CONSOLIDATED HIGHLIGHTS

Second Quarter 2019

- Total revenue increased 6.1% to $1,890 million

- Property revenue increased 5.7% to $1,849 million

- Net income increased 38.1% to $434 million

- Adjusted EBITDA increased 9.2% to $1,183 million

- Consolidated AFFO increased 7.8% to $910 million

American Tower Corporation (NYSE: AMT) today reported financial

results for the quarter ended June 30, 2019.

Jim Taiclet, American Tower’s Chief Executive Officer, stated,

“We had another strong quarter in Q2 2019, highlighted by 7.5%

Organic Tenant Billings Growth in the U.S. and sustained momentum

across our international operations. U.S. consumer demand for

mobile data continues to expand more than 30% per year, with

broadly similar usage growth rates in our overseas markets fueling

ongoing demand for tower space. In addition, initial 5G deployments

are now picking up in the U.S. and we are seeing increasing signs

that low and mid-band spectrum on macro towers will serve as a

substantial component of next generation networks.

Our strong second quarter results indicate that our Stand and

Deliver strategy of leading wireless connectivity around the globe

predominantly with macro towers, innovating for a mobile future,

driving efficiency both internally and for the industry and

selectively growing our portfolio to serve our tenants is the right

course for American Tower and our stockholders. Moreover, the

success of this strategy and effective operational execution across

our served markets has led us to raise our full year expectations

for all of our key metrics as we drive towards a successful second

half of 2019.”

CONSOLIDATED OPERATING RESULTS OVERVIEW American Tower

generated the following operating results for the quarter ended

June 30, 2019 (all comparative information is presented against the

quarter ended June 30, 2018).

($ in millions, except per share

amounts.)

Q2 2019(1)

Growth Rate

Total revenue

$

1,890

6.1

%

Total property revenue

$

1,849

5.7

%

Total Tenant Billings Growth

$

80

5.6

%

Organic Tenant Billings Growth

$

49

3.4

%

Property Gross Margin

$

1,300

8.4

%

Property Gross Margin %

70.3

%

Net income(2)

$

434

38.1

%

Net income attributable to AMT common

stockholders(2)

$

429

39.9

%

Net income attributable to AMT common

stockholders per diluted share(2)

$

0.96

39.1

%

Adjusted EBITDA

$

1,183

9.2

%

Adjusted EBITDA Margin %

62.6

%

Nareit Funds From Operations (FFO)

attributable to AMT common stockholders

$

829

16.5

%

Consolidated AFFO

$

910

7.8

%

Consolidated AFFO per Share

$

2.04

7.4

%

AFFO attributable to AMT common

stockholders

$

893

15.3

%

AFFO attributable to AMT common

stockholders per Share

$

2.01

15.5

%

Cash provided by operating activities

$

1,037

10.3

%

Less: total cash capital

expenditures(3)

$

248

8.4

%

Free Cash Flow

$

789

10.9

%

_______________

(1)

Inclusive of the negative impacts of

Indian Carrier Consolidation-Driven Churn (ICCC). For

reconciliations of these impacts on key metrics, please see tables

below.

(2)

Q2 2019 growth rates positively impacted

by the nonrecurrence of an approximately $33 million impairment

charge primarily related to assets in India recognized in Q2

2018.

(3)

Q2 2019 cash capital expenditures include

$6.7 million of finance lease and perpetual land easement payments

reported in cash flows from financing activities in the condensed

consolidated statements of cash flows.

The Company’s operational and financial results during the

second quarter of 2019 were impacted by churn driven by carrier

consolidation in India (Indian Carrier Consolidation-Driven Churn,

“ICCC”). We are disclosing the additional financial metrics below

to provide insight into the underlying long-term trends across the

Company’s business excluding these impacts. We expect ICCC to

impact our operational and financial results at varying rates

throughout the remainder of 2019 and to result in an overall

reduction in Indian contracted tenant revenue. The impacts of ICCC

on net income are not provided, as the impact on all components of

the net income measure cannot be reasonably calculated.

Reconciliation of Indian Carrier

Consolidation-Driven Churn Impact to Operating Results: ($ in

millions, except per share amounts. Totals may not add due to

rounding.)

Q2 2019 Results

Q2 2018 Results

Growth Rates vs. Prior

Year

($ in millions)

As Reported

Impact of ICCC(1)(2)

Normalized

As Reported

Impact of ICCC(1)

Normalized

As Reported

Impact of ICCC(1)(2)

Normalized

Total property revenue

$

1,849

$

88

$

1,937

$

1,749

$

42

$

1,792

5.7

%

2.4

%

8.1

%

Adjusted EBITDA

1,183

59

1,243

1,084

24

1,108

9.2

%

2.9

%

12.1

%

Consolidated AFFO

910

47

957

844

19

864

7.8

%

3.0

%

10.8

%

Consolidated AFFO per Share

$

2.04

$

0.11

$

2.15

$

1.90

$

0.04

$

1.94

7.4

%

3.5

%

10.8

%

Consolidated Organic Tenant Billings

49

63

112

76

25

100

3.4

%

4.3

%

7.7

%

International Organic Tenant Billings

(19

)

63

44

14

25

39

(3.6

)%

11.6

%

8.0

%

_______________

(1)

Reflects the cumulative impacts of ICCC

since 2017.

(2)

Includes the benefit of approximately $9

million of settlement payments related to ICCC in prior

periods.

Please refer to “Non-GAAP and Defined Financial Measures” below

for definitions and other information regarding the Company’s use

of non-GAAP measures. For financial information and reconciliations

to GAAP measures, please refer to the “Unaudited Selected

Consolidated Financial Information” below.

CAPITAL ALLOCATION OVERVIEW

Distributions – During the quarter ended June 30, 2019,

the Company declared the following regular cash distributions to

its common stockholders:

Common Stock Distributions

Q2 2019(1)

Distributions per share

$

0.92

Aggregate amount (in millions)

$

407

Year-over-year per share growth

19.5

%

_______________

(1)

The distribution declared on May 22, 2019

was paid in the third quarter of 2019 to stockholders of record as

of the close of business on June 19, 2019.

Capital Expenditures – During the second quarter of 2019,

total capital expenditures were $248 million, of which $39 million

was for non-discretionary capital improvements and corporate

capital expenditures. For additional capital expenditure details,

please refer to the supplemental disclosure package available on

the Company’s website.

Acquisitions – During the second quarter of 2019, the

Company spent approximately $43 million to acquire 256

communications sites and other related assets, primarily in

international markets.

Additionally, as previously disclosed, the Company has entered

into a definitive agreement to acquire Eaton Towers Holding Limited

(“Eaton Towers”) for total consideration, including the assumption

of existing debt, of $1.85 billion. Eaton Towers’ portfolio

includes approximately 5,500 communications sites across five

African markets and the transaction is expected to close by the end

of 2019, subject to customary closing conditions and regulatory

approvals.

