- Corporation improves performance in Q1 following a return to

profitability in Q4 2019

- GAAP EPS of $0.33 for quarter ended March 31, 2020, versus

GAAP net loss per share of $(1.21) in the year-ago quarter

- GAAP Operating Income improves by 43% from Q4 2019 to Q1

2020 as restructuring and efficiency improvements continue

Ampco-Pittsburgh Corporation (NYSE: AP) reports sales from

continuing operations of $91.1 million for the three months ended

March 31, 2020, compared to $107.5 million for the three months

ended March 31, 2019. The decrease is principally attributable to a

lower volume of shipments for the Forged and Cast Engineered

Products segment due to weaker demand in the flat rolled steel and

oil and gas markets.

Income from continuing operations for the three months ended

March 31, 2020, was $4.4 million compared to a loss from continuing

operations for the three months ended March 31, 2019, of $12.0

million which included a $10.1 million impairment charge and $0.9

million of restructuring-related costs. Income from continuing

operations for the current quarter also benefited from the

elimination of excess carrying costs of the Avonmore, PA cast roll

plant which was divested in 2019, additional proceeds from a 2018

insurance claim, manufacturing efficiencies and cost reduction

actions across the Corporation.

Adjusted income from continuing operations for the quarter,

which is not based on U.S. generally accepted accounting principles

(“GAAP”), was $3.6 million, an improvement of $2.3 million when

compared to the same period of the prior year prepared on the same

basis. The improvement is primarily driven by the aforementioned

manufacturing efficiencies and cost reductions. A reconciliation of

these GAAP to non-GAAP results is provided below under “Non-GAAP

Financial Measures Reconciliation Schedule.”

Other expense for the three months ended March 31, 2020,

includes higher foreign exchange losses and unrealized losses on

rabbi trust investments, which are principally due to market

disruptions caused by the COVID-19 pandemic, when compared to the

same period of the prior year. The income tax benefit recognized in

the current quarter includes a benefit of approximately $3.5

million for the reversal of previously established valuation

allowances due to expanded tax loss carryback provisions made

possible by the CARES Act.

Net income attributable to Ampco-Pittsburgh for the three months

ended March 31, 2020, was $4.1 million, or $0.33 per common share.

By comparison, net loss for the three months ended March 31, 2019,

was $15.1 million, or $1.21 per common share, including

approximately $0.88 per common share for the impairment charge and

restructuring-related costs and $0.18 per common share for the loss

from discontinued operations.

Segment Results

Sales from continuing operations for the Forged and Cast

Engineered Products segment for the three months ended March 31,

2020, declined compared to the prior year due to a lower volume of

shipments of mill rolls, both forged and cast, and forged

engineered products offset slightly by a more favorable product

mix. Operating results for the Forged and Cast Engineered Products

segment for the three months ended March 31, 2020, improved

significantly compared to the prior year quarter, which included

the impairment charge, excess carrying costs of the Avonmore, PA

cast roll plant, and certain restructuring-related costs. In

addition, the segment’s cost structure has improved year-over-year

as a result of manufacturing efficiencies and cost reductions

implemented.

Sales for the Air and Liquid Processing segment for the three

months ended March 31, 2020, were comparable to the prior year

quarter with operating results improving primarily due to product

mix and cost reductions.

CEO Commentary

Commenting on the quarter’s results, Brett McBrayer,

Ampco-Pittsburgh’s Chief Executive Officer, said, “After returning

to profitability last quarter, we improved our positive trajectory

in Q1. Operating income improved by 43% sequentially from Q4 2019

to Q1 2020, and excluding unusual items, adjusted operating income

from continuing operations was up 85% sequentially. The cost

reductions and right-sizing of our operations through the

divestitures we completed last year are paying off as anticipated.

The effect of COVID-19 is evident in some of our Q1 numbers, such

as the impacts from changes in the foreign exchange and equity

markets, as well as the impact of Federal relief actions on income

taxes. Our leaner cost structure and agility to respond to changes

in our markets position us to better weather the evolving effects

of COVID-19 as the year progresses.”

