UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

ATENTO S.A.

Ordinary Shares

(Title of Class of Securities)

L0427L105

Joseph Virgilio

HPS Investment Partners, LLC

40 West 57th Street, 33rd Floor

New York, New York 10019

Telephone: 212-287-6767

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

June 24, 2020

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is

filing this schedule because § 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g) check the following box ☐.

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule,

including all exhibits. See § 240.13d-7(b) for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of

securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

1

|

Names of Reporting Persons

HPS Investment Partners, LLC

|

|

|

|

|

2

|

Check the Appropriate Box if a Member of a Group

|

|

|

|

(a)

|

☐

|

|

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC Use Only

|

|

|

|

|

4

|

Source of Funds

OO

|

|

|

|

|

5

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e): ☐

|

|

|

|

|

6

|

Citizenship or Place of Organization

Delaware

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7

|

Sole Voting Power

0 (see item 5)

|

|

|

|

8

|

Shared Voting Power

19,126,703 (see item 5)

|

|

|

|

9

|

Sole Dispositive Power

0 (see item 5)

|

|

|

|

10

|

Shared Dispositive Power

19,126,703 (see item 5)

|

|

|

|

|

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

19,126,703 (see item 5)

|

|

|

|

|

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ☐

|

|

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

26.9% (1) (see item 5)

|

|

|

|

|

14

|

Type of Reporting Person

IA

|

|

|

(1)

|

Based on 71,179,765 Ordinary Shares of the Issuer issued and outstanding as of May 6, 2020 and the date hereof, which includes 10,904,985 million Ordinary Shares owned by Mezzanine Partners II

Offshore Lux S.à r.l II, 6,342,902 million Ordinary Shares owned by Mezzanine Partners II Onshore Lux S.à r.l II and 1,878,816 million Ordinary Shares owned by Mezzanine Partners II Institutional Lux S.à r.l II and Mezzanine Partners II AP Lux

S.à r.l II, collectively, over which HPS Investment Partners, LLC has indirect control.

|

|

|

1

|

Names of Reporting Persons

HPS Mezzanine Partners II, LLC

|

|

|

|

|

2

|

Check the Appropriate Box if a Member of a Group

|

|

|

|

(a)

|

☐

|

|

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC Use Only

|

|

|

|

|

4

|

Source of Funds

OO

|

|

|

|

|

5

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e): ☐

|

|

|

|

|

6

|

Citizenship or Place of Organization

Delaware

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7

|

Sole Voting Power

0 (see item 5)

|

|

|

|

8

|

Shared Voting Power

19,126,703 (see item 5)

|

|

|

|

9

|

Sole Dispositive Power

0 (see item 5)

|

|

|

|

10

|

Shared Dispositive Power

19,126,703 (see item 5)

|

|

|

|

|

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

19,126,703 (see item 5)

|

|

|

|

|

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ☐

|

|

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

26.9% (1) (see item 5)

|

|

|

|

|

14

|

Type of Reporting Person

IA

|

|

|

(1)

|

Based on 71,179,765 Ordinary Shares of the Issuer issued and outstanding as of May 6, 2020 and the date hereof, which includes 10,904,985 million Ordinary Shares owned by Mezzanine Partners II

Offshore Lux S.à r.l II, 6,342,902 million Ordinary Shares owned by Mezzanine Partners II Onshore Lux S.à r.l II and 1,878,816 million Ordinary Shares owned by Mezzanine Partners II Institutional Lux S.à r.l II and Mezzanine Partners II AP Lux

S.à r.l II, collectively, over which HPS Mezzanine Partners II, LLC has indirect control.

|

|

|

1

|

Names of Reporting Persons

HPS Mezzanine Partners II Offshore GP, L.P.

|

|

|

|

|

2

|

Check the Appropriate Box if a Member of a Group

|

|

|

|

(a)

|

☐

|

|

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC Use Only

|

|

|

|

|

4

|

Source of Funds

OO

|

|

|

|

|

5

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e): ☐

|

|

|

|

|

6

|

Citizenship or Place of Organization

Cayman Islands

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7

|

Sole Voting Power

0 (see item 5)

|

|

|

|

8

|

Shared Voting Power

12,054,691 (see item 5)

|

|

|

|

9

|

Sole Dispositive Power

0 (see item 5)

|

|

|

|

10

|

Shared Dispositive Power

12,054,691 (see item 5)

|

|

|

|

|

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

12,054,691 (see item 5)

|

|

|

|

|

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ☐

|

|

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

16.9% (1) (see item 5)

|

|

|

|

|

14

|

Type of Reporting Person

PN

|

|

|

(1)

|

Based on 71,179,765 Ordinary Shares of the Issuer issued and outstanding as of May 6, 2020 and the date hereof, which includes 10,904,985 million Ordinary Shares owned by Mezzanine Partners II

Offshore Lux S.à r.l II and 1,149,706 million Ordinary Shares owned by Mezzanine Partners II Institutional Lux S.à r.l II over which HPS Mezzanine Partners II Offshore GP, L.P. has indirect control.

|

|

|

1

|

Names of Reporting Persons

Mezzanine Partners - Offshore Investment Master Fund II, L.P.

|

|

|

|

|

2

|

Check the Appropriate Box if a Member of a Group

|

|

|

|

(a)

|

☐

|

|

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC Use Only

|

|

|

|

|

4

|

Source of Funds

OO

|

|

|

|

|

5

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e): ☐

|

|

|

|

|

6

|

Citizenship or Place of Organization

Cayman Islands

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7

|

Sole Voting Power

0 (see item 5)

|

|

|

|

8

|

Shared Voting Power

10,904,985 (see item 5)

|

|

|

|

9

|

Sole Dispositive Power

0 (see item 5)

|

|

|

|

10

|

Shared Dispositive Power

10,904,985 (see item 5)

|

|

|

|

|

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

10,904,985 (see item 5)

|

|

|

|

|

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ☐

|

|

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

15.3% (1) (see item 5)

|

|

|

|

|

14

|

Type of Reporting Person

PN

|

|

|

(1)

|

Based on 71,179,765 Ordinary Shares of the Issuer issued and outstanding as of May 6, 2020 and the date hereof, which includes 10,904,985 million Ordinary Shares owned by Mezzanine Partners II