On July 24, 2019, the Company entered into a definitive

agreement to acquire approximately 400 towers and other related

property interests in the United States for approximately $0.5

billion. The transaction is expected to close in the third quarter

of 2019, subject to customary closing conditions.

Other Events – In April 2019, Tata Teleservices Limited

(“Tata Teleservices”) served notice of exercise of its put options

with respect to 100% of its remaining combined holdings with Tata

Sons in ATC Telecom Infrastructure Private Limited (“ATC TIPL”).

The Company expects to complete the redemption of the remaining put

shares in Q3 2019 for total consideration of approximately INR 24.8

billion (approximately $359.4 million as of June 30, 2019), subject

to regulatory approval. After the completion of the redemption, the

Company will hold an approximately 92% ownership interest in ATC

TIPL.

LEVERAGE AND FINANCING OVERVIEW

Leverage – For the quarter ended June 30, 2019, the

Company’s Net Leverage Ratio was 4.2x net debt (total debt less

cash and cash equivalents) to second quarter 2019 annualized

Adjusted EBITDA.

Calculation of Net Leverage Ratio

($ in millions, totals may not add due to rounding)

As of June 30, 2019

Total debt

$

21,058

Less: Cash and cash equivalents

1,192

Net Debt

19,866

Divided By: Second quarter annualized

Adjusted EBITDA(1)

4,734

Net Leverage Ratio

4.2x

_______________

(1)

Q2 2019 Adjusted EBITDA multiplied by

four.

Liquidity – As of June 30, 2019, the Company had $5.5

billion of total liquidity, consisting of $1.2 billion in cash and

cash equivalents plus the ability to borrow an aggregate of $4.3

billion under its revolving credit facilities, net of any

outstanding letters of credit.

On April 22, 2019, the Company completed its previously

announced redemption of all of its outstanding 5.050% senior

unsecured notes due 2020 for an aggregate principal amount of $700

million.

On June 13, 2019, the Company issued $650.0 million aggregate

principal amount of 2.950% senior unsecured notes due 2025 and

$1.65 billion aggregate principal amount of 3.800% senior unsecured

notes due 2029. The Company used the net proceeds to repay existing

indebtedness under its credit facilities.

FULL YEAR 2019 OUTLOOK The following full year 2019

financial and operational estimates are based on a number of

assumptions that management believes to be reasonable and reflect

the Company’s expectations as of July 31, 2019. Actual results may

differ materially from these estimates as a result of various

factors, and the Company refers you to the cautionary language

regarding “forward-looking” statements included in this press

release when considering this information.

The Company’s outlook is based on the following average foreign

currency exchange rates to 1.00 U.S. Dollar for July 31, 2019

through December 31, 2019: (a) 46.90 Argentinean Pesos; (b) 3.85

Brazilian Reais; (c) 700 Chilean Pesos; (d) 3,270 Colombian Pesos;

(e) 0.89 Euros; (f) 5.45 Ghanaian Cedi; (g) 69.80 Indian Rupees;

(h) 102 Kenyan Shillings; (i) 19.50 Mexican Pesos; (j) 360 Nigerian

Naira; (k) 6,260 Paraguayan Guarani; (l) 3.35 Peruvian Soles; (m)

14.40 South African Rand; and (n) 3,770 Ugandan Shillings.

The Company is raising the midpoint of its full year 2019

outlook for property revenue, net income, Adjusted EBITDA and

Consolidated AFFO by $60 million, $15 million, $60 million and $70

million, respectively.

The Company’s outlook reflects estimated unfavorable impacts of

foreign currency exchange rate fluctuations to property revenue,

Adjusted EBITDA and Consolidated AFFO, of approximately $3 million,

$3 million and $6 million, respectively, as compared to the

Company’s prior 2019 outlook. The impact of foreign currency

exchange rate fluctuations on net income is not provided, as the

impact on all components of the net income measure cannot be

calculated without unreasonable effort.

The Company’s full year 2019 outlook also reflects estimated

cumulative expected unfavorable impacts of ICCC on property

revenue, Adjusted EBITDA and Consolidated AFFO of approximately

$375 million, $261 million and $209 million, respectively,

inclusive of an expected reduction in pass-through revenue of

approximately $85 million and the benefit of approximately $9

million of settlement payments related to ICCC in prior periods,

which was not contemplated within the Company’s prior outlook. The

expected 2019-specific impacts of ICCC to property revenue,

Adjusted EBITDA and Consolidated AFFO are $186 million, $141

million and $113 million, respectively, including $24 million in

lower pass-through revenue and the expected benefit of the

settlement payments. At this time, the Company expects the impacts

of ICCC to last throughout 2019 and anticipates that churn rates in

India will return to lower levels in 2020 and beyond. The Company

is providing key outlook measures adjusted to quantify the impacts

of ICCC on such measures and the impact of ICCC and the Company’s

settlement with Tata Teleservices and related entities (“Tata”) in

the fourth quarter of 2018 on growth rates as it believes that

these adjusted measures better reflect the long-term trajectory of

its recurring business and provide investors with a more

comprehensive analysis of the Company’s operations. The impacts of

ICCC and the Tata settlement on net income are not provided, as the

impact on all components of the net income measure cannot be

calculated without unreasonable effort.

Additional information pertaining to the impact of foreign

currency, London Interbank Offered Rate (“LIBOR”) fluctuations and

ICCC on the Company’s outlook has been provided in the supplemental

disclosure package available on the Company’s website.

2019 Outlook ($ in millions)

Full Year 2019

Midpoint Growth Rates vs.

Prior Year

Total property revenue(1)

$

7,205

to

$

7,335

(0.6)%

Net income

1,590

to

1,660

28.5%

Adjusted EBITDA

4,490

to

4,570

(2.9)%

Consolidated AFFO

3,460

to

3,530

(1.2)%

_______________

(1)

Includes U.S. property revenue of $3,960

million to $4,020 million and international property revenue of

$3,245 million to $3,315 million, reflecting midpoint growth rates

of 4.4% and (6.1)%, respectively. The U.S. growth rate includes a

negative impact of over 2% associated with a decrease in non-cash

straight-line revenue recognition. The international growth rate

includes estimated negative impacts of approximately 15%

attributable to ICCC and the non-recurrence of the Tata settlement,

and approximately 3% from the translational effects of foreign

currency exchange rate fluctuations. International property revenue

reflects the Company’s Latin America, EMEA and Asia segments.

2019 Outlook for Total Property

revenue, at the midpoint, includes the following components(1):

($ in millions, totals may not add due to rounding.)

U.S. Property

International

Property(2)

Total Property

International pass-through revenue

N/A

$

1,000

$

1,000

Straight-line revenue

(25

)

40

15

_______________

(1)

For additional discussion regarding these

components, please refer to “Revenue Components” below.

(2)

International property revenue reflects

the Company’s Latin America, EMEA and Asia segments.

