A10 Networks (NYSE: ATEN), a provider of intelligent and

automated cybersecurity solutions, today announced financial

results for its third quarter ended Sept. 30, 2018.

Third Quarter 2018 Financial

Summary

- Revenue of $60.5 million, compared with

$62.0 million in third quarter 2017

- GAAP gross margin of 78.5 percent,

non-GAAP gross margin of 78.8 percent

- GAAP operating margin loss of 2.6

percent, non-GAAP operating margin of 4.2 percent

- GAAP net loss of $1.8 million, or $0.02

per share, non-GAAP net income of $2.3 million, or $0.03 per

share

A reconciliation between GAAP and non-GAAP information is

contained in the financial statements below.

“We delivered a solid third quarter achieving revenue of $60.5

million, which exceeded the high-end of our guidance range. In the

quarter, we continued to execute on our initiatives to transform

our sales team, sharpen our focus on execution and expand our

advanced suite of 5G, security and cloud solutions, and we are

pleased with the initial results of our efforts,” said Lee Chen,

president and chief executive officer of A10 Networks. “We are

building momentum in the market with our highly scalable and

intelligent automation driven security solutions. During the

quarter, strong growth in sales for Thunder TPS and record Thunder

CFW sales drove security product revenue to exceed 40 percent of

total product revenue. We have a clear strategy and are

hyper-focused on maximizing our opportunities in the fast-growing

areas of our market. We believe we are on the right path and remain

confident in our strategy to grow our business.”

Prepared Materials and Conference Call Information

A10 Networks has made available a presentation with management’s

prepared remarks on its third quarter 2018 financial results. These

materials are accessible from the “Investor Relations” section of

the A10 Networks website at investors.a10networks.com.

A10 Networks will host a conference call today at 4:30 p.m.

Eastern time / 1:30 p.m. Pacific time for analysts and investors to

discuss its third quarter 2018 results and outlook for its fourth

quarter of 2018. Open to the public, investors may access the call

by dialing +1-844-792-3728 or +1-412-317-5105. A live audio webcast

of the conference call will be accessible from the “Investor

Relations” section of the A10 Networks website at

investors.a10networks.com. The webcast will be archived for a

period of one year. A telephonic replay of the conference call will

be available two hours after the call, will run for five business

days, and may be accessed by dialing +1-877-344-7529 or

+1-412-317-0088 and entering the passcode 10124388. The press

release and supplemental financials will be accessible from the

“Investor Relations” section of the A10 Networks website prior to

the commencement of the conference call.

Forward-Looking Statements

This press release contains “forward-looking statements,”

including statements regarding our initiatives to transform our

sales team, improve our execution and expand our solutions, our

ability to maximize our opportunities, the pace of growth in our

market, our belief that we are on the right path, and our

confidence in our strategies. Forward-looking statements are

subject to known and unknown risks and uncertainties and are based

on assumptions that may prove to be incorrect, which could cause

actual results to differ materially from those expected or implied

by the forward-looking statements. Factors that may cause actual

results to differ include execution risks related to closing key

deals and improving our execution, the continued market adoption of

our products, our ability to successfully anticipate market needs

and opportunities, our timely development of new products and

features, our ability to achieve or maintain profitability, any

loss or delay of expected purchases by our largest end-customers,

our ability to attract and retain new end-customers, our ability to

maintain and enhance our brand and reputation, continued growth in

markets relating to network security, the success of any future

acquisitions or investments in complementary companies, products,

services or technologies, the ability of our sales team to execute

well, our ability to shorten our close cycles, the ability of our

channel partners to sell our products, variations in product mix or

geographic locations of our sales and risks associated with our

presence in international markets.

Non-GAAP Financial Measures

In addition to disclosing financial measures prepared in

accordance with U.S. generally accepted accounting principles

(GAAP), this press release and the accompanying table contain

certain non-GAAP financial measures, including non-GAAP net income

(loss), non-GAAP gross profit and non-GAAP operating income (loss).

Non-GAAP financial measures do not have any standardized meaning

and are therefore unlikely to be comparable to similarly titled

measures presented by other companies.

A10 Networks considers these non-GAAP financial measures to be

important because they provide useful measures of the operating

performance of the company, exclusive of unusual events or factors

that do not directly affect what we consider to be our core

operating performance, and are used by the company's management for

that purpose. We define non-GAAP net income (loss) as our GAAP net

loss excluding: (i) stock-based compensation, (ii) amortization

expense related to acquisition and (iii) non-recurring expenses

associated with the litigation and internal investigation. We

define non-GAAP gross profit as our GAAP gross profit excluding

stock-based compensation. We define non-GAAP operating income

(loss) as our GAAP loss from operations excluding (i) stock-based

compensation, (ii) amortization expense related to acquisition and

(iii) non-recurring expenses associated with the litigation and

internal investigation.