Offshore Lux S.à r.l II in which Mezzanine Partners - Offshore Investment Master Fund II, L.P. has an indirect interest.

|

|

|

1

|

Names of Reporting Persons

Mezzanine Partners II Offshore Lux S.à r.l

|

|

|

|

|

2

|

Check the Appropriate Box if a Member of a Group

|

|

|

|

(a)

|

☐

|

|

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC Use Only

|

|

|

|

|

4

|

Source of Funds

OO

|

|

|

|

|

5

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e): ☐

|

|

|

|

|

6

|

Citizenship or Place of Organization

Luxembourg

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7

|

Sole Voting Power

0 (see item 5)

|

|

|

|

8

|

Shared Voting Power

10,904,985 (see item 5)

|

|

|

|

9

|

Sole Dispositive Power

0 (see item 5)

|

|

|

|

10

|

Shared Dispositive Power

10,904,985 (see item 5)

|

|

|

|

|

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

10,904,985 (see item 5)

|

|

|

|

|

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ☐

|

|

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

15.3% (1) (see item 5)

|

|

|

|

|

14

|

Type of Reporting Person

OO

|

|

|

(1)

|

Based on 71,179,765 Ordinary Shares of the Issuer issued and outstanding as of May 6, 2020 and the date hereof, which includes 10,904,985 million Ordinary Shares owned by Mezzanine Partners II

Offshore Lux S.à r.l II in which Mezzanine Partners - Offshore Investment Master Fund II, L.P. has an interest.

|

|

|

1

|

Names of Reporting Persons

Mezzanine Partners II Offshore Lux S.à r.l II

|

|

|

|

|

2

|

Check the Appropriate Box if a Member of a Group

|

|

|

|

(a)

|

☐

|

|

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC Use Only

|

|

|

|

|

4

|

Source of Funds

OO

|

|

|

|

|

5

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e): ☐

|

|

|

|

|

6

|

Citizenship or Place of Organization

Luxembourg

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7

|

Sole Voting Power

0 (see item 5)

|

|

|

|

8

|

Shared Voting Power

10,904,985 (see item 5)

|

|

|

|

9

|

Sole Dispositive Power

0 (see item 5)

|

|

|

|

10

|

Shared Dispositive Power

10,904,985 (see item 5)

|

|

|

|

|

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

10,904,985 (see item 5)

|

|

|

|

|

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ☐

|

|

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

15.3% (1) (see item 5)

|

|

|

|

|

14

|

Type of Reporting Person

OO

|

|

|

(1)

|

Based on 71,179,765 Ordinary Shares of the Issuer issued and outstanding as of May 6, 2020 and the date hereof.

|

|

|

1

|

Names of Reporting Persons

HPS Mezzanine Partners II GP, L.P.

|

|

|

|

|

2

|

Check the Appropriate Box if a Member of a Group

|

|

|

|

(a)

|

☐

|

|

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC Use Only

|

|

|

|

|

4

|

Source of Funds

OO

|

|

|

|

|

5

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e): ☐

|

|

|

|

|

6

|

Citizenship or Place of Organization

Delaware

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7

|

Sole Voting Power

0 (see item 5)

|

|

|

|

8

|

Shared Voting Power

7,072,012 (see item 5)

|

|

|

|

9

|

Sole Dispositive Power

0 (see item 5)

|

|

|

|

10

|

Shared Dispositive Power

7,072,012 (see item 5)

|

|

|

|

|

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

7,072,012 (see item 5)

|

|

|

|

|

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ☐

|

|

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

9.9% (1) (see item 5)

|

|

|

|

|

14

|

Type of Reporting Person

PN

|

|

|

(1)

|

Based on 71,179,765 Ordinary Shares of the Issuer issued and outstanding as of May 6, 2020 and the date hereof, which includes 6,342,902 million Ordinary Shares owned by Mezzanine Partners II

Onshore Lux S.à r.l II and 729,110 million Ordinary Shares owned by Mezzanine Partners II AP Lux S.à r.l II over which HPS Mezzanine Partners II GP, L.P. has indirect control.

|

|

|

1

|

Names of Reporting Persons

Mezzanine Partners II, L.P.

|

|

|

|

|

2

|

Check the Appropriate Box if a Member of a Group

|

|

|

|

(a)

|

☐

|

|

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC Use Only

|

|

|

|

|

4

|

Source of Funds

OO

|

|

|

|

|

5

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e): ☐

|

|

|

|

|

6

|

Citizenship or Place of Organization

Delaware

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7

|

Sole Voting Power

0 (see item 5)

|

|

|

|

8

|

Shared Voting Power

6,342,902 (see item 5)

|

|

|

|

9

|

Sole Dispositive Power

0 (see item 5)

|

|

|

|

10

|

Shared Dispositive Power

6,342,902 (see item 5)

|

|

|

|

|

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

6,342,902 (see item 5)

|

|

|

|

|

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ☐

|

|

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

8.9% (1) (see item 5)

|

|

|

|

|

14

|

Type of Reporting Person

PN

|

|

|

(1)

|

Based on 71,179,765 Ordinary Shares of the Issuer issued and outstanding as of May 6, 2020 and the date hereof, which includes 6,342,902 million Ordinary Shares owned by Mezzanine Partners II

