Washington, D.C. 20549

Exchange Act of 1934 (Amendment No. )

PROXY STATEMENT

March 27, 2020

Annual Meeting of Shareholders to be held May 7, 2020

PROXY SUMMARY

This summary highlights information contained elsewhere in this proxy statement. You should read the entire proxy statement carefully before voting. This proxy statement and the related proxy materials were first mailed to shareholders and made available on the internet on or about March 27, 2020.

|

Annual Meeting of Shareholders

|

|

|

|

|

|

|

• Time and Date:

|

|

10:00 A.M., Eastern Time, May 7, 2020

|

|

|

|

|

• Place:

|

|

Virtually via:

www.virtualshareholdermeeting.com/AP2020

|

|

|

|

|

• Record Date

|

|

March 10, 2020

|

|

|

|

|

• Voting

|

|

Only shareholders as of the record date, March 10, 2020, are entitled to vote.

Your broker will NOT be able to vote your shares with respect to any of the matters presented at the meeting other than the ratification of the selection of our independent registered public accounting firm unless you give your broker specific voting instructions.

Even if you plan to attend the annual meeting virtually, please cast your vote as soon as possible by:

• Using the Internet at www.proxyvote.com;

• Calling toll-free from the United States, U.S. territories and Canada to 1-800-690-6903; or

• Mailing your signed proxy or voting instruction form.

|

|

|

|

1

|

• Attending the Annual Meeting

|

|

To be admitted to the virtual meeting, you will need the control number provided to you with your proxy voting materials.

You do not need to attend the annual meeting to vote if you have properly submitted your proxy in advance of the meeting.

|

|

|

|

|

|

• Meeting Agenda

|

|

1. Election of four directors;

2. Non-binding, advisory vote to approve our executive compensation;

3. Ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for 2020; and

4. Transaction of such other business as may properly come before the meeting and any adjournment or postponement thereof.

|

|

|

|

|

Voting Matters

|

Proposals

|

|

Board Recommendation

|

|

Election of Directors

|

|

FOR each nominee named in this proxy statement

|

|

Non-binding, advisory vote to approve our executive compensation

|

|

FOR

|

|

Ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for 2020

|

|

FOR

|

2

Board Nominees

|

Name

|

|

Age

|

|

|

Director

Since

|

|

Occupation

|

|

Experience/

Qualification

|

|

Independent

|

|

Committee

Assignments

|

|

James J. Abel

|

|

|

74

|

|

|

2014

|

|

Private Investor

|

|

Extensive operations and financial management experience including manufacturing operations; many years of service as a director of companies; broad leadership experience

|

|

X

|

|

Chair of Executive

|

|

William K. Lieberman

|

|

72

|

|

|

2004

|

|

Principal of The Lieberman Companies

|

|

Extensive management experience in the insurance, benefit and risk management areas; board service; broad leadership experience

|

|

X

|

|

Audit; Compensation; Executive; Chair of Nominating and Governance

|

|

Stephen E. Paul

|

|

|

52

|

|

|

2002

|

|

Principal of Laurel Crown Partners

|

|

Extensive management experience in investment banking and private equity investment; broad leadership experience

|

|

|

|

|

|

Carl H. Pforzheimer, III

|

|

|

83

|

|

|

1982

|

|

Principal of Carl H. Pforzheimer & Co. LLC.

|

|

Extensive management experience in the investment banking industry and attendant investment advisory analytical skills gained from such a position; board service; broad leadership experience

|

|

X

|

|

Compensation; Nominating and Governance; Executive; Chair of Audit

|

Ratification of the Appointment of our Independent Registered Public Accounting Firm for 2020

We are requesting that shareholders ratify the appointment of BDO USA, LLP as the Corporation’s independent registered public accounting firm for the fiscal year ending December 31, 2020. The table below shows the fees paid by the Corporation to Deloitte & Touche LLP, the independent public accounting firm for the fiscal year ended December 31, 2019.

|

|

|

2019

|

|

|

Audit fees(a)

|

|

$

|

1,306,203

|

|

|

Audit-related fees(b)

|

|

$

|

1,895

|

|

|

Tax fees

|

|

$

|

—

|

|

|

All other fees

|

|

|

—

|

|

|

Total

|

|

$

|

1,308,098

|

|

|

(a)

|

Fees for audit services primarily related to the audit of (1) the Corporation’s annual consolidated financial statements and its internal control over financial reporting and (2) statutory filings for the Corporation’s foreign subsidiaries.

|

|

(b)

|

Fees for audit-related services primarily related to the subscription fee for Deloitte’s Authoritative Guidance.

|

Executive Compensation Program Highlights

Our executive compensation program is designed to attract and retain top talent by enabling the Corporation to compete effectively for the highest quality personnel and to pay for performance by aligning compensation with the achievement of both short-term and long-term financial objectives that build shareholder value.

3

The 2019 executive compensation program features a balanced mix of salary and performance-driven annual and long-term incentive award opportunities. In designing our executive compensation program, we have implemented programs and policies that support our commitment to good compensation governance and that create alignment between our executives and our shareholders, as highlighted below:

|

|

•

|

The Compensation Committee of our Board of Directors (also referred to herein as the “Compensation Committee”) is comprised solely of independent directors. Each member of the Compensation Committee is a “non-employee director” of the Corporation, as defined under Rule 16b-3 of the Securities Exchange Act of 1934, and an “outside director” for purposes of the corporate compensation provisions contained in Section 162(m) of the Internal Revenue Code.

|

|

|

•

|

The Compensation Committee conducts an annual review and approval of our compensation strategies, including a review of our compensation-related risk profile to ensure that our compensation-related risks are not reasonably likely to have a material adverse effect on our company.

|

|

|

•

|

In 2019, the Compensation Committee engaged Pay Governance LLC as its independent provider of compensation consulting services for decisions relating to compensation. Pay Governance was retained to identify a reasonable group of companies as a peer group to benchmark executive compensation levels and incentive plan design and to assist the Compensation Committee in fulfilling its responsibilities and duties.

|

|

|

•

|

A significant portion of each executive’s annual pay is based on objective performance metrics and, therefore, “at-risk” based on corporate performance. In addition, the equity-based portion of our executive compensation program is designed to align the interests of our executive officers and shareholders.

|

|

|

•

|

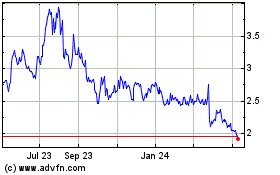

The Compensation Committee periodically reviews its compensation decisions against executive compensation at a peer group of companies comparable in terms of the primary scope metric of revenue and secondary scope metrics of assets and number of employees to ensure that our executive compensation program provides competitive compensation opportunities. Our stock price over the period ended December 31, 2019 places us lowest in our peer group for the market cap metric. The same peer group is used to determine our relative performance for vesting of a portion of performance share unit awards.

|

|

|

•

|

The equity awards granted to our executive officers vest over multi-year periods, consistent with current practice and our retention objectives.

|

|

|

•

|

We have a clawback policy applicable to executive officers pursuant to which, if the Corporation is required, because of fraud or negligence, to restate financial results for any period (the “Restatement Period”) in a manner that would have adversely affected the amount of the payout of any incentive compensation awards, the Compensation Committee has the right during the three-year period following the Restatement Period to review the matter and determine what, if any, repayment executives will be required to make.

|

|

|

•

|

We do not provide any Internal Revenue Code Section 280G excise tax gross-up rights or any other significant tax gross-up rights to our executive officers other than for reasonable and customary relocation expenses.

|

|

|

•

|

The compensation arrangements with our executive officers contain double-trigger equity acceleration provisions in the event of a change in control.

|

|

|

•

|

We have a policy prohibiting “underwater” options from being repriced or replaced (either with new options or other equity awards), unless approved by our shareholders.

|

Additional information about our compensation philosophy and program, including compensation determinations for each of our named executive officers, can be found in the “Executive Compensation Overview” starting on page 21 in this Proxy Statement.

