Statement of Changes in Beneficial Ownership (4)

May 28 2020 - 4:27PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

CHUNG PETER Y |

2. Issuer Name and Ticker or Trading Symbol

A10 Networks, Inc.

[

ATEN

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

C/O SUMMIT PARTNERS, 222 BERKELEY STREET, 18TH FLOOR |

3. Date of Earliest Transaction

(MM/DD/YYYY)

5/27/2020 |

|

(Street)

BOSTON, MA 02116

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 5/27/2020 | | A | | 21865 (1) | A | $0 | 9560941 (2) | I | See Footnotes. (3)(4) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | Represents restricted stock units ("RSUs") of the Issuer granted to Mr. Chung as part of the Issuer's director compensation program. The RSUs will settle solely by delivery of an equal number of shares of the Issuer's common stock, par value $0.00001 per share ("Common Stock") on the earlier of the first anniversary of the grant date or the date of the 2021 annual meeting of stockholders of the Issuer, subject to the Reporting Person's continued service on the Issuer's board of directors as of such date. Mr. Chung holds any RSUs for the benefit of Summit Partners, L.P., which he has empowered to determine when the underlying shares of Common Stock will be sold and which is entitled to the proceeds of any such sales. |

| (2) | The Common Stock is held as follows: 6,873,136 shares in the name of Summit Partners Growth Equity Fund VIII-A, L.P.; 2,510,989 shares in the name of Summit Partners Growth Equity Fund VIII-B, L.P.; 40,186 shares in the name of Summit Investors I, LLC; 3,535 shares in the name of Summit Investors I (UK), L.P.; 133,095 shares (including shares underlying RSUs) in the name of Mr. Chung, which are held for the benefit of Summit Partners, L.P. |

| (3) | Summit Partners, L.P. is the managing member of Summit Partners GE VIII, LLC, which is the general partner of Summit Partners GE VIII, L.P., which is the general partner of each of Summit Partners Growth Equity Fund VIII-A, L.P. and Summit Partners Growth Equity Fund VIII-B, L.P. Summit Master Company, LLC is the managing member of Summit Investors Management, LLC, which is the manager of Summit Investors I, LLC and the general partner of Summit Investors I (UK), L.P. Summit Master Company, LLC, as the managing member of Summit Investors Management, LLC has delegated investment decisions, including voting and dispositive power, to Summit Partners, L.P. and its Investment Committee responsible for voting and investment decisions with respect to the Issuer. |

| (4) | Summit Partners, L.P., through a two-person Investment Committee responsible for voting and investment decisions with respect to the Issuer, currently composed of Martin J. Mannion and Mr. Chung, has voting and dispositive authority over the shares of Common Stock held by each of the entities described in the foregoing footnotes (2) and (3) and therefore may be deemed to beneficially own such shares. In addition, Mr. Chung is a member of Summit Master Company, LLC. Each of the Summit entities, Mr. Mannion and Mr. Chung disclaims beneficial ownership of the shares of Common Stock (including shares underlying RSUs) reported herein, except to the extent of their pecuniary interest therein. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

CHUNG PETER Y

C/O SUMMIT PARTNERS

222 BERKELEY STREET, 18TH FLOOR

BOSTON, MA 02116 | X | X |

|

|

Signatures

|

| Robin W. Devereux, POA for Peter Y. Chung | | 5/28/2020 |

| **Signature of Reporting Person | Date |

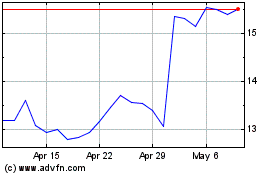

A10 Networks (NYSE:ATEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

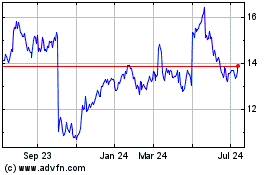

A10 Networks (NYSE:ATEN)

Historical Stock Chart

From Apr 2023 to Apr 2024