Current Report Filing (8-k)

July 30 2019 - 4:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 26, 2019

A10 NETWORKS, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-36343

|

|

20-1446869

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

3 West Plumeria Drive

San Jose, CA 95134

(Address of Principal Executive Offices, including zip code)

(408)

325-8668

(Registrant’s telephone number including area code)

Not Applicable

(Former

Name or Address, if Changed Since Last Report)

Check the appropriate box below

if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17

CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.00001 par value

|

|

ATEN

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On July 26, 2019, A10 Networks, Inc. (the “Company”) entered into a letter agreement (the “Agreement”) with VIEX

Capital Advisors, LLC (“VIEX”), VIEX Opportunities Fund, LP – Series One, VIEX Opportunities Fund, LP – Series Two, VIEX GP, LLC, VIEX Special Opportunities Fund II, LP, VIEX Special Opportunities GP II, LLC, VIEX Special

Opportunities Fund III, LP, VIEX Special Opportunities GP III, LLC and Eric Singer (collectively, the “VIEX Group”). Among other things, the Agreement provides that:

|

|

•

|

|

The Company will increase the size of its Board of Directors (the “Board”) to six and appoint

Mr. Singer to the Board to serve as a director with a term expiring at the Company’s 2019 Annual Meeting of Stockholders (the “2019 Annual Meeting”).

|

|

|

•

|

|

The Board will appoint Mr. Singer to the Board’s Compensation Committee, Nominating and Corporate

Governance Committee, and Strategy Committee.

|

|

|

•

|

|

During the Restricted Period (as defined below), if (1) Mr. Singer ceases to serve on the Board and

(2) at that time the VIEX Group beneficially owns Net Long Shares (as defined in the Agreement) representing in the aggregate at least two percent of the Company’s then-outstanding common stock, then VIEX will have the right to recommend

(and the Board will promptly appoint) another person to serve as a director in place of Mr. Singer.

|

|

|

•

|

|

After August 25, 2019, and prior to the expiration of the Restricted Period, VIEX has the right to recommend

one independent director for appointment to the Board, and the Board must take appropriate action to appoint that person. If VIEX exercises this right, Phillip J. Salsbury has agreed to resign from the Board in connection with the appointment of the

director identified by VIEX.

|

|

|

•

|

|

During the Restricted Period, a unanimous vote of all directors then serving on the Board will be required to

increase the size of the Board beyond six members.

|

|

|

•

|

|

The Company will nominate and support Mr. Singer and Tor R. Braham for election as directors at the 2019

Annual Meeting.

|

|

|

•

|

|

The VIEX Group will vote its shares of the Company’s common stock in a manner consistent with the

recommendation of the Board, subject to certain exceptions specified in the Agreement.

|

|

|

•

|

|

The VIEX Group will abide by certain customary standstill provisions lasting from the date of the Agreement until

11:59 p.m., Pacific time, on the day that is 15 business days prior to the deadline for the submission of stockholder nominations of directors and business proposals for the Company’s 2020 Annual Meeting of Stockholders (such period, the

“Restricted Period”). The standstill provisions provide, among other things, that the VIEX Group cannot:

|

|

|

•

|

|

solicit proxies regarding any matter to come before any annual or special meeting of stockholders of the Company,

including the election of directors;

|

|

|

•

|

|

enter into a voting agreement or any “group” with stockholders of the Company, other than with other

members of the VIEX Group or any of their Affiliates (as defined in the Agreement);

|

|

|

•

|

|

encourage any person to submit nominees in furtherance of a contested solicitation for the election or removal of

directors;

|

|

|

•

|

|

submit any proposal for consideration by stockholders of the Company at any annual or special meeting of

stockholders;

|

|

|

•

|

|

acquire any securities of the Company or rights that would result in the Investors beneficially owning more than

9.9 percent of the then-outstanding Voting Securities (as defined in the Agreement); or

|

|

|

•

|

|

other than through certain open market transactions and public offerings, sell securities of the Company to any

person not a party to the Agreement that, to VIEX’s knowledge, would result in such party having any beneficial or other ownership interest of more than 4.9 percent of the then-outstanding Voting Securities.

|

The foregoing summary of the Agreement does not purport to be complete and is subject to,

and qualified in its entirety by, the full text of the Agreement, which is attached as Exhibit 10.1 and incorporated herein by reference.

|

Item 2.02.

|

Results of Operations and Financial Condition.

|

On July 30, 2019, the Company issued a press release regarding financial results for the quarter ended June 30, 2019. The Company

also posted on its website (www.a10networks.com) slides with accompanying prepared remarks regarding such financial results. Copies of the press release and slides with accompanying prepared remarks by the Company are attached as Exhibits 99.1 and

99.2, respectively, and the information in Exhibits 99.1 and 99.2 are incorporated herein by reference.

