UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule

13D/A

(Amendment No. 1)

Under the Securities Exchange Act of 1934

ATI Physical

Therapy, Inc.

(Name of Issuer)

Class A

Common Stock, par value $0.0001 per share

(Title of Class of Securities)

00216W109

(CUSIP Number)

Laura Torrado

c/o Knighthead Capital Management, LLC

280 Park Avenue, 22nd Floor

New York, New York 10017

(212) 356-2900

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

COPY TO:

Tim

Cruickshank, P.C.

Kirkland & Ellis LLP

601 Lexington Avenue

New

York, NY 10022

(212) 446-4800

September 26, 2022

(Date of Event which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-l(e),

240.13d-l(f) or 240.13d-l(g), check the following box.

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. 00216W109

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons

Knighthead Capital Management, LLC |

| 2. |

|

Check The Appropriate Box

if a Member of a Group (See Instructions)

(a) (b) |

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of funds (see

instructions) AF |

| 5. |

|

Check box if disclosure of

legal proceedings is required pursuant to Items 2(d) or 2(e) |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned By Each

Reporting Person

With |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

15,609,943(1) |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

15,609,943(1) |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

15,609,943(1) |

| 12. |

|

Check Box if the Aggregate

Amount in Row (11) Excludes Certain Shares |

| 13. |

|

Percent of Class

Represented By Amount in Row (11) 7.35%(2) |

| 14. |

|

Type of Reporting Person

(See Instructions) IA |

| (1) |

Represents 15,609,943 shares of Class A Common Stock, par value $0.0001 per share (“Class A

Common Stock”), including (i) 10,342,978 shares of Class A Common Stock, (ii) 3,157,147 shares of Class A Common Stock issuable upon exercise of an equal number of warrants to acquire shares of Class A Common Stock upon payment

of $0.01 per share (“Penny Warrants”) and (iii) 2,109,818 shares of Class A Common Stock issuable upon exercise of an equal number of warrants to acquire shares of Class A Common Stock upon payment of $3.00 per share (“$3

Warrants”). |

| (2) |

Calculated based on (i) 207,148,839 shares of Class A Common Stock issued and outstanding as of

August 4, 2022 as reported on the Issuer’s Form 10-K, filed on August 9, 2022, and (ii) 5,266,965 shares of Class A Common Stock issuable in connection with the 3,157,147 Penny Warrants and

2,109,818 $3 Warrants. |

CUSIP No. 00216W109

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons

Knighthead Master Fund, L.P. |

| 2. |

|

Check The Appropriate Box

if a Member of a Group (See Instructions)

(a) (b) |

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of funds (see

instructions) WC |

| 5. |

|

Check box if disclosure of

legal proceedings is required pursuant to Items 2(d) or 2(e) |

| 6. |

|

Citizenship or Place of

Organization Cayman

Islands |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned By Each

Reporting Person

With |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

6,492,892(1) |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

6,492,892(1) |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

6,492,892(1) |

| 12. |

|

Check Box if the Aggregate

Amount in Row (11) Excludes Certain Shares |

| 13. |

|

Percent of Class

Represented By Amount in Row (11) 3.06%(2) |

| 14. |

|

Type of Reporting Person

(See Instructions) IA |

| (1) |

Represents 6,492,892 shares of Class A Common Stock, including (i) 4,254,815 shares of Class A Common

Stock, (ii) 1,342,846 Penny Warrants and (iii) 895,231 $3 Warrants. |

| (2) |

Calculated based on (i) 207,148,839 shares of Class A Common Stock issued and outstanding as of

August 4, 2022 as reported on the Issuer’s Form 10-K, filed on August 9, 2022, and (ii) 5,266,965 shares of Class A Common Stock issuable in connection with the 3,157,147 Penny Warrants and

2,109,818 $3 Warrants. |

CUSIP No. 00216W109

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons

Knighthead (NY) Fund, L.P. |

| 2. |

|

Check The Appropriate Box

if a Member of a Group (See Instructions)