Teleconference Access

Ampco-Pittsburgh Corporation (NYSE: AP) will hold a conference

call on Wednesday, May 6, 2020, at 10:30 a.m. Eastern Time (ET) to

discuss its financial results for the quarter ended March 31, 2020.

The Corporation encourages participants to pre-register at any

time, including up to and after the call start time via this link:

http://dpregister.com/10141809. Those without internet

access or unable to pre-register should dial in at least five

minutes before the start time using:

- Participant Dial-in (Toll Free): 1-844-308-3408

- Participant International Dial-in: 1-412-317-5408

For those unable to listen to the live broadcast, a replay will

be available one hour after the event concludes on the

Corporation’s website under the Investors menu at

www.ampcopgh.com.

Non-GAAP Financial

Measures

The Corporation presents non-GAAP adjusted income from

continuing operations as a supplemental financial measure to GAAP

financial measures regarding the Corporation’s operational

performance. This non-GAAP financial measure excludes unusual items

affecting comparability, as described more fully in the footnotes

to the attached “Non-GAAP Financial Measures Reconciliation

Schedule,” including the Impairment Charge, the

Restructuring-Related Costs, the Excess Costs of Avonmore, and the

Proceeds from Business Interruption Insurance Claim, which the

Corporation believes are not indicative of its core operating

results. A reconciliation of this non-GAAP financial measure to

income (loss) from continuing operations, the most directly

comparable GAAP financial measure, is provided below under

“Non-GAAP Financial Measures Reconciliation Schedule.”

The Corporation has presented non-GAAP adjusted income from

continuing operations because it is a key measure used by the

Corporation’s management and Board of Directors to understand and

evaluate the Corporation’s operating performance and to develop

operational goals for managing the business. Management believes

this non-GAAP financial measure provides useful information to

investors and others in understanding and evaluating the operating

results of the Corporation, enhancing the overall understanding of

the Corporation’s past performance and future prospects, and

allowing for greater transparency with respect to key financial

metrics used by management in its financial and operational

decision-making. Non-GAAP adjusted income from continuing

operations should be used only as a supplement to GAAP information,

in conjunction with the Corporation’s condensed consolidated

financial statements prepared in accordance with GAAP, and should

not be considered in isolation of, or as an alternative to,

measures prepared in accordance with GAAP. There are limitations

related to the use of non-GAAP adjusted income from continuing

operations rather than GAAP income (loss) from continuing

operations. Among other things, the Excess Costs of Avonmore, which

are excluded from the non-GAAP financial measure, necessarily

reflect judgments made by management in allocating manufacturing

and operating costs between Avonmore and the Corporation’s other

operations and in anticipating how the Corporation will conduct

business following the sale of Avonmore, which was completed on

September 30, 2019.

Forward-Looking

Statements

Information presented under the heading “CEO Commentary” above

contains forward-looking statements for purposes of the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Actual results may vary significantly from the Corporation’s

expectations based on a number of risks and uncertainties,

including but not limited to the following: cyclical demand for

products and economic downturns may reduce demand for the

Corporation’s products; excess global capacity in the steel

industry could lower prices for the Corporation’s products; the

Corporation’s profitability could be reduced by increases in

commodity prices or shortages of key production materials;

restructuring activities of the Corporation may generate greater

expenses or losses than currently anticipated; new trade

restrictions and regulatory burdens associated with “Brexit” could

adversely impact the Corporation’s operations and financial

performance; disruptions caused by global pandemics could cause the

Corporation and its customers and suppliers to temporarily idle

operations resulting in orders being delayed or potentially

cancelled; and the other risks described under the heading “Risk

Factors” in the Corporation’s Annual Report on Form 10-K and other

reports required to be filed by the Corporation under the

Securities Exchange Act of 1934, as amended. Forward-looking

statements speak only as of the date on which such statements are

made, are not guarantees of future performance or expectations, and

involve risks and uncertainties. The Corporation cannot guarantee

any future results, levels of activity, performance or

achievements. Except as required by applicable law, the Corporation

assumes no obligation, and disclaims any obligation, to update

forward-looking statements whether as a result of new information,

events or otherwise.