2019 Outlook for Total Tenant Billings

Growth, at the midpoint, includes the following components(1):

(Totals may not add due to rounding.)

U.S. Property

International

Property(2)

Total Property

Organic Tenant Billings

≥7%

~(2)%

~4%

New Site Tenant Billings

<0.5%

~5-6%

~2%

Total Tenant Billings Growth

>7%

~3-4%

~6%

_______________

(1)

For additional discussion regarding these

components, please refer to “Revenue Components” below.

(2)

International property revenue reflects

the Company’s Latin America, EMEA and Asia segments.

Reconciliation of Indian Carrier

Consolidation-Driven Churn Impact to 2019 Outlook: ($ in

millions, except per share amounts. Totals may not add due to

rounding.)

FY 2018 Results

2019 Outlook, at the

Midpoint

Midpoint Growth Rates vs.

Prior Year

($ in millions)

As Reported

Impact of Tata Settlement(1)

Impact of ICCC(2)

Normalized

As Reported

Impact of ICCC(2)(3)

Normalized

As Reported

Impact of ICCC and Tata

Settlement(3)(4)

Normalized

Total property revenue(5)

$

7,315

$

(334

)

$

189

$

7,170

$

7,270

$

375

$

7,645

(0.6

)%

7.2

%

6.6

%

Adjusted EBITDA

4,667

(327

)

120

4,459

4,530

261

4,791

(2.9

)%

10.4

%

7.4

%

Consolidated AFFO

3,539

(313

)

96

3,322

3,495

209

3,704

(1.2

)%

12.8

%

11.5

%

Consolidated AFFO per Share(6)

$

7.99

$

(0.71

)

$

0.22

$

7.50

$

7.85

$

0.47

$

8.32

(1.8

)%

12.7

%

10.9

%

Consolidated Organic Tenant Billings

275

—

128

403

216

210

426

~4%

~3-4%

>7%

International Organic Tenant Billings

32

—

128

160

(42

)

210

169

~(2)%

~10%

~8%

_______________

(1)

Includes the one-time net positive impacts

to 2018 property revenue, Adjusted EBITDA and Consolidated AFFO

related to the Company's settlement with Tata. Churn associated

with the settlement is reflected in the ICCC column.

(2)

Reflects the cumulative impacts of ICCC

since 2017.

(3)

Includes the impacts of settlement payments of approximately $9

million related to ICCC in prior periods.

(4)

Reflects the cumulative impacts of ICCC since 2017 and the 2018

impacts of the Tata settlement.

(5)

Expected ICCC impacts include a cumulative decline of approximately

$61 million and $85 million in pass-through revenue for 2018 and

2019, respectively.

(6)

Assumes 2019 weighted average diluted share count of 445 million

shares.

Outlook for Capital Expenditures:

($ in millions, totals may not add due to rounding.)

Full Year 2019

Discretionary capital projects(1)

$

350

to

$

380

Ground lease purchases

150

to

160

Start-up capital projects

70

to

90

Redevelopment

270

to

290

Capital improvement

150

to

170

Corporate

10

—

10

Total

$

1,000

to

$

1,100

_______________

(1)

Includes the construction of 3,000 to

4,000 communications sites globally.

Reconciliation of Outlook for Adjusted

EBITDA to Net income: ($ in millions, totals may not add due to

rounding.)

Full Year 2019

Net income

$

1,590

to

$

1,660

Interest expense

820

to

810

Depreciation, amortization and

accretion

1,760

to

1,800

Income tax provision

135

to

125

Stock-based compensation expense

100

to

110

Other, including other operating expenses,

interest income, gain (loss) on retirement of long-term obligations

and other income (expense)

85

to

65

Adjusted EBITDA

$

4,490

to

$

4,570

Reconciliation of Outlook for

Consolidated AFFO to Net income: ($ in millions, totals may not

add due to rounding.)

Full Year 2019

Net income

$

1,590

to

$

1,660

Straight-line revenue

(15

)

—

(15

)

Straight-line expense

42

—

42

Depreciation, amortization and

accretion

1,760

to

1,800

Stock-based compensation expense

100

to

110

Deferred portion of income tax

3

—

3

Other, including other operating expense,

amortization of deferred financing costs, capitalized interest,

debt discounts and premiums, gain (loss) on retirement of long-term

obligations, other income (expense), long-term deferred interest

charges and distributions to minority interests

140

to

110

Capital improvement capital

expenditures

(150

)

to

(170

)

Corporate capital expenditures

(10

)

—

(10

)

Consolidated AFFO

$

3,460

to

$

3,530

Conference Call Information American Tower will host a

conference call today at 8:30 a.m. ET to discuss its financial

results for the quarter ended June 30, 2019 and its updated outlook

for 2019. Supplemental materials for the call will be available on

the Company’s website, www.americantower.com. The conference call dial-in

numbers are as follows:

U.S./Canada dial-in: (800) 260-0718

International dial-in: (612) 288-0318 Passcode: 469119

When available, a replay of the call can be accessed until 11:59

p.m. ET on August 14, 2019. The replay dial-in numbers are as

follows:

U.S./Canada dial-in: (800) 475-6701

International dial-in: (320) 365-3844 Passcode: 469119

American Tower will also sponsor a live simulcast and replay of

the call on its website, www.americantower.com.

About American Tower American Tower, one of the largest

global REITs, is a leading independent owner, operator and

developer of multitenant communications real estate with a

portfolio of approximately 171,000 communications sites. For more

information about American Tower, please visit the “Earnings

Materials” and “Company & Industry Resources” sections of our

investor relations website at www.americantower.com.

Non-GAAP and Defined Financial Measures In addition to

the results prepared in accordance with generally accepted

accounting principles in the United States (GAAP) provided

throughout this press release, the Company has presented the

following Non-GAAP and Defined Financial Measures: Gross Margin,

Operating Profit, Operating Profit Margin, Adjusted EBITDA,

Adjusted EBITDA Margin, Nareit Funds From Operations (FFO)

attributable to American Tower Corporation common stockholders,

Consolidated Adjusted Funds From Operations (AFFO), AFFO

attributable to American Tower Corporation common stockholders,

Consolidated AFFO per Share, AFFO attributable to American Tower

Corporation common stockholders per Share, Free Cash Flow, Net

Debt, Net Leverage Ratio and Indian Carrier Consolidation-Driven

Churn (ICCC). In addition, the Company presents: Tenant Billings,

Tenant Billings Growth, Organic Tenant Billings Growth and New Site

Tenant Billings Growth.

These measures are not intended to replace financial performance

measures determined in accordance with GAAP. Rather, they are

presented as additional information because management believes

they are useful indicators of the current financial performance of

the Company's core businesses and are commonly used across its

industry peer group. As outlined in detail below, the Company

believes that these measures can assist in comparing company

performance on a consistent basis irrespective of depreciation and

amortization or capital structure, while also providing valuable

incremental insight into the underlying operating trends of its

business.

