American Realty Investors, Inc. (NYSE:ARL), a Dallas-based real

estate investment company, today reported results of operations for

the first quarter ended March 31, 2019.

In November 2018, the Company created a new subsidiary Victory

Abode Apartments, LLC (“VAA”) and contributed 52 multi-family

projects that it owned and operated to VAA. The Company

subsequently sold a 50% interest to a third party and recorded a

$154 million gain. Beginning November 19, 2018, the Company began

reflecting its ownership of VAA on the Balance Sheet as an

investment and its share of the Revenues, Operating Expenses,

Depreciation, Amortization and Interest as “Earning from VAA”. The

Statement of Operations for the three months ended March 31, 2018

and the information thereon reflect the operations for the

properties contributed to VAA on a consolidated basis.

The Company believes that the completion of the joint venture

creating Victory Abode Apartments has positioned the company with a

dynamic platform to continue its expansion in the multifamily

sector. The ongoing plan is to continue to develop and acquire

apartments in the geographic markets where demand exceeds

supply.

For the three months ended March 31, 2019, we reported a net

loss applicable to common shares of $6.1 million or ($0.38) per

diluted loss per share compared to a net loss applicable to common

shares of $0.9 million or ($0.06) per diluted loss per share for

the same period ended 2018.

Revenues

Rental and other property revenues were $11.9 million for the

three months ended March 31, 2019, compared to $31.1 million for

the same period in 2018. The $19.2 million decrease is primarily

due to a decrease in the amount of multifamily residential

apartment buildings currently in our portfolio of nine as compared

to 53 multifamily residential apartment buildings for the same

period a year ago as a result of the deconsolidation of 49

residential apartment properties that were sold into the VAA Joint

Venture during the fourth quarter of 2018. As the assets are now

treated as unconsolidated investments, our share of rental revenues

is part of income from unconsolidated investments in the current

period and are no longer treated as rental income.

Expense

Property operating expenses decreased by $8.4 million to $6.0

million for the three months ended March 31, 2019 as compared to

$14.4 million for the same period in 2018. The decrease in property

operating expenses is primarily due to the deconsolidation of 49

residential apartment properties that were sold into the VAA Joint

Venture during the fourth quarter of 2018 which resulted in a

decrease in salary and related payroll expenses of $1.7 million,

real estate taxes of approximately $3.0 million and general

property operating and maintenance expenses of $3.7 million.

Depreciation and amortization decreased by $3.3 million

to $3.1 million during the three months

ended March 31, 2019 as compared to $6.4

million for the three months ended March 31, 2018.

This decrease is primarily due to the deconsolidation of the

residential apartments in connection with our previous sale and

contribution of our interests to the VAA Joint Venture.

General and administrative expense was $2.6 million for the

three months ended March 31, 2019, compared to $2.3 million for the

same period in 2018. The increase of $0.3 million in general and

administrative expenses is the result of increases in advisory and

management fees of approximately $0.4 million and professional and

finance fees of $0.3 million offset by a decrease in accounting,

tax and other general administrative fees of $0.6 million.

Other income (expense)

Interest income was $6.2 million for the three months ended

March 31, 2019, compared to $5.1 million for the same period in

2018. The increase of $1.1 million was due to an increase of

$1.3 million in interest on receivable owed from our Advisors,

offset by a decrease of $0.8 in interest on notes receivable from

other related parties.

Other income was $3.7 million for the three months ended March

31, 2019, compared to $1.9 million for the same period in 2018. The

increase is primarily the result of a $3.6 million gain recognized

for deferred income associated with the sale of land during the

quarter just ended to third parties.

Mortgage and loan interest expense was $9.9

million for the three months ended March 31,

2019 as compared to $15.7 million for the same

period in 2018. The decrease of $5.8 million is due to the

deconsolidation of residential apartment properties into the VAA

Joint Venture which were encumbered by mortgage debt.

Foreign currency transaction was a loss of $5.8 million for

the three months ended March 31, 2019 as compared to a gain of $1.8

million for the same period in 2018. During the first quarter just

ended, we paid $10.4 million in principal and $5.8 million in

interests payments to our bonds denominated in Israel Shekels.

Loss from unconsolidated investments was $1.0 million for the

three months ended March 31, 2019 as compared to earnings of $320

thousand for the three months ended March 31, 2018. The loss from

unconsolidated investments during the first quarter just ended was

driven primarily from our share in the losses reported by the VAA

Joint Venture.

Gain on land sales was $2.2 for the three months ended March 31,

2019, compared to $1.3 million for the same period in 2018. In the

current period, we sold approximately 22.3 acres of land for a

sales price of $8.7 million, which resulted in a gain of $2.2

million. For the same period in 2018, we sold 112.2 acres of land

for a sales price of $7.2 million and recognized a gain of $1.3

million.

About American Realty Investors, Inc.

American Realty Investors, Inc., a Dallas-based real estate

investment company, holds a diverse portfolio of equity real estate

located across the U.S., including office buildings, apartments,

shopping centers, and developed and undeveloped land. The Company

invests in real estate through direct ownership, leases and

partnerships and invests in mortgage loans on real estate. The

Company also holds mortgage receivables. For more information,

visit the Company’s website at www.americanrealtyinvest.com.

