American Tower Raises Guidance After Agreement with AT&T

September 03 2019 - 10:03AM

Dow Jones News

By Dave Sebastian

American Tower Corp. (AMT) on Tuesday raised its full-year

guidance after the real-estate investment trust struck an agreement

with AT&T Inc. (T) that streamlines wireless-network

deployments on American Tower's U.S. sites.

American Tower said it sees full-year net income to be between

$1.73 billion and $1.8 billion, up from its previous guidance of

$1.59 billion to $1.66 billion.

It said it expects total property revenue to be between $7.34

billion and $7.47 billion, up from its previous guidance of $7.21

billion to $7.34 billion.

Through the pact, American Tower said it expects about $135

million in additional straight-line revenue for the fiscal

year.

The company also raised its guidance for adjusted earnings

before interest, taxes, depreciation and amortization to between

$4.63 billion and $4.71 billion from between $4.49 billion and

$4.57 billion.

American Tower said it backs its outlook for organic tenant

billings to grow 4% during the year and for consolidated adjusted

funds from operations to be between $3.46 billion and $3.53

billion.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

September 03, 2019 09:48 ET (13:48 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

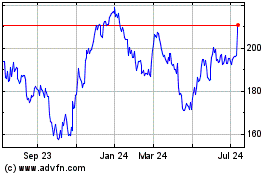

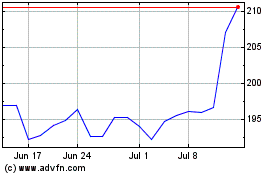

American Tower (NYSE:AMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Tower (NYSE:AMT)

Historical Stock Chart

From Apr 2023 to Apr 2024