Exceeded Revenue and EPS Guidance

83.3% Paid Subscriber Growth Year Over Year Right-sized

Channel Inventory

Arlo Technologies, Inc. (NYSE: ARLO), the #1 network connected

camera brand (1), today reported financial results for the second

quarter ended June 30, 2019.

Second Quarter 2019 Financial Highlights

- Revenue of $83.6 million

- GAAP gross margin of 11.5%; non-GAAP gross margin of

12.5%.

- GAAP net loss per diluted share of $0.45, non-GAAP net loss per

diluted share of $0.36.

“In the second quarter, Arlo again delivered a solid quarter

through strong execution with a focus on costs, while continuing

our innovation. Bringing our channel inventory in line with

historical norms allowed us to continue our progress on the top

line, achieving 44% sequential growth. Aided by our first full

quarter of Ultra in the market, we maintained our leading market

share position and performed well against our guidance metrics,”

said Matthew McRae, Chief Executive Officer of Arlo Technologies.

“We continue to exhibit the innovation Arlo is known for and will

be adding a new camera introduction to the doorbell that will hit

the market in the coming quarters. I am excited about the

trajectory Arlo is on and look forward to accelerating growth in

the back half of the year.”

Business Highlights

- Service revenue of $11.2 million for Q2’19, for growth of 23.3%

year over year

- 83.3% year over year paid subscriber growth in Q2

- 54.1% year over year cumulative registered user growth in

Q2

- Ultra named an Editor’s Choice by PC Magazine.

- Announced that HomeKit, Apple’s smart home platform, is now

supported on Arlo Pro and Arlo Pro 2 Security Camera Systems,

allowing unique functionality through the Apple Home app and Siri

voice commands.

- Launched direct-to-consumer sales on Arlo.com, enabling a

unique platform to engage with our customers, gain new insights

into their preferences and drive greater lifetime value.

- Announcing a new camera with 2K resolution and will include the

same great wire-free design, range and battery performance

customers enjoy with all of our cameras.

_________________________

(1) The NPD Group, Inc., U.S. Retail Tracking Service, Security

& Monitoring, Camera Technology: Decentralized IP Camera and

Centralized IP Camera, based on Dollars, Jan 2018-Dec 2018.

Third Quarter 2019 Business Outlook (1)

- Revenue of $95 million to $105 million

- GAAP gross margin between 8.1% and 11.1%, and non-GAAP gross

margin between 9.0% and 12.0%

- GAAP net loss per diluted share of ($0.53) to ($0.47), and

non-GAAP net loss per diluted share of ($0.43) to ($0.37)

A reconciliation of our business outlook on a GAAP and non-GAAP

basis is provided in the following table:

Three Months Ending September

29, 2019

Gross

Margin Rate

Net Loss

per Diluted Share

Tax

Expense

(in thousands)

GAAP

8.1% - 11.1%

($0.53) - ($0.47)

$300

Estimated adjustments for (1):

Separation expense

__

$0.01

__

Stock-based compensation expense

0.5%

$0.08

__

Amortization of intangibles

0.4%

$0.01

__

Tax effects of non-GAAP adjustments

__

__

__

Non-GAAP

9.0% - 12.0%

($0.43) - ($0.37)

$300

_________________________

(1) Business outlook does not include estimates for any

currently unknown income and expense items which, by their nature,

could arise late in a quarter, including: restructuring and other

charges; litigation reserves, net; acquisition-related charges;

impairment charges; discrete tax benefits or detriments relating to

tax windfalls or shortfalls from equity awards; and any additional

impacts relating to the implementation of U.S. tax reform. New

material income and expense items such as these could have a

significant effect on our guidance and future results.

Investor Conference Call / Webcast Details

Arlo will review the second quarter of 2019 results and discuss

management’s expectations for the third quarter of 2019 today,

Tuesday, August 6, 2019 at 5:00 p.m. ET (2:00 p.m. PT). The toll

free dial-in number for the live audio call is (866) 393-4306. The

international dial-in number for the live audio call is (734)

385-2616. The conference ID for the call is 9492805. A live webcast

of the conference call will be available on Arlo’s Investor

Relations website at https://investor.arlo.com. A replay of the

call will be available via the web at

https://investor.arlo.com.

