American Tower Closes Eaton Towers Transaction & Announces Agreement to Acquire Joint Venture Stakes in Ghana & Uganda From MTN

January 02 2020 - 8:00AM

Business Wire

American Tower Corporation (NYSE:AMT) announced today that it

has closed its previously announced acquisition of Eaton Towers

Holdings Limited (“Eaton Towers”), adding approximately 5,700

communications sites to its African portfolio. Total consideration

for the acquisition, subject to certain post-closing adjustments,

was approximately $1.85 billion, including the assumption of

existing Eaton Towers debt.

The Company has also reached an agreement with MTN Group Limited

(“MTN”) to acquire MTN’s minority stakes in each of the Company’s

joint ventures in Ghana and Uganda for total consideration of

approximately $523 million. The transaction is expected to close in

the first quarter of 2020, subject to regulatory approval, and will

result in a one-time impact for American Tower of approximately $65

million in 2020 from the payment of previously deferred cash

interest related to joint venture debt.

About American Tower

American Tower, one of the largest global REITs, is a leading

independent owner, operator and developer of multitenant

communications real estate with a portfolio of approximately

177,000 communications sites. For more information about American

Tower, please visit www.americantower.com.

Cautionary Language Regarding Forward-Looking

Statements

This press release contains statements about future events and

expectations, or “forward-looking statements,” all of which are

inherently uncertain. We have based those forward-looking

statements on management’s current expectations and assumptions and

not on historical facts. Examples of these statements include, but

are not limited to, statements regarding our expectations for the

acquisition of MTN’s interests, the expected consideration for the

transaction and the impact on our consolidated results. These

forward-looking statements involve a number of risks and

uncertainties. For important factors that may cause actual results

to differ materially from those indicated in our forward-looking

statements, we refer you to the information contained in Item 1A of

our Form 10-K for the year ended December 31, 2018, as updated in

Part II, Item 1A of our Form 10-Q for the quarter ended September

30, 2019, under the caption “Risk Factors” and in other filings we

make with the Securities and Exchange Commission. We undertake no

obligation to update the information contained in this press

release to reflect subsequently occurring events or

circumstances.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200102005240/en/

Igor Khislavsky Vice

President, Investor Relations Telephone: (617) 375-7500

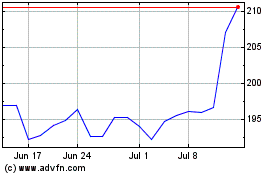

American Tower (NYSE:AMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

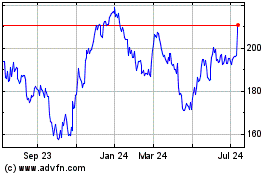

American Tower (NYSE:AMT)

Historical Stock Chart

From Apr 2023 to Apr 2024