We encourage you to read the entire proxy statement and to vote your shares at the Annual Meeting. If you are unable to attend the Annual Meeting virtually, we encourage you to submit a proxy so that your shares will be represented and voted.

4

QUESTIONS AND ANSWERS REGARDING THE ANNUAL MEETING

Q: Why is the Annual Meeting of Shareholders being held virtually this year?

A: The Annual Meeting of Shareholders is being held virtually this year because of the Coronavirus (COVID-19) pandemic and various restrictions related to large gatherings, along with our desire to protect our shareholders, directors and employees.

Q: How do I attend the virtual meeting?

A: You will be able to attend the meeting virtually, vote your shares electronically, and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/AP2020 and following the instructions on your proxy card. The meeting starts at 10:00 A.M. Eastern Time. To be admitted to the virtual meeting you will need the control number provided to you with your proxy voting materials.

Q: Will you hold the Annual Meeting of Shareholders virtually next year?

A: We will decide whether to hold the 2021 Annual Meeting of Shareholders virtually, in person, or a combination of both once we weight the benefits and detriments of virtual and in-person meetings following this year’s annual meeting.

Q: Why am I receiving these materials?

A: As a shareholder, we are providing these proxy materials to you in connection with our solicitation of proxies to be voted at our Annual Meeting of Shareholders, which will take place on May 7, 2020. These materials were first mailed to shareholders on or about March 27, 2020. You are invited to attend the Annual Meeting, and you are requested to vote on the proposals described in this Proxy Statement.

Q: What is included in these materials?

A: These materials include:

|

|

•

|

Our Proxy Statement for the Annual Meeting;

|

|

|

•

|

The proxy/voting instruction card for the Annual Meeting; and

|

|

|

•

|

Our 2019 Annual Report on Form 10-K, which includes our audited consolidated financial statements.

|

Q: What am I being asked to vote on?

A: You are being asked to vote on the following proposals:

|

|

•

|

Proposal 1 —Election of four directors;

|

|

|

•

|

Proposal 2 —Non-binding, advisory vote to approve our executive compensation (the “Say-on-Pay Proposal”);

|

|

|

•

|

Proposal 3 — Ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for 2020 (the “BDO Ratification Proposal”); and

|

|

|

•

|

Such other business as may properly come before the meeting and any adjournment or postponement thereof.

|

Q: What are the voting recommendations of the Board of Directors?

A: The Board recommends the following votes:

|

|

•

|

FOR the election of the four director nominees for the specified terms named in this proxy statement;

|

|

|

•

|

FOR the Say-on-Pay Proposal; and

|

|

|

•

|

FOR the BDO Ratification Proposal.

|

5

Q: Will any other matters be voted on?

A: We are not aware of any other matters that will be brought before the shareholders for a vote at the Annual Meeting. If any other matter is properly brought before the meeting, your proxy will authorize each of Rose Hoover and Melanie Sprowson (together, the “Proxies”) to vote on such matters in their discretion.

Q: How do I cast my vote?

A: If you are a shareholder of record, you may cast your vote using any of the following methods:

|

|

•

|

Via the Internet, by visiting the website “www.proxyvote.com” and following the instructions for Internet voting on your proxy/voting instruction card;

|

|

|

•

|

By dialing 1-800-690-6903 and following the instructions for telephone voting on your proxy/voting instruction card;

|

|

|

•

|

By completing and mailing your proxy/voting instruction card; or

|

|

|

•

|

By casting your vote electronically during the Annual Meeting being held virtually via www.virtualshareholdermeeting.com/AP2020

|

If you vote over the Internet, you may incur related ancillary costs, such as telephone and Internet access charges, for which you will be responsible. The telephone and Internet voting facilities for the shareholders of record of all shares will close at 11:59 P.M. Eastern Time on May 6, 2020. The Internet and telephone voting procedures are designed to authenticate shareholders by use of a control number and to allow you to confirm that your instructions have been properly recorded.

If you vote by Internet or telephone or return your signed proxy/voting instruction card, your shares will be voted as you indicate. If you do not indicate how your shares are to be voted on a proposal, your shares will be voted, with respect to that proposal, in accordance with the voting recommendations of the Board of Directors.

If your shares are held in a brokerage account in your broker’s name (also known as “street name”), you should follow the instructions for voting provided by your broker or nominee. You may submit voting instructions by Internet or telephone, or you may complete and mail a voting instruction card to your broker or nominee. If you provide specific voting instructions by telephone, Internet or mail, your broker or nominee will vote your shares as you have directed.

You will be able to vote your shares electronically during the Annual Meeting if you attend virtually.

Q: Can I change my vote?

A: Yes. If you are a shareholder of record, you can change your vote or revoke your proxy at any time prior to the voting thereof at the Annual Meeting by:

|

|

•

|

Submitting a valid, later-dated proxy/voting instruction card;

|

|

|

•

|

Submitting a valid, subsequent vote by telephone or the Internet at any time prior to 11:59 P.M. Eastern Time on May 6, 2020;

|

|

|

•

|

Notifying our Corporate Secretary in writing that you have revoked your proxy; or

|

|

|

•

|

Voting electronically at the virtual Annual Meeting (your attendance at the Annual Meeting will not, in and of itself, revoke your prior proxy).

|

If your shares are held in a brokerage account in your broker’s name, you should follow the instructions for changing or revoking your vote provided by your broker or nominee.

Q: What will happen if I do not instruct my broker how to vote?

A: If your shares are held in street name and you do not instruct your broker how to vote, one of two things can happen depending on the type of proposal. Pursuant to New York Stock Exchange (“NYSE”) rules, brokers have discretionary power to vote your shares on “routine” matters, but they do not have discretionary power to vote your shares on “non-routine” matters. We believe that the only proposal that will be considered routine under NYSE rules is the

6

BDO Ratification Proposal, which means that your broker may vote your shares in its discretion on that proposal. This is known as “broker discretionary voting.”

The election of directors and the Say-on-Pay Proposal are considered non-routine matters. Accordingly, your broker may not vote your shares with respect to these matters if you have not provided instructions. This is called a “broker non-vote.”

We strongly encourage you to submit your proxy and exercise your right to vote as a shareholder.

Q: How many shares must be present to conduct business at the Annual Meeting?

A: Holders of at least a majority of the votes that all shareholders are entitled to cast at the Annual Meeting must be represented virtually at the Annual Meeting in order to conduct business. This is called a quorum. If you vote, your shares will be part of the quorum. Abstentions, withheld votes and broker non-votes also will be counted in determining whether a quorum exists.

Q: What vote is required to approve the proposals?

A: In the election of directors, the nominees who receive the most votes for the available positions will be elected. If you withhold authority to vote for a particular nominee, your vote will not count either “FOR” or “AGAINST” the nominee. Abstentions are not counted in the election of directors, and neither abstentions nor broker non-votes will affect the outcome.

The Say-on-Pay Proposal and the BDO Ratification Proposal will require approval by the majority of the votes cast at the Annual Meeting, assuming the presence of a quorum. Neither abstentions nor broker non-votes will have any effect on these proposals.

