Amended Statement of Beneficial Ownership (sc 13d/a)

July 19 2019 - 4:51PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)

Amneal Pharmaceuticals, Inc.

(Name of Issuer)

Class A Common Stock, par value $0.01

per share

(Titles of Class of Securities)

03168L105

(CUSIP Number)

Michael LaGatta

TPG Global, LLC

301 Commerce Street, Suite 3300

Fort Worth, TX 76102

(817) 871-4000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

July 18, 2019

(Date of Event which Requires Filing

of this Statement)

If the filing person has previously

filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule

because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note:

Schedules filed in paper

format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7(b) for other

parties to whom copies are to be sent.

(Continued on following pages)

(Page 1 of 7 Pages)

____________

*The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder

of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of

1934 (“

Act

”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all

other provisions of the Act (however,

see

the

Notes

).

|

|

|

|

|

CUSIP No.

03168L105

|

SCHEDULE 13D

|

Page

2

of

7

Pages

|

|

|

|

|

|

|

|

1

|

NAMES OF REPORTING PERSONS

TPG Group Holdings (SBS) Advisors, Inc.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a)

☐

(b)

☐

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (see instructions)

OO (See Item 3)

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF SHARES

|

7

|

SOLE VOTING POWER

- 0 -

|

|

BENEFICIALLY OWNED BY

|

8

|

SHARED VOTING POWER

16,213,367 (See Items 3, 4 and

5)

|

|

EACH REPORTING PERSON

|

9

|

SOLE DISPOSITIVE POWER

- 0 -

|

|

WITH

|

10

|

SHARED DISPOSITIVE POWER

16,213,367 (See Items 3, 4 and 5)

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

16,213,367 (See Items 3, 4 and 5)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) ☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

12.7% (See Item 5)*

|

|

14

|

TYPE OF REPORTING PERSON

CO

|

|

|

*

|

The calculation is based on a total of 127,893,017 Class A Shares (as defined herein) outstanding as of April 30, 2019,

as reported in the Quarterly Report on Form 10-Q filed by the Issuer with the Securities and Exchange Commission (the “

Commission

”)

on May 9, 2019, after giving effect to the Conversion (as defined herein).

|

CUSIP No.

03168L105

|

SCHEDULE 13D

|

Page

6

of

7

Pages

|

|

1

|

NAMES OF REPORTING PERSONS

David Bonderman

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a)

☐

(b)

☐

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (see instructions)

OO (See Item 3)

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

|

NUMBER OF SHARES

|

7

|

SOLE VOTING POWER

-0-

|

|

BENEFICIALLY OWNED BY

|

8

|

SHARED VOTING POWER

16,213,367 (See Items 3, 4 and 5)

|

|

EACH REPORTING PERSON

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

WITH

|

10

|

SHARED DISPOSITIVE POWER

16,213,367 (See Items 3, 4 and 5)

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

16,213,367 (See Items 3, 4 and 5)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

12.7% (See Item 5)*

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

|

|

|

|

|

|

*

|

The calculation is based on a total of 127,893,017 Class A Shares outstanding as of April 30, 2019, as reported in the

Quarterly Report on Form 10-Q filed by the Issuer with the Commission on May 9, 2019, after giving effect to the Conversion.

|

|

CUSIP No.

03168L105

|

SCHEDULE 13D

|

Page

7

of

7

Pages

|

.

|

1

|

NAMES OF REPORTING PERSONS

James G. Coulter

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a)

☐

(b)

☐

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (see instructions)

OO (See Item 3)

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

|

NUMBER OF SHARES

|

7

|

SOLE VOTING POWER

-0-

|

|

BENEFICIALLY OWNED BY

|

8

|

SHARED VOTING POWER

16,213,367 (See Items 3, 4 and 5)

|

|

EACH REPORTING PERSON

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

WITH

|

10

|

SHARED DISPOSITIVE POWER

16,213,367 (See Items 3, 4 and 5)