The information in this Item 2.02

and Exhibits 99.1 and 99.2 attached hereto shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section, nor shall it be deemed

incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers.

|

(b) Departure of Directors or Certain Officers

On July 30, 2019, the Company announced the planned retirement of Lee Chen, the Company’s president and chief executive officer. The

Board has formed a search committee and retained an executive search firm for the purpose of recruiting and exploring potential CEO candidates. Upon the appointment of a successor, Mr. Chen will resign as president and chief executive officer.

(d) Election of Director

In

connection with the Agreement, the Board increased the size of the Board to six directors and appointed Mr. Singer to serve as a director, effective July 26, 2019. Mr. Singer was also appointed to the Board’s Compensation

Committee, Nominating and Corporate Governance Committee and Strategy Committee.

Following this, the Board’s standing committees are

composed of:

|

|

|

|

|

Audit Committee:

|

|

Alan S. Henricks

|

|

|

|

Tor R. Braham

|

|

|

|

Phillip J. Salsbury

|

|

|

|

|

Compensation Committee:

|

|

Peter Y. Chung

|

|

|

|

Tor R. Braham

|

|

|

|

Alan S. Henricks

|

|

|

|

Eric Singer

|

|

|

|

|

Nominating and Governance Committee:

|

|

Phillip J. Salsbury

|

|

|

|

Peter Y. Chung

|

|

|

|

Alan S. Henricks

|

|

|

|

Eric Singer

|

Other than as described in Item 1.01, there are no arrangements or understandings between

Mr. Singer, on the one hand, and the Company or any other persons, on the other hand, pursuant to which Mr. Singer was selected as a director. There are no related party transactions between the Company and Mr. Singer (or any of his

immediate family members) requiring disclosure under Item 404(a) of

Regulation S-K.

Mr. Singer does not have any family relationships with any of the Company’s directors or executive

officers.

Mr. Singer will participate in the director benefits arrangements applicable to

non-employee

directors as described in the Company’s Annual Report on Form

10-K/A

filed with the Securities and Exchange Commission on April 26, 2019. In

addition, the Company will enter into its standard form of indemnification agreement with Mr. Singer.

|

Item 9.01

|

Financial Statements and Exhibits

|

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

10.1

|

|

Letter Agreement, dated as of July

26, 2019, among A10 Networks, Inc., VIEX Opportunities Fund, LP – Series One, VIEX Opportunities Fund, LP – Series Two, VIEX GP, LLC, VIEX Special Opportunities Fund II, LP, VIEX Special Opportunities GP II, LLC, VIEX Special Opportunities Fund

III, LP, VIEX Special Opportunities GP III, LLC, VIEX Capital Advisors, LLC and Eric Singer.

|

|

|

|

|

99.1

|

|

Press Release, issued on July 30, 2019, regarding financial results of A10 Networks, Inc. for the second quarter ended June 30, 2019.

|

|

|

|

|

99.2

|

|

Slides with accompanying prepared remarks of A10 Networks, Inc., dated July 30, 2019, regarding financial results of the second quarter ended June 30, 2019.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

A10 NETWORKS, INC.

|

|

|

|

|

By:

|

|

/s/ Tom Constantino

|

|

Name:

|

|

Tom Constantino

|

|

Title:

|

|

Executive Vice President and Chief Financial Officer

|

Date: July 30, 2019

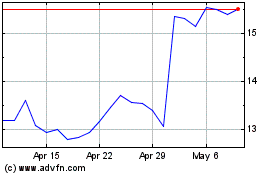

A10 Networks (NYSE:ATEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

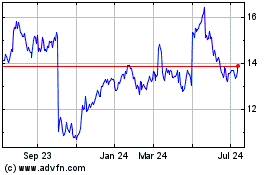

A10 Networks (NYSE:ATEN)

Historical Stock Chart

From Apr 2023 to Apr 2024