Votes will be tabulated by an inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

Q: What does it mean if I receive more than one notice or proxy card or voting instruction form?

A: It means your shares are registered differently or are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares.

Q: What do I need to do to attend the Annual Meeting?

A: In order to attend the virtual Annual Meeting, you will need the control number provided to you with your proxy voting materials. The virtual meeting will begin at 10:00 A.M. Eastern Time at the following link: www.virtualshareholdermeeting.com/AP2020.

If you wish to vote the shares you own beneficially during the meeting, you must first obtain a “legal proxy” from your broker or custodian. If you choose not to provide instructions or a legal proxy, your shares are referred to as “uninstructed shares.” Whether your broker or custodian has the discretion to vote these shares on your behalf depends on the ballot item.

Q: Where can I find the voting results of the Annual Meeting?

A: We plan to announce preliminary voting results at the Annual Meeting and to publish final results in a Current Report on Form 8-K filed with the SEC within four business days after the Annual Meeting.

SOLICITATION OF PROXIES

This Proxy Statement is furnished in connection with the solicitation of proxies to be used at the Annual Meeting of Shareholders (the “Annual Meeting”) of AMPCO-PITTSBURGH CORPORATION (the “Corporation”) to be held virtually on May 7, 2020. The first mailing of the proxy material to the shareholders is expected to be made on or about March 27, 2020.

The accompanying proxy is solicited on behalf of the Board of Directors of the Corporation. In addition to the solicitation of proxies by use of the mails, proxies may be solicited by directors and employees, in person or by telephone, and brokers and nominees may be requested to send proxy material to and obtain proxies from their principals. The Corporation will pay the costs incurred for solicitations of proxies.

7

Any shareholder has the power to revoke the proxy at any time prior to the voting thereof. Revocation of the proxy will not be effective until notice thereof has been given to the Secretary of the Corporation, a duly executed proxy bearing a later date is presented or the shareholder subsequently votes the shares subject to the proxy.

VOTING SECURITIES AND RECORD DATE

Only holders of record of Common Stock of the Corporation at the close of business on March 10, 2020, will be entitled to vote at the meeting. On that date, there were 12,658,844 shares of Common Stock outstanding. The holders of those shares are entitled to one vote per share. In the election of directors, the shares may be voted cumulatively. Cumulative voting means that the number of shares owned by each shareholder may be multiplied by the number of directors to be elected and that total voted for the nominees in any proportion. Shares that are not voted cumulatively are voted on a one vote per share basis for each nominee, except for those nominees, if any, for whom the shareholder is withholding authority to vote. If you return your signed proxy but do not indicate how you wish to vote, your shares will be voted non-cumulatively “FOR” the election of each of the director nominees named in this Proxy Statement or voted cumulatively for one or more of the nominees at the discretion of the Proxies; “FOR” approval of the Say-on-Pay Proposal; and “FOR” approval of the BDO Ratification Proposal.

REQUIRED VOTE

Under Pennsylvania law and the Corporation’s Amended and Restated Bylaws, the presence of a quorum is required to transact business at the 2020 Annual Meeting. A quorum is defined as the presence, either in person or by proxy, of a majority of the votes that all shareholders are entitled to cast at the meeting. For these purposes, shares that are present or represented by proxy at the Annual Meeting will be counted toward a quorum, regardless of whether the holder of the shares or proxy abstains with respect to or withholds authority to vote on a particular matter, whether a broker is present or represented by proxy but lacks discretionary voting authority with respect to any particular matter or whether a broker with discretionary authority fails to exercise such authority with respect to any particular matter.

Proposal 1—Election of Directors. With respect to the election of directors, the nominees who receive the most votes for the available positions will be elected. If you withhold authority to vote for a particular nominee on your proxy card, your vote will not count either “FOR” or “AGAINST” the nominee. Abstentions are not counted in the election of directors, and neither abstentions nor broker non-votes will affect the outcome.

Proposal 2 — Advisory Vote on Executive Compensation. The approval of a majority of the votes cast at the Annual Meeting is required for advisory (non-binding) approval of our executive compensation program under the Say-on-Pay Proposal. The vote is advisory, and therefore not binding on the Corporation, the Compensation Committee or our Board. Neither abstentions nor broker non-votes will count as votes cast and neither will affect the outcome of the Say-on-Pay Proposal.

Proposal 3—BDO Ratification Proposal. With respect to the ratification of the appointment of BDO USA, LLP as the Corporation’s independent registered public accounting firm for 2020, the affirmative vote of a majority of the votes cast at the Annual Meeting is required for approval. If the shareholders do not ratify the appointment of BDO, the selection of the independent registered public accounting firm will be reconsidered by the Audit Committee, but BDO may still be retained. Neither abstentions nor broker non-votes will count as votes cast and neither will affect the outcome of the BDO Ratification Proposal.

If a broker indicates on its proxy that it does not have authority to vote certain shares held in “street name,” the shares not voted are referred to as “broker non-votes.” Broker non-votes occur when brokers do not have discretionary voting authority to vote certain shares held in street name on particular proposals under the rules of the NYSE, and the beneficial owner of those shares has not instructed the broker how to vote on those proposals. If you are a beneficial owner, your broker, bank or other nominee is permitted to exercise discretionary authority to vote your shares on Proposal 3, the BDO Ratification Proposal, even if it does not receive voting instructions from you. However, it is not permitted to exercise discretionary authority to vote your shares on Proposals 1 and 2 in the absence of voting instructions from you.

8

ELECTION OF DIRECTORS

(Proposal 1)

One director will stand for election for a term of one year and three directors will stand for election for a term of three years to fill the class of directors whose term expires in 2020. Mr. Pforzheimer agreed to stand for a one-year term in order to rebalance the number of directors in the three classes. All of the nominees for election to the Board of Directors are currently directors. The nominees were recommended by the Nominating and Governance Committee and nominated by the Board of Directors at its March meeting and have indicated that they are willing to serve as directors if elected. THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES LISTED BELOW. If at the time of the Annual Meeting a nominee should be unable or unwilling to stand for election, the proxies will be voted for the election of such person, if any, as may be selected by the Board of Directors to replace him or her.

Nominee for Director Whose Term of Office Expires in 2021

CARL H. PFORZHEIMER, III (age 83, Director since 1982). Mr. Pforzheimer has been Managing Partner or Manager of Carl H. Pforzheimer & Co. LLC, an investment banking firm, or its predecessors or related entities for more than five years. In addition to the attendant investment advisory analytical skills gained from such a position, his former role as chairman of the Audit and Risk Management Committees of U. S. Trust Co. led the Board to conclude Mr. Pforzheimer should serve as a director.

Nominees for Directors Whose Term of Office Expires in 2023:

JAMES J. ABEL (age 74, Director since 2014). Prior to his retirement, Mr. Abel served as Interim President and Chief Executive Officer of CPI Corporation, an operator of portrait studios, from February 2012 to April 2013 and as a director from 2004 to April 2013. Mr. Abel previously served as President and Chief Executive Officer of Financial Executives International, a firm representing senior financial executives in dealing with regulatory agencies involved with corporate financial reporting and internal controls, from May 2008 to February 2009. Mr. Abel has served as a director of The LGL Group, Inc., a globally-positioned producer of industrial and commercial electronic components and instruments, from 2011 until 2014. Mr. Abel’s background as a senior executive, his expertise in financial management and his experience with manufacturing operations, as well as his board experience, led the Board to conclude that he should serve as a director.