About Arlo Technologies, Inc.

Arlo (NYSE: ARLO) is the award-winning, industry leader that is

transforming the way people experience the connected lifestyle.

Arlo’s deep expertise in product design, wireless connectivity,

cloud infrastructure and cutting-edge AI capabilities focuses on

delivering a seamless, smart home experience for Arlo users that is

easy to setup and interact with every day. Arlo’s cloud-based

platform provides users with visibility, insight and a powerful

means to help protect and connect in real-time with the people and

things that matter most, from any location with a Wi-Fi or a

cellular connection. To date, Arlo has launched several categories

of award-winning smart connected devices, including wire-free smart

Wi-Fi and LTE-enabled cameras, advanced baby monitors and smart

security lights.

© 2019 Arlo Technologies, Inc., Arlo and the Arlo logo are

trademarks and/or registered trademarks of Arlo Technologies, Inc.

and/or certain of its affiliates in the United States and/or other

countries. Other brand and product names are for identification

purposes only and may be trademarks or registered trademarks of

their respective holder(s). The information contained herein is

subject to change without notice. Arlo shall not be liable for

technical or editorial errors or omissions contained herein. All

rights reserved.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995:

This press release contains forward-looking statements within

the meaning of the U.S. Private Securities Litigation Reform Act of

1995. The words “anticipate,” “expect,” “believe,” “will,” “may,”

“should,” “estimate,” “project,” “outlook,” “forecast” or other

similar words are used to identify such forward-looking statements.

However, the absence of these words does not mean that the

statements are not forward-looking. The forward-looking statements

represent Arlo Technologies, Inc.’s expectations or beliefs

concerning future events based on information available at the time

such statements were made and include statements regarding: Arlo’s

future operating performance and financial condition, expected

revenue, GAAP and non-GAAP gross margins, operating margins, and

tax expense; expectations regarding market expansion and future

growth; and plans to invest in product innovation. These statements

are based on management's current expectations and are subject to

certain risks and uncertainties, including the following: future

demand for the Company's products may be lower than anticipated;

consumers may choose not to adopt the Company's new product

offerings or adopt competing products; product performance may be

adversely affected by real world operating conditions; the Company

may be unsuccessful or experience delays in manufacturing and

distributing its new and existing products; telecommunications

service providers may choose to slow their deployment of the

Company's products or utilize competing products; the Company may

be unable to collect receivables as they become due; the Company

may fail to manage costs, including the cost of developing new

products and manufacturing and distribution of its existing

offerings; the Company may fail to successfully continue to effect

operating expense savings; changes in the level of Arlo's cash

resources and the Company's planned usage of such resources;

changes in the Company's stock price and developments in the

business that could increase the Company's cash needs; fluctuations

in foreign exchange rates; and the actions and financial health of

the Company's customers. Further, certain forward-looking

statements are based on assumptions as to future events that may

not prove to be accurate. Therefore, actual outcomes and results

may differ materially from what is expressed or forecast in such

forward-looking statements. Further information on potential risk

factors that could affect Arlo and its business are detailed in the

Company's periodic filings with the Securities and Exchange

Commission, including, but not limited to, those risks and

uncertainties listed in the section entitled “Part II - Item 1A.

Risk Factors,” in the Company's quarterly report on Form 10-Q for

the fiscal quarter ended March 31, 2019, filed with the Securities

and Exchange Commission on May 3, 2019. Given these circumstances,

you should not place undue reliance on these forward-looking

statements. Arlo undertakes no obligation to release publicly any

revisions to any forward-looking statements contained herein to

reflect events or circumstances after the date hereof or to reflect

the occurrence of unanticipated events.