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

16,213,367 (See Items 3, 4 and 5)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

12.7% (See Item 5)*

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

|

|

|

|

|

|

*

|

The calculation is based on a total of 127,893,017 Class A Shares outstanding as of April 30, 2019, as reported in the

Quarterly Report on Form 10-Q filed by the Issuer with the Commission on May 9, 2019, after giving effect to the Conversion.

|

This Amendment No. 1 (the “

Amendment

”)

amends and supplements the Schedule 13D filed by the Reporting Persons on May 14, 2018 (the “

Original Schedule 13D

”

and, as amended and supplemented by this Amendment, the “

Schedule 13D

”), with respect to the Class A Shares.

Capitalized terms used in this Amendment and not otherwise defined shall have the same meanings ascribed to them in the Original

Schedule 13D.

Item 2.

Identity and Background

.

This Amendment amends and restates the

second paragraph of Item 3 of the Original Schedule 13D in its entirety as set forth below:

“Group Advisors is the sole member

of TPG Group Holdings (SBS) Advisors, LLC, a Delaware limited liability company, which is the general partner of TPG Group Holdings

(SBS), L.P., a Delaware limited partnership, which is (i) the sole member of TPG Holdings I-A, LLC, a Delaware limited liability

company, and (ii) the sole shareholder of TPG Holdings III-A, Inc., a Cayman corporation. TPG Holdings I-A, LLC is the general

partner of TPG Holdings I, L.P., a Delaware limited partnership, which is the sole member of TPG GenPar VII Advisors, LLC, a Delaware

limited liability company, which is the general partner of TPG GenPar VII, L.P., a Delaware limited partnership, which is the general

partner of TPG Improv Holdings, L.P., a Delaware limited partnership (“

TPG Improv

”), which directly holds 12,328,767

Class A Shares. TPG Holdings III-A, Inc. is the general partner of TPG Holdings III-A, L.P., a Cayman limited partnership, which

is the general partner of TPG Holdings III, L.P., a Delaware limited partnership, which is general partner of TPG PEP GenPar Advisors,

L.P., a Delaware limited partnership, which is the general partner of TPG PEP GenPar Governance, L.P., a Delaware limited partnership,

which is the general partner of each of (i) TPG Public Equity Partners, L.P., a Delaware limited partnership, which directly

holds 430,412 Class A Shares, and (ii) TPG Public Equity Partners Master Fund, L.P., a Cayman Islands limited partnership

(together with TPG Public Equity Partners, L.P., the “

TPEP Funds

”), which directly holds 3,454,188 Class A Shares.”

This Amendment amends and restates the

fourth paragraph of Item 3 of the Original Schedule 13D in its entirety as set forth below:

“Pursuant to the Restated Certificate

of Incorporation of the Issuer (the “

Certificate of Incorporation

”), each share of Class B-1 common stock (“

Class

B-1 Shares

” and, together with the Class A Shares, the “

Common Stock

”) had been convertible into one

Class A Share at the option of the holder, provided that such conversion would not have resulted in such holder beneficially owning

in excess of 9.9% of the Class A Shares outstanding immediately after giving effect to such conversion. If TPG Improv were to have

transferred a Class B-1 Share to someone other than an affiliate of TPG Improv or the Issuer (or an affiliate of the Issuer), the

Class B-1 Share would have converted automatically into one Class A Share. The Issuer had been entitled to convert all Class B-1

Shares into Class A Shares upon the earlier of (i) the first anniversary of the closing of the Transaction (as defined below)

and (ii) such time as TPG Improv designates a Director to the Issuer’s Board of Directors. On July 18, 2019, the

Issuer informed TPG Improv that it had exercised its right to convert all the Class B-1 Shares held by TPG Improv into Class A

Shares, with such conversion occurring on July 1, 2019 (the “

Conversion

”).”

Item 5.

Interest in Securities of the Issuer

.