(a) (b) |

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of funds (see

instructions) WC |

| 5. |

|

Check box if disclosure of

legal proceedings is required pursuant to Items 2(d) or 2(e) |

| 6. |

|

Citizenship or Place of

Organization

Delaware |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned By Each

Reporting Person

With |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

1,973,735(1) |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

1,973,735(1) |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

1,973,735(1) |

| 12. |

|

Check Box if the Aggregate

Amount in Row (11) Excludes Certain Shares |

| 13. |

|

Percent of Class

Represented By Amount in Row (11) 0.93%(2) |

| 14. |

|

Type of Reporting Person

(See Instructions) IA |

| (1) |

Represents 1,973,735 shares of Class A Common Stock, including (i) 1,313,308 shares of Class A Common

Stock, (ii) 396,256 Penny Warrants and (iii) 264,171 $3 Warrants. |

| (2) |

Calculated based on (i) 207,148,839 shares of Class A Common Stock issued and outstanding as of

August 4, 2022 as reported on the Issuer’s Form 10-K, filed on August 9, 2022, and (ii) 5,266,965 shares of Class A Common Stock issuable in connection with the 3,157,147 Penny Warrants and

2,109,818 $3 Warrants. |

CUSIP No. 00216W109

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons

Knighthead Annuity & Life Assurance Company |

| 2. |

|

Check The Appropriate Box

if a Member of a Group (See Instructions)

(a) (b) |

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of funds (see

instructions) WC |

| 5. |

|

Check box if disclosure of

legal proceedings is required pursuant to Items 2(d) or 2(e) |

| 6. |

|

Citizenship or Place of

Organization Cayman

Islands |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned By Each

Reporting Person

With |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

4,308,938(1) |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

4,308,938(1) |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

4,308,938(1) |

| 12. |

|

Check Box if the Aggregate

Amount in Row (11) Excludes Certain Shares |

| 13. |

|

Percent of Class

Represented By Amount in Row (11) 2.03%(2) |

| 14. |

|

Type of Reporting Person

(See Instructions) IA |

| (1) |

Represents 4,308,938 shares of Class A Common Stock, including (i) 3,280,702 shares of Class A Common

Stock, (ii) 616,942 Penny Warrants and (iii) 411,294 $3 Warrants. |

| (2) |

Calculated based on (i) 207,148,839 shares of Class A Common Stock issued and outstanding as of

August 4, 2022 as reported on the Issuer’s Form 10-K, filed on August 9, 2022, and (ii) 5,266,965 shares of Class A Common Stock issuable in connection with the 3,157,147 Penny Warrants and

2,109,818 $3 Warrants. |

CUSIP No. 00216W109

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons

Knighthead Distressed Opportunities Fund, L.P. |

| 2. |

|

Check The Appropriate Box

if a Member of a Group (See Instructions)

(a) (b) |

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of funds (see

instructions) WC |

| 5. |

|

Check box if disclosure of

legal proceedings is required pursuant to Items 2(d) or 2(e) |

| 6. |

|

Citizenship or Place of

Organization Cayman

Islands |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned By Each

Reporting Person

With |

|

7. |

|

Sole Voting Power

0 |

| |

8. |

|

Shared Voting Power

2,834,378(1) |

| |

9. |

|

Sole Dispositive Power

0 |

| |

10. |

|

Shared Dispositive Power

2,834,378(1) |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

2,834,378(1) |

| 12. |

|

Check Box if the Aggregate

Amount in Row (11) Excludes Certain Shares |

| 13. |

|

Percent of Class

Represented By Amount in Row (11) 1.33%(2) |

| 14. |

|

Type of Reporting Person

(See Instructions) IA |

| (1) |

Represents 2,834,378 shares of Class A Common Stock, including (i) 1,494,153 shares of Class A Common

Stock, (ii) 801,103 Penny Warrants and (iii) 539,122 $3 Warrants. |

| (2) |

Calculated based on (i) 207,148,839 shares of Class A Common Stock issued and outstanding as of