We have included our non-GAAP net income (loss), non-GAAP gross

profit and non-GAAP operating income (loss) in this press release.

Non-GAAP financial measures are presented for supplemental

informational purposes only for understanding the company's

operating results. The non-GAAP financial measures should not be

considered a substitute for financial information presented in

accordance with GAAP, and may be different from non-GAAP financial

measures presented by other companies. Please see the

reconciliation of non-GAAP financial measures to the most directly

comparable GAAP measure attached to this release.

About A10 Networks

A10 Networks (NYSE: ATEN) is a provider of intelligent and

automated cybersecurity solutions, providing a portfolio of

high-performance secure application solutions that enable

intelligent automation with machine learning to ensure

business-critical applications are secure and always available.

Founded in 2004, A10 Networks is based in San Jose, Calif., and

serves customers in more than 80 countries with offices worldwide.

For more information, visit: www.a10networks.com and @A10Networks.

The A10 logo, A10 Networks, A10 Thunder and A10 5G-GiLAN are

trademarks or registered trademarks of A10 Networks, Inc. in the

United States and other countries. All other trademarks are the

property of their respective owners.

A10 NETWORKS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(unaudited, in thousands, except per

share amounts)

Three Months EndedSeptember

30,

Nine Months Ended September

30,

2018 2017 2018 2017

Revenue: Products $ 38,265 $ 40,404 $ 105,638 $ 116,930 Services

22,237 21,601 64,760 62,982 Total

revenue 60,502 62,005 170,398 179,912

Cost of revenue: Products 8,790 9,357 24,979 28,124 Services 4,224

4,510 13,106 13,286 Total cost of

revenue 13,014 13,867 38,085 41,410

Gross profit 47,488 48,138 132,313 138,502

Operating expenses: Sales and marketing 24,539 26,930 77,231

78,754 Research and development 15,505 15,997 49,874 49,529 General

and administrative 9,012 6,945 30,464 21,444

Total operating expenses 49,056 49,872 157,569

149,727 Loss from operations (1,568 ) (1,734 )

(25,256 ) (11,225 ) Non-operating income (expense): Interest

expense (34 ) (20 ) (99 ) (128 ) Interest and other income

(expense), net (131 ) (37 ) 6 779 Total non-operating

income (expense), net (165 ) (57 ) (93 ) 651 Loss before

income taxes (1,733 ) (1,791 ) (25,349 ) (10,574 ) Provision for

income taxes 74 454 660 963 Net loss $

(1,807 ) $ (2,245 ) $ (26,009 ) $ (11,537 ) Net loss per share:

Basic and diluted $ (0.02 ) $ (0.03 ) $ (0.36 ) $ (0.17 )

Weighted-average shares used in computing net loss per share: Basic

and diluted 72,707 70,705 72,550 69,688

A10 NETWORKS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (Continued)

(unaudited, in thousands, except per

share amounts)

Three Months EndedSeptember

30,

Nine Months Ended September 30, 2018

2017 2018 2017 GAAP net loss $ (1,807 )

$ (2,245 ) $ (26,009 ) $ (11,537 ) Stock-based compensation 2,333

4,545 13,055 13,824 Amortization expense related to acquisition 253

253 758 758 Litigation and investigation expense 1,531 —

9,031 — Non-GAAP net income (loss) $ 2,310

$ 2,553 $ (3,165 ) $ 3,045 Non-GAAP net income

(loss) per share: Basic $ 0.03 $ 0.04 $ (0.04 ) $

0.04 Diluted $ 0.03 $ 0.03 $ (0.04 ) $ 0.04

Weighted average shares used in computing non-GAAP net

income (loss) per share: Basic 72,707 70,705 72,550

69,688 Diluted 74,940 73,572 72,550

74,086

A10 NETWORKS, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(unaudited, in thousands)

September 30, 2018 December 31,

2017 ASSETS Current Assets: Cash and cash equivalents

$ 36,162 $ 46,567 Marketable securities 87,391 84,567 Accounts

receivable, net of allowances 51,084 48,266 Inventory 15,102 17,577

Prepaid expenses and other current assets 13,266 6,825

Total current assets 203,005 203,802 Property and equipment,

net 7,994 9,913 Goodwill 1,307 1,307 Intangible assets 4,108 5,190

Other non-current assets 8,380 4,646 Total Assets $

224,794 $ 224,858

LIABILITIES AND STOCKHOLDERS’