AMPCO-PITTSBURGH

CORPORATION

FINANCIAL SUMMARY

(in thousands except per share

amounts)

Three

Months Ended

March

31,

2020

2019

Sales

$

91,063

$

107,494

Cost of products sold (excl. depreciation

and amortization)

70,160

90,221

Selling and administrative

11,830

13,885

Depreciation and amortization

4,699

5,259

Impairment charge

-

10,082

Loss on disposal of assets

23

6

Total operating expenses

86,712

119,453

Income (loss) from continuing

operations

4,351

(11,959

)

Other (expense) income – net

(2,532

)

51

Income (loss) from continuing operations

before income taxes

1,819

(11,908

)

Income tax benefit (provision)

2,783

(643

)

Net income (loss) from continuing

operations

4,602

(12,551

)

Loss from discontinued operations, net of

tax

-

(2,242

)

Net income (loss)

4,602

(14,793

)

Less: Net income attributable to

noncontrolling interest

460

355

Net income (loss) attributable to

Ampco-Pittsburgh

$

4,142

$

(15,148

)

Net income (loss) from continuing

operations per share attributable to Ampco-Pittsburgh common

shareholders:

Basic

$

0.33

$

(1.03

)

Diluted

$

0.33

$

(1.03

)

Loss from discontinued operations, net of

tax, per share attributable to Ampco-Pittsburgh common

shareholders:

Basic

$

-

$

(0.18

)

Diluted

$

-

$

(0.18

)

Net income (loss) per share attributable

to Ampco-Pittsburgh common shareholders:

Basic

$

0.33

$

(1.21

)

Diluted

$

0.33

$

(1.21

)

Weighted-average number of common shares

outstanding:

Basic

12,656

12,497

Diluted

12,672

12,497

AMPCO-PITTSBURGH CORPORATION NON-GAAP

FINANCIAL MEASURES RECONCILIATION SCHEDULE (in thousands)

As described under “Non-GAAP Financial Measures” above, the

Corporation presents non-GAAP adjusted income from continuing

operations as a supplemental financial measure to GAAP financial

measures. The following is a reconciliation of this non-GAAP

financial measure to income (loss) from continuing operations, the

most directly comparable GAAP financial measure, for the three

months ended March 31, 2020 and 2019:

Three Months Ended

March 31,

2020

2019

Income (loss) from continuing operations,

as reported (GAAP)

$

4,351

$

(11,959

)

Impairment Charge(1)

-

10,082

Restructuring-Related Costs(2)

-

921

Excess costs of Avonmore(3)

-

2,202

Proceeds from Business Interruption

Insurance Claim(4)

(769

)

-

Income from continuing operations, as

adjusted (Non-GAAP)

$

3,582

$

1,246

(1)

Represents an impairment charge

to record the Avonmore plant to its estimated net realizable value

less costs to sell in anticipation of its sale, which was completed

in September 2019.

(2)

Represents professional fees

associated with the Corporation’s overall restructuring plan and

employee severance costs due to reductions in force.

(3)

Represents estimated net

operating costs not expected to continue after the sale of the

Avonmore plant, which was completed in September 2019. The

estimated excess costs include judgments made by management in

allocating manufacturing and operating costs between the Avonmore

plant and the Corporation’s other operations and in anticipating

how it will conduct business following the sale of the Avonmore

plant.

(4)

Represents business interruption

insurance proceeds received in 2020 for equipment outages that

occurred in 2018.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200506005511/en/

Michael G. McAuley Senior Vice President, Chief Financial

Officer and Treasurer (412) 429-2472 mmcauley@ampcopgh.com

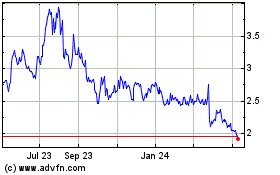

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

From Apr 2023 to Apr 2024