August 4, 2022 as reported on the Issuer’s Form 10-K, filed on August 9, 2022, and (ii) 5,266,965 shares of Class A Common Stock issuable in connection with the 3,157,147 Penny Warrants and

2,109,818 $3 Warrants. |

This Amendment No. 1 (“Amendment No. 1”) amends and supplements the statement on

Schedule 13D filed with the Securities and Exchange Commission (the “SEC”) on March 4, 2022, (the “Original Schedule 13D”), with respect to the Class A Common Stock, par value $0.0001 per share of ATI Physical Therapy,

Inc., a Delaware corporation (the “Issuer” or the “Company”). Capitalized terms used herein and not otherwise defined in this Amendment No. 1 have the meanings set forth in the Original Schedule 13D.

This Amendment No. 1 amends the Original Schedule 13D as specifically set forth herein.

Item 3. Source and Amount of Funds or Other Consideration.

The purchases of Shares reported herein were made using funds from the working capital of the Knighthead Funds, which may, at any given time,

include margin loans made by brokerage firms in the ordinary course of business. A total of approximately $[ ] (excluding brokerage commissions) was paid to acquire the Shares reported in this Amendment No. 1.

Item 4. Purpose of Transaction.

Item 4 is hereby amended to include the following at the end thereof:

On May 6, 2022, Knighthead Distressed Opportunities Fund, L.P. entered into a Securities Purchase Agreement with Caspian Capital LP on

behalf of its managed funds, to purchase from Blackstone Alternative Investment Fund Plc (BXIII) and Blackstone Alternative Investment Fund Plc (BXIIIb) an aggregate of (i) 21,219 Penny Warrants and (ii) 19,199 $3 Warrants (together, the

“Warrants”). The holders of the Warrants are subject to the terms and conditions of both the Warrant Agreement and the Investors’ Rights Agreement.

This summary is qualified in its entirety by (i) reference to the text of the Warrant Agreement, which is attached as Exhibit 4.1 to the

Issuer’s Current Report on Form 8-K filed by the Issuer with the Commission on February 25, 2022 and is incorporated herein by reference and (ii) reference to the text of the Investors’

Rights Agreement, which is attached as Exhibit 10.3 to the Issuer’s Current Report on Form 8-K filed by the Issuer with the Commission on February 25, 2022, and is incorporated herein by reference.

Item 5. Interest in Securities of the Issuer.

(a)—(b) The information relating to the beneficial ownership of the Shares by each of the Reporting Persons set forth in Rows 7 through 13

on each of the cover pages hereto is incorporated by reference herein and is as of the date hereof. Such information assumes there are 207,148,839 shares of Class A Common Stock issued and outstanding as of August 4, 2022 as reported on

the Issuer’s Form 10-K, filed on August 9, 2022

By virtue of the relationship among the

Reporting Persons described in Item 2, each such Reporting Person may be deemed to share the power to vote or direct the vote and to share the power to dispose of or direct the disposition of the Shares as set forth in rows 7 through 13 of the cover

pages of this Statement. The filing of this Statement shall not be construed as an admission that any such Reporting Person, Mr. O’Hara, Mr. Wagner or Mr. Cohen is, for the purpose of Section 13(d) or 13(g) of the Exchange

Act, the beneficial owner of any securities covered by this Statement.

(c) Except as otherwise set forth in this Statement, including,

but not limited to, the Class A Common Stock transactions described in Exhibit A to this Schedule 13D/A, none of the Reporting Persons has effected any transactions in the Class A Common Stock during the past 60 days.

(d) Except as stated within this Item 5, to the knowledge of the Reporting Persons, only the Reporting Persons have the right to receive or

the power to direct the receipt of dividends from, or proceeds from the sale of, the Class A Common Stock of the Issuer reported by this Statement.

(e) Inapplicable.

Item 6. Contracts,

Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

The information set forth in or incorporated by

reference in Item 4 of this Schedule 13D/A is hereby incorporated by reference in its entirety into this Item 6.