This Amendment amends and restates the

second paragraph of Item 5 of the Original Schedule 13D in its entirety as set forth below:

“(a)-(b) The following sentence

is based on a total of 127,893,017 Class A Shares outstanding as of April 30, 2019, as reported in the Quarterly Report on

Form 10-Q filed by the Issuer with the Commission on May 9, 2019, after giving effect to the Conversion. Pursuant to Rule

13d-3 under the Act, the Reporting Persons may be deemed to beneficially own 16,213,367 Class A Shares, which constitutes approximately

12.7% of the outstanding Class A Shares.”

SIGNATURE

After reasonable inquiry and to the best

of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: July 19, 2019

|

|

TPG Group Holdings (SBS) Advisors, Inc.

|

|

|

By:

|

|

|

|

Name:

|

Michael LaGatta

|

|

|

Title:

|

Vice President

|

|

|

|

|

|

David Bonderman

|

|

|

By:

|

|

|

|

Name:

|

Bradford Berenson, on behalf of David Bonderman

(1)

|

|

|

|

|

|

James G. Coulter

|

|

|

By:

|

|

|

|

Name:

|

Bradford Berenson, on behalf of James G. Coulter

(2)

|

(1)

Bradford Berenson is signing on behalf of Mr. Bonderman

pursuant to an authorization and designation letter dated March 13, 2018, which was previously filed with the Commission

as an exhibit to a Schedule 13G filed by Mr. Bonderman on April 2, 2018 (SEC File No. 005-90172).

(2)

Bradford Berenson is signing on behalf of Mr. Coulter

pursuant to an authorization and designation letter dated March 13, 2018, which was previously filed with the Commission

as an exhibit to a Schedule 13G filed by Mr. Coulter on April 2, 2018 (SEC File No. 005-90172).

INDEX TO EXHIBITS

|

1.

|

|

Agreement of Joint Filing by TPG Advisors II, Inc., TPG Advisors III, Inc., TPG Advisors V, Inc., TPG Advisors VI, Inc., T3 Advisors, Inc., T3 Advisors II, Inc., TPG Group Holdings (SBS) Advisors, Inc., David Bonderman and James G. Coulter, dated as of February 14, 2011 (incorporated by reference to Exhibit 1 to Schedule 13G filed with the Commission on February 14, 2011 by TPG Group Holdings (SBS) Advisors, Inc., David Bonderman and James G. Coulter).

|

|

|

|

|

|

2.

|

|

Share Purchase Agreement dated as of October 17, 2017 by and among Amneal Holdings, LLC and the purchasers set forth in Schedule A thereto.

|

|

|

|

|

|

3.

|

|

Amendment No. 1 to Share Purchase Agreement dated as of May 3, 2018 by and between TPG Improv Holdings, L.P. and Amneal Holdings, LLC.

|

|

|

|

|

|

4.

|

|

Letter Agreement dated as of November 21, 2017 by and among Amneal Holdings, LLC, Amneal Pharmaceuticals, Inc. and TPG Improv Holdings, L.P. (incorporated by reference to Exhibit 2.4 to the Issuer’s Registration Statement on Form S-1 filed with the Commission on May 7, 2018).

|

|

|

|

|

|

5.

|

|

Form of Restated Certificate Of Incorporation Amneal Pharmaceuticals, Inc. (incorporated by reference to Exhibit 3.1 to the Issuer’s Registration Statement on Form S-1 filed with the Commission on May 7, 2018).

|

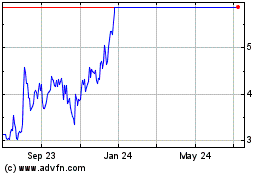

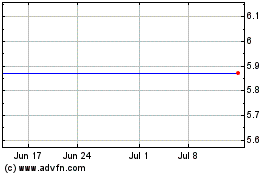

Amneal Pharmaceuticals (NYSE:AMRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amneal Pharmaceuticals (NYSE:AMRX)

Historical Stock Chart

From Apr 2023 to Apr 2024