American Realty Investors, Inc. (NYSE:ARL), a Dallas-based real

estate investment company, today reported results of operations for

the quarter ended June 30, 2019. For the three months ended June

30, 2019, we reported a net loss applicable to common shares of

$2.8 million or ($0.17) per diluted loss per share compared to a

net income applicable to common shares of $5.6 million or ($0.35)

per diluted loss per share for the same period ended 2018.

We would like to take a brief moment to share with you our

recent successes for TCI and affiliated Companies and thank you for

your steadfast dedication to the company.

2018 and 2019 have been met with unprecedented expansion and

repositioning for Pillar, TCI, SPC, and affiliated Companies. We

ended 2018 with our largest and most strategic transactions, the

newly created subsidiary Victory Abode Apartments, LLC (“VAA”)

Joint Venture and Bond Series B raised on the Tel Aviv Stock

Exchange. In 2019, the company recently raised an additional $78

million bond series C on the Tel Aviv Stock Exchange. This expanded

offering creates additional financial strength to our already

thriving organization. With these existing and newly engaged

projects and our continuously burgeoning multifamily asset base, we

are committed to the continued growth and education of our

staff.

The JV’s primary focus is to create a business platform that

will allow dramatic expansion in the multifamily arena. The intent

is to increase the overall size of the portfolio over the next

several years through strategic buildout of its robust development

pipeline alongside opportunistic acquisitions.

All of these initiatives further demonstrate our ability to

increase shareholder value, aligning with the strategic direction

we announced three years ago. Our company has been dramatically

transformed to a highly viable operating company with solid

development capabilities in the multifamily arena. Our main goal

has always been to act in the best interest of the company and

protect asset value for its investors. We continue to invest in new

development projects and grow the company’s asset base.

Revenues

Rental and other property revenues were $11.8 million for the

three months ended June 30, 2019, compared to $31.6 million for the

same period in 2018. The $19.8 million decrease is primarily due to

a decrease in the amount of multifamily residential apartment

buildings currently in our portfolio of nine as compared to

fifty-three multifamily residential apartment buildings for the

same period a year ago as a result of the deconsolidation of

forty-nine residential apartment properties that were sold into the

VAA Joint Venture during the fourth quarter of 2018. As the assets

are now treated as unconsolidated investments, our share of rental

revenues is part of income from unconsolidated investments in the

current period and are no longer treated as rental income.

Expense

Property operating expenses decreased by $8.2 million to $7.3

million for the three months ended June 30, 2019 as compared to

$15.5 million for the same period in 2018. The decrease in property

operating expenses is primarily due to the deconsolidation of

forty-nine residential apartment properties that were sold into the

VAA Joint Venture during the fourth quarter of 2018 which resulted

in a decrease in salary and related payroll expenses of $1.8

million, real estate taxes of $2.4 million, management fees paid to

third parties of $0.7 million, and other general property operating

and maintenance expenses of $3.3 million.

Depreciation and amortization decreased by $3.1 million to $3.4

million during the three months ended June 30, 2019 as compared to

$6.5 million for the three months ended June 30, 2018. This

decrease is primarily due to the deconsolidation of the residential

apartments in connection with our previous sale and contribution of

our interests to the VAA Joint Venture.

General and administrative expense was $4.1 million for the

three months ended June 30, 2019 and $2.9 million for the same

period in 2018. The increase of $1.2 million in general and

administrative expenses is due primarily to increases in fees paid

to our Advisors of $0.9 million, franchise taxes of $0.1 million,

and professional fees of $0.2 million.

Other income (expense)

Interest income was $6.5 million for the three months ended June

30, 2019, compared to $4.9 million for the same period in 2018. The

increase of $1.6 million was due primarily to an increase of $1.5

million in interest on the receivables owed by our Advisors.

Other income was $3.4 million for the three months ended June

30, 2019, compared to $7.5 million for the same period in 2018. The

decrease of $4.1 was due primarily to cash proceeds of $3.1 million

received during the quarter ended June 30, 2019, from the

collection of tax increment incentives related to infrastructure

development work at Mercer Crossing, located in Farmers Branch,

Texas, compared to insurance proceeds received during the second

quarter of 2018 of approximately $6.6 million as a result of

damages caused by a hurricane to one of our properties that was

subsequently sold during the same quarter.