SIGNATURES

After reasonable inquiry and to the best of each of the undersigned’s knowledge and belief, each of the undersigned certify that the

information set forth in this statement is true, complete and correct.

Date: September 28, 2022

|

| KNIGHTHEAD CAPITAL MANAGEMENT, LLC |

|

| /s/ Laura Torrado |

| Name: Laura Torrado |

| Title: General Counsel |

|

| KNIGHTHEAD MASTER FUND, L.P. |

|

| By: Knighthead Capital Management, LLC, its investment manager |

|

| /s/ Laura Torrado |

| Name: Laura Torrado |

| Title: General Counsel |

|

| KNIGHTHEAD (NY) FUND, L.P. |

| By: Knighthead Capital Management, LLC, its investment advisor |

|

| /s/ Laura Torrado |

| Name: Laura Torrado |

| Title: General Counsel |

|

| KNIGHTHEAD ANNUITY & LIFE ASSURANCE COMPANY |

| By: Knighthead Capital Management, LLC, its investment advisor |

|

| /s/ Laura Torrado |

| Name: Laura Torrado |

| Title: General Counsel |

|

| KNIGHTHEAD DISTRESSED OPPORTUNITIES FUND, L.P. |

|

| By: Knighthead Capital Management, LLC, its investment manager |

|

| /s/ Laura Torrado |

| Name: Laura Torrado |

| Title: General Counsel |

Exhibit A

Volume-Weighted Average Price (“VWAP”) Trade Details

|

|

|

|

|

|

|

| Trade Date |

|

Name |

|

Amount

Purchased |

|

VWAP* |

| 08/18/2022 |

|

Knighthead Master Fund, L.P. |

|

38,081 |

|

$0.93 |

| 08/18/2022 |

|

Knighthead (NY) Fund, L.P. |

|

12,196 |

|

$0.93 |

| 08/18/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

29,448 |

|

$0.93 |

| 08/18/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

13,922 |

|

$0.93 |

| 08/19/2022 |

|

Knighthead Master Fund, L.P. |

|

30,741 |

|

$0.92 |

| 08/19/2022 |

|

Knighthead (NY) Fund, L.P. |

|

9,773 |

|

$0.92 |

| 08/19/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

23,788 |

|

$0.92 |

| 08/19/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

11,210 |

|

$0.92 |

| 08/22/2022 |

|

Knighthead Master Fund, L.P. |

|

76,925 |

|

$0.89 |

| 08/22/2022 |

|

Knighthead (NY) Fund, L.P. |

|

24,455 |

|

$0.89 |

| 08/22/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

59,524 |

|

$0.89 |

| 08/22/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

28,049 |

|

$0.89 |

| 08/23/2022 |

|

Knighthead Master Fund, L.P. |

|

45,149 |

|

$0.91 |

| 08/23/2022 |

|

Knighthead (NY) Fund, L.P. |

|

14,352 |

|

$0.91 |

| 08/23/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

34,936 |

|

$0.91 |

| 08/23/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

16,463 |

|

$0.91 |

| 08/24/2022 |

|

Knighthead Master Fund, L.P. |

|

19,337 |

|

$0.96 |

| 08/24/2022 |

|

Knighthead (NY) Fund, L.P. |

|

6,147 |

|

$0.96 |

| 08/24/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

14,963 |

|

$0.96 |

| 08/24/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

7,052 |

|

$0.96 |

| 08/25/2022 |

|

Knighthead Master Fund, L.P. |

|

20,749 |

|

$0.97 |

| 08/25/2022 |

|

Knighthead (NY) Fund, L.P. |

|

6,596 |

|

$0.97 |

| 08/25/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

16,055 |

|

$0.97 |

| 08/25/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

7,566 |

|

$0.97 |

| 08/26/2022 |

|

Knighthead Master Fund, L.P. |

|

25,077 |

|

$0.95 |

| 08/26/2022 |

|

Knighthead (NY) Fund, L.P. |

|

7,972 |

|

$0.95 |

| 08/26/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

19,404 |

|

$0.95 |

| 08/26/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

9,142 |

|

$0.95 |