Depreciation and amortization can vary significantly among

companies depending on accounting methods, particularly where

acquisitions or non-operating factors, including historical cost

basis, are involved. The Company's Non-GAAP and Defined Financial

Measures may not be comparable to similarly titled measures used by

other companies.

Revenue Components

In addition to reporting total revenue, the Company believes

that providing transparency around the components of its revenue

provides investors with insight into the indicators of the

underlying demand for, and operating performance of, its real

estate portfolio. Accordingly, the Company has provided disclosure

of the following revenue components: (i) Tenant Billings, (ii) New

Site Tenant Billings; (iii) Organic Tenant Billings; (iv)

International pass-through revenue; (v) Straight-line revenue; (vi)

Pre-paid amortization revenue; (vii) Foreign currency exchange

impact; and (viii) Other revenue.

Tenant Billings: The majority of the Company’s revenue is

generated from non-cancellable, long-term tenant leases. Revenue

from Tenant Billings reflects several key aspects of the Company’s

real estate business: (i) “colocations/amendments” reflects new

tenant leases for space on existing sites and amendments to

existing leases to add additional tenant equipment; (ii)

“escalations” reflects contractual increases in billing rates,

which are typically tied to fixed percentages or a variable

percentage based on a consumer price index; (iii) “cancellations”

reflects the impact of tenant lease terminations or non-renewals

or, in limited circumstances, when the lease rates on existing

leases are reduced; and (iv) “new sites” reflects the impact of new

property construction and acquisitions.

New Site Tenant Billings: Day-one Tenant Billings

associated with sites that have been built or acquired since the

beginning of the prior-year period. Incremental

colocations/amendments, escalations or cancellations that occur on

these sites after the date of their addition to our portfolio are

not included in New Site Tenant Billings. The Company believes

providing New Site Tenant Billings enhances an investor’s ability

to analyze the Company’s existing real estate portfolio growth as

well as its development program growth, as the Company’s

construction and acquisition activities can drive variability in

growth rates from period to period.

Organic Tenant Billings: Tenant Billings on sites that

the Company has owned since the beginning of the prior-year period,

as well as Tenant Billings activity on new sites that occurred

after the date of their addition to the Company’s portfolio.

International pass-through revenue: A portion of the

Company’s pass-through revenue is based on power and fuel expense

reimbursements and therefore subject to fluctuations in fuel

prices. As a result, revenue growth rates may fluctuate depending

on the market price for fuel in any given period, which is not

representative of the Company’s real estate business and its

economic exposure to power and fuel costs. Furthermore, this

expense reimbursement mitigates the economic impact associated with

fluctuations in operating expenses, such as power and fuel costs

and land rents in certain of the Company’s markets. As a result,

the Company believes that it is appropriate to provide insight into

the impact of pass-through revenue on certain revenue growth

rates.

Straight-line revenue: Under GAAP, the Company recognizes

revenue on a straight-line basis over the term of the contract for

certain of its tenant leases. Due to the Company’s significant base

of non-cancellable, long-term tenant leases, this can result in

significant fluctuations in growth rates upon tenant lease signings

and renewals (typically increases), when amounts billed or received

upfront upon these events are initially deferred. These signings

and renewals are only a portion of the Company’s underlying

business growth and can distort the underlying performance of our

Tenant Billings Growth. As a result, the Company believes that it

is appropriate to provide insight into the impact of straight-line

revenue on certain growth rates in revenue and select other

measures.

Pre-paid amortization revenue: The Company recovers a

portion of the costs it incurs for the redevelopment and

development of its properties from its tenants. These upfront

payments are then amortized over the initial term of the

corresponding tenant lease. Given this amortization is not

necessarily directly representative of underlying leasing activity

on its real estate portfolio, (i.e. does not have a renewal option

or escalation as our tenant leases do) the Company believes that it

is appropriate to provide insight into the impact of pre-paid

amortization revenue on certain revenue growth rates to provide

transparency into the underlying performance of our real estate

business.

Foreign currency exchange impact: The majority of the

Company’s international revenue and operating expenses are

denominated in each country’s local currency. As a result, foreign

currency fluctuations may distort the underlying performance of our

real estate business from period to period, depending on the

movement of foreign currency exchange rates versus the U.S. Dollar.

The Company believes it is appropriate to quantify the impact of

foreign currency exchange rate fluctuations on its reported growth

to provide transparency into the underlying performance of its real

estate business.

Other revenue: Other revenue represents revenue not

captured by the above listed items and can include items such as

tenant settlements and fiber solutions revenue.

Non-GAAP and Defined Financial Measure

Definitions

Tenant Billings Growth: The increase or decrease

resulting from a comparison of Tenant Billings for a current period

with Tenant Billings for the corresponding prior-year period, in

each case adjusted for foreign currency exchange rate fluctuations.

The Company believes this measure provides valuable insight into

the growth in recurring Tenant Billings and underlying demand for

its real estate portfolio.

Organic Tenant Billings Growth: The portion of Tenant

Billings Growth attributable to Organic Tenant Billings. The

Company believes that organic growth is a useful measure of its

ability to add tenancy and incremental revenue to its assets for

the reported period, which enables investors and analysts to gain

additional insight into the relative attractiveness, and therefore

the value, of the Company’s property assets.

New Site Tenant Billings Growth: The portion of Tenant

Billings Growth attributable to New Site Tenant Billings. The

Company believes this measure provides valuable insight into the

growth attributable to Tenant Billings from recently acquired or

constructed properties.

Indian Carrier Consolidation-Driven Churn (ICCC): Tenant

cancellations specifically attributable to short-term carrier

consolidation in India. Includes impacts of carrier exits from the

marketplace and carrier cancellations as a result of consolidation,

but excludes normal course churn. The Company believes that

providing this additional metric enhances transparency and provides

a better understanding of its recurring business without the impact

of what it believes to be a transitory event.

Gross Margin: Revenues less operating expenses, excluding

stock-based compensation expense recorded in costs of operations,

depreciation, amortization and accretion, selling, general,

administrative and development expense and other operating

expenses. The Company believes this measure provides valuable

insight into the site-level profitability of its assets.

Operating Profit: Gross Margin less selling, general,

administrative and development expense, excluding stock-based

compensation expense and corporate expenses. The Company believes

this measure provides valuable insight into the site-level

profitability of its assets while also taking into account the

overhead expenses required to manage each of its operating

segments.

For segment reporting purposes, in periods through the third

quarter of 2018, the Latin America property segment Operating

Profit and Gross Margin also include interest income (expense), TV

Azteca, net. Operating Profit and Gross Margin are before interest

income, interest expense, gain (loss) on retirement of long-term

obligations, other income (expense), net income (loss) attributable

to noncontrolling interest and income tax benefit (provision).

Operating Profit Margin: The percentage that results from

dividing Operating Profit by revenue.

