(21.4)

|

(7.3)

|

|

|

(1)

|

Includes holding company level revenues and consolidation adjustments.

|

Brazil

Revenue

in Brazil for the six months ended June 30, 2019 and 2020 was $428.7 million and $307.3 million, respectively, a decrease of $121.4

million, or 28.3%. Excluding the impact of foreign exchange, revenue in Brazil decreased by 9.2% due to a 40.7% decrease in revenue

from Telefónica which was offset by a 6.9% increase in revenue from multisector clients. The increase in revenue from multisector

clients was primarily due to higher sales to born-digital companies acquired during 2019 and new clients acquired in 2020, including

Riot Games. The decrease in revenue from Telefónica was mainly due to (i) the discontinuation of unprofitable programs since

the fourth quarter of 2019 and (ii) the COVID-19 pandemic’s impact on volumes, mostly during April and part of May, as Atento

focused its delivery capacity on multisector clients.

Americas

Revenue

in Americas for the six months ended June 30, 2019 and 2020 was $333.5 million and $277.3 million, respectively, a decrease of

$56.2 million, or 16.9%. Excluding the impact of foreign exchange, revenue in Americas decreased by 5.2% due to a 20.1% decrease

in revenue from Telefónica which was offset by a 5.1% increase in revenue from multisector clients, mainly in the United

States. The decrease in revenue from Telefónica in the region was primarily due to lower volumes resulting from the COVID-19

pandemic. The increase in multisector sales was attributable to higher volumes in tech and born-digital companies, combined with

the pipeline acquired in the second half of 2019 and the growth in the U.S. in the second quarter of 2020.

EMEA

Revenue

in EMEA for the six months ended June 30, 2019 and 2020 was $123.3 million and $108.0 million, respectively, a decrease of $15.3

million, or 12.4%. Excluding the impact of foreign exchange, revenue in EMEA decreased by 10.2%. The decrease in revenue was primarily

due to a 23.3% decrease in revenue from Telefónica due to the impact of COVID-19 in the region, partially offset by a 9.9%

increase in revenue from multisector clients supported by higher volumes.

Other operating income

Other

operating income totaled $1.4 million and $2.0 million for the six months ended June 30, 2019 and 2020, respectively.

Other

gains and own work capitalized

Other

gains and own work capitalized totaled $0.1 million for the six months ended June 30, 2019 and nil for the six months ended June

30, 2020.

Total operating expenses

Total

operating expenses decreased by $174.1 million, or 20.2%, from $863.2 million for the six months ended June 30, 2019 to $689.1

million for the six months ended June 30, 2020. Excluding the impact of foreign exchange, operating expenses decreased by 6.0%,

mainly due to the acceleration of operational improvements under a new cost savings program which seeks to further optimize our

cost structure through right-sizing of operations as well as implementation of shared services, a zero-based budgeting system

and the WAHA model. As a percentage of revenue, operating expenses represented 98.3% and 99.9% for the six months ended June

30, 2019 and 2020, respectively.

Supplies:

Supplies expenses increased by $0.8 million, or 2.6%, from $31.9 million for the six months ended June 30, 2019 to $32.7 million

for the six months ended June 30, 2020. Excluding the impact of foreign exchange, supplies expenses increased by 20.1%, mainly

due to Brazil and EMEA regions. As a percentage of revenue, supplies represented 3.6% and 4.7% for the six months ended June 30,

2019 and 2020, respectively.

Employee benefit

expenses: Employee benefit expenses decreased by $140.0 million, or 20.8%, from $674.0 million for the six months ended June

30, 2019 to $534.0 million for the six months ended June 30, 2020. Excluding the impact of foreign exchange, employee benefit expenses

decreased by 6.7%, mainly due to the impact of the operational improvements made as a result of our new cost savings program, including

lower headcount, mainly in Brazil. As a percentage of revenue, employee benefit expenses represented 76.8% and 77.4% for the six

months ended June 30, 2019 and 2020, respectively.

Depreciation

and amortization: Depreciation and amortization expenses decreased by $8.3 million, or 12.1%, from $68.5 million for the six

months ended June 30, 2019 to $60.2 million for the six months ended June 30, 2020. Excluding the impact of foreign exchange, depreciation

and amortization expense increased by 3.5%, mainly due to Brazil region.