Mortgage and loan interest expense was $9.4 million for the

three months ended June 30, 2019 as compared to $15.9 million for

the same period in 2018. The decrease of $6.5 million is due to the

deconsolidation of residential apartment properties into the VAA

Joint Venture, which were encumbered by mortgage debt.

Foreign currency transaction was a loss of $2.3 million for the

three months ended June 30, 2019 as compared to a gain of $5.9

million for the same period in 2018. The foreign currency loss is

due primarily to a decrease in the exchange rate of our Israel New

Shekels (NIS) denominated corporate bonds registered on the

Tel-Aviv Stock Exchange. The exchange rate of the NIS to USD went

from 3.63 at the beginning of the second quarter to an exchange

rate of 3.58 at June 30, 2019. As of June 30, 2019, we have

outstanding bonds of $159.4 million (or NIS 570 million) and

accrued interest payable of approximately $2.8 million (or NIS 10.1

million).

Loss from unconsolidated investments was a net of $0.06 million

for the three months ended June 30, 2019 as compared to earnings of

$0.28 million for the three months ended June 30, 2018. The loss

from unconsolidated investments during the second quarter just

ended was driven primarily from our share in the losses reported by

our VAA Joint Venture of $0.24 million offset by earnings from

other unconsolidated investees of $0.17 million.

Loss from the sale of income-producing property increased for

the three months ended June 30, 2019 as compared to the prior

period. In the current period, we sold a multifamily residential

property, located in Mary Ester, Florida for a sales price of $3.1

million and recorded a loss of $0.08 million. There were no

apartment sales for the three months ended June 30, 2018.

Gain on land sales increased for the three months ended June 30,

2019 as compared to the prior period. In the current period, we

sold 41.6 acres of land for an aggregate sales price of $7.6

million and recorded a gain of $2.5 million. There were no land

sales for the three months ended June 30, 2018.

About American Realty Investors, Inc.

American Realty Investors, Inc., a Dallas-based real estate

investment company, holds a diverse portfolio of equity real estate

located across the U.S., including office buildings, apartments,

shopping centers, and developed and undeveloped land. The Company

invests in real estate through direct ownership, leases and

partnerships and invests in mortgage loans on real estate. The

Company also holds mortgage receivables. For more information,

visit the Company’s website at www.americanrealtyinvest.com.

AMERICAN REALTY INVESTORS,

INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2019

2018

2019

2018

Revenues: Rental and other property revenues (including $202

and $208 for the three months and $413 and $415 for the six months

ended 2019 and 2018, respectively, from related parties)

$

11,840

$

31,607

$

23,769

$

62,690

Expenses: Property operating expenses (including $246

and $231 for the three months ended and $504 and $458 for the six

months ended 2019 and 2018, respectively, from related parties)

7,323

15,550

13,320

29,974

Depreciation and amortization

3,439

6,504

6,548

12,895

General and administrative (including $985 and $1,297 for the three

months ended and $2,582 and $2,437 for the six months ended 2019

and 2018, respectively, from related parties)

4,127

2,954

6,732

5,295

Net income fee to related party

90

53

190

106

Advisory fee to related party

1,238

2,929

3,091

5,885

Total operating expenses

16,217

27,990

29,881

54,155

Net operating (loss) income

(4,377

)

3,617

(6,112

)

8,535

Other income (expenses): Interest income (including $6,207

and $4,832 for the three months ended and $12,304 and $9,311 for

the six months ended 2019 and 2018, respectively, from related

parties)

6,505

4,882

12,658

9,991

Other income

3,364

7,537

7,031

9,438

Mortgage and loan interest (including $2,385 and $1,909 for the

three months ended and $4,692 and $3,708 for the six months ended

2019 and 2018, respectively, from related parties)

(9,408

)

(15,907

)

(19,376

)

(31,631

)

Foreign currency transaction (loss) gain

(2,325

)

5,889

(8,143

)

7,645

Equity loss from VAA

(236

)

-

(1,291

)

-

Earnings from unconsolidated subsidiaries and investees

173

277

231

597

Total other (expenses) income

(1,927

)

2,678

(8,890

)

(3,960

)

(Loss) income before gain on land sales, non-controlling interest,

and taxes

(6,304

)

6,295

(15,002

)

4,575

Loss on sale of income producing properties

(80

)

-

(80

)

-

Gain on land sales

2,517

-

4,733

1,335

Net (loss) income from continuing operations before taxes

(3,867

)

6,295

(10,349

)

5,910

Net (loss) income from continuing operations

(3,867

)

6,295

(10,349

)

5,910

Net (loss) income

(3,867

)

6,295

(10,349

)

5,910

Net (income) loss attributable to non-controlling interest

1,089

(441

)

1,424

(716

)

Net (loss) income attributable to American Realty Investors, Inc.