Non-GAAP Financial Information:

To supplement our unaudited selected financial data presented on

a basis consistent with Generally Accepted Accounting Principles

(“GAAP”), we disclose certain non-GAAP financial measures that

exclude certain charges, including non-GAAP gross profit, non-GAAP

gross margin, non-GAAP research and development, non-GAAP sales and

marketing, non-GAAP general and administrative, non-GAAP total

operating expenses, non-GAAP operating income (loss), non-GAAP

operating margin, non-GAAP net income(loss) and non-GAAP net income

(loss) per diluted share. These supplemental measures exclude

adjustments for separation expense, stock-based compensation

expense, amortization of intangibles, activist shareholder response

costs, restructuring and other charges, litigation reserves, and

the related tax effects. These non-GAAP measures are not in

accordance with or an alternative for GAAP, and may be different

from similarly-titled non-GAAP measures used by other companies. We

believe that these non-GAAP measures have limitations in that they

do not reflect all of the amounts associated with our results of

operations as determined in accordance with GAAP and that these

measures should only be used to evaluate our results of operations

in conjunction with the corresponding GAAP measures. The

presentation of this additional information is not meant to be

considered in isolation or as a substitute for the most directly

comparable GAAP measures. We compensate for the limitations of

non-GAAP financial measures by relying upon GAAP results to gain a

complete picture of our performance.

In calculating non-GAAP financial measures, we exclude certain

items to facilitate a review of the comparability of our operating

performance on a period-to-period basis because such items are not,

in our view, related to our ongoing operational performance. We use

non-GAAP measures to evaluate the operating performance of our

business, for comparison with forecasts and strategic plans, and

for benchmarking performance externally against competitors. In

addition, management’s incentive compensation is determined using

certain non-GAAP measures. Since we find these measures to be

useful, we believe that investors benefit from seeing results

“through the eyes” of management in addition to seeing GAAP

results. We believe that these non-GAAP measures, when read in

conjunction with our GAAP measures, provide useful information to

investors by offering:

· the ability to make more meaningful

period-to-period comparisons of our on-going operating results;

· the ability to better identify trends in

our underlying business and perform related trend analyses;

· a better understanding of how management

plans and measures our underlying business; and

· an easier way to compare our operating

results against analyst financial models and operating results of

competitors that supplement their GAAP results with non-GAAP

financial measures.

The following are explanations of the adjustments that we

incorporate into non-GAAP measures, as well as the reasons for

excluding them in the reconciliations of these non-GAAP financial

measures:

Separation expense consists of expenses that are related to the

separation of our business from NETGEAR. These consist primarily of

third-party consulting fees, legal fees, IT costs, employee bonuses

for services related to the separation, and other one-time expenses

incurred to complete the separation. We consider our operating

results without these charges when evaluating our ongoing

performance and forecasting our earnings trends, and therefore

exclude such charges when presenting non-GAAP financial measures.

We believe that the assessment of our operations excluding these

costs is relevant to our assessment of internal operations and

comparisons to the performance of our competitors.

Stock-based compensation expense consists of non-cash charges

for the estimated fair value of stock options, performance-based

stock options, restricted stock units and shares under the employee

stock purchase plan granted to employees. We believe that the

exclusion of these charges provides for more accurate comparisons

of our operating results to peer companies due to the varying

available valuation methodologies, subjective assumptions and the

variety of award types. In addition, we believe it is useful to

investors to understand the specific impact stock-based

compensation expense has on our operating results.

Amortization of intangibles consists primarily of non-cash

charges that can be impacted by, among other things, the timing and

magnitude of acquisitions. We consider our operating results

without these charges when evaluating our ongoing performance and

forecasting our earnings trends, and therefore exclude such charges

when presenting non-GAAP financial measures. We believe that the

assessment of our operations excluding these costs is relevant to

an assessment of our internal operations and comparisons to our

prior and future periods and to the performance of our

competitors.

Activist shareholder response costs primarily consist of legal

fees and third-party consulting costs incurred. We consider our

operating results without these charges when evaluating our ongoing

performance and forecasting our earnings trends, and therefore

exclude such charges when presenting non-GAAP financial measures.