Changes in

trade provisions: Changes in trade provisions amounted to a loss of $1.5 million and a loss of $1.9 million for the six

months ended June 30, 2019 and 2020, respectively.

Other operating

expenses: Other operating expenses decreased by $27.0 million, or 30.9%, from $87.3 million for the six months ended June 30,

2019 to $60.3 million for the six months ended June 30, 2020. Excluding the impact of foreign exchange, other operating expenses

decreased by 19.4%, mainly due to the impact of the operational improvements made as a result of our new cost savings program.

As a percentage of revenue, other operating expenses totaled 9.9% and 8.7% for the six months ended June 30, 2019 and 2020, respectively.

Brazil

Total

operating expenses in Brazil decreased by $110.5 million, or 26.3%, from $419.9 million for the six months ended June 30, 2019

to $309.4 million for the six months ended June 30, 2020. Excluding the impact of foreign exchange, operating expenses in Brazil

decreased by 6.7%, less than the decline in revenue growth, reflecting the impact of the operational improvements made as

a result of our new cost savings program. Operating expenses as a percentage of revenue in Brazil increased from 97.9% for the

six months ended June 30, 2019 to 100.7% for the six months ended June 30, 2020.

Americas

Total

operating expenses in Americas decreased by $51.9 million, or 15.7%, from $330.0 million for the six months ended June 30, 2019

to $278.1 million for the six months ended June 30, 2020. Excluding the impact of foreign exchange, operating expenses in Americas

decreased by 3.7%, reflecting the impact of the operational improvements made as a result of our new cost savings program. Operating

expenses as a percentage of revenue in Americas increased from 98.9% for the six months ended June 30, 2019 to 100.3% for the six

months ended June 30, 2020.

EMEA

Total

operating expenses in EMEA decreased by $8.7 million, or 7.2%, from $121.4 million for the six months ended June 30, 2019 to $112.7

million for the six months ended June 30, 2020. Excluding the impact of foreign exchange, operating expenses in EMEA decreased

by 4.8%, reflecting the impact of the operational improvements made as a result of our new cost savings program. Operating expenses

as a percentage of revenue in EMEA increased from 98.5% for the six months ended June 30, 2019 to 104.4% for the six months ended

June 30, 2020.

Operating profit

Operating

profit decreased by $13.3 million, from $16.1 million for the six months ended June 30, 2019 to $2.8 million for the six months

ended June 30, 2020, a decrease of 82.5% due to the reasons mentioned above. Excluding the impact of foreign

exchange, operating profit decreased 76.7% for the six months ended June 30, 2020. Operating profit margin decreased from 1.8%

for the six months ended June 30, 2019 to 0.4% for the six months ended June 30, 2019.

Brazil

Operating

profit in Brazil decreased $11.1 million from $9.0 million for the six months ended June 30, 2019 to an operating loss of $2.1

million for the six months ended June 30, 2020 due to the reasons mentioned above. Excluding the impact of foreign exchange, operating

profit decreased by 130.0%. Operating profit margin in Brazil decreased from 2.1% for the six months ended June 30, 2019 to negative

0.7% for the six months ended June 30, 2020.

Americas

Operating

profit in Americas decreased by $3.6 million, or 87.9%, from $4.1 million for the six months ended June 30, 2019, to $0.5 million

for the six months ended June 30, 2020. Excluding the impact of foreign exchange, operating profit decreased by 87.9%, for the

reasons mentioned above. Operating profit margin in Americas decreased from 1.2% for the six months ended June 30, 2019 to 0.2%

for the six months ended June 30, 2020.

EMEA

Operating profit

in EMEA decreased $6.8 million from $2.6 million for the six months ended June 30, 2019 to an operating loss of $4.2 million for

the six months ended June 30, 2020, due to the reasons mentioned above. Operating profit margin in EMEA decreased from 2.1% for

the six months ended June 30, 2019 to negative 3.9% for the six months ended June 30, 2020.

Finance income

Finance

income was $4.4 million for the six months ended June 30, 2019 as compared to $11.0 million for the six months ended June 30, 2020.