AMERICAN REALTY INVESTORS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited)

For the Three Months Ended March

31, 2019 2018

Revenues: Rental and other property revenues

(including $113 and $208 for the three months ended 2019 and 2018,

respectively, from related parties) $ 11,929 $ 31,083

Expenses: Property operating expenses (including $257 and

$227 for the three months ended 2019 and 2018, respectively, from

related parties) 5,997 14,424 Depreciation and amortization 3,109

6,391 General and administrative (including $1,597 and $1,140 for

the three months ended 2019 and 2018, respectively, from related

parties) 2,605 2,341 Net income fee to related party 100 53

Advisory fee to related party 1,853 2,956

Total operating expenses 13,664 26,165

Net operating (loss) income (1,735 ) 4,918

Other income

(expenses): Interest income (including $5,881 and $4,426 for

the three months ended 2019 and 2018, respectively, from related

parties) 6,153 5,109 Other income 3,667 1,901 Mortgage and loan

interest (including $2,307 and $1,799 for the three months ended

2019 and 2018, respectively, from related parties) (9,968 ) (15,724

) Foreign currency transaction (loss) gain (5,818 ) 1,756 Equity

loss from VAA (1,055 ) - Earnings from unconsolidated subsidiaries

and investees 58 320 Total other

expenses (6,963 ) (6,638 ) Loss before gain on land

sales, non-controlling interest, and taxes (8,698 ) (1,720 ) Gain

on land sales 2,216 1,335 Net loss from

continuing operations before taxes (6,482 ) (385 )

Net loss from continuing operations (6,482 ) (385 ) Net loss (6,482

) (385 ) Net loss (income) attributable to non-controlling interest

335 (275 ) Net loss attributable to American

Realty Investors, Inc. (6,147 ) (660 ) Preferred dividend

requirement - (225 ) Net loss applicable to

common shares $ (6,147 ) $ (885 )

Earnings per share - basic

Net loss from continuing operations $ (0.38 ) $ (0.06 )

Earnings per share - diluted Net loss from continuing

operations $ (0.38 ) $ (0.06 ) Weighted average common

shares used in computing earnings per share 15,997,076 15,938,077

Weighted average common shares used in computing diluted earnings

per share 15,997,076 15,938,077

Amounts attributable to

American Realty Investors, Inc. Net loss from continuing

operations $ (6,147 ) $ (660 ) Net loss applicable to American

Realty Investors, Inc. $ (6,147 ) $ (660 )

AMERICAN REALTY INVESTORS, INC. CONSOLIDATED BALANCE

SHEETS March 31,

December 31, 2019 2018

(unaudited) (audited)

(dollars in thousands, except share

and par value amounts) Assets Real estate, at cost $

449,007 $ 455,993 Real estate subject to sales contracts at cost

3,488 3,149 Real estate held for sale at cost, net of depreciation

14,737 - Less accumulated depreciation (80,755 )

(78,099 ) Total real estate 386,477 381,043 Notes and

interest receivable (including $102,031 in 2019 and $105,803 in

2018 from related parties) 138,731 140,327 Less allowance for

estimated losses (including $14,269 in 2019 and 2018 from related

parties) (14,269 ) (14,269 ) Total notes and interest

receivable 124,462 126,058 Cash and cash equivalents 28,163

36,428 Restricted cash 52,964 70,187 Investment in VAA 67,229

68,399 Investment in other unconsolidated investees 7,660 7,602

Receivable from related party 78,348 70,377 Other assets

69,510 66,055 Total assets $ 814,813 $

826,149

Liabilities and Shareholders’ Equity

Liabilities: Notes and interest payable $ 293,473 $ 286,968 Bond

and interest payable 151,465 158,574 Deferred revenue (including

$30,359 in 2019 and $33,904 in 2018 to related parties) 30,359

33,904 Accounts payable and other liabilities (including $10,212 in

2019 and $9,984 in 2018 to related parties) 24,938

25,576 Total liabilities 500,235 505,022

Shareholders’ equity: Preferred stock, Series A: $2.00 par value,

authorized 15,000,000 shares, issued 1,800,614 and outstanding 614

in 2019 and 2018 (liquidation preference $10 per share), including

1,800,000 shares held by ARL and its subsidiaries in 2019 and 2018.

5 5

Common stock, $0.01 par value, 100,000,000

shares authorized; 16,412,861 shares issued and 15,997,076

outstanding as of 2019 and 2018, including 140,000 shares held by

TCI (consolidated) in 2019 and 2018.

164 164 Treasury stock at cost; 415,785 shares in 2019 and 2018,

and 140,000 shares held by TCI (consolidated) as of 2019 and 2018.

(6,395 ) (6,395 ) Paid-in capital 84,818 84,885 Retained earnings

173,519 179,666 Total American Realty

Investors, Inc. shareholders' equity 252,111 258,325

Non-controlling interest 62,467 62,802

Total shareholders' equity 314,578 321,127

Total liabilities and shareholders' equity $ 814,813

$ 826,149

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190515005931/en/

American Realty Investors, Inc.Investor

RelationsGene Bertcher (800)

400-6407investor.relations@americanrealtyinvest.com

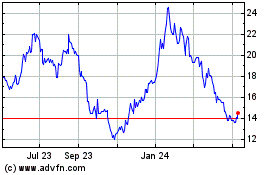

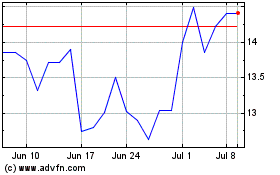

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Apr 2023 to Apr 2024