Adjusted EBITDA: Net income before income (loss) from

equity method investments, income tax benefit (provision), other

income (expense), gain (loss) on retirement of long-term

obligations, interest expense, interest income, other operating

income (expense), depreciation, amortization and accretion and

stock-based compensation expense. The Company believes this measure

provides valuable insight into the profitability of its operations

while at the same time taking into account the central overhead

expenses required to manage its global operations. In addition, it

is a widely used performance measure across the telecommunications

real estate sector.

Adjusted EBITDA Margin: The percentage that results from

dividing Adjusted EBITDA by total revenue.

Nareit Funds From Operations (FFO), as defined by the

National Association of Real Estate Investment Trusts (Nareit),

attributable to American Tower Corporation common stockholders:

Net income before gains or losses from the sale or disposal of real

estate, real estate related impairment charges, real estate related

depreciation, amortization and accretion and dividends on preferred

stock, and including adjustments for (i) unconsolidated affiliates

and (ii) noncontrolling interests. The Company believes this

measure provides valuable insight into the operating performance of

its property assets by excluding the charges described above,

particularly depreciation expenses, given the high initial,

up-front capital intensity of the Company’s operating model. In

addition, it is a widely used performance measure across the

telecommunications real estate sector.

Consolidated Adjusted Funds From Operations (AFFO):

Nareit FFO attributable to American Tower Corporation common

stockholders before (i) straight-line revenue and expense, (ii)

stock-based compensation expense, (iii) the deferred portion of

income tax, (iv) non-real estate related depreciation, amortization

and accretion, (v) amortization of deferred financing costs,

capitalized interest, debt discounts and premiums and long-term

deferred interest charges, (vi) other income (expense), (vii) gain

(loss) on retirement of long-term obligations, (viii) other

operating income (expense), and adjustments for (ix) unconsolidated

affiliates and (x) noncontrolling interests, less cash payments

related to capital improvements and cash payments related to

corporate capital expenditures. The Company believes this measure

provides valuable insight into the operating performance of its

property assets by further adjusting the Nareit FFO attributable to

American Tower Corporation common stockholders metric to exclude

the factors outlined above, which if unadjusted, may cause material

fluctuations in Nareit FFO attributable to American Tower

Corporation common stockholders growth from period to period that

would not be representative of the underlying performance of the

Company’s property assets in those periods. In addition, it is a

widely used performance measure across the telecommunications real

estate sector.

Adjusted Funds From Operations (AFFO) attributable to

American Tower Corporation common stockholders: Consolidated

AFFO, excluding the impact of noncontrolling interests on both

Nareit FFO attributable to American Tower Corporation common

stockholders and the other line items included in the calculation

of Consolidated AFFO. The Company believes that providing this

additional metric enhances transparency, given the minority

interests in its Indian and European businesses.

Consolidated AFFO per Share: Consolidated AFFO divided by

the diluted weighted average common shares outstanding.

AFFO attributable to American Tower Corporation common

stockholders per Share: AFFO attributable to American Tower

Corporation common stockholders divided by the diluted weighted

average common shares outstanding.

Free Cash Flow: Cash provided by operating activities

less total cash capital expenditures, including payments on finance

leases and perpetual land easements. The Company believes that Free

Cash Flow is useful to investors as the basis for comparing our

performance and coverage ratios with other companies in its

industry, although this measure of Free Cash Flow may not be

directly comparable to similar measures used by other

companies.

Net Debt: Total long-term debt, including current portion

and finance lease liabilities, less cash and cash equivalents.

Net Leverage Ratio: Net Debt divided by the quarter’s

annualized Adjusted EBITDA (the quarter’s Adjusted EBITDA

multiplied by four). The Company believes that including this

calculation is important for investors and analysts given it is a

critical component underlying its credit agency ratings.

Cautionary Language Regarding Forward-Looking Statements

This press release contains “forward-looking statements” concerning

our goals, beliefs, expectations, strategies, objectives, plans,

future operating results and underlying assumptions and other

statements that are not necessarily based on historical facts.

Examples of these statements include, but are not limited to,

statements regarding our full year 2019 outlook and other targets,

our expectations regarding Indian Carrier Consolidation-Driven

Churn (ICCC) and factors that could affect such expectations,

foreign currency exchange rates, our expectations for the closing

of signed acquisitions, our expectations for the redemption of

shares in ATC TIPL and our expectations regarding the leasing

demand for communications real estate. Actual results may differ

materially from those indicated in our forward-looking statements

as a result of various important factors, including: (1) a

significant decrease in leasing demand for our communications

infrastructure would materially and adversely affect our business

and operating results, and we cannot control that demand; (2)

increasing competition within our industry may materially and

adversely affect our revenue; (3) if our tenants consolidate their

operations, exit the telecommunications business or share site

infrastructure to a significant degree, our growth, revenue and

ability to generate positive cash flows could be materially and

adversely affected; (4) our business is subject to government and

tax regulations and changes in current or future laws or

regulations could restrict our ability to operate our business as

we currently do or impact our competitive landscape; (5) our

foreign operations are subject to economic, political and other

risks that could materially and adversely affect our revenues or

financial position, including risks associated with fluctuations in

foreign currency exchange rates; (6) a substantial portion of our

revenue is derived from a small number of tenants, and we are

sensitive to changes in the creditworthiness and financial strength

of our tenants; (7) our expansion initiatives involve a number of

risks and uncertainties, including those related to integrating

acquired or leased assets, that could adversely affect our

operating results, disrupt our operations or expose us to

additional risk; (8) new technologies or changes in our or a

tenant’s business model could make our tower leasing business less

desirable and result in decreasing revenues and operating results;

(9) competition for assets could adversely affect our ability to

achieve our return on investment criteria; (10) our leverage and

debt service obligations may materially and adversely affect our

ability to raise additional financing to fund capital expenditures,

future growth and expansion initiatives and to satisfy our

distribution requirements; (11) if we fail to remain qualified for

taxation as a REIT, we will be subject to tax at corporate income

tax rates, which may substantially reduce funds otherwise

available, and even if we qualify for taxation as a REIT, we may

face tax liabilities that impact earnings and available cash flow;

(12) complying with REIT requirements may limit our flexibility or

cause us to forego otherwise attractive opportunities; (13)

restrictive covenants in the agreements related to our

securitization transactions, our credit facilities and our debt

securities could materially and adversely affect our business by

limiting flexibility, and we may be prohibited from paying

dividends on our common stock, which may jeopardize our

qualification for taxation as a REIT; (14) our towers, fiber

networks, data centers or computer systems may be affected by

natural disasters, security breaches and other unforeseen events

for which our insurance may not provide adequate coverage; (15) our

costs could increase and our revenues could decrease due to

perceived health risks from radio emissions, especially if these

perceived risks are substantiated; (16) we could have liability

under environmental and occupational safety and health laws; (17)

if we are unable to protect our rights to the land under our

towers, it could adversely affect our business and operating

results; and (18) if we are unable or choose not to exercise our

rights to purchase towers that are subject to lease and sublease

agreements at the end of the applicable period, our cash flows

derived from those towers will be eliminated. For additional

information regarding factors that may cause actual results to

differ materially from those indicated in our forward-looking

statements, we refer you to the information contained in Item 1A of

our Form 10-K for the year ended December 31, 2018, under the

caption “Risk Factors”. We undertake no obligation to update the

information contained in this press release to reflect subsequently

occurring events or circumstances.