The increase in finance income was mainly due to a one-off gain of $6.3 million related to tax reversals in Brazil.

Finance costs

Finance

costs decreased by $5.1 million, or 13.3%, from $37.9 million for the six months ended June 30, 2019 to $32.8 million for the six

months ended June 30, 2020. Excluding the impact of foreign exchange, finance costs decreased by 2.8% during the six months ended

June 30, 2020. The decrease in finance costs was driven by a $1.8 million swap gain from a foreign denominated debt in Brazil,

partially offset by higher interest costs from the higher use of credit lines to ensure adequate liquidity during the COVID-19

pandemic.

Net foreign exchange gain/(loss)

Net

foreign exchange loss changed by $6.3 million, from a loss of $3.0 million for the six months ended June 30, 2019 to a loss of

$9.3 million for the six months ended June 30, 2020, primarily due to Brazilian Reais, Colombian Peso and Mexican Peso depreciations

against the U.S. dollar that impacted our intercompany balances, but with no significant cash effect.

Income

tax benefit/(expense)

Income

tax expense for the six months ended June 30, 2019 totaled $31.9 million as compared to income tax benefit for the six months ended

June 30, 2020 of $2.5 million. Income tax expense for the six months ended June 30, 2019 contained a negative one-off tax impact

of $37.8 million due to a settlement with the Spanish Tax Authority in the first quarter of 2019 in connection with a claim against

us for certain inconsistencies in historical tax payments.

Profit/(loss)

for the period

As a result of

the foregoing, loss for the six months ended June 30, 2019 and 2020 was $52.2 million and $25.8 million, respectively.

EBITDA and Adjusted EBITDA

EBITDA decreased

by $21.6 million, or 25.6%, from $84.6 million for the six months ended June 30, 2019 to $63.0 million for the six months ended

June 30, 2020, of which $14.8 million was generated in June 2020, when volumes reached near-normal levels. Excluding the impact

of foreign exchange EBITDA decreased by 10.2%, mainly due to the impact of COVID-19, which was felt more strongly in the second

half of March, April and May 2020.

EBITDA margin

for the six months ended June 30, 2020 was 9.1% compared to 9.6% in the six months ended June 30, 2019. On a run-rate basis, excluding

the impact of COVID-19, total EBITDA increased 36% compared to normalized EBITDA (excluding the impact of extraordinary items)

in the six months ended June 30, 2019.

Brazil

Adjusted

EBITDA in Brazil decreased by $19.3 million, or 35.6%, from $54.3 million for the six months ended June 30, 2019 to $35.0 million

for the six months ended June 30, 2020. Excluding the impact of foreign exchange, Adjusted EBITDA decreased by 18.0%.

Adjusted

EBITDA margin in Brazil for the six months ended June 30, 2020 decreased to 11.4% from 12.7% for the six months ended June 30,

2019.

The

decrease in Adjusted EBITDA and Adjusted EBITDA margin in Brazil was mainly due to the impact of COVID-19.

Americas

Adjusted

EBITDA in Americas decreased by $4.5 million, or 13.8%, from $32.7 million for the six months ended June 30, 2019 to $28.2 million

for the six months ended June 30, 2020. Excluding the impact of foreign exchange, Adjusted EBITDA decreased by 5.2% due to the

impact of COVID-19.

Adjusted

EBITDA margin in Americas for the six months ended June 30, 2020 increased to 10.2% from 9.8% for the six months ended June 30,

2019. Despite the decrease in Adjusted EBITDA due to the impact of COVID-19, Adjusted EBITDA margin increased due to a better revenue

mix and cost management.

EMEA

Adjusted

EBITDA decreased by $8.3 million, or 70.6%, from $11.8 million for the six months ended June 30, 2019 to $3.5 million for the six

months ended June 30, 2020. Excluding the impact of foreign exchange, Adjusted EBITDA decreased by 69.8%.

Adjusted

EBITDA margin in EMEA for the six months ended June 30, 2020 decreased to 3.2% from 9.6% for the six months ended June 30, 2019,

mainly due to the impact of COVID-19.