Onshore Lux S.à r.l II in which Mezzanine Partners II, L.P. has an indirect interest.

|

|

|

1

|

Names of Reporting Persons

Mezzanine Partners II Onshore Lux S.à r.l

|

|

|

|

|

2

|

Check the Appropriate Box if a Member of a Group

|

|

|

|

(a)

|

☐

|

|

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC Use Only

|

|

|

|

|

4

|

Source of Funds

OO

|

|

|

|

|

5

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e): ☐

|

|

|

|

|

6

|

Citizenship or Place of Organization

Luxembourg

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7

|

Sole Voting Power

0 (see item 5)

|

|

|

|

8

|

Shared Voting Power

6,342,902 (see item 5)

|

|

|

|

9

|

Sole Dispositive Power

0 (see item 5)

|

|

|

|

10

|

Shared Dispositive Power

6,342,902 (see item 5)

|

|

|

|

|

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

6,342,902 (see item 5)

|

|

|

|

|

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ☐

|

|

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

8.9% (1) (see item 5)

|

|

|

|

|

14

|

Type of Reporting Person

OO

|

|

|

(1)

|

Based on 71,179,765 Ordinary Shares of the Issuer issued and outstanding as of May 6, 2020 and the date hereof, which includes 6,342,902 million Ordinary Shares owned by Mezzanine Partners II

Onshore Lux S.à r.l II in which Mezzanine Partners II, L.P. has an interest.

|

|

|

1

|

Names of Reporting Persons

Mezzanine Partners II Onshore Lux S.à r.l II

|

|

|

|

|

2

|

Check the Appropriate Box if a Member of a Group

|

|

|

|

(a)

|

☐

|

|

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC Use Only

|

|

|

|

|

4

|

Source of Funds

OO

|

|

|

|

|

5

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e): ☐

|

|

|

|

|

6

|

Citizenship or Place of Organization

Luxembourg

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With:

|

7

|

Sole Voting Power

0 (see item 5)

|

|

|

|

8

|

Shared Voting Power

6,342,902 (see item 5)

|

|

|

|

9

|

Sole Dispositive Power

0 (see item 5)

|

|

|

|

10

|

Shared Dispositive Power

6,342,902 (see item 5)

|

|

|

|

|

11

|

Aggregate Amount Beneficially Owned by Each Reporting Person

6,342,902 (see item 5)

|

|

|

|

|

12

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ☐

|

|

|

|

|

13

|

Percent of Class Represented by Amount in Row (11)

8.9% (1) (see item 5)

|

|

|

|

|

14

|

Type of Reporting Person

OO

|

|

|

(1)

|

Based on 71,179,765 Ordinary Shares of the Issuer issued and outstanding as of May 6, 2020 and the date hereof.

|

|

Item 1.

|

Security and Issuer

|

This statement on Schedule 13D (this “Schedule 13D”) relates to the ordinary shares, no par value (the

“Ordinary Shares”), of Atento S.A., a public limited liability company (société anonyme) incorporated under the laws of Luxembourg (the “Issuer”). The Issuer’s principal executive office is located at 1, rue Hildegard Von Bingen, L-1282, Luxembourg, Grand Duchy of

Luxembourg.

|

Item 2.

|

Identity and Background

|

This Schedule 13D is being filed jointly pursuant to Rule 13d-1(a) under the Act on behalf of (i) HPS

Investment Partners, LLC (“HPS”), (ii) HPS Mezzanine Partners II, LLC (“HPS Mezzanine”), (iii) HPS Mezzanine Partners II Offshore GP, L.P. (“Offshore GP”), (iv) Mezzanine Partners - Offshore Investment Master Fund II, L.P. (“Offshore

LP”), (v) Mezzanine Partners II Offshore Lux S.à r.l (“Offshore Sarl”), (vi) Mezzanine Partners II Offshore Lux S.à r.l II (“Mezzanine Offshore”), (vii) HPS Mezzanine Partners II GP, L.P. (“Onshore GP”), (viii) Mezzanine

Partners II, L.P. (“Onshore LP”), (ix) Mezzanine Partners II Onshore Lux S.à r.l (“Onshore Sarl”) and (X) Mezzanine Partners II Onshore Lux S.à r.l II (“Mezzanine Onshore,” and together with HPS, HPS Mezzanine, Offshore GP,

Offshore LP, Offshore Sarl, Mezzanine Offshore, Onshore GP, Onshore LP and Onshore Sarl, the “Reporting Persons”).

The principal business and office address of each of HPS and HPS Mezzanine is 40 West 57th Street, 33rd

Floor, New York, New York 10019. HPS Mezzanine is the investment manager of Offshore LP, Onshore LP, Mezzanine Offshore and Mezzanine Onshore. HPS is a registered investment adviser under the Investment Advisers Act of 1940 and HPS Mezzanine is a

relying adviser of HPS, and each is principally engaged in the business of investment in securities through various privately offered funds and separate accounts for which it or its subsidiary serves as, direct or indirect, investment manager.

The principal business and office address of each of Offshore GP and Offshore LP is 40 West 57th Street, 33rd

Floor, New York, New York 10019. Offshore GP is the general partner of and has control over Offshore LP. Offshore LP owns Offshore Sarl. Offshore GP and Offshore LP are principally engaged in providing creative capital solutions and generating

attractive risk-adjusted returns.

The principal business and office address of Offshore Sarl is 291 route d’Arlon, L-1150 Luxembourg. Offshore

Sarl owns Mezzanine Offshore. Offshore Sarl is principally engaged in providing creative capital solutions and generating attractive risk-adjusted returns.