We believe that the assessment of our operations excluding these

costs is relevant to our assessment of internal operations and

comparisons to the performance of our competitors.

Other items are the result of either unique or unplanned events,

including, when applicable: restructuring and other charges and

litigation reserves, net. It is difficult to predict the occurrence

or estimate the amount or timing of these items in advance.

Although these events are reflected in our GAAP financial

statements, these unique transactions may limit the comparability

of our on-going operations with prior and future periods. The

amounts result from events that often arise from unforeseen

circumstances, which often occur outside of the ordinary course of

continuing operations. Therefore, the amounts do not accurately

reflect the underlying performance of our continuing business

operations for the period in which they are incurred.

Tax effects consist of the various above adjustments that we

incorporate into non-GAAP measures in order to provide a more

meaningful measure on non-GAAP net income. We also believe

providing financial information with and without the income tax

effects relating to our non-GAAP financial measures provides our

management and users of the financial statements with better

clarity regarding the on-going performance of our business.

Source: Arlo-F

ARLO TECHNOLOGIES,

INC.

UNAUDITED CONDENSED

CONSOLIDATED BALANCE SHEETS

As of

June 30, 2019

December 31, 2018

(in thousands)

ASSETS

Current assets:

Cash and cash equivalents

$

93,050

$

151,290

Short-term investments

44,877

49,737

Accounts receivable, net

79,707

166,045

Inventories

97,222

124,791

Prepaid expenses and other current

assets

11,459

23,611

Total current assets

326,315

515,474

Property and equipment, net

27,964

49,428

Operating lease right-of-use assets,

net

32,654

—

Intangibles, net

2,060

2,823

Goodwill

15,638

15,638

Restricted cash

4,134

4,134

Other non-current assets

6,697

8,449

Total assets

$

415,462

$

595,946

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

22,312

$

82,542

Deferred revenue

26,854

26,678

Accrued liabilities

110,040

172,036

Income tax payable

792

734

Total current liabilities

159,998

281,990

Non-current deferred revenue

20,610

23,313

Non-current operating lease

liabilities

31,592

—

Non-current financing lease obligation

—

19,978

Non-current income taxes payable

22

22

Other non-current liabilities

10

1,141

Total liabilities

212,232

326,444

Stockholders’ Equity:

Common stock

75

74

Additional paid-in capital

323,648

315,277

Accumulated other comprehensive income

51

—

Accumulated deficit

(120,544

)

(45,849

)

Total stockholders’ equity

203,230

269,502

Total liabilities and stockholders’

equity

$

415,462

$

595,946

ARLO TECHNOLOGIES,

INC.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

Three Months Ended

Six Months Ended

June 30, 2019

March 31, 2019

July 1,

2018 (1)

June 30, 2019

July 1,

2018 (1)

(in thousands, except

percentage and per share data)

Revenue:

Products

$

72,445

$

46,608

$

101,900

$

119,053

$

194,331

Services

11,153

11,272

9,048

22,425

17,255

Total revenue

83,598

57,880

110,948

141,478

211,586

Cost of revenue:

Products

67,839

50,284

77,211

118,123

145,054

Services

6,109

5,651

5,443

11,760

9,185

Total cost of revenue

73,948

55,935

82,654

129,883

154,239

Gross profit

9,650

1,945

28,294

11,595

57,347

Gross margin

11.5

%

3.4

%

25.5

%

8.2

%

27.1

%

Operating expenses:

Research and development

17,594

18,161

13,804

35,755

25,829

Sales and marketing

14,511

14,221

13,068

28,732

24,280

General and administrative

10,914

10,536

6,318

21,450

11,196

Separation expense

717

906

11,269

1,623

17,826

Total operating expenses

43,736

43,824

44,459

87,560

79,131

Loss from operations

(34,086

)

(41,879

)

(16,165

)

(75,965

)

(21,784

)