Liquidity

and Capital Resources

As

of June 30, 2020, our outstanding debt was $733.1 million, which includes $503.8 million of our 6.125% Senior Secured Notes due

2022, $134.7 million of lease liabilities, including $129.6 million of IFRS 16-related leases, and $94.7 million of short-term

debt, including $50.7 million of financing under a super senior revolving credit facility and $44.0 million of other bank borrowings,

especially financing for working capital needs.

During

the six months ended June 30, 2020, our cash flow from operating activities was $57.7 million, which includes interest paid of

$22.0 million. Our cash flow from operating activities, before giving effect to the payment of interest, was $79.7 million.

Consolidated

Statements of Cash Flows for the Six Months Ended June 30, 2019 and 2020

|

|

For the

six months

ended June 30,

|

|

($ in millions)

|

2019

|

2020

|

|

|

(unaudited)

|

|

Operating activities

|

|

|

|

Loss before income tax

|

(20.3)

|

(28.3)

|

|

Adjustments to reconcile loss before income tax to net cash flows:

|

|

|

|

Amortization and depreciation

|

68.5

|

60.2

|

|

Changes in trade provisions

|

1.5

|

1.9

|

|

Share-based payment expense

|

2.1

|

1.1

|

|

Changes in provisions

|

21.6

|

16.4

|

|

Grants released to income

|

(0.4)

|

(0.3)

|

|

Losses on disposal of property, plant and equipment

|

0.1

|

0.2

|

|

Finance income

|

(4.4)

|

(11.0)

|

|

Finance costs

|

37.9

|

32.8

|

|

Net foreign exchange differences

|

3.0

|

9.3

|

|

Change in other (gains)/losses and own work capitalized

|

2.1

|

(0.4)

|

|

|

131.9

|

110.2

|

|

Changes in working capital:

|

|

|

|

Changes in trade and other receivables

|

(105.2)

|

(9.8)

|

|

Changes in trade and other payables

|

33.4

|

32.6

|

|

Other assets/(payables)

|

3.5

|

(21.8)

|

|

|

(68.3)

|

1.0

|

|

|

|

|

|

Interest paid

|

(23.2)

|

(22.0)

|

|

Interest received

|

0.3

|

10.1

|

|

Income tax paid

|

(14.4)

|

(7.5)

|

|

Other payments

|

(19.1)

|

(5.7)

|

|

|

(56.5)

|

(25.1)

|

|

Net cash flows from/(used in) operating activities

|

(13.3)

|

57.7

|

|

Investing activities

|

|

|

|

Payments for acquisition of intangible assets

|

(15.7)

|

(3.6)

|

|

Payments for acquisition of property, plant and equipment

|

(6.5)

|

(14.8)

|

|

Acquisition of subsidiaries, net of cash acquired

|

(14.9)

|

—

|

|

Payments for financial instruments

|

(1.1)

|

(0.3)

|

|

Proceeds from sale of PP&E and intangible assets

|

—

|

—

|

|

Net cash flows used in investing activities

|

(38.1)

|

(18.6)

|

|

Financing activities

|

|

|

|

Proceeds from borrowing from third parties

|

150.3

|

100.4

|

|

Repayment of borrowing from third parties

|

(86.3)

|

(23.3)

|

|

Payments of lease liabilities

|

(29.7)

|

(19.4)

|

|

Acquisition of treasury shares

|

(0.5)

|

(0.5)

|

|

Net cash flows provided by financing activities

|

33.8

|

57.1

|

|

Net (decrease)/increase in cash and cash equivalents

|

(17.5)

|

96.2

|

|

Foreign exchange differences

|

0.6

|

(13.9)

|

|

Cash and cash equivalents at beginning of period

|

133.5

|

124.7

|

|

Cash and cash equivalents at end of period

|

116.6

|

207.2

|

Cash

flow

As

of June 30, 2020, we had cash and cash equivalents of $207.2 million. We believe that our current cash flow provided by operating

activities and financing arrangements will provide us with sufficient liquidity to meet our working capital needs.

|

|

For the

six months ended June 30,

|

|

($ in millions)

|

2019

|

2020

|

|

|

(unaudited)

|

|

Cash flows from/(used in) operating activities

|

(13.3)

|

57.7

|

|

Cash flows used in investing activities

|

(38.1)

|

(18.6)

|

|

Cash flows provided by financing activities

|

33.8

|

57.1

|

|

Net (decrease)/increase in cash and cash equivalents

|

(17.5)

|

96.2

|

|

Effect of changes in exchange rates

|

0.6

|

(13.9)

|

Cash

flows from operating activities

Six Months

Ended June 30, 2019 Compared to Six Months Ended June 30, 2020

For

the six months ended June 30, 2020, cash from operating activities was $57.7 million compared to cash used in operating activities

of $13.3 million for the same period in the prior year. The increase was due to a $69.3 million improvement in working capital

resulting from the collection efforts on some past due accounts, stricter treasury policies and the implementation of our Three

Horizon Plan.