UNAUDITED CONSOLIDATED BALANCE

SHEETS (In millions)

June 30, 2019

December 31, 2018

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

1,192.2

$

1,208.7

Restricted cash

93.8

96.2

Accounts receivable, net

459.5

459.0

Prepaid and other current assets

486.9

621.2

Total current assets

2,232.4

2,385.1

PROPERTY AND EQUIPMENT, net

11,268.6

11,247.1

GOODWILL

5,557.8

5,501.9

OTHER INTANGIBLE ASSETS, net

10,895.2

11,174.3

DEFERRED TAX ASSET

147.8

157.7

DEFERRED RENT ASSET

1,597.1

1,581.7

RIGHT-OF-USE ASSET(1)

7,110.0

—

NOTES RECEIVABLE AND OTHER NON-CURRENT

ASSETS

263.8

962.6

TOTAL

$

39,072.7

$

33,010.4

LIABILITIES

CURRENT LIABILITIES:

Accounts payable

$

144.9

$

130.8

Accrued expenses

835.6

948.3

Distributions payable

413.0

377.4

Accrued interest

154.2

174.5

Current portion of operating lease

liability(1)

496.9

—

Current portion of long-term

obligations

2,442.2

2,754.8

Unearned revenue

334.8

304.1

Total current liabilities

4,821.6

4,689.9

LONG-TERM OBLIGATIONS

18,615.9

18,405.1

OPERATING LEASE LIABILITY(1)

6,335.4

—

ASSET RETIREMENT OBLIGATIONS

1,252.3

1,210.0

DEFERRED TAX LIABILITY

546.2

535.9

OTHER NON-CURRENT LIABILITIES

868.0

1,265.1

Total liabilities

32,439.4

26,106.0

COMMITMENTS AND CONTINGENCIES

REDEEMABLE NONCONTROLLING

INTERESTS

590.2

1,004.8

EQUITY:

Common stock

4.5

4.5

Additional paid-in capital

10,492.7

10,380.8

Distributions in excess of earnings

(1,206.2

)

(1,199.5

)

Accumulated other comprehensive loss

(2,606.7

)

(2,642.9

)

Treasury stock

(1,206.8

)

(1,206.8

)

Total American Tower Corporation

equity

5,477.5

5,336.1

Noncontrolling interests

565.6

563.5

Total equity

6,043.1

5,899.6

TOTAL

$

39,072.7

$

33,010.4

_______________

(1)

Reflects the new lease accounting standard

requiring a right-of-use model.

UNAUDITED CONSOLIDATED STATEMENTS OF

OPERATIONS (In millions, except share and per share data)

Three Months Ended June

30,

Six Months Ended June

30,

2019

2018

2019

2018

REVENUES:

Property

$

1,848.9

$

1,749.4

$

3,634.9

$

3,459.8

Services

40.7

31.5

68.1

62.9

Total operating revenues

1,889.6

1,780.9

3,703.0

3,522.7

OPERATING EXPENSES:

Costs of operations (exclusive of items

shown separately below):

Property(1)

549.4

547.2

1,082.4

1,054.6

Services(1)

13.9

13.1

24.3

25.6

Depreciation, amortization and

accretion

448.9

449.7

885.8

896.0

Selling, general, administrative and

development expense(1)(2)

164.8

157.9

362.9

362.8

Other operating expenses(3)

28.7

67.0

48.8

234.8

Total operating expenses

1,205.7

1,234.9

2,404.2

2,573.8

OPERATING INCOME

683.9

546.0

1,298.8

948.9

OTHER INCOME (EXPENSE):

Interest expense, TV Azteca

—

(3.4

)

—

(0.7

)

Interest income

11.7

18.4

24.1

33.8

Interest expense

(204.5

)

(207.9

)

(412.0

)

(407.5

)

Loss on retirement of long-term

obligations

(22.1

)

—

(22.2

)

—

Other (expense) income (including foreign

currency (losses) gains of $(5.3), $(40.4), $14.8 and $(17.1),

respectively)

(5.1

)

(34.8

)

16.8

(7.0

)

Total other expense

(220.0

)

(227.7

)

(393.3

)

(381.4

)

INCOME FROM CONTINUING OPERATIONS BEFORE

INCOME TAXES

463.9

318.3

905.5

567.5

Income tax (provision) benefit(4)

(29.6

)

(3.9

)

(63.6

)

27.2

NET INCOME

434.3

314.4

841.9

594.7

Net income attributable to noncontrolling

interests

(5.2

)

(7.7

)

(15.4

)

(2.8

)

NET INCOME ATTRIBUTABLE TO AMERICAN TOWER

CORPORATION STOCKHOLDERS

429.1

306.7

826.5

591.9

Dividends on preferred stock

—

—

—

(9.4

)

NET INCOME ATTRIBUTABLE TO AMERICAN TOWER

CORPORATION COMMON STOCKHOLDERS

$

429.1

$

306.7

$

826.5

$

582.5

NET INCOME PER COMMON SHARE AMOUNTS:

Basic net income attributable to American

Tower Corporation common stockholders

$

0.97

$

0.69

$

1.87

$

1.33

Diluted net income attributable to

American Tower Corporation common stockholders

$

0.96

$

0.69

$

1.86

$

1.32

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING

(in thousands):

BASIC

442,203

441,497

441,778

438,328

DILUTED

445,337

444,362

445,040

441,513

_______________

(1)

Property costs of operations, services

costs of operations and selling, general, administrative and

development expense include stock-based compensation expense in

aggregate amounts of $21.9 million and $64.4 million for the three

and six months ended June 30, 2019, respectively, and $24.8 million

and $67.5 million for the three and six months ended June 30, 2018,

respectively.

(2)

Six months ended June 30, 2018 includes

approximately $29 million of bad debt expense, primarily associated

with Aircel’s bankruptcy in India.

(3)

Three and six months ended June 30, 2018

reflect impairment charges of approximately $33 million and $181

million, respectively, primarily related to assets in India,

partially offset by an income tax benefit in India. The portion of

these items attributable to American Tower Corporation common

stockholders for the three and six months ended June 30, 2018 was

approximately $11 million and $70 million, respectively.