Operating margin

(40.8

)%

(72.4

)%

(14.6

)%

(53.7

)%

(10.3

)%

Interest income

712

862

—

1,574

—

Other income (expense), net

31

(47

)

(1,369

)

(16

)

(794

)

Loss before income taxes

(33,343

)

(41,064

)

(17,534

)

(74,407

)

(22,578

)

Provision for income taxes

349

220

288

569

607

Net loss

$

(33,692

)

$

(41,284

)

$

(17,822

)

$

(74,976

)

$

(23,185

)

Net loss per share:

Basic

$

(0.45

)

$

(0.55

)

$

(0.29

)

$

(1.01

)

$

(0.37

)

Diluted

$

(0.45

)

$

(0.55

)

$

(0.29

)

$

(1.01

)

$

(0.37

)

Weighted average shares used to compute

net loss per share:

Basic

74,729

74,409

62,500

74,569

62,500

Diluted

74,729

74,409

62,500

74,569

62,500

________________________

(1) The three and six months ended July 1, 2018 were based on

carve-out financials whereas financial periods after July 1, 2018

were based on standalone financials. Further detail regarding

carve-out financials was contained in our SEC filings, including

our previously filed Form 10-K, Form S-1 and related public

offering prospectus, standalone financials represents our actual

results for the period as a standalone public company.

ARLO TECHNOLOGIES,

INC.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

Six Months Ended

June 30, 2019

July 1, 2018

(In thousands)

Cash flows from operating

activities:

Net loss

$

(74,976

)

$

(23,185

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

7,087

1,956

Premium amortization / discount accretion

on investments, net

(274

)

—

Stock-based compensation

10,042

1,899

Deferred income taxes

74

—

Changes in assets and liabilities:

Accounts receivable, net

86,338

47,395

Inventories

27,569

(40,620

)

Prepaid expenses and other assets

1,784

(4,558

)

Accounts payable

(59,865

)

4,385

Deferred revenue

(2,527

)

4,553

Accrued and other liabilities

(49,913

)

5,437

Net cash used in operating activities

(54,661

)

(2,738

)

Cash flows from investing

activities:

Purchases of property and equipment

(7,116

)

(7,534

)

Purchases of short-term investments

(24,793

)

—

Maturities of short-term investments

30,000

—

Net cash used in investing activities

(1,909

)

(7,534

)

Cash flows from financing

activities:

Proceeds related to employee benefit

plans

12

—

Restricted stock unit withholdings

(1,682

)

—

Net investment from parent

—

10,297

Net cash provided by (used in) financing

activities

(1,670

)

10,297

Net increase (decrease) in cash and cash

equivalents and restricted cash

(58,240

)

25

Cash and cash equivalents and restricted

cash, at beginning of period

155,424

108

Cash and cash equivalents and restricted

cash, at end of period

$

97,184

$

133

Non-cash investing and financing

activities:

Purchases of property and equipment

included in accounts payable and accrued liabilities

$

(2,753

)

$

2,166

De-recognition of build-to-suit assets and

liabilities

$

(21,610

)

$

—

ARLO TECHNOLOGIES,

INC.

RECONCILIATIONS OF GAAP

MEASURES TO NON-GAAP MEASURES

STATEMENT OF OPERATIONS DATA:

Three Months Ended

Six Months Ended

June 30, 2019

March 31, 2019

July 1, 2018

June 30, 2019

July 1, 2018

(in thousands, except

percentage data)

GAAP gross profit

$

9,650

$

1,945

$

28,294

$

11,595

$

57,347

GAAP gross margin

11.5

%

3.4

%

25.5

%

8.2

%

27.1

%

Stock-based compensation expense

450

369

347

819

683

Amortization of intangibles

382

381

381

763

763

Non-GAAP gross profit

$

10,482

$

2,695

$

29,022

$

13,177

$

58,793

Non-GAAP gross margin

12.5

%

4.7

%

26.2

%

9.3

%

27.8

%

GAAP research and development

$

17,594

$

18,161

$

13,804

$

35,755

$

25,829

Stock-based compensation expense

(1,635

)