WILLIAM K. LIEBERMAN (age 72, Director since 2004). Mr. Lieberman has been President of The Lieberman Companies, insurance brokerage and consulting company, for more than five years. In addition to more than forty years of management experience in the insurance, benefit and risk management areas, Mr. Lieberman has served as a director or trustee of many organizations including charitable companies, hospitals and universities. These qualifications led the Board to conclude that he should serve as a director.

STEPHEN E. PAUL (age 52, Director since 2002). Mr. Paul has been a managing principal of Laurel Crown Partners, a private investment company, for more than five years. He became a President of The Louis Berkman Investment Company, a private investment company, in 2013. Mr. Paul’s background in investment banking and private equity investment led the Board to conclude that he should serve as a director.

Continuing Directors Whose Term of Office Expires in 2022:

ELIZABETH A. FESSENDEN (age 64, Director since 2017). Ms. Fessenden served in several leadership positions at Alcoa Inc. from 1977 to 2005. Since 2008, she has been the principal of Fessenden Associates, a business consulting company. She has been a member of the board of directors of Quarles Petroleum since January of 2015. She also served as a director of Cardno from 2014 to 2015 and of O’Brien & Gere, from 2008 to 2014. Ms. Fessenden also served on the advisory board of Alloy Polymers and the board of directors of Polymer Group Inc. Ms. Fessenden was appointed to the Board effective as of August 10, 2017, to fill a newly created directorship. Ms. Fessenden’s extensive operations experience in the metals industry, her many years of service as a director of companies, and her broad leadership experience led the Board to conclude that she should serve as a director.

TERRY L. DUNLAP (age 60, Director since 2019). Mr. Dunlap is currently serving as Interim CEO and President of TimkenSteel, a manufacturer of SBQ steel bars and seamless mechanical tubing in North America. Mr. Dunlap served in several leadership positions at Allegheny Technologies Incorporated, a global manufacturer of technically

9

advanced specialty materials and complex components, from 1983 to 2014, where he last served as Executive Vice President, ATI Flat-Rolled Products, from 2011 to 2014. Mr. Dunlap has been the principal of Sweetwater LLC, a consulting and investment firm with a primary focus on metals and manufacturing, since January 2015. Mr. Dunlap has been a member of the board of directors of Matthews International since February 2015 and the board of directors of TimkenSteel since August 2015. He also served on the board of directors of Elliott Group Holdings from 2015 to 2019. Mr. Dunlap’s extensive operations experience in the metals industry, years of board service and broad leadership experience led the Board to conclude that he should serve as a director.

Continuing Directors Whose Term of Office Expires in 2021:

MICHAEL I. GERMAN (age 69, Director since 2014). Mr. German has been the Chief Executive Officer and President of Corning Natural Gas Holding Corporation (formerly known as Corning Natural Gas Corporation), a holding company for natural gas and electric utilities, for more than five years. Mr. German has been a director of Corning Natural Gas Holding Corporation since 2014 (and a director of Corning Natural Gas Corporation from 2006 until 2014) and is on the Boards of Directors of Three River Development Corporation and Northeast Gas Association, as well as the board of trustees of the Adirondack Park Institute. Mr. German also was a director of Pennichuck Corporation from 2008 until 2011. Mr. German’s experience as the chief executive officer of a public company, his many years of service as a director of companies and his broad leadership experience led the Board to conclude that he should serve as a director.

J. BRETT MCBRAYER (age 54, Director since 2018). Mr. McBrayer has served as the Corporation’s Chief Executive Officer since July of 2018. He previously served as President and Chief Executive Officer at Airtex Products and ASC Industries, a global manufacturer and distributor of automotive aftermarket and OEM fuel and water pumps, from 2012 through 2017. Mr. McBrayer had also served as Vice President and General Manager of the Alcan Cable business at Rio Tinto Alcan, as Vice President and General Manager of the Specialty Metals Division at Precision Cast Parts Corporation, and held positions of various responsibility and leadership during his 20 years with Alcoa, Inc. Mr. McBrayer’s extensive experience in global industrial businesses and his broad executive leadership experience led the Board to conclude that he should serve as a director.

10

CORPORATE GOVERNANCE

Corporate Governance Summary

Presented below are some highlights of our corporate governance practices and policies. You can find further details about these and other corporate governance practices and policies in the following pages of this Proxy Statement.

|

|

•

|

Our Board is currently comprised of eight directors, a majority of whom have been determined by the Board to be independent. Pursuant to the Shareholder Support Agreement, dated as of March 3, 2016, by and among the Corporation, Altor Fund II GP Limited (“Altor Fund”), and other signatories thereto, Altor Fund is entitled to designate one nominee to serve on our Board, until such time when Altor Fund and certain of its affiliates own, in the aggregate, less than 888,302 shares. Altor Fund’s prior nominee, Mr. Fredrik Strömholm, resigned from the Board effective May 9, 2018, and Altor Fund has not designated another nominee since his resignation.

|

|

|

•

|

We currently have separate non-executive Chairman and Chief Executive Officer roles.

|

|

|

•

|

All of the Board’s standing committees, other than the Executive Committee, are composed entirely of independent directors, and each such standing committee has a written charter that is reviewed and reassessed annually.

|

|

|

•

|

We have an annual self-evaluation process for the Board and each standing committee, other than the Executive Committee.

|

|

|

•

|

The Board evaluates individual directors whose terms are nearing expiration and who may be proposed for re-election. The Nominating and Governance Committee will consider director candidates recommended by shareholders on the same basis as other candidates.

|

|

|

•

|

The Board has designated Carl H. Pforzheimer, III, Chairman of our Audit Committee, as an “audit committee financial expert.” Our internal audit function reports directly to the Audit Committee. We annually ask our shareholders to ratify the Audit Committee’s selection of the Corporation’s independent auditors.

|

|

|

•

|

The Corporation has determined that it will hold a Say-on-Pay vote annually until the next shareholder vote on the frequency of such votes.

|

|

|

•

|

Our Corporate Governance Guidelines are available on the Corporation’s website at www.ampcopittsburgh.com.

|

|

|

•

|

Our Code of Business Conduct and Ethics, which applies to all of the Corporation’s officers, directors and employees, and our additional Code of Ethics, which applies to our Chief Executive Officer and Chief Financial Officer, are available on the Corporation’s website at www.ampcopittsburgh.com.

|

|

|

•

|

The Board has adopted an anti-hedging policy pursuant to which, without prior approval, no director, officer or employee of the Corporation at any time may purchase financial instruments that are designed to or that may reasonably be expected to have the effect of hedging or offsetting a decrease in the market value of any securities of the Corporation.

|

|

|

•

|

The Board has adopted an anti-pledging policy pursuant to which officers and directors of the Corporation are prohibited from holding any securities of the Corporation in margin accounts or pledging any securities of the Corporation as collateral for any loan, subject to exceptions for de minimis pledging with prior approval.

|

|

|

•

|

The Board has adopted a clawback policy in connection with short and long-term incentive plans. Pursuant to the policy, if the Corporation is required, because of fraud or negligence, to restate financial results for any restatement period in a manner that would have adversely affected the amount of the payout of any incentive compensation awards, the Compensation Committee has the right, during the three-year period following the restatement period, to review the matter and determine what, if any, repayment participants will be required to make.

|

11

|

|

•

|

The Board has adopted a policy prohibiting excise tax gross-ups of perquisites pursuant to which the Corporation is prohibited from making any tax gross-up payments to executive officers, except for gross-ups applicable to management employees generally, such as a relocation reimbursement policy.

|

|

|

•

|

The Board has adopted a whistleblower policy to protect any employee who, in good faith, reports incidents of unethical business conduct, violations of laws or accounting standards, internal accounting controls or audit standards or danger to employees or public health and safety.

|

Board Independence

The Board of Directors has adopted categorical standards to assist it in evaluating the independence of its directors. The standards are attached to the Corporate Governance Guidelines which are available on the Corporation’s website at www.ampcopittsburgh.com. After performing this evaluation in accordance with those guidelines, the Board has determined that James J. Abel, Elizabeth A. Fessenden, Michael I. German, William K. Lieberman, and Carl H. Pforzheimer, III do not have material relationships with the Corporation (other than as members of the Board of Directors) and are independent within the meaning of the Corporation’s independence standards and those of the NYSE.