(4)

Six months ended June 30, 2018 includes

income tax benefit in India.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (In millions)

Six Months Ended June

30,

2019

2018

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income

$

841.9

$

594.7

Adjustments to reconcile net income to

cash provided by operating activities:

Depreciation, amortization and

accretion

885.8

896.0

Amortization of operating leases(1)

298.8

—

Stock-based compensation expense

64.4

67.5

Loss on early retirement of long-term

obligations

22.2

—

Other non-cash items reflected in

statements of operations

86.5

206.0

Increase in net deferred rent balances

(11.0

)

(10.7

)

Reduction in operating lease

liability(1)

(259.3

)

—

Increase in assets

(52.4

)

(68.9

)

(Decrease) increase in liabilities

(55.2

)

47.2

Cash provided by operating activities

1,821.7

1,731.8

CASH FLOWS FROM INVESTING ACTIVITIES:

Payments for purchase of property and

equipment and construction activities

(464.3

)

(424.9

)

Payments for acquisitions, net of cash

acquired

(134.5

)

(1,336.5

)

Proceeds from sales of short-term

investments and other non-current assets

368.7

894.5

Payments for short-term investments

(355.9

)

(952.8

)

Deposits and other

(4.7

)

(23.3

)

Cash used for investing activities

(590.7

)

(1,843.0

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Borrowings under credit facilities

2,620.0

2,663.3

Proceeds from issuance of senior notes,

net

3,529.7

584.9

Proceeds from term loan

1,300.0

1,500.0

Proceeds from issuance of securities in

securitization transaction

—

500.0

Repayments of notes payable, credit

facilities, senior notes, secured debt, term loan, finance leases

and capital leases(2)

(7,413.2

)

(4,257.4

)

Distributions to noncontrolling interest

holders, net

(14.0

)

(13.9

)

Purchases of common stock

—

(98.6

)

Proceeds from stock options and employee

stock purchase plan

56.6

40.2

Payment for early retirement of long-term

obligations

(21.0

)

—

Deferred financing costs and other

financing activities(3)

(104.7

)

(55.1

)

Purchase of redeemable noncontrolling

interest

(425.7

)

—

Purchase of noncontrolling interest

—

(20.5

)

Distributions paid on preferred stock

—

(18.9

)

Distributions paid on common stock

(775.1

)

(635.6

)

Cash (used for) provided by financing

activities

(1,247.4

)

188.4

Net effect of changes in foreign currency

exchange rates on cash and cash equivalents, and restricted

cash

(2.5

)

(62.0

)

NET (DECREASE) INCREASE IN CASH AND CASH

EQUIVALENTS, AND RESTRICTED CASH

(18.9

)

15.2

CASH AND CASH EQUIVALENTS, AND RESTRICTED

CASH, BEGINNING OF PERIOD

1,304.9

954.9

CASH AND CASH EQUIVALENTS, AND RESTRICTED

CASH, END OF PERIOD

$

1,286.0

$

970.1

CASH PAID FOR INCOME TAXES, NET

$

77.9

$

44.6

CASH PAID FOR INTEREST

$

419.3

$

382.5

_______________

(1)

Reflects the new lease accounting standard

requiring a right-of-use model.

(2)

Six months ended June 30, 2019 includes

$4.5 million of finance lease payments. Six months ended June 30,

2018 includes $16.0 million of payments on capital leases of

property and equipment.

(3)

Six months ended June 30, 2019 includes

$15.0 million of perpetual land easement payments.

UNAUDITED CONSOLIDATED RESULTS FROM

OPERATIONS, BY SEGMENT ($ in millions, totals may not add due

to rounding.)

Three Months Ended June 30,

2019

Property

Services

Total

U.S.

Latin America

Asia(1)

EMEA

Total International

Total Property

Segment revenues

$

1,007

$

346

$

321

$

175

$

842

$

1,849

$

41

$

1,890

Segment operating expenses(2)

197

104

188

61

352

549

14

563

Segment Gross Margin

$

811

$

242

$

133

$

114

$

489

$

1,300

$

27

$

1,327

Segment SG&A(2)

42

24

18

20

62

104

2

106

Segment Operating Profit

$

768

$

218

$

115

$

94

$

428

$

1,196

$

25

$

1,221

Segment Operating Profit Margin

76

%

63

%

36

%

54

%

51

%

65

%

61

%

65

%

Revenue Growth

5.3

%

8.7

%

4.3

%

5.0

%

6.2

%

5.7

%

29.2

%

6.1

%

Total Tenant Billings Growth

7.8

%

8.9

%

(13.7

)%

12.3

%

1.9

%

5.6

%

Organic Tenant Billings Growth

7.5

%

7.3

%

(23.8

)%

7.2

%

(3.6

)%

3.4

%

Revenue Components(3)

Prior-Year Tenant Billings

$

898

$

215

$

184

$

129

$

528

$

1,426

Colocations/Amendments

52

10

18

4

33

85

Escalations

29

11

3

6

20

49

Cancellations

(12

)

(7

)

(66

)

(3

)

(75

)

(87

)

Other

(1

)

1

0

2

4

2

Organic Tenant Billings

$

965

$

231

$

140

$

138

$

510

$

1,475

New Site Tenant Billings

2

3

19

7

29

31

Total Tenant Billings

$

967

$

235

$

159

$

144

$

538

$

1,506

Foreign Currency Exchange Impact(4)

—

(13

)

(6

)

(9

)

(29

)

(29

)

Total Tenant Billings (Current Period)

$

967

$

222

$

153

$

135

$

510

$

1,477

Straight-Line Revenue

(4

)

6

3

1

10

6

Prepaid Amortization Revenue

26

1

—

1

2

29

Other Revenue

18

40

19

3

62

80

International Pass-Through Revenue

—

82

153

37

272

272

Foreign Currency Exchange Impact(5)

—

(5

)

(7

)

(2

)

(14

)

(14

)

Total Property Revenue (Current

Period)

$

1,007

$

346

$

321

$

175

$

842

$

1,849

_______________

(1)

Inclusive of the negative impacts of ICCC.

See quarterly supplemental materials package for additional

detail.

(2)

Excludes stock-based compensation

expense.

(3)

All components of revenue, except those

labeled current period, have been translated at prior-period

foreign currency exchange rates.

(4)

Reflects foreign currency exchange impact

on all components of Total Tenant Billings.

(5)

Reflects foreign currency exchange impact on components of revenue,

other than Total Tenant Billings.

UNAUDITED CONSOLIDATED RESULTS FROM

OPERATIONS, BY SEGMENT (CONTINUED) ($ in millions, totals may

not add due to rounding.)

Three Months Ended June 30,

2018

Property

Services

Total

U.S.