(1,297

)

(977

)

(2,932

)

(1,710

)

Non-GAAP research and development

$

15,959

$

16,864

$

12,827

$

32,823

$

24,119

GAAP sales and marketing

$

14,511

$

14,221

$

13,068

$

28,732

$

24,280

Stock-based compensation expense

(991

)

(940

)

(782

)

(1,931

)

(1,454

)

Non-GAAP sales and marketing

$

13,520

$

13,281

$

12,286

$

26,801

$

22,826

GAAP general and administrative

$

10,914

$

10,536

$

6,318

$

21,450

$

11,196

Stock-based compensation expense

(2,313

)

(2,047

)

(1,146

)

(4,360

)

(2,100

)

Restructuring and other charges

—

—

(74

)

—

(74

)

Non-GAAP general and administrative

$

8,601

$

8,489

$

5,098

$

17,090

$

9,022

GAAP total operating expenses

$

43,736

$

43,824

$

44,459

$

87,560

$

79,131

Separation expense

(717

)

(906

)

(11,269

)

(1,623

)

(17,826

)

Stock-based compensation expense

(4,939

)

(4,284

)

(2,905

)

(9,223

)

(5,264

)

Restructuring and other charges

—

—

(74

)

—

(74

)

Activist shareholder response costs

(237

)

—

—

(237

)

—

Non-GAAP total operating expenses

$

37,843

$

38,634

$

30,211

$

76,477

$

55,967

ARLO TECHNOLOGIES,

INC.

RECONCILIATIONS OF GAAP

MEASURES TO NON-GAAP MEASURES (CONTINUED)

STATEMENT OF OPERATIONS DATA (CONTINUED):

Three Months Ended

Six Months Ended

June 30, 2019

March 31, 2019

July 1, 2018

June 30, 2019

July 1, 2018

(in thousands, except

percentage and per share data)

GAAP operating loss

$

(34,086

)

$

(41,879

)

$

(16,165

)

$

(75,965

)

$

(21,784

)

GAAP operating margin

(40.8

)%

(72.4

)%

(14.6

)%

(53.7

)%

(10.3

)%

Separation expense

717

906

11,269

1,623

17,826

Stock-based compensation expense

5,389

4,653

3,252

10,042

5,947

Amortization of intangibles

382

381

381

763

763

Restructuring and other charges

—

—

74

—

74

Activist shareholder response costs

237

—

—

237

—

Non-GAAP operating income (loss)

$

(27,361

)

$

(35,939

)

$

(1,189

)

$

(63,300

)

$

2,826

Non-GAAP operating margin

(32.7

)%

(62.1

)%

(1.1

)%

(44.7

)%

1.3

%

GAAP provision for income taxes

$

349

$

220

$

288

$

569

$

607

GAAP income tax rate

(1.0

)%

(0.5

)%

(1.6

)%

(0.8

)%

(2.7

)%

Tax effects

142

—

—

142

—

Non-GAAP provision for income taxes

$

207

$

220

$

288

$

427

$

607

Non-GAAP income tax rate

(0.8

)%

(0.6

)%

(11.3

)%

(0.7

)%

29.9

%

GAAP net loss

$

(33,692

)

$

(41,284

)

$

(17,822

)

$

(74,976

)

$

(23,185

)

Separation expense

717

906

11,269

1,623

17,826

Stock-based compensation expense

5,389

4,653

3,252

10,042

5,947

Amortization of intangibles

382

381

381

763

763

Restructuring and other charges

—

—

74

—

74

Activist shareholder response costs

237

—

—

237

—

Tax effects

142

—

—

142

—

Non-GAAP net income (loss)

$

(26,825

)

$

(35,344

)

$

(2,846

)

$

(62,169

)

$

1,425

ARLO TECHNOLOGIES,

INC.