Cash

flows used in investing activities

Six Months

Ended June 30, 2019 Compared to Six Months Ended June 30, 2020

For

the six months ended June 30, 2020, cash used in investing activities was $18.6 million compared to cash used in investment

activities of $38.1 million for the same period in the prior year. In addition to the reasons above, there has been a rationalization

of capital expenditure, with a focus on emergency projects related to COVID-19, such as expenses relating to WAHA and the implementation

of strict sanitary measures in the delivery centers. Ordinary capital expenditure has been put on hold for most of the period.

Cash

flows provided by financing activities

Six Months

Ended June 30, 2019 Compared to Six Months Ended June 30, 2020

For

the six months ended June 30, 2020, cash provided by financing activities was $57.1 million compared to cash provided by financing

activities of $33.8 million for the same period in the prior year. The change was due to the full utilization of our credit lines

in 2020 to ensure we have adequate liquidity during the COVID-19 crisis.

Finance

leases

The

Company holds the following assets under finance leases:

|

|

As of June 30,

|

|

|

2019

|

2020

|

|

($ in millions)

|

Net carrying amount of

asset

|

Net carrying amount of

asset

|

|

Finance leases

|

(unaudited)

|

|

Plant and machinery

|

0.7

|

-

|

|

Furniture, tools and other tangible assets

|

3.2

|

3.6

|

|

Buildings - IFRS 16

|

163.4

|

120.8

|

|

Total

|

167.2

|

124.4

|

The

present value of future finance lease payments is as follows:

|

|

As of June 30,

|

|

|

2019

|

2020

|

|

($ in millions)

|

Net carrying amount of

asset

|

Net carrying amount of

asset

|

|

|

(unaudited)

|

|

Up to 1 year

|

49.0

|

43.7

|

|

Between 1 and 5 years

|

120.6

|

91.0

|

|

Total

|

169.6

|

134.7

|

Capital

expenditure

Our

business has significant capital expenditure requirements, including for the construction and initial fit-out of our service delivery

centers; improvements and refurbishment of leased facilities for our service delivery centers; acquisition of various items

of property, plant and equipment, mainly composed of furniture, computer equipment and technology equipment; and acquisition and

upgrades of our software or specific customer’s software.

The

funding of the majority of our capital expenditure is covered by existing cash and EBITDA generation. The table below shows our

capital expenditure by segment for the six months ended June 30, 2019 and 2020.

|

|

For the

six months ended June 30,

|

|

|

2019

|

2020

|

|

($ in millions)

|

(unaudited)

|

|

Brazil

|

13.3

|

7.3

|

|

Americas

|

5.9

|

4.1

|

|

EMEA

|

1.9

|

1.3

|

|

Total capital expenditure

|

21.2

|

12.7

|

The

capital expenditures for the six months ended June 30, 2020 include costs associated with shifting a portion of Atento’s

call center employees to the WAHA model. Owing to the impact of the COVID-19 pandemic on Atento’s markets, all non-essential

capital expenditures remained largely suspended in April and May 2020.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

ATENTO S.A.

(Registrant)

Date: September 17, 2020

By:

Name: Carlos López-Abadía

Title: Chief Executive Officer

By:

Name: José Antonio de Souza Azevedo

Title: Chief Financial Officer

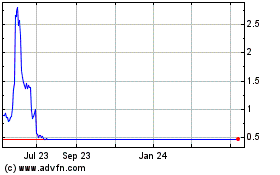

Atento (NYSE:ATTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Atento (NYSE:ATTO)

Historical Stock Chart

From Apr 2023 to Apr 2024