Latin America

Asia(1)

EMEA

Total International

Total Property

Segment revenues

$

957

$

318

$

308

$

167

$

792

$

1,749

$

32

$

1,781

Segment operating expenses(2)

199

109

180

59

348

547

13

560

Interest expense, TV Azteca, net(3)

—

(3

)

—

—

(3

)

(3

)

—

(3

)

Segment Gross Margin

$

758

$

205

$

128

$

108

$

441

$

1,199

$

19

$

1,218

Segment SG&A(2)

44

19

15

18

52

96

3

99

Segment Operating Profit

$

714

$

186

$

113

$

91

$

389

$

1,104

$

16

$

1,119

Segment Operating Profit Margin

75

%

59

%

37

%

54

%

49

%

63

%

50

%

63

%

Revenue Growth

6.7

%

10.8

%

4.5

%

4.4

%

7.0

%

6.8

%

29.1

%

7.1

%

Total Tenant Billings Growth

8.1

%

16.0

%

6.6

%

8.0

%

10.7

%

9.1

%

Organic Tenant Billings Growth

7.4

%

12.4

%

(10.2

)%

6.8

%

2.9

%

5.7

%

Revenue Components(4)

Prior-Year Tenant Billings

$

830

$

198

$

179

$

119

$

497

$

1,327

Colocations/Amendments

46

14

11

4

29

76

Escalations

26

11

3

6

20

46

Cancellations

(10

)

(2

)

(33

)

(2

)

(37

)

(47

)

Other

(1

)

2

0

(0

)

2

1

Organic Tenant Billings

$

891

$

223

$

161

$

127

$

511

$

1,402

New Site Tenant Billings

6

7

30

1

39

45

Total Tenant Billings

$

898

$

230

$

191

$

129

$

550

$

1,447

Foreign Currency Exchange Impact(5)

—

(15

)

(6

)

(0

)

(21

)

(21

)

Total Tenant Billings (Current Period)

$

898

$

216

$

184

$

129

$

528

$

1,426

Straight-Line Revenue

13

9

4

2

15

28

Prepaid Amortization Revenue

24

1

—

0

1

25

Other Revenue

23

17

(7

)

1

12

35

International Pass-Through Revenue

—

83

130

35

249

249

Foreign Currency Exchange Impact(6)

—

(7

)

(5

)

(1

)

(12

)

(12

)

Total Property Revenue (Current

Period)

$

957

$

318

$

308

$

167

$

792

$

1,749

_______________

(1)

Inclusive of the negative impacts of ICCC.

See quarterly supplemental materials package for additional

detail.

(2)

Excludes stock-based compensation

expense.

(3)

Represents reversal of interest income

recognized in the prior period due to nonpayment. The Company

subsequently signed a new agreement with TV Azteca which

extinguished this note.

(4)

All components of revenue, except those

labeled current period, have been translated at prior-period

foreign currency exchange rates.

(5)

Reflects foreign currency exchange impact

on all components of Total Tenant Billings.

(6)

Reflects foreign currency exchange impact on components of revenue,

other than Total Tenant Billings.

UNAUDITED SELECTED CONSOLIDATED

FINANCIAL INFORMATION

($ in millions, totals may not add due to

rounding.)

The reconciliation of Adjusted EBITDA

to net income and the calculation of Adjusted EBITDA Margin are as

follows:

Three Months Ended June

30,

2019(1)

2018(1)

Net income

$

434.3

$

314.4

Income tax provision

29.6

3.9

Other expense

5.1

34.8

Loss on retirement of long-term

obligations

22.1

—

Interest expense

204.5

207.9

Interest income

(11.7

)

(18.4

)

Other operating expenses

28.7

67.0

Depreciation, amortization and

accretion

448.9

449.7

Stock-based compensation expense

21.9

24.8

Adjusted EBITDA

$

1,183.4

$

1,084.1

Total revenue

1,889.6

1,780.9

Adjusted EBITDA Margin

63

%

61

%

The reconciliation of Nareit FFO

attributable to American Tower Corporation common stockholders to

net income and the calculation of Consolidated AFFO, Consolidated

AFFO per Share, AFFO attributable to American Tower Corporation

common stockholders and AFFO attributable to American Tower

Corporation common stockholders per Share are as follows:

Three Months Ended June

30,

2019(1)

2018(1)

Net income

$

434.3

$

314.4

Real estate related depreciation,

amortization and accretion

400.7

400.1

Losses from sale or disposal of real

estate and real estate related impairment charges(2)

24.4

56.7

Adjustments for unconsolidated affiliates

and noncontrolling interests

(30.8

)

(60.2

)

Nareit FFO attributable to AMT common

stockholders

$

828.6

$

711.0

Straight-line revenue

(5.7

)

(27.5

)

Straight-line expense

12.0

20.6

Stock-based compensation expense

21.9

24.8

Deferred portion of income tax(3)

(11.4

)

(16.0

)

Non-real estate related depreciation,

amortization and accretion

48.2

49.6

Amortization of deferred financing costs,

capitalized interest and debt discounts and premiums and long-term

deferred interest charges

6.4

6.1

Payment of shareholder loan

interest(4)

(14.2

)

—

Other expense(5)

5.1

34.8

Loss on retirement of long-term

obligations

22.1

—

Other operating expense(6)

4.3

10.3

Capital improvement capital

expenditures

(36.4

)

(27.6

)

Corporate capital expenditures

(2.1

)

(2.3

)

Adjustments for unconsolidated affiliates

and noncontrolling interests

30.8

60.2

Consolidated AFFO

909.6

844.0

Adjustments for unconsolidated affiliates

and noncontrolling interests(7)

(16.5

)

(69.3

)

AFFO attributable to AMT common

stockholders

$

893.1

$

774.7

Divided by weighted average diluted shares

outstanding

445,337

444,362

Consolidated AFFO per Share

$

2.04

$

1.90

AFFO attributable to AMT common

stockholders per Share

$

2.01

$

1.74

_______________

(1)

Reflects the negative impacts of ICCC.

(2)

Q2 2018 includes impairment charge

of approximately $33 million.

(3)

Q2 2018 reflects income tax benefit in India

(4)

In Q2 2019, the Company made a capitalized

interest payment of approximately $14.2 million associated with the

purchase of the shareholder loan previously held by its joint

venture partner in Ghana. This long-term deferred interest was

previously expensed but excluded from Consolidated AFFO.

(5)

Q2 2019 and Q2 2018 include losses on

foreign currency exchange rate fluctuations of $5.3 million and

$40.4 million, respectively.

(6)

Primarily includes integration and acquisition-related

costs.

(7)

Includes adjustments for the impact on both Nareit FFO

attributable to American Tower Corporation common stockholders and

the other line items included in the calculation of Consolidated

AFFO.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190731005358/en/

Igor Khislavsky Vice President, Investor Relations Telephone:

(617) 375-7500

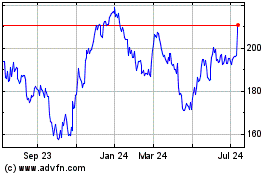

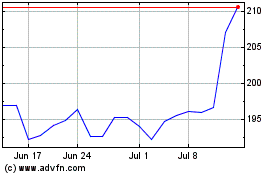

American Tower (NYSE:AMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Tower (NYSE:AMT)

Historical Stock Chart

From Apr 2023 to Apr 2024