Report of Foreign Issuer (6-k)

June 17 2020 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of June, 2020

Commission File Number 001-36671

Atento S.A.

(Translation of Registrant's name into English)

4, rue Lou Hemmer, L-1748 Luxembourg Findel

Grand Duchy of Luxembourg

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F: x Form 40-F: o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes: o No: x

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes: o No: x

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Atento Receives NYSE Compliance Notification

· Notification relates to Atento shares falling below a continued listing standard

· Average closing price over last 30 trading days already above minimum requirement of $1.00

· Company considering all options to remain compliant with NYSE’s listing requirements

· Compliance may be regained through January 1, 2021

NEW YORK, June 16, 2020 – Atento S.A. (NYSE: ATTO, “Atento” or “Company”), the leading provider of customer relationship management and business process outsourcing services (CRM / BPO) in Latin America and one of the top five providers worldwide, today announced that it received a May 13, 2020 letter from the New York Stock Exchange (“NYSE”) notifying the Company that its Common Shares had traded below an average closing price of $1.00 over a consecutive 30-trading-day period, the minimum price threshold required under Section 802.01C of the NYSE Listed Company Manual.

Under the NYSE’s Continued Listing Standards, a Listed Company would have a period of six months following the receipt of the notification to regain compliance. In order to regain compliance, on the last trading day in any calendar month, the common stock must have (i) a closing price of at least $1.00 per share and (ii) an average closing price of at least $1.00 per share over the 30 consecutive trading-day period ending on the last trading day of such month.

Pursuant to rule filing NYSE SR 2020-36, which became effective on April 21, 2020, the NYSE is providing a longer period of time for Companies to regain compliance by tolling the applicable compliance period through June 30, 2020 for companies that have been identified as below compliance with certain continued listing requirements, including its minimum $1.00 share price and $50 million market capitalization. The tolling period is now calculated as beginning on July 1, 2020, and Atento has now until January 1, 2021 to regain compliance. If the Company is unable to regain compliance, the NYSE would initiate procedures to suspend and delist the common stock.

On May 28, 2020, Atento notified the NYSE of its intent to cure the aforementioned listing standard deficiency. The Company’s common shares will continue to be listed and traded on the NYSE, subject to compliance with this and other NYSE’s Continued Listing Standards and to other rights of the NYSE to delist the common shares. Currently, the Company is in compliance with all other NYSE Continued Listing Standards. The NYSE notification does not affect the Company’s business operations or its SEC reporting requirements.

As of June 15, 2020, the trailing 30 trading-day average closing price of Atento’s common shares was already above $1.00 at $1.04, while in June, month-to-date, the average closing price was $1.30.

Additional information can be found at investors.atento.com, including the Company’s Annual Report on Form 20F, which was filed with the SEC on April 17, 2020.

|

1

|

|

About Atento

Atento is the largest provider of customer relationship management and business process outsourcing (CRM BPO) services in Latin America, and among the top five providers globally, based on revenues. Atento is also a leading provider of nearshoring CRM/BPO services to companies that carry out their activities in the United States. Since 1999, the company has developed its business model in 13 countries where it employs 150,000 people. Atento has over 400 clients to whom it offers a wide range of CRM/BPO services through multiple channels. Atento’s clients are mostly leading multinational corporations in sectors such as telecommunications, banking and financial services, health, retail and public administrations, among others. Atento’s shares trade under the symbol ATTO on the New York Stock Exchange (NYSE). In 2019, Atento was named one of the World’s 25 Best Multinational Workplaces and one of the Best Multinationals to Work for in Latin America by Great Place to Work®. For more information visit www.atento.com

|

Investor Relations

Shay Chor

+55 11 3293-5926

shay.chor@atento.com

|

Investor Relations

Fernando Schneider

+ 55 11 3779-8119

fernando.schneider@atento.com

|

Media Relations

Pablo Sánchez Pérez

+34 670031347

pablo.sanchez@atento.com

|

Forward-Looking Statements

This press release contains forward-looking statements. Forward-looking statements can be identified by the use of words such as "may," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "intends," "continue" or similar terminology. These statements reflect only Atento’s current expectations and are not guarantees of future performance or results. These statements are subject to risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements. In particular, the COVID-19 pandemic, and governments’ extraordinary measures to limit the spread of the virus, are disrupting the global economy and Atento’s industry, and consequently adversely affecting the Company’s business, results of operation and cash flows and, as conditions are recent, uncertain and changing rapidly, it is difficult to predict the full extent of the impact that the pandemic will have. Risks and uncertainties include, but are not limited to, competition in Atento’s highly competitive industries; increases in the cost of voice and data services or significant interruptions in these services; Atento’s ability to keep pace with its clients' needs for rapid technological change and systems availability; the continued deployment and adoption of emerging technologies; the loss, financial difficulties or bankruptcy of any key clients; the effects of global economic trends on the businesses of Atento’s clients; the non-exclusive nature of Atento’s client contracts and the absence of revenue commitments; security and privacy breaches of the systems Atento uses to protect personal data; the cost of pending and future litigation; the cost of defending Atento against intellectual property infringement claims; extensive regulation affecting many of Atento’s businesses; Atento’s ability to protect its proprietary information or technology; service interruptions to Atento’s data and operation centers; Atento’s ability to retain key personnel and attract a sufficient number of qualified employees; increases in labor costs and turnover rates; the political, economic and other conditions in the countries where Atento operates; changes in foreign exchange rates; Atento’s ability to complete future acquisitions and integrate or achieve the objectives of its recent and future acquisitions; future impairments of our substantial goodwill, intangible assets, or other long-lived assets; and Atento’s ability to recover consumer receivables on behalf of its clients. In addition, Atento is subject to risks related to its level of indebtedness. Such risks include Atento’s ability to generate sufficient cash to service its indebtedness and fund its other liquidity needs; Atento’s ability to comply with covenants contained in its debt instruments; the ability to obtain additional financing; the incurrence of significant additional indebtedness by Atento and its subsidiaries; and the ability of Atento’s lenders to fulfill their lending commitments. Atento is also subject to other risk factors described in documents filed by the company with the United States Securities and Exchange Commission.

These forward-looking statements speak only as of the date on which the statements were made. Atento undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

|

2

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

ATENTO S.A.

|

|

Date: June 16, 2020.

|

|

|

|

By: /s/ Carlos López-Abadía

Name: Carlos López-Abadía

Title: Chief Executive Officer

By: /s/ José Antonio de Sousa Azevedo

Name: José Antonio de Sousa Azevedo

Title: Chief Financial Officer

|

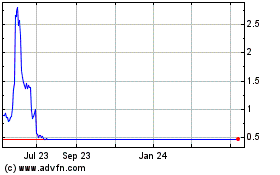

Atento (NYSE:ATTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Atento (NYSE:ATTO)

Historical Stock Chart

From Apr 2023 to Apr 2024