The principal business and office address of each of Onshore GP and Onshore LP is 40 West 57th Street, 33rd

Floor, New York, New York 10019. Onshore GP is the general partner of and has control over Onshore LP. Onshore GP and Onshore LP are principally engaged in providing creative capital solutions and generating attractive risk-adjusted returns.

The principal business and office address of Onshore Sarl is 291 route d’Arlon, L-1150 Luxembourg. Onshore

Sarl owns Mezzanine Onshore. Onshore Sarl is principally engaged in providing creative capital solutions and generating attractive risk-adjusted returns.

Mezzanine Offshore and Mezzanine Onshore are wholly-owned subsidiaries of Offshore Sarl and Onshore Sarl,

respectively. The principal business and office address of each of Mezzanine Offshore and Mezzanine Onshore is 291 route d’Arlon L-1150 Luxembourg.

Additional information called for by this item with respect to each executive officer and director of the

Reporting Persons is contained in Schedule A attached hereto and is incorporated herein by reference.

During the last five years, none of the Reporting Persons nor any the executive officers and directors listed

on Schedule A have been (i) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and

as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or

prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

|

Item 3.

|

Source and Amount of Funds or Other Consideration

|

Prior to the Closing (as defined below), certain affiliates of Bain Capital (“Bain”), through various parent affiliates of

the Issuer controlled by Bain beneficially owned 48,520,671 ordinary shares of the Issuer (the “PIKCo Shares”).

Pursuant to an indenture, dated as of May 30, 2014 (the “Indenture”), by and among Atalaya Luxco PIKCo, a partnership

limited by shares (société en commandite par actions) organized under the laws of Grand Duchy of Luxembourg whose registered office is located at 4, rue Lou Hemmer, L-1748 Luxembourg, Grand Duchy of Luxembourg,

and registered with the Luxembourg Register of Commerce and Companies under number B986929 (“Atalaya”), as issuer, acting through its general partner Atalaya PIKco, a private limited liability company (société à

responsabilité limitée) incorporated and existing under the laws of Luxembourg, having its registered office at 4, rue Lou Hemmer, L-1748 Luxembourg, and registered with the R.C.S. Luxembourg under number B187036 (“PIKCo GP”), Atalaya

Luxco Topco, a partnership limited by shares (société en commandite par actions) organized under the laws of Luxembourg , whose registered office is located at 4, rue Lou Hemmer, L-1748 Luxembourg, Grand Duchy

of Luxembourg, and registered with the R.C.S. Luxembourg under number B. 173 107 (together with Atalaya and PIKCo GP, the “Atalaya Entities”), as security providers, Citibank, N.A., London Branch, as trustee and paying agent, Citigroup Global

Markets Deutschland AG as registrar and Citibank, N.A., London Branch, as security agent, Atalaya issued 11.50%/13.25% senior PIK notes due 2020 (the “Senior PIK Notes”). In connection with the issuance of the Senior PIK Notes, PIKCo GP pledged

100% of the shares in PIKco as security for the Senior PIK Notes (the “Collateral”). As the maturity date of the Senior PIK Notes approached, HPS engaged in discussions with the Atalaya Entities regarding the forfeiture of a portion of the PIKCo

Shares in lieu of the forfeiture of the Collateral securing the Senior PIK Notes held by Mezzanine Offshore, Mezzanine Onshore, Mezzanine Partners II Institutional Lux S.à r.l II (“Mezzanine Institutional”) and Mezzanine Partners II AP Lux S.à

r.l II (“Mezzanine AP,” together with Mezzanine Offshore, Mezzanine Onshore and Mezzanine Institutional, the “Holders”) in order to satisfy the obligations of the Atalaya Entities under the Senior PIK Notes held by the Holders. Atalaya

and HPS ultimately negotiated a share transfer agreement to effect such exchange, as further described below. Prior to the Closing, the Holders held, collectively, $180,288,182 principal amount of the Senior PIK Notes. HPS had acquired the Senior PIK

Notes as part of its regular investing activities.

In connection with the closing (the “Closing”) on June 24, 2020 (the “Closing Date”) of the

transactions contemplated by the share transfer agreement (“Share Transfer Agreement”), a copy of which is filed with this Schedule 13D as Exhibit 2 (which is

hereby incorporated by reference), dated as of May 6, 2020, by and among Atalaya, the Holders, the Issuer and certain other holders of Senior PIK Notes, Atalaya transferred to the Holders an aggregate of 19,126,703 Ordinary Shares in the

Issuer, of which (i) 10,904,985 Ordinary Shares were transferred to Mezzanine Offshore, (ii) 6,342,902 Ordinary Shares were transferred to Mezzanine Onshore, (iii) 1,149,706 Ordinary Shares were transferred to Mezzanine Institutional and (iv) 729,110

Ordinary Shares were transferred to Mezzanine AP (collectively, the “HPS Shares”) as consideration for the Holders’ surrender of its $180,288,182 principal amount of the Senior PIK Notes. The sale of Atalaya’s Ordinary Shares pursuant to the

Share Transfer Agreement was contingent upon, among other things, certain regulatory requirements being met.

|

Item 4.

|

Purpose of Transaction

|

The response of the Reporting Persons to Item 3 hereof is incorporated herein by reference.

The Ordinary Shares of the Issuer transferred on the Closing Date and beneficially owned by the Reporting Persons were acquired in connection with

the Share Transfer Agreement. The Reporting Persons will continue to assess the business, financial condition, results of operations and prospects of the Issuer, general economic conditions, the securities markets in general and the Ordinary Shares of

the Issuer in particular, other developments and other investment opportunities. Depending on such assessments, the Reporting Persons may acquire beneficial ownership of additional Ordinary Shares of the Issuer or may sell or otherwise dispose of all

or some of the Ordinary Shares of the Issuer beneficially owned by the Reporting Persons in any matter permitted by law. As part of its ongoing evaluation, the Reporting Persons expect that from time to time they will express their views to, or

meet with, the Issuer’s management, the Issuer’s board of directors, other partners or members of the Issuer or third parties concerning, among other things, the

Issuer’s business, management, capital structure and strategy. In connection with such evaluation, the Reporting Persons may consider any of the matters described in Items 4(a)-(j) of the instructions to Schedule 13D and may formulate a plan or

proposal with respect to such matters.