Audit Committee members must meet additional independence standards under NYSE listing standards and rules of the Securities and Exchange Commission (the “SEC”). Specifically, Audit Committee members may not receive any compensation from the Corporation other than their directors’ compensation. The Board has also determined that each member of the Audit Committee satisfies the enhanced standards of independence applicable to Audit Committee members under NYSE listing standards and SEC rules.

The Board has determined in its judgment that the Compensation Committee is composed entirely of independent directors within the Corporation’s independence standards and those of the NYSE. In making its determination, the Board considered, among other things, the factors applicable to members of the Compensation Committee pursuant to NYSE listing standards and Rule 10C-1 of the Securities Exchange Act of 1934.

Leadership Structure

Mr. McBrayer is the Corporation’s Chief Executive Officer. Mr. James J. Abel serves as non-executive Chairman of the Board. The Chairman sets the agendas for and presides over the Board meetings. Mr. McBrayer is a member of the Board and participates in its meetings. The Board believes that this leadership structure is appropriate for the Corporation at this time because it allows for independent oversight of management, increases management accountability and encourages an objective evaluation of management’s performance relative to compensation. The Board will assess periodically whether the roles should be separated or combined based on its evaluation of what is in the best interests of the Corporation and its shareholders.

As Chief Executive Officer, Mr. McBrayer is the full-time executive managing the day-to-day operations of the Corporation.

Director Nominating Procedures

The Corporation’s Corporate Governance Guidelines and its Nominating and Governance Committee Charter charge the Nominating and Governance Committee with selecting nominees for election to the Board of Directors and with reviewing, at least annually, the qualifications of new and existing members of the Board of Directors. The Nominating and Governance Committee also considers the extent to which such members may be considered “independent” within the meaning of applicable NYSE rules, as well as other appropriate factors, including overall skills and experience.

From time to time, the Nominating and Governance Committee will seek to identify potential candidates for director nominees and will consider potential candidates proposed by other members of the Board of Directors, by management of the Corporation or by shareholders of the Corporation.

In considering candidates submitted by shareholders of the Corporation, the Nominating and Governance Committee will take into consideration the needs of the Board of Directors and the candidate’s qualifications. To have a candidate considered by the Committee, a shareholder must submit the recommendation in writing and must provide

12

the information set forth in, and otherwise comply with, Section 18 of Article II of the Corporation’s Amended and Restated By-Laws.

The shareholder recommendation and information described above must be sent to Ampco-Pittsburgh Corporation “c/o Corporate Secretary” at 726 Bell Avenue, Suite 301, P.O. Box 457, Carnegie, PA 15106 and, in order to allow for timely consideration, must be received not less than 90 days in advance of the anniversary date of the Corporation’s most recent annual meeting of shareholders.

Once a person has been identified by the Nominating and Governance Committee as a potential candidate, the Committee may collect and review publicly available information regarding the person to assess whether the person should be considered further. Generally, if the person expresses a willingness to be considered and to serve on the Board of Directors and the Nominating and Governance Committee believes that the candidate has the potential to be a good candidate, the Nominating and Governance Committee would seek to gather information from or about the candidate. Such information may include information gathered through one or more interviews as appropriate and review of his or her accomplishments and qualifications generally, in light of any other candidates that the Nominating and Governance Committee may be considering. The Nominating and Governance Committee’s evaluation process does not vary based on whether the candidate is recommended by a shareholder. Although the Nominating and Governance Committee does not have a formal written diversity policy, it considers the diversity of our Board as a whole, including the skills, background and experience of our directors.

Non-Management Directors

The non-management directors have regularly scheduled executive sessions. Any shareholder who wants to communicate directly with the presiding director or the non-management directors as a group can do so by following the procedure below under “Shareholder Communications with Directors”.

Shareholder Communications with Directors

The Board of Directors has established a process to receive communications from shareholders and other interested parties. To communicate with the Board of Directors, any individual director or any group or committee of directors, correspondence should be addressed to the Board of Directors or such individual or group or committee and sent to Ampco-Pittsburgh Corporation “c/o Corporate Secretary” at 726 Bell Avenue, Suite 301, P.O. Box 457, Carnegie, PA 15106. Communications sent in this manner will be reviewed by the office of the Corporate Secretary for the purpose of determining whether the contents represent a message to one or more of the Corporation’s directors. Depending on the subject matter, the Corporate Secretary may attempt to handle the inquiry directly, such as when it is a request for information about the Corporation or a stock-related matter. The Corporate Secretary also may not forward the communication if it is primarily commercial in nature or it relates to an improper or irrelevant topic.

Board’s Role in Risk Oversight

The Board of Directors as a whole is responsible for risk management oversight of the Corporation and ensuring that management develops sound business strategies. The involvement of the full Board of Directors in setting the Corporation’s business strategy and objectives is integral to the Board’s assessment of our risk profile and also a determination of what constitutes an appropriate level of risk and how best to manage any such risk. This involves receiving reports and/or presentations from applicable members of management, the Chief Risk Officer, the Enterprise Risk Management Committee of the Corporation, and the committees of the Board. The full Board of Directors continually evaluates risks such as financial risk, legal/compliance risk, operational/strategic risk, cybersecurity risk and fraud risk and addresses individual risk issues with management throughout the year as necessary.

While the Board of Directors has the ultimate oversight responsibility for the risk management process, the Board delegates responsibility for certain aspects of risk management to its standing committees. In particular, the Audit Committee focuses on enterprise risks and related controls and procedures, including financial reporting, fraud and regulatory risks. The Compensation Committee strives to create compensation practices that do not encourage excessive levels of risk taking that would be inconsistent with the Corporation’s strategy and objectives. The Nominating and Corporate Governance Committee is responsible for overseeing the Corporation’s corporate governance and corporate governance principles.

13

Director Terms

The Board is divided into three classes, and the directors in each class serve for three-year terms unless there is a need to adjust the number of Directors in a class or they are unable to continue to serve due to death, resignation, retirement or disability or are otherwise removed from office during such term. The term of one class of directors expires each year at the Corporation’s annual meeting of shareholders. The Board may fill a vacancy by electing a new director to the same class as the director being replaced or by reassigning a director from another class. The Board also may create a new director position in any class and elect a director to hold the newly created position. In accordance with our Amended and Restated Articles of Incorporation, all directors elected to fill vacancies shall hold office for a term expiring at the annual meeting of shareholders at which the term of the class to which they have been elected expires.

Annual Meeting Attendance

The Corporation encourages its directors to attend the Annual Meeting of the Corporation’s shareholders. All of the directors then in office were in attendance at the 2019 Annual Meeting.