RECONCILIATIONS OF GAAP

MEASURES TO NON-GAAP MEASURES (CONTINUED)

STATEMENT OF OPERATIONS DATA (CONTINUED):

Three Months Ended

Six Months Ended

June 30, 2019

March 31, 2019

July 1, 2018

June 30, 2019

July 1, 2018

(in thousands, except

percentage and per share data)

NET INCOME (LOSS) PER DILUTED SHARE:

GAAP net loss per diluted share

$

(0.45

)

$

(0.55

)

$

(0.29

)

$

(1.01

)

$

(0.37

)

Separation expense

0.01

0.01

0.18

0.02

0.28

Stock-based compensation expense

0.07

0.06

0.05

0.15

0.10

Amortization of intangibles

0.01

0.01

0.01

0.01

0.01

Restructuring and other charges

—

—

0.00

—

0.00

Activist shareholder response costs

0.00

—

—

0.00

—

Tax effects

0.00

—

—

0.00

—

Non-GAAP net income (loss) per diluted

share

$

(0.36

)

$

(0.47

)

$

(0.05

)

$

(0.83

)

$

0.02

Shares used in computing GAAP net loss per

diluted share

74,729

74,409

62,500

74,569

62,500

Shares used in computing non-GAAP net

income (loss) per diluted share

74,729

74,409

62,500

74,569

62,500

ARLO TECHNOLOGIES,

INC.

UNAUDITED SUPPLEMENTAL

FINANCIAL INFORMATION

Three Months Ended

June 30, 2019

March 31, 2019

December 31, 2018

September 30, 2018

July 1, 2018

(in thousands, except

headcount and per share data)

Cash, cash equivalents and short-term

investments

$

137,927

$

180,374

$

201,027

$

187,846

$

133

Cash, cash equivalents and short-term

investments per diluted share

$

1.85

$

2.42

$

2.71

$

2.70

$

0.00

Accounts receivable, net

$

79,707

$

71,566

$

166,045

$

117,119

$

111,113

Days sales outstanding

87

111

125

81

91

Inventories

$

97,222

$

131,227

$

124,791

$

132,479

$

123,195

Ending inventory turns

2.8

1.5

3.6

2.9

2.5

Weeks of channel inventory:

U.S. retail channel

10.1

14.5

8.1

13.5

9.5

U.S. distribution channel

8.9

8.9

10.9

9.1

3.9

EMEA distribution channel

2.7

4.4

6.7

4.4

3.6

APAC distribution channel

5.1

6.7

6.0

9.2

17.4

Deferred revenue (current and

non-current)

$

47,464

$

47,737

$

49,991

$

45,906

$

42,389

Cumulative registered users

3,397

3,126

2,850

2,498

2,204

Paid subscribers

187

162

*

144

125

102

Headcount

402

401

386

344

153

Non-GAAP diluted shares

74,729

74,409

74,247

69,600

62,500

_________________________

* We recently factored in an adjustment to our Q1’19 paid

subscriber number and have subsequently revised the Q1’19 total to

162,000.

REVENUE BY GEOGRAPHY

Three Months Ended

Six Months Ended

June 30, 2019

March 31, 2019

July 1, 2018

June 30, 2019

July 1, 2018

(in thousands, except

percentage data)

Americas

$

64,564

77

%

$

44,366

77

%

$

86,681

79

%

$

108,930

77

%

$

161,404

77

%

EMEA

15,066

18

%

9,302

16

%

19,390

17

%

24,368

17

%

38,656

18

%

APAC

3,968

5

%

4,212

7

%

4,877

4

%

8,180

6

%

11,526

5

%

Total

$

83,598

100

%

$

57,880

100

%

$

110,948

100

%

$

141,478

100

%

$

211,586

100

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190806005907/en/

Arlo Investor Relations Erik Bylin investors@arlo.com (510)

315-1004

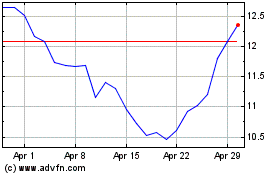

Arlo Technologies (NYSE:ARLO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arlo Technologies (NYSE:ARLO)

Historical Stock Chart

From Apr 2023 to Apr 2024