On the Closing Date, pursuant to the Director Nomination Agreement, dated as of May 6, 2020 (the “Director Nomination Agreement”), a copy of

which is filed with this Schedule 13D as Exhibit 4 (which is hereby incorporated by reference), the Holders have the right (but not the obligation) to nominate

two directors to the board of directors of the Issuer for so long as they collectively hold greater than 22.5% of the Ordinary Shares of the Issuer. The following persons affiliated with the Reporting Persons will be nominated to join the board of

directors of the Issuer: John Madden and Oliver Feix, and the Reporting Persons may have influence over the corporate activities of the Issuer, including activities which may relate to items described in Item 4 of this Schedule 13D.

Except as described in this Schedule 13D, the Reporting Persons do not have any present plans or proposals

that relate to or would result in any of the actions described in Item 4 of this Schedule 13D, although, subject to the agreements described herein, the Reporting Persons, at any time and from time to time, may review, reconsider and change their

position and/or change their purpose and/or develop such plans and may seek to influence management of the Issuer of the Issuer’s board of directors with respect to the business and affairs of the Issuer and may from time to time consider pursuing or

proposing such matters with advisors, the Issuer or other persons.

|

Item 5.

|

Interest in Securities of the Issuer

|

(a)-(b) The

responses of the Reporting Persons to Rows (7) through (13) of the cover page of this Schedule 13D, as of the date hereof are incorporated herein by reference.

HPS and HPS Mezzanine may be deemed to beneficially own, in the aggregate, 19,126,703 Ordinary Shares, which

represents 26.9% of the Issuer’s outstanding Ordinary Shares as of May 6, 2020 and the date hereof, which includes 10,904,985 million Ordinary Shares owned by Mezzanine Offshore, 6,342,902 million Ordinary Shares owned by Mezzanine Onshore and

1,878,816 million Ordinary Shares owned by Mezzanine Institutional and Mezzanine AP, collectively, over which HPS and HPS Mezzanine have indirect control.

Offshore GP may be deemed to beneficially own, in the aggregate, 12,054,691 Ordinary Shares, which represents

16.9% of the Issuer’s outstanding Ordinary Shares as of May 6, 2020 and the date hereof, which includes 10,904,985 million Ordinary Shares owned by Mezzanine Offshore and 1,149,706 million Ordinary Shares owned by Mezzanine Institutional over which

Offshore GP has indirect control.

Offshore LP, Offshore Sarl and Mezzanine Offshore may be deemed to beneficially own, in the aggregate,

10,904,985 Ordinary Shares, which represents 15.3% of the Issuer’s outstanding Ordinary Shares as of May 6, 2020 and the date hereof. Offshore LP holds indirect ownership interests in Mezzanine Offshore. Offshore Sarl holds direct ownership interests

in Mezzanine Offshore.

Onshore GP may be deemed to beneficially own, in the aggregate, 7,072,012 Ordinary Shares, which represents

9.9% of the Issuer’s outstanding Ordinary Shares as of May 6, 2020 and the date hereof, which includes 6,342,902 million Ordinary Shares owned by Mezzanine Onshore and 729,110 million Ordinary Shares owned by Mezzanine AP over which Onshore GP has

indirect control.

Onshore LP, Onshore Sarl and Mezzanine Onshore may be deemed to beneficially own, in the aggregate, 6,342,902

Ordinary Shares, which represents 8.9% of the Issuer’s outstanding Ordinary Shares as of May 6, 2020 and the date hereof. Onshore LP holds indirect ownership interests in Mezzanine Onshore. Onshore Sarl holds direct ownership interests in Mezzanine

Onshore.

To the knowledge of the Reporting Persons, no person listed on Schedule A beneficially owns any Ordinary

Shares. Each of the Reporting Person disclaims beneficial ownership of the Ordinary Shares, except to the extent of its pecuniary interest in such Ordinary Shares.

Neither the filing of this Schedule 13D nor any of its contents shall be deemed to constitute an admission that any of the

Reporting Persons is the beneficial owner of the Ordinary Shares referred to herein for purposes of Section 13(d) of the Act, or for any other purpose, and such beneficial ownership is expressly disclaimed. Each Reporting Person expressly disclaims any

assertion or presumption that it or he or she and the other persons on whose behalf this Schedule 13D is filed constitute a “group.”

Neither the filing of this Schedule 13D nor any of its contents, including without limitation the disclosure

herein regarding the Share Transfer Agreement, shall be deemed to constitute an admission that the Reporting Persons, or any of the other holders of the Senior PIK Notes who were party to the Share Transfer Agreement (referred to herein as the “Other

Participating Holders”), are members of any “group” for purposes of Section 13(d) of the Exchange Act. The Other Participating Holders have separately made (or are expected to make) Schedule 13D filings reporting the Ordinary Shares they may be

deemed to beneficially own. Collectively, the Reporting Persons believe that they and the Other Participating Holders beneficially own an aggregate of 46,817,886 Ordinary Shares, representing approximately 65.8% of the outstanding Ordinary Shares. Each

Reporting Person disclaims beneficial ownership of the Ordinary Shares that may be deemed to be beneficially owned by the Other Participating Holders.