14

BOARD COMMITTEES; DIRECTOR COMPENSATION; STOCK OWNERSHIP GUIDELINES

Summary

During 2019, the Board had four standing committees: Audit Committee, Compensation Committee, Executive Committee, and Nominating and Corporate Governance Committee. The Board makes committee and committee chair assignments annually at its meeting immediately preceding the annual meeting of shareholders, although further changes to committee assignments may be made from time to time as deemed appropriate by the Board. The Nominating and Governance Committee Charter, the Compensation Committee Charter, the Audit Committee Charter and the Corporate Governance Guidelines are available on the Corporation’s website at www.ampcopittsburgh.com.

The current composition of the Board and each committee of the Board is set forth below:

|

Director

|

|

Audit

Committee

|

|

|

Compensation

Committee

|

|

|

Executive

Committee

|

|

|

Nominating and

Corporate

Governance

Committee

|

|

|

Board of

Directors

|

|

|

James J. Abel

|

|

|

|

|

|

|

|

|

|

C

|

|

|

|

|

|

|

C

|

|

|

Terry L. Dunlap

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

|

Elizabeth A. Fessenden

|

|

|

|

|

|

C

|

|

|

X

|

|

|

|

|

|

|

X

|

|

|

Michael I. German

|

|

X

|

|

|

|

|

|

|

|

|

|

|

X

|

|

|

X

|

|

|

William K. Lieberman

|

|

X

|

|

|

X

|

|

|

X

|

|

|

C

|

|

|

X

|

|

|

J. Brett McBrayer

|

|

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

X

|

|

|

Stephen E. Paul

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

|

Carl H. Pforzheimer, III

|

|

C

|

|

|

X

|

|

|

X

|

|

|

X

|

|

|

X

|

|

|

2019 Meetings

|

|

|

6

|

|

|

|

6

|

|

|

|

0

|

|

|

|

2

|

|

|

|

6

|

|

X—Member

C—Chair

All of the directors attended at least 75% of the applicable Board and committee meetings in 2019.

The non-management directors meet separately in regularly scheduled executive sessions without members of management present, except to the extent that the non-management directors request the attendance of one or more members of management. The Board Chair presides over meetings of the non-management directors.

Audit Committee

The Audit Committee held six meetings in 2019 and was comprised of three directors: Carl H. Pforzheimer, III (Chair), Michael I. German and William K. Lieberman. None of the Audit Committee members is now, or has within the past five years been, an employee of the Corporation. The Board has determined that none of the members of the Audit Committee have any financial or personal ties to the Corporation (other than director compensation and equity ownership as described in this Proxy Statement) and that they meet the NYSE and SEC standards for independence applicable to members of the Audit Committee.

The Audit Committee reviews the Corporation’s accounting and reporting practices, including internal control procedures, and maintains a direct line of communication with the Directors and the independent accountants. The Audit Committee also is directly responsible for the appointment, compensation and oversight of the work of our independent registered public accounting firm, including pre-approval of all audit and non-audit services to be performed by our independent registered public accounting firm, as well as evaluating the performance of our internal audit function and our financial reporting processes.

The Board of Directors has determined that Mr. Pforzheimer meets the SEC criteria to be deemed an “audit committee financial expert” and meets the NYSE standard of having accounting or related financial management expertise. Each member of the Audit Committee is financially literate.

15

Compensation Committee

The Compensation Committee met six times in 2019 and is comprised of three directors: Elizabeth A. Fessenden (Chair), William K. Lieberman and Carl H. Pforzheimer, III. The Compensation Committee is responsible for reviewing and recommending to the Board of Directors compensation programs and policies and reviewing and recommending to the Board of Directors the participation of executives and other key management employees in the various compensation plans of the Corporation.

The Compensation Committee, under the terms of its charter, has the sole authority to retain, approve fees and other terms for, and terminate any compensation consultant used to assist the Committee in executive compensation matters. The Compensation Committee also may obtain advice and assistance from internal or external legal, accounting or other advisors. In 2019, the Compensation Committee engaged Pay Governance LLC as its independent provider of compensation consulting services for decisions relating to 2019 compensation. The Committee also utilizes external legal advisors and assesses the independence of its advisors.

Certain executive officers of the Corporation attend meetings of the Compensation Committee from time to time and are given the opportunity to express their views on executive compensation matters.

Each member of the Compensation Committee is a “non-employee director” of the Corporation as defined under Rule 16b-3 of the Securities Exchange Act of 1934, and each member is also an “outside director” for the purposes of the corporate compensation provisions contained in Section 162(m) of the Internal Revenue Code.

Executive Committee

The Executive Committee did not meet in 2019. It is comprised of the following five directors: James J. Abel (Chair), Elizabeth A. Fessenden, William K. Lieberman, Carl H. Pforzheimer, III, and J. Brett McBrayer. This Committee is responsible for providing guidance and counsel to the Corporation’s management team on significant matters affecting the Corporation and taking action on behalf of the Board where required in exigent circumstances, such as where it is impracticable or infeasible to convene, or obtain the unanimous written consent of, the full Board.

Nominating and Corporate Governance Committee

The Nominating and Governance Committee met twice in 2019 and was comprised of three directors: William K. Lieberman (Chair), Michael I. German and Carl H. Pforzheimer, III. The Nominating and Governance Committee is responsible for identifying individuals qualified to become directors and recommending candidates for membership on the Board of Directors and its committees, developing and recommending to the Board of Directors the Corporation’s corporate governance policies and reviewing the effectiveness of board governance, including overseeing an annual assessment of the performance of the Board of Directors and each of its committees.

Director Compensation

In 2019, each director who was not employed by the Corporation received an annual retainer of $40,000, payable quarterly in cash in equal installments. The Board Chair received an additional $25,000 fee, the Chair of the Audit Committee received an additional $15,000 annual fee, the Chair of the Compensation Committee received an additional $10,000 fee, and the Chair of the Nominating and Governance Committee received an additional $7,500 fee. Further, members of Board committees received the following additional fees in lieu of per meeting fees: $7,500 for the Audit Committee, $5,000 for the Compensation Committee, and $3,750 for the Nominating and Governance Committee. Each non-employee director was entitled to receive an annual stock award valued at $70,000, however, in 2019 the Committee reduced the 2019 long-term incentive awards for executives and non-employee directors in recognition of the significant decrease in the Company’s stock price since the 2018 long-term incentive grant. This reduction substantially limited the number of shares granted in a low stock price environment. In order to determine the number of shares to grant, the Committee used a consistent value as in the prior year, divided by a $7.00 stock price, instead of the fair market value of $3.17 on the date of grant. This resulted in executives and non-employee directors receiving approximately 55% fewer shares and corresponding grant value than that which would have been granted had the Committee used the fair market value on the date of grant, consistent with historical practice. Directors do not receive meeting fees. The Compensation Committee reviews director compensation periodically, but at least once every two years, in consultation with Pay Governance LLC, and considers whether changes are necessary.