(2,778

)

5,854

(8,925

)

5,194

Preferred dividend requirement

-

(225

)

-

(450

)

Net (loss) income applicable to common shares

$

(2,778

)

$

5,629

$

(8,925

)

$

4,744

(Loss) earnings per share - basic Net (loss) income from

continuing operations

$

(0.17

)

$

0.35

$

(0.56

)

$

0.30

(Loss) earnings per share - diluted Net (loss) income

from continuing operations

$

(0.17

)

$

0.34

$

(0.56

)

$

0.28

Weighted average common shares used in computing earnings

per share

15,997,076

15,997,076

15,997,076

15,967,740

Weighted average common shares used in computing diluted earnings

per share

15,997,076

16,682,753

15,997,076

16,653,417

Amounts attributable to American Realty Investors,

Inc. Net (loss) income from continuing operations

$

(2,778

)

$

5,854

$

(8,925

)

$

5,194

Net (loss) income applicable to American Realty Investors, Inc.

$

(2,778

)

$

5,854

$

(8,925

)

$

5,194

AMERICAN REALTY INVESTORS, INC.

CONSOLIDATED BALANCE SHEETS

June 30,

December 31,

2019

2018

(unaudited)

(audited)

(dollars in thousands, except

share and par value amounts)

Assets

Real estate, at cost

$

450,143

$

455,993

Real estate subject to sales contracts at cost

1,626

3,149

Real estate held for sale at cost, net of depreciation

14,737

-

Less accumulated depreciation

(83,084

)

(78,099

)

Total real estate

383,422

381,043

Notes and interest receivable (including $106,102 in 2019

and $105,803 in 2018 from related parties)

173,851

140,327

Less allowance for estimated losses (including $14,269 in 2019 and

2018 from related parties)

(14,269

)

(14,269

)

Total notes and interest receivable

159,582

126,058

Cash and cash equivalents

37,644

36,428

Restricted cash

44,603

70,187

Investment in VAA

67,078

68,399

Investment in other unconsolidated investees

7,833

7,602

Receivable from related party

61,676

70,377

Other assets

55,715

66,055

Total assets

$

817,553

$

826,149

Liabilities and Shareholders’

Equity

Liabilities: Notes and interest payable

$

293,079

$

286,968

Bond and interest payable

157,328

158,574

Deferred revenue (including $30,188 in 2019 and $33,904 in 2018 to

related parties)

30,188

33,904

Accounts payable and other liabilities (including $11,363 in 2019

and $9,984 in 2018 to related parties)

26,292

25,576

Total liabilities

506,887

505,022

Shareholders’ equity: Preferred stock, Series A: $2.00 par

value, authorized 15,000,000 shares, issued 1,800,614 and

outstanding 614 in 2019 and 2018 (liquidation preference $10 per

share), including 1,800,000 shares held by ARL and its subsidiaries

in 2019 and 2018.

5

5

Common stock, $0.01 par value, 100,000,000 shares authorized;

16,412,861 shares issued and 15,997,076 outstanding as of 2019 and

2018, including 140,000 shares held by TCI (consolidated) in 2019

and 2018.

164

164

Treasury stock at cost; 415,785 shares in 2019 and 2018, and

140,000 shares held by TCI (consolidated) as of 2019 and 2018.

(6,395

)

(6,395

)

Paid-in capital

84,773

84,885

Retained earnings

170,741

179,666

Total American Realty Investors, Inc. shareholders' equity

249,288

258,325

Non-controlling interest

61,378

62,802

Total shareholders' equity

310,666

321,127

Total liabilities and shareholders' equity

$

817,553

$

826,149

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190814005771/en/

American Realty Investors, Inc. Investor Relations

Michele Rougon (800) 400-6407

investor.relations@americanrealtyinvest.com

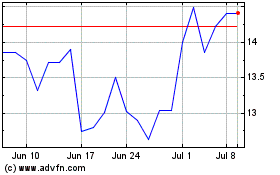

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Mar 2024 to Apr 2024

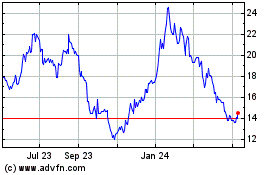

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Apr 2023 to Apr 2024