(c) Except

as disclosed in Items 3 and 4 of this Schedule 13D (which are incorporated herein by reference), none of the Reporting Persons nor, to its knowledge any person listed on Schedule A, effected any transaction in the Ordinary Shares in the 60 days prior

to the Closing Date or from the Closing Date until the date hereof.

(d) Under

certain circumstances, partners, members or managed accounts of the Reporting Persons, as the case may be, could have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, Ordinary Shares

beneficially owned by the Reporting Persons. The responses of the Reporting Persons to Item 2 and Item 5(a) and (b) of this Schedule 13D are incorporated herein by reference.

(e) Inapplicable.

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

|

The Reporting Persons have entered into a Joint Filing Agreement, dated as of July 6, 2020, a copy of which

is attached as Exhibit 1 hereto (which is hereby incorporated by reference), pursuant to which the Reporting Persons have agreed to file this statement jointly in accordance with the provisions of Rule 13d-1(k)(1) of the Exchange Act.

The responses of the Reporting Persons to Items 2, 3 and 4 hereof are incorporated herein by reference.

In connection with the Share Transfer Agreement, the Holders entered into a Registration Rights Agreement, dated May 6, 2020 (the Registration

Rights Agreement”), a copy of which is filed with this Schedule 13D as Exhibit 3 (which is hereby incorporated by reference), pursuant to which the Issuer has granted certain demand and piggyback registration rights with respect to the Ordinary Shares that were transferred pursuant to the Share Transfer Agreement.

Pursuant to the Pledge Agreement (the “Pledge Agreement”), a copy of which is filed with this Schedule 13D as Exhibit 5, Atalaya

pledged 712,963 Ordinary Shares in the Issuer for the benefit of the Holders and the Other Participating Holders in accordance with the terms and conditions of such pledge agreement(s). The pledged Ordinary Shares secure certain indemnification

obligations of the Atalaya Entities.

Pursuant to the Director Nomination Agreement, the Holders agreed that during the 24-month period following its acquisition of the HPS Shares, the

Holders will not sell, assign, transfer, pledge hypothecate, encumber or otherwise dispose of the HPS Shares without the written permission of the Issuer. Transfers between HPS-controlled funds are excluded from such restrictions, subject to certain

conditions.

|

Item 7.

|

Material to be Filed as Exhibits

|

The following documents are filed as exhibits:

|

|

|

|

1

|

Joint Filing Agreement, dated as of July 6, 2020, by and between HPS Investment Partners, LLC, HPS Mezzanine Partners II, LLC, HPS Mezzanine Partners II Offshore GP, L.P., Mezzanine Partners -

Offshore Investment Master Fund II, L.P., Mezzanine Partners II Offshore Lux S.à r.l, Mezzanine Partners II Offshore Lux S.à r.l II, HPS Mezzanine Partners II GP, L.P., Mezzanine Partners II, L.P., Mezzanine Partners II Onshore Lux S.à r.l and

Mezzanine Partners II Onshore Lux S.à r.l II.

|

|

2

|

Share Transfer Agreement, dated as of May 6, 2020, by and among Atalaya Luxco PIKco, Mezzanine Partners II Offshore Lux S.à r.l II, Mezzanine Partners II Onshore Lux S.à r.l II,

Mezzanine Partners II Institutional Lux S.à r.l II, Mezzanine Partners II AP Lux S.à r.l II, Chesham Investment Pte. Ltd., Taheebo Holdings LLC and Atento S.A.

|

|

|

Registration Rights Agreement, dated as of May 6, 2020, by and among Atento S.A. and the entities listed thereto (incorporated by reference to Exhibit 10.4 to the Issuer’s Current Report on Form

6-K filed on June 30, 2020).

|

|

|

Director Nomination Agreement, dated as of May 6, 2020, by and among Atento S.A., Mezzanine Partners II Offshore Lux S.à r.l II, Mezzanine Partners II Onshore Lux S.à r.l II, Mezzanine Partners

II Institutional Lux S.à r.l II and Mezzanine Partners II AP Lux S.à r.l II (incorporated by reference to Exhibit 10.3 to the Issuer’s Current Report on Form 6-K filed on June 30, 2020).

|

|

5

|

Share Pledge Agreement, dated as of June 22, 2020, by and among Atalaya Luxco PIKco, Mezzanine Partners II Offshore Lux S.à r.l. II, Mezzanine Partners II Onshore Lux S.à r.l.

II, Mezzanine Partners II AP LUX S.à r.l. II, Chesham Investment Pte. Ltd., an entity to be designated by Farallon Capital Management, L.L.C. and Atento S.A.

|

Signature

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this

statement is true, complete and correct.

|

Date: July 6, 2020

|

HPS INVESTMENT PARTNERS, LLC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ John Madden

|

|

|

|

|

Name:

|

John Madden

|

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HPS MEZZANINE PARTNERS II, LLC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: HPS Investment Partners, LLC, its sole member

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ John Madden

|

|

|

|

|

Name:

|

John Madden

|

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

|

HPS MEZZANINE PARTNERS II OFFSHORE GP, L.P.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: HPS Partners Holdings II, LLC, its general partner

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ John Madden

|

|

|

|

|

Name:

|

John Madden

|

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MEZZANINE PARTNERS - OFFSHORE INVESTMENT MASTER FUND II, L.P.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: HPS Mezzanine Partners II, LLC, its investment manager

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: HPS Investment Partners, LLC, its sole member

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ John Madden

|

|

|

|

|

Name:

|

John Madden

|

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

[Signature Page to Schedule 13D]

|

|

MEZZANINE PARTNERS II OFFSHORE LUX S.À R.L

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ John Madden

|

|

|

|

|

Name:

|

John Madden

|

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MEZZANINE PARTNERS II OFFSHORE LUX S.À R.L II

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ John Madden

|

|

|

|

|

Name:

|

John Madden

|

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

|

HPS MEZZANINE PARTNERS II GP, L.P.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: HPS Partners Holdings II, LLC, its general partner