| 08/29/2022 |

|

Knighthead Master Fund, L.P. |

|

12,261 |

|

$0.93 |

| 08/29/2022 |

|

Knighthead (NY) Fund, L.P. |

|

3,898 |

|

$0.93 |

| 08/29/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

9,487 |

|

$0.93 |

| 08/29/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

4,471 |

|

$0.93 |

| 08/30/2022 |

|

Knighthead Master Fund, L.P. |

|

6,319 |

|

$0.90 |

| 08/30/2022 |

|

Knighthead (NY) Fund, L.P. |

|

2,009 |

|

$0.90 |

|

|

|

|

|

|

|

| 08/30/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

4,890 |

|

$0.90 |

| 08/30/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

2,304 |

|

$0.90 |

| 08/31/2022 |

|

Knighthead Master Fund, L.P. |

|

4,927 |

|

$0.91 |

| 08/31/2022 |

|

Knighthead (NY) Fund, L.P. |

|

1,566 |

|

$0.91 |

| 08/31/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

3,812 |

|

$0.91 |

| 08/31/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

1,797 |

|

$0.91 |

| 09/01/2022 |

|

Knighthead Master Fund, L.P. |

|

18,784 |

|

$0.89 |

| 09/01/2022 |

|

Knighthead (NY) Fund, L.P. |

|

5,972 |

|

$0.89 |

| 09/01/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

14,535 |

|

$0.89 |

| 09/01/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

6,849 |

|

$0.89 |

| 09/02/2022 |

|

Knighthead Master Fund, L.P. |

|

3,949 |

|

$0.94 |

| 09/02/2022 |

|

Knighthead (NY) Fund, L.P. |

|

1,255 |

|

$0.94 |

| 09/02/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

3,056 |

|

$0.94 |

| 09/02/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

1,440 |

|

$0.94 |

| 09/06/2022 |

|

Knighthead Master Fund, L.P. |

|

20,834 |

|

$0.96 |

| 09/06/2022 |

|

Knighthead (NY) Fund, L.P. |

|

6,623 |

|

$0.96 |

| 09/06/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

16,122 |

|

$0.96 |

| 09/06/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

7,597 |

|

$0.96 |

| 09/07/2022 |

|

Knighthead Master Fund, L.P. |

|

15,942 |

|

$0.99 |

| 09/07/2022 |

|

Knighthead (NY) Fund, L.P. |

|

5,068 |

|

$0.99 |

| 09/07/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

12,336 |

|

$0.99 |

| 09/07/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

5,813 |

|

$0.99 |

| 09/08/2022 |

|

Knighthead Master Fund, L.P. |

|

45,552 |

|

$1.10 |

| 09/08/2022 |

|

Knighthead (NY) Fund, L.P. |

|

15,014 |

|

$1.10 |

| 09/08/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

37,386 |

|

$1.10 |

| 09/08/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

17,242 |

|

$1.10 |

| 09/09/2022 |

|

Knighthead Master Fund, L.P. |

|

21,592 |

|

$1.14 |

| 09/09/2022 |

|

Knighthead (NY) Fund, L.P. |

|

7,116 |

|

$1.14 |

| 09/09/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

17,721 |

|

$1.14 |

| 09/09/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

8,173 |

|

$1.14 |

| 09/12/2022 |

|

Knighthead Master Fund, L.P. |

|

33,635 |

|

$1.15 |

| 09/12/2022 |

|

Knighthead (NY) Fund, L.P. |

|

11,061 |

|

$1.15 |

| 09/12/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

27,408 |

|

$1.15 |

| 09/12/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

12,650 |

|

$1.15 |

| 09/13/2022 |

|

Knighthead Master Fund, L.P. |

|

19,843 |

|

$1.14 |

| 09/13/2022 |

|

Knighthead (NY) Fund, L.P. |

|

6,526 |

|

$1.14 |

| 09/13/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

16,168 |

|

$1.14 |

| 09/13/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

7,463 |

|

$1.14 |

| 09/14/2022 |

