Current Report Filing (8-k)

January 11 2022 - 8:01AM

Edgar (US Regulatory)

false 0001723128 0001723128 2022-01-11 2022-01-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 11, 2022

AMNEAL PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-38485

|

|

32-0546926

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

400 Crossing Blvd

Bridgewater, NJ 08807

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (908) 947-3120

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Class A Common Stock, par value $0.01 per share

|

|

AMRX

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02

|

Results of Operations and Financial Condition

|

In connection with a presentation to be made at an investor conference on January 12, 2022, Amneal Pharmaceuticals, Inc., a Delaware corporation (the “Company”), reaffirms previously issued guidance with respect to the year ended December 31, 2021, which was previously issued on November 3, 2021 in connection with the Company’s third quarter 2021 results:

|

|

|

|

|

|

|

Full Year 2021 Financial Guidance

|

|

Net revenue

|

|

Approximately $2.1 billion

|

|

Adjusted EBITDA (1)

|

|

$530 million - $550 million

|

|

Adjusted diluted EPS (2)

|

|

$0.78 - $0.88

|

|

Operating cash flow

|

|

$220 million - $250 million

|

|

Capital expenditures

|

|

$50 million - $60 million

|

|

Weighted average diluted shares outstanding (3)

|

|

Approximately 304 million

|

|

(1)

|

Includes 100% of EBITDA from the AvKARE acquisition.

|

|

(2)

|

Accounts for 35% non-controlling interest in AvKARE and reflects the current federal tax rate of 21%.

|

|

(3)

|

Assumes the weighted average diluted shares outstanding of class A and class B common stock under the if-converted method.

|

The Company cannot provide a reconciliation of projected adjusted EBITDA to projected net income, nor a reconciliation of projected adjusted diluted EPS to projected EPS under U.S. generally accepted accounting principles (“GAAP”), without unreasonable efforts because it is unable to predict with reasonable certainty the ultimate outcome of certain significant items required for the reconciliation as such items are subject to the completion of year- and quarter-end accounting and financial reporting processes that have not been completed. The items include, but are not limited to, acquisition-related expenses, restructuring expenses and benefits, asset impairments, charges related to legal matters and other gains and losses. These items are uncertain, depend on various factors, and could have a material impact on GAAP reported results.

The forward-looking statements herein provide projected information based on the Company’s current estimates and expectations and remain subject to change and finalization based on management’s ongoing review of results of the quarter and completion of all year- and quarter-end close processes. The Company cautions investors that if the estimates, expectations or assumptions underlying the forward-looking statements contained herein prove inaccurate or if other risks or uncertainties arise, actual results could differ materially from those expressed in, or implied by, these forward-looking statements. Other factors that could cause actual results to differ materially from the forward-looking statements contained herein are discussed under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s most recent annual report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on March 1, 2021, as updated by the subsequent Form 10-Q and periodic filings with the SEC. The Company’s forward-looking statements speak only as of the date that such statements are made, and the Company undertakes no obligation to update forward-looking statements.

Pursuant to General Instruction B.2 of Current Report on Form 8-K, the information contained in, or incorporated into, Item 2.02 and Item 7.01, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any registration statement or other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference to such filing.

|

Item 7.01

|

Regulation FD Disclosure

|

The disclosure in Item 2.02 hereof is incorporated by reference into this Item 7.01.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: January 11, 2022

|

|

|

|

AMNEAL PHARMACEUTICALS, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Anastasios Konidaris

|

|

|

|

|

|

Name:

|

|

Anastasios Konidaris

|

|

|

|

|

|

Title:

|

|

Executive Vice President and Chief Financial Officer

(Principal Financial and Accounting Officer)

|

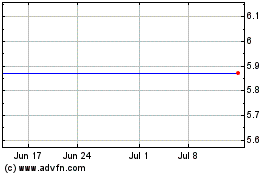

Amneal Pharmaceuticals (NYSE:AMRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

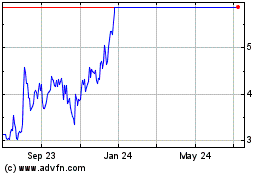

Amneal Pharmaceuticals (NYSE:AMRX)

Historical Stock Chart

From Apr 2023 to Apr 2024