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ John Madden

|

|

|

|

|

Name:

|

John Madden

|

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MEZZANINE PARTNERS II, L.P.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: HPS Mezzanine Partners II Offshore GP, L.P., its general partner

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: HPS Partners Holdings II, LLC, its general partner

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ John Madden

|

|

|

|

|

Name:

|

John Madden

|

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

[Signature Page to Schedule 13D]

|

|

MEZZANINE PARTNERS II ONSHORE LUX S.À R.L

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ John Madden

|

|

|

|

|

Name:

|

John Madden

|

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MEZZANINE PARTNERS II ONSHORE LUX S.À R.L II

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ John Madden

|

|

|

|

|

Name:

|

John Madden

|

|

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

[Signature Page to Schedule 13D]

SCHEDULE A

HPS Investment Partners, LLC

Pursuant to Instruction C to Schedule 13D, the below information relates to the executive officers and

directors of HPS Investment Partners, LLC (“HPS”). Each executive officer or director listed below is a citizen of the United States. Additionally, unless otherwise indicated, none of the below executive officers or directors shares voting or

dispositive power over any Ordinary Shares of Atento S.A., except in their capacity as an executive officer or director of HPS. The executive officers and directors of HPS are as follows.

|

|

Present Principal Occupation or Employment

|

Principal Business Address

|

|

Scott Kapnick

|

Chief Executive Officer of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

|

Yoohyun Katherine Choi

|

General Counsel of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

|

Joseph Virgilio

|

Chief Compliance Officer of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

|

Faith Rosenfeld

|

Chief Administrative Officer of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

|

Paul Knollmeyer

|

Chief Financial Officer of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

HPS is controlled by Scott Kapnick, Michael Patterson, Scot French, Faith Rosenfeld and Purnima Puri.

HPS Mezzanine Partners II, LLC

Pursuant to Instruction C to Schedule 13D, HPS Mezzanine Partners II, LLC (“HPS Mezzanine”) is member

managed by HPS.

HPS Mezzanine Partners II Offshore GP, L.P.

Pursuant to Instruction C to Schedule 13D, the below information relates to the executive officers and

directors of HPS Partners Holdings II, LLC, which is the general partner of HPS Mezzanine Partners II Offshore GP, L.P. (“Offshore GP”). Additionally, unless otherwise indicated, none of the below executive officers or directors shares voting or

dispositive power over any Ordinary Shares of Atento S.A., except in their capacity as an executive officer or director of HPS Partners Holdings II, LLC. The executive officers and directors of HPS Partners Holdings II, LLC are as follows.

|

|

Present Principal Occupation or Employment

|

Principal Business Address

|

|

Scott Kapnick

|

Chief Executive Officer of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

|

Yoohyun Katherine Choi

|

General Counsel of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

|

Joseph Virgilio

|

Chief Compliance Officer of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

|

Faith Rosenfeld

|

Chief Administrative Officer of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

|

Paul Knollmeyer

|

Chief Financial Officer of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

Mezzanine Partners - Offshore Investment Master Fund II, L.P.

Pursuant to Instruction C to Schedule 13D, the below information relates to the executive officers and

directors of HPS Partners Holdings II, LLC, which is the general partner of Offshore GP, which is the general partner of Mezzanine Partners - Offshore Investment Master Fund II, L.P. (“Offshore LP”). Additionally, unless otherwise indicated,

none of the below executive officers or directors shares voting or dispositive power over any Ordinary Shares of Atento S.A., except in their capacity as an executive officer or director of HPS Partners Holdings II, LLC. The executive officers and

directors of HPS Partners Holdings II, LLC are as follows.

|

|

Present Principal Occupation or Employment

|

Principal Business Address

|

|

Scott Kapnick

|

Chief Executive Officer of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

|

Yoohyun Katherine Choi

|

General Counsel of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

|

Joseph Virgilio

|

Chief Compliance Officer of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

|

Faith Rosenfeld

|

Chief Administrative Officer of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

|

Paul Knollmeyer

|

Chief Financial Officer of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

Mezzanine Partners II Offshore Lux S.à r.l

Pursuant to Instruction C to Schedule 13D, the below information relates to the executive officers and

directors of Mezzanine Partners II Offshore Lux S.à r.l (“Offshore Sarl”). Additionally, unless otherwise indicated, none of the below executive officers or directors shares voting or dispositive power over any Ordinary Shares of Atento S.A.,

except in their capacity as an executive officer or director of Offshore Sarl. The executive officers and directors of Offshore Sarl are as follows.

|

|

Present Principal Occupation or Employment

|

Principal Business Address

|

|

|

Doris Lee Silvestri

|

Managing Director of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

United States

|

|

Hyana Kim

|

Managing Director of HPS Investment Partners (UK) LLP

|

HPS Investment Partners (UK) LLP

Devonshire House

1 Mayfair Place

4th Floor

London, W1J 8AJ

|

United Kingdom and Australia

|

|

Armando Correia

|

Vice President HPS

|

291 route d’Arlon, L-1150 Luxembourg

|

Portugal

|

|

Francois Daloze

|

Director Alter Domus

|

15 Boulevard F. W. Raiffeisen, 2411 Luxemburg, Luxembourg

|

Belgium

|

Mezzanine Partners II Offshore Lux S.à r.l II

Pursuant to Instruction C to Schedule 13D, the below information relates to the executive officers and

directors of Mezzanine Partners II Offshore Lux S.à r.l II (“Mezzanine Offshore”). Additionally, unless otherwise indicated, none of the below executive officers or directors shares voting or dispositive power over any Ordinary Shares of Atento