16

The table below summarizes the director compensation earned by non-employee directors of the Corporation in 2019:

|

Name(1)

|

|

Fees Earned or

Paid in

Cash($)(1)

|

|

|

Stock Awards

($)(2)

|

|

|

Other

Compensation

($)

|

|

|

Total ($)

|

|

|

James J. Abel

|

|

|

59,667

|

|

|

|

31,700

|

|

|

|

0

|

|

|

|

91,367

|

|

|

Terry L. Dunlap

|

|

|

26,667

|

|

|

|

31,700

|

|

|

|

0

|

|

|

|

58,367

|

|

|

Elizabeth A. Fessenden

|

|

|

48,333

|

|

|

|

31,700

|

|

|

|

0

|

|

|

|

80,033

|

|

|

Michael I. German

|

|

|

50,000

|

|

|

|

31,700

|

|

|

|

0

|

|

|

|

81,700

|

|

|

William K. Lieberman

|

|

|

60,417

|

|

|

|

31,700

|

|

|

|

0

|

|

|

|

92,117

|

|

|

Stephen E. Paul

|

|

|

40,000

|

|

|

|

31,700

|

|

|

|

0

|

|

|

|

71,700

|

|

|

Carl H. Pforzheimer, III

|

|

|

63,750

|

|

|

|

31,700

|

|

|

|

0

|

|

|

|

95,450

|

|

|

(1)

|

This column reflects annual cash retainer fees, including committee chair fees, as well as committee membership fees paid to each listed director.

|

|

(2)

|

This column reflects the aggregate grant date fair value, determined in accordance with FASB ASC Topic 718, of the stock awards granted to directors. The assumptions made in calculating the grant date fair values are set forth in Note 15 to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2019.

|

Stock Ownership Guidelines

We have a long-standing approach of compensating executive officers and directors in part with stock awards and encouraging retention of stock acquired through such awards or by market purchases. We believe retention of stock creates a long-term perspective and aligns the interests of our directors and executive officers with those of our shareholders. In 2019, stock ownership guidelines for our CEO required the CEO to hold a minimum of 30,000 shares of the Corporation’s common stock, subject to certain exceptions for reasonable estate and tax planning and diversification purposes. In 2019, our directors were required to hold at least 1,000 shares of the Corporation’s common stock.

In 2020, the Board of Directors, upon recommendation of the Compensation Committee, adopted new Stock Ownership Policy Guidelines requiring, among other things, (i) non-employee Directors to hold stock at a target level of three times their annual cash retainer; (ii) the CEO to hold stock at a target level of three times his base salary; and (iii) other Executive Officers to hold stock at a target level of one times their base salaries.

17

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Beneficial Ownership of More Than Five Percent

The following table sets forth information, to the extent known by the Corporation, concerning individuals (other than directors or officers of the Corporation) or entities holding more than five percent of the outstanding shares of the Corporation’s Common Stock. The “percent of class” in the table below is calculated based upon 12,658,844 shares outstanding as of March 10, 2020.

|

Name of beneficial owner

|

|

Amount and nature of

beneficial ownership

|

|

|

|

Percent

of class

|

|

|

Mario J. Gabelli

(and entities which he controls or for which he acts as chief investment officer)

One Corporate Center

Rye, NY 10580

|

|

|

2,374,575

|

|

(1)

|

|

|

18.76

|

%

|

|

Altor Fund II GP Limited

(and affiliates)

11-15 Seaton Place

St Helier

Jersey JE4 OQH

Channel Islands

|

|

|

1,776,604

|

|

(2)

|

|

|

14.03

|

%

|

|

The Louis Berkman Investment Company

600 Grant Street, Suite 3230

Pittsburgh, PA 15219

|

|

|

1,321,762

|

|

(3)

|

|

|

10.44

|

%

|

|

Dimensional Fund Advisors LP(4)

Building One, 6300 Bee Cave Road

Austin, TX, 78746

|

|

|

720,251

|

|

(4)

|

|

|

5.69

|

%

|

|

Columbia Management Investment Advisers, LLC

225 Franklin Street

Boston, MA 02110

|

|

|

645,563

|

|

(5)

|

|

|

5.10

|

%

|

|

(1)

|

According to the amended Schedule 13D filed on August 28, 2019, Mario J. Gabelli beneficially owns 2,374,575 shares of our Common Stock of which he has sole voting power with respect to 2,197,275 shares and sole dispositive power with respect to 2,374,575 shares.

|

|

(2)

|

According to Schedule 13D filed on April 1, 2016, Altor Fund beneficially owns 1,776,604 shares of our Common Stock. Altor Fund has shared voting and dispositive power with respect to the shares beneficially owned by each of the reporting persons, as set forth in such Schedule.

|

|

(3)

|

According to the amended Schedule 13D filed on April 10, 2018, and Form 4 filed on May 28, 2019, The Louis Berkman Investment Company beneficially owns 1,321,762 shares of our Common Stock and has sole voting and dispositive power with respect to such shares; Stephen E. Paul, a director of the Corporation, owns 28.24% of The Louis Berkman Investment Company’s non-voting stock, held in various trusts.

|

|

(4)

|

According to the amended Schedule 13G filed on February 12, 2020, Dimensional Fund Advisors LP (“Dimensional Fund”) has sole dispositive power with respect to 720,251 shares our Common Stock and sole voting power with respect to 675,802 shares of our Common Stock. Dimensional Fund is an investment adviser to four investment companies and furnishes investment advice to certain funds, trusts and separate accounts (the “Funds”). All shares of Common Stock are owned by the Funds and Dimensional Fund disclaims beneficial ownership of these securities.

|

|

(5)

|

According to Schedule 13G filed on February 14, 2020, Columbia Management Investment Advisers, LLC (“CMIA”) has shared voting power with respect to 645,363 shares of our Common Stock and shared dispositive power with respect to 645,563 shares of our Common Stock. CMIA is an investment adviser. CMIA and its parent holding company, Ameriprise Financial, Inc., disclaim beneficial ownership of these securities.

|

18

Director and Executive Officer Stock Ownership

The following table sets forth as of March 10, 2020, information concerning the beneficial ownership of the Corporation’s Common Stock by the Directors and Named Executive Officers and all Directors and Executive Officers of the Corporation as a group. The “percent of class” in the table below is calculated based upon 12,658,844 shares outstanding as of March 10, 2020.

|

Name of beneficial owner

|

|

Amount and nature of

beneficial ownership

|

|

|

|

Percent

of class

|

|

|

Stephen E. Paul

|

|

|

1,354,893

|

|

(1)

|

|

|

10.7

|

%

|

|

Rose Hoover

|

|

|

72,198

|

|

(2)

|

|

*

|

|

|

James J. Abel

|

|

|

51,266

|

|

(3)

|

|

*

|

|

|

Michael I. German

|

|

|

50,266

|

|

(3)

|

|

*

|

|

|

William K. Lieberman

|

|

|

37,431

|

|

(4)

|

|

*

|

|

|

J. Brett McBrayer

|

|

|

24,892

|

|

(5)

|

|

*

|

|

|

Elizabeth A. Fessenden

|

|

|

24,718

|

|

(3)

|

|

*

|

|

|

Carl H. Pforzheimer, III

|

|

|

21,600

|

|

(6)

|

|

*

|

|

|

Michael G. McAuley

|

|

|

18,115

|

|

(7)

|

|

*

|

|

|

Terry L. Dunlap

|

|

|

10,000

|

|

(3)

|

|

*

|

|

|

Directors and Executive Officers as a group (14 persons)

|

|

|

1,810,443

|

|

(9)

|

|

|

14.3

|

%

|

|

(1)

|

Represents 33,131 shares owned directly and 1,321,762 shares owned by The Louis Berkman Investment Company. Mr. Paul is a President of The Louis Berkman Investment Company and is a trustee of various trusts which own 28.24% of its non-voting stock.