EQUITY Current Liabilities: Accounts payable $ 9,630 $ 9,033

Accrued liabilities 20,602 21,835 Deferred revenue 60,653

61,858 Total current liabilities 90,885 92,726 Deferred

revenue, non-current 34,202 32,779 Other non-current liabilities

642 967 Total Liabilities 125,729 126,472

Stockholders’ Equity: Common stock and additional

paid-in-capital 369,859 355,534 Accumulated other comprehensive

loss (157 ) (123 ) Accumulated deficit (1) (270,637 ) (257,025 )

Total Stockholders' Equity 99,065 98,386 Total

Liabilities and Stockholders' Equity $ 224,794 $ 224,858

(1) The adoption of ASU 2014-09, Revenue from Contracts with

Customers (Topic 606) in the first quarter of 2018 resulted in a

reduction to the accumulated deficit balance of $12.4 million as of

January 1, 2018.

A10 NETWORKS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(unaudited, in thousands)

Nine Months Ended September 30, 2018

2017 Cash flows from operating activities: Net loss $

(26,009 ) $ (11,537 ) Adjustments to reconcile net loss to net cash

(used in) provided by operating activities: Depreciation and

amortization 6,020 6,222 Stock-based compensation 13,055 13,824

Other non-cash items 152 930 Changes in operating assets and

liabilities: Accounts receivable (3,144 ) 11,288 Inventory 1,550

(2,513 ) Prepaid expenses and other assets (868 ) (2,785 ) Accounts

payable 806 (1,243 ) Accrued and other liabilities (1,482 ) (3,023

) Deferred revenue 4,219 (1,245 ) Other 183 102 Net

cash (used in) provided by operating activities (5,518 ) 10,020

Cash flows from investing activities: Proceeds from sales of

marketable securities 23,194 18,747 Proceeds from maturities of

marketable securities 41,732 52,119 Purchases of marketable

securities (67,754 ) (69,580 ) Purchase of investment (1,000 ) —

Purchases of property and equipment (2,252 ) (4,223 ) Net cash used

in investing activities (6,080 ) (2,937 ) Cash flows from financing

activities: Proceeds from issuance of common stock under employee

equity incentive plans 1,269 7,665 Repurchases and retirement of

common stock — (3,071 ) Payment of contingent consideration — (650

) Other (76 ) (83 ) Net cash provided by financing activities 1,193

3,861 Net (decrease) increase in cash and cash

equivalents (10,405 ) 10,944 Cash and cash equivalents - beginning

of period $ 46,567 $ 28,975 Cash and cash equivalents

- end of period $ 36,162 $ 39,919

A10 NETWORKS, INC.

RECONCILIATION OF GAAP GROSS PROFIT TO

NON-GAAP GROSS PROFIT

(unaudited, in thousands, except

percentages)

Three Months Ended September 30,

Nine Months Ended September 30, 2018

2017 2018 2017 GAAP gross profit $

47,488 $ 48,138 $ 132,313 $ 138,502 GAAP gross margin 78.5 % 77.6 %

77.6 % 77.0 % Non-GAAP adjustments: Stock-based compensation 187

403 1,277 1,068 Non-GAAP gross profit $

47,675 $ 48,541 $ 133,590 $ 139,570

Non-GAAP gross margin 78.8 % 78.3 % 78.4 % 77.6 %

RECONCILIATION OF GAAP OPERATING LOSS

TO NON-GAAP OPERATING INCOME (LOSS)

(unaudited, in thousands, except

percentages)

Three Months Ended September 30,

Nine Months Ended September 30, 2018

2017 2018 2017 GAAP loss from

operations $ (1,568 ) $ (1,734 ) $ (25,256 ) $ (11,225 ) GAAP

operating margin (2.6 )% (2.8 )% (14.8 )% (6.2

)%

Non-GAAP adjustments: Stock-based compensation 2,333 4,545 13,055

13,824 Amortization expense related to acquisition 253 253 758 758

Litigation and investigation expense 1,531 — 9,031

— Non-GAAP operating income (loss) $ 2,549 $

3,064 $ (2,412 ) $ 3,357 Non-GAAP operating margin

4.2

%

4.9

%

(1.4 )% 1.9

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181030005946/en/

Investor Contact:The Blueshirt GroupMaria Riley &

Chelsea Lish, 415-217-7722investors@a10networks.com

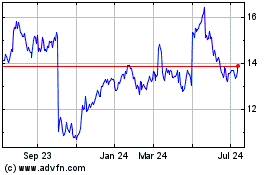

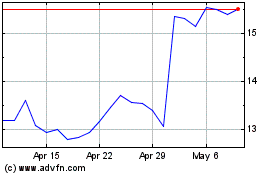

A10 Networks (NYSE:ATEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

A10 Networks (NYSE:ATEN)

Historical Stock Chart

From Apr 2023 to Apr 2024