S.A., except in their capacity as an executive officer or director of Mezzanine Offshore. The executive officers and directors of Mezzanine Offshore are as follows.

|

|

Present Principal Occupation or Employment

|

Principal Business Address

|

|

|

Doris Lee Silvestri

|

Managing Director of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

United States

|

|

Hyana Kim

|

Managing Director of HPS Investment Partners (UK) LLP

|

HPS Investment Partners (UK) LLP

Devonshire House

1 Mayfair Place

4th Floor

London, W1J 8AJ

|

United Kingdom and Australia

|

|

Armando Correia

|

Vice President HPS

|

291 route d’Arlon, L-1150 Luxembourg

|

Portugal

|

|

Guillaume Sadler

|

Senior Manager Alter Domus

|

15 Boulevard F. W. Raiffeisen, 2411 Luxemburg, Luxembourg

|

France

|

HPS Mezzanine Partners II GP, L.P.

Pursuant to Instruction C to Schedule 13D, the below information relates to the executive officers and

directors of HPS Partners Holdings II, LLC, which is the general partner of HPS Mezzanine Partners II GP, L.P. (“Onshore GP”). Additionally, unless otherwise indicated, none of the below executive officers or directors shares voting or

dispositive power over any Ordinary Shares of Atento S.A., except in their capacity as an executive officer or director of HPS Partners Holdings II, LLC. The executive officers and directors of HPS Partners Holdings II, LLC are as follows.

|

|

Present Principal Occupation or Employment

|

Principal Business Address

|

|

Scott Kapnick

|

Chief Executive Officer of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

|

Yoohyun Katherine Choi

|

General Counsel of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

|

Joseph Virgilio

|

Chief Compliance Officer of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

|

Faith Rosenfeld

|

Chief Administrative Officer of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

|

Paul Knollmeyer

|

Chief Financial Officer of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

Mezzanine Partners II, L.P.

Pursuant to Instruction C to Schedule 13D, the below information relates to the executive officers and

directors of HPS Partners Holdings II, LLC, which is the general partner of Onshore GP, which is the general partner of Mezzanine Partners II, L.P. (“Onshore LP”). Additionally, unless otherwise indicated, none of the below executive officers or

directors shares voting or dispositive power over any Ordinary Shares of Atento S.A., except in their capacity as an executive officer or director of HPS Partners Holdings II, LLC. The executive officers and directors of HPS Partners Holdings II, LLC

are as follows.

|

|

Present Principal Occupation or Employment

|

Principal Business Address

|

|

Scott Kapnick

|

Chief Executive Officer of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

|

Yoohyun Katherine Choi

|

General Counsel of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

|

Joseph Virgilio

|

Chief Compliance Officer of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

|

Faith Rosenfeld

|

Chief Administrative Officer of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

|

Paul Knollmeyer

|

Chief Financial Officer of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

Mezzanine Partners II Onshore Lux S.à r.l

Pursuant to Instruction C to Schedule 13D, the below information relates to the executive officers and

directors of Mezzanine Partners II Onshore Lux S.à r.l (“Onshore Sarl”). Additionally, unless otherwise indicated, none of the below executive officers or directors shares voting or dispositive power over any Ordinary Shares of Atento S.A.,

except in their capacity as an executive officer or director of Onshore Sarl. The executive officers and directors of Onshore Sarl are as follows.

|

|

Present Principal Occupation or Employment

|

Principal Business Address

|

|

|

Doris Lee Silvestri

|

Managing Director of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

United States

|

|

Hyana Kim

|

Managing Director of HPS Investment Partners (UK) LLP

|

HPS Investment Partners (UK) LLP

Devonshire House

1 Mayfair Place

4th Floor

London, W1J 8AJ

|

United Kingdom and Australia

|

|

Armando Correia

|

Vice President HPS

|

291 route d’Arlon, L-1150 Luxembourg

|

Portugal

|

|

Francois Daloze

|

Director Alter Domus

|

15 Boulevard F. W. Raiffeisen, 2411 Luxemburg, Luxembourg

|

Belgium

|

Mezzanine Partners II Onshore Lux S.à r.l II

Pursuant to Instruction C to Schedule 13D, the below information relates to the executive officers and

directors of Mezzanine Partners II Onshore Lux S.à r.l II (“Mezzanine Onshore”). Additionally, unless otherwise indicated, none of the below executive officers or directors shares voting or dispositive power over any Ordinary Shares of Atento

S.A., except in their capacity as an executive officer or director of Mezzanine Onshore. The executive officers and directors of Mezzanine Onshore are as follows.

|

|

Present Principal Occupation or Employment

|

Principal Business Address

|

|

|

Doris Lee Silvestri

|

Managing Director of HPS

|

40 West 57th Street

33rd Floor,

New York, NY 10019

|

United States

|

|

Hyana Kim

|

Managing Director of HPS Investment Partners (UK) LLP

|

HPS Investment Partners (UK) LLP

Devonshire House

1 Mayfair Place

4th Floor

London, W1J 8AJ

|

United Kingdom and Australia

|

|

Armando Correia

|

Vice President HPS

|

291 route d’Arlon, L-1150 Luxembourg

|

Portugal

|

|

Guillaume Sadler

|

Senior Manager Alter Domus

|

15 Boulevard F. W. Raiffeisen, 2411 Luxemburg, Luxembourg

|

France

|

A-5

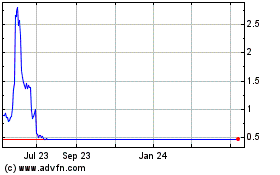

Atento (NYSE:ATTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Atento (NYSE:ATTO)

Historical Stock Chart

From Apr 2023 to Apr 2024