|

|

(2)

|

Represents 13,512 shares owned directly, 46,000 shares that she has the right to acquire within sixty days pursuant to stock options, 9,405 restricted stock units that will vest within sixty days and 3,281 performance stock unit shares that she has the right to acquire within 60 days.

|

|

(3)

|

Represents shares held directly.

|

|

(4)

|

Includes 5,300 shares held jointly with his wife and 32,131 shares owned directly.

|

|

(5)

|

Represents 14,521 shares held directly and 10,371 restricted stock units that will vest within sixty days.

|

|

(6)

|

Includes 20,000 shares owned directly, 800 shares held by a trust of which he is a trustee and principal beneficiary, and the following shares in which he disclaims beneficial ownership: 800 shares held by a trust of which he is a trustee.

|

|

(7)

|

Represents 8,541 shares held directly, 7,140 restricted stock units that will vest within sixty days and 2,434 performance stock unit shares that he has the right to acquire within 60 days.

|

|

(9)

|

Excludes double counting of shares deemed to be beneficially owned by more than one director.

|

Unless otherwise indicated, the individuals named have sole investment and voting power.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires the Corporation’s directors, executive officers and persons who beneficially own more than 10% of the Corporation’s common stock, to file reports of holdings and transactions in the Corporation’s common stock with the SEC and to furnish the Corporation with copies of all Section 16(a) reports that they file. Based on those records and other information furnished, during 2019, executive officers, directors and persons who beneficially own more than 10% of the Corporation’s common stock complied with all filing requirements except for Mr. McBrayer. Through no fault of his own, an error was made on the calculation of Mr. McBrayer’s 2019 Restricted Stock Units to be granted. When the error was discovered, and additional shares granted, Mr. McBrayer filed an amended Form 4 on July 1, 2019.

19

ADVISORY VOTE ON EXECUTIVE COMPENSATION

(Proposal 2)

The Say-on-Pay vote is advisory and therefore not binding on the Corporation or the Board. However, the Board of Directors and the Compensation Committee will carefully review the opinions that our shareholders express and will take the outcome of the vote into account when making decisions regarding executive compensation. Our Board of Directors adopted a policy to hold this advisory vote on executive compensation annually.

We believe that the Say-on-Pay vote represents an additional means by which we may obtain important feedback from our shareholders about executive compensation. As set forth in the Compensation Overview, the overall objectives of our executive compensation program are to provide compensation that is competitive, create a structure that is based on achievement of performance goals and provide incentive for long-term continued employment.

In accordance with the voting results for the proposal considered at the Corporation’s 2017 Annual Meeting of Shareholders regarding the frequency of advisory Say-on-Pay votes, the Corporation determined to hold an advisory Say-on-Pay vote annually until the next shareholder vote on the frequency of such advisory Say-on-Pay votes which is required in 2023.

Shareholders are encouraged to read the Executive Compensation Overview, starting on page 21, which discusses how the elements of the compensation packages for the named executive officers are determined, and review the Summary Compensation Table and the other related information following the Summary Compensation Table. The Board and the Compensation Committee believe that the Corporation’s policies and procedures on executive compensation are strongly aligned with the long-term interests of our shareholders and are effective in achieving the strategic goals of the Corporation. The Say-on-Pay vote gives you, as a shareholder, the opportunity to endorse or not endorse our executive compensation program by voting for or against the following resolution:

“RESOLVED, that the shareholders of Ampco-Pittsburgh Corporation (the “Corporation”) approve, on an advisory basis, the compensation of the Corporation’s named executive officers, as disclosed in the Corporation’s proxy statement for the 2020 Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Executive Compensation Overview, the Summary Compensation Table and the other related tables and disclosure.”

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THIS RESOLUTION AND THEREBY ENDORSE THE CORPORATION’S EXECUTIVE COMPENSATION PROGRAM.

20

COMPENSATION DISCUSSION AND ANALYSIS (“CD&A”)

EXECUTIVE COMPENSATION OVERVIEW

In this CD&A we summarize the compensation awarded to our executive officers listed in the Summary Compensation Table on page 31. We refer to these executive officers as our “named executive officers” or “NEOs.”

Executive Compensation Overview describes the key features of our executive compensation program for 2019 for our “named executive officers”:

2019 Named Executive Officers

|

Name

|

|

Title (as of last day of 2019)

|

|

J. Brett McBrayer

|

|

Chief Executive Officer

|

|

Michael G. McAuley

|

|

Senior Vice President, Chief Financial Officer and Treasurer

|

|

Rose Hoover

|

|

President and Chief Administrative Officer

|

We have divided this discussion into five parts:

|

|

2.

|

Key Features of Our Executive Compensation Program

|

|

|

3.

|

2019 Compensation Objectives

|

|

|

4.

|

2019 Compensation Decisions

|

|

|

5.

|

Other Compensation Practices and Policies

|

2019 HIGHLIGHTS

The 2019 executive compensation program features a balanced mix of salary and performance-driven annual and long-term incentive award opportunities. The chart below illustrates the target compensation opportunities in 2019 for Mr. McBrayer, our Chief Executive Officer (“CEO,” and also referred to as our “Principal Executive Officer” or “PEO”).

21

Management worked diligently on its strategic priorities in 2019 to restructure the operating businesses and return the Corporation to profitability. Those efforts started paying off in the fourth quarter when we achieved the first positive income from continuing operations in sixteen quarters.

The Forged and Cast Engineered Products segment and the Air and Liquid Processing segment exceeded their operating income goals, a key metric in our compensation program. This helped the Corporation to also achieve the adjusted earnings per share (“EPS”) goal.

Based on these business performance results, the named executive officers earned bonuses under the short-term incentive program, which illustrates our pay-for-performance philosophy and also motivates our officers to continue to focus their efforts on improvements in the overall financial results of the Corporation. Each of the named executive officers also earned annual incentive awards based on personal performance.

In addition, the portion of our 2017-2019 long-term incentive (“LTI”) program related to EPS was achieved. This represents the first time since the LTI program was put in place in 2015, the officers earned awards under the Performance Stock Units (“PSU”) portion of our LTI program. The threshold for the PSU relative total shareholder return (“rTSR”) portion of the 2017-2019 PSUs was not achieved, and as a result, that portion of the 2017-2019 PSU was forfeited.

KEY FEATURES OF OUR EXECUTIVE COMPENSATION PROGRAM

Our Compensation Committee (also referred to as the “Committee”) believes that our executive compensation program includes key features that align the interests of our named executive officers and the Corporation’s long-term strategic direction with the interests of our shareholders and is designed to avoid features that could misalign their interests.

22

|

|

|

|

|

|

|

|

|

KEY FEATURES

|

|

|

|

|

|

• Align CEO Pay with Corporate Performance:

A significant portion of our CEO’s actual pay is tied to annual performance goals and long-term shareholder returns. A majority of long-term incentive awards were provided as PSUs.

|

|

|

|

|

|

• Use Long-Term Incentives to Link a Significant Portion of Named Executive Officer Pay to Company Performance:

A significant portion of pay for our named executive officers is long-term incentives linked to Return on Invested Capital (“ROIC”) and relative total shareholder return (“rTSR”).

|

|

|

|

|

|

• Balance Short-Term and Long-Term Incentives:

Our incentive programs provide an appropriate balance of annual and long-term incentives and include multiple measures of performance.

|

|

|

|

|

|

• Cap Incentive Awards:

Annual incentive awards and PSUs include capped payouts (200% for annual incentives and 150% for PSUs).

|

|

|

|

|

|