Lending Acres LLC America’s Alternative Mortgage Lender for Agricultural Businesses

September 07 2022 - 11:47AM

ARMOUR Capital Management LP (“ACM”), a Securities and Exchange

Commission (“SEC”) registered investment adviser (“RIA”), is

pleased to announce the launch of Lending Acres LLC (“Lending

Acres”), an alternative lending platform for American agriculture

businesses.

About Lending Acres

Lending Acres provides loans that fill the

financing gaps that exist today for American agricultural

businesses, cooperatives, rural infrastructure projects, and

agricultural real estate ventures. The senior executives of Lending

Acres, Jitin Singhal and Bobby Roy, along with the principals of

ACM, bring together over 100 years of expertise in fixed income

investing, fund management, capital allocation, underwriting,

servicing, and workouts. In addition to this extensive experience,

the Lending Acres team brings significant technology and data

capabilities into the lending process that enables the team to

analyze loan applications quickly and reliably, as well as execute

documentation promptly. Lending Acres’ goal is to close loans as

early as 30 days from credit approval.

Types of loans offered:

- Bridge Loans

- Cash-Out Loans

- Debt Restructuring Loans

- Acquisition Financing

- High Loan to Value Loans, up to 80%

- Custom Loans

Mr. Singhal serves as the Chief Executive

Officer and Chief Credit Officer of Lending Acres. He is also the

President & CEO of EJ Financial Corp. Mr. Singhal is a

strategic finance and technology leader with a proven track record

of over 25 years of credit investing, growing existing lines of

business, and bringing new products/companies to the market. He has

deep expertise in originating and managing agricultural real-estate

secured loans and previously managed a $10 billion portfolio of

agricultural and rural utility loans as well as a more than $3

billion portfolio of fixed income securities at Farmer Mac.

Mr. Roy serves as the President and Chief

Investment Officer of Lending Acres and has over 18 years of

experience as a structured finance professional with deep knowledge

and experience as an institutional portfolio manager and investment

banking executive. He has held multiple senior investment

leadership and advisory roles at large asset managers and

investment banks.

About ARMOUR Capital

Management

ACM is an RIA with the SEC and a Delaware

limited partnership that commenced its management business in 2009.

As of June 30, 2022, it managed approximately $7.3 billion in

assets, including for the New York Stock Exchange (“NYSE”) listed

company, ARMOUR RESIDENTIAL REIT, INC. (NYSE: ARR). ACM has 22

employees, plus an additional 11 employees at its broker-dealer

subsidiary BUCKLER Securities LLC, and is based in Vero Beach,

FL.

Additional Information and Where to Find

It

Interested parties may find additional

information regarding Lending Acres on the website

www.lendingacres.com, or by directing requests to: Lending Acres

LLC., 3001 Ocean Drive, Suite 201, Vero Beach, Florida 32963.

Investor/Borrower Contact:

Bobby RoyPresident & CIOLending Acres

LLC772-263-8422contact@lendingacres.com

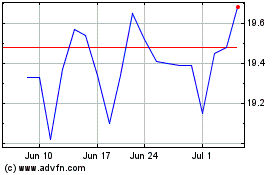

ARMOUR Residential REIT (NYSE:ARR)

Historical Stock Chart

From Mar 2024 to Apr 2024

ARMOUR Residential REIT (NYSE:ARR)

Historical Stock Chart

From Apr 2023 to Apr 2024