|

Knighthead Master Fund, L.P. |

|

15,098 |

|

$1.12 |

| 09/14/2022 |

|

Knighthead (NY) Fund, L.P. |

|

4,965 |

|

$1.12 |

| 09/14/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

12,303 |

|

$1.12 |

|

|

|

|

|

|

|

| 09/14/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

5,678 |

|

$1.12 |

| 09/15/2022 |

|

Knighthead Master Fund, L.P. |

|

20,612 |

|

$1.20 |

| 09/15/2022 |

|

Knighthead (NY) Fund, L.P. |

|

6,777 |

|

$1.20 |

| 09/15/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

16,798 |

|

$1.20 |

| 09/15/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

7,713 |

|

$1.20 |

| 09/16/2022 |

|

Knighthead Master Fund, L.P. |

|

24,468 |

|

$1.17 |

| 09/16/2022 |

|

Knighthead (NY) Fund, L.P. |

|

8,044 |

|

$1.17 |

| 09/16/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

19,943 |

|

$1.17 |

| 09/16/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

9,156 |

|

$1.17 |

| 09/19/2022 |

|

Knighthead Master Fund, L.P. |

|

59,534 |

|

$1.08 |

| 09/19/2022 |

|

Knighthead (NY) Fund, L.P. |

|

19,573 |

|

$1.08 |

| 09/19/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

48,518 |

|

$1.08 |

| 09/19/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

22,281 |

|

$1.08 |

| 09/20/2022 |

|

Knighthead Master Fund, L.P. |

|

85,559 |

|

$1.10 |

| 09/20/2022 |

|

Knighthead (NY) Fund, L.P. |

|

28,130 |

|

$1.10 |

| 09/20/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

69,730 |

|

$1.10 |

| 09/20/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

32,020 |

|

$1.10 |

| 09/21/2022 |

|

Knighthead Master Fund, L.P. |

|

71,645 |

|

$1.09 |

| 09/21/2022 |

|

Knighthead (NY) Fund, L.P. |

|

23,555 |

|

$1.09 |

| 09/21/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

58,387 |

|

$1.09 |

| 09/21/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

26,813 |

|

$1.09 |

| 09/22/2022 |

|

Knighthead Master Fund, L.P. |

|

60,286 |

|

$1.09 |

| 09/22/2022 |

|

Knighthead (NY) Fund, L.P. |

|

19,821 |

|

$1.09 |

| 09/22/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

49,131 |

|

$1.09 |

| 09/22/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

22,562 |

|

$1.09 |

| 09/23/2022 |

|

Knighthead Master Fund, L.P. |

|

35,902 |

|

$1.02 |

| 09/23/2022 |

|

Knighthead (NY) Fund, L.P. |

|

11,804 |

|

$1.02 |

| 09/23/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

29,259 |

|

$1.02 |

| 09/23/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

13,435 |

|

$1.02 |

| 09/26/2022 |

|

Knighthead Master Fund, L.P. |

|

10,443 |

|

$0.99 |

| 09/26/2022 |

|

Knighthead (NY) Fund, L.P. |

|

3,434 |

|

$0.99 |

| 09/26/2022 |

|

Knighthead Annuity & Life Assurance Company |

|

8,512 |

|

$0.99 |

| 09/26/2022 |

|

Knighthead Distressed Opportunities Fund, L.P. |

|

3,909 |

|

$0.99 |

| * |

The prices reported in this Column are volume-weighted average prices. These shares were bought in transactions

at prices that did not exceed a $1 price range. The reporting persons undertake to provide to the Issuer, any security holder of the Issuer, or the staff of the Securities and Exchange Commission, upon request, full information regarding the number

of shares bought at each separate price. |

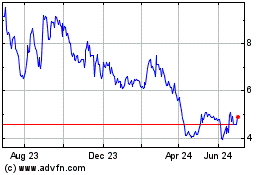

ATI Physical Therapy (NYSE:ATIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

ATI Physical Therapy (NYSE:ATIP)

Historical Stock Chart

From Apr 2023 to Apr 2024