AMG Advanced Metallurgical Group N.V. Completes Issuance of $550 Million of Credit Facilities

November 30 2021 - 4:00PM

Amsterdam, 30

November

2021 --- AMG

Advanced Metallurgical Group N.V. ("AMG", EURONEXT AMSTERDAM:

"AMG") is pleased to announce that it has entered into a new $350

million 7-year senior secured term loan B facility ("term loan")

and a $200 million 5-year senior secured revolving credit facility

("revolver"). The total facility amount of $550 million replaces

AMG’s existing credit facility and extends our term loan maturity

from 2025 to 2028 and revolver maturity from 2023 to

2025. AMG will use the proceeds of the new term loan to

refinance its existing credit facility.

Further strengthening AMG’s commitment to

Environmental, Social and Governance ("ESG"), we have embedded

annual CO2 intensity reduction targets into the Revolving Credit

Facility, making it a Sustainability Linked Loan.

Moody's Investors Service ("Moody's") assigned a

Ba3 rating to the new senior secured credit facility, affirmed our

B2 corporate family rating and changed their outlook to positive

from stable. S&P Global Ratings assigned a BB- to

the new facility, affirmed our B+ issuer credit rating and revised

their outlook to stable from negative.

The refinancing was well received in the debt

markets, allowing AMG to secure attractive pricing while enhancing

liquidity, improving flexibility, and extending its debt maturity

profile.

HSBC Securities (USA) Inc. ("HSBC") acted as

sole bookrunner on the credit facilities. Joint lead arrangers were

HSBC, Citibank, N.A. ("Citi"), BofA Securities Inc. ("BofA") and

JPMorgan Chase Bank, N.A ("JPM"). Fifth Third Bank,

National Association and ABN AMRO Securities (USA) LLC acted as

co-managers. HSBC and ABN AMRO Bank N.V. acted as Joint

Sustainability Coordinators.

Dr. Heinz Schimmelbusch, Chief Executive Officer

of AMG, stated, “We want to thank our joint lead arrangers HSBC,

Citi, BofA and JPM for their efficient work. The new long-term

facility represents one very important building block in the

execution of our stated target to increase EBITDA to $350 million,

or more, in 5 years, or less. We are also happy to have a

Sustainability Linked Loan. AMG is deeply invested in the subject

of ESG, and is dedicated to producing critical materials in a

sustainable and responsible manner. AMG was built to be a global

leader in critical materials which are vital to the transition to

clean energy and energy saving strategies.”

About AMG

AMG is a global critical materials company at

the forefront of CO2 reduction trends. AMG produces highly

engineered specialty metals and mineral products and provides

related vacuum furnace systems and services to the transportation,

infrastructure, energy, and specialty metals & chemicals end

markets.

AMG Clean Energy Materials segment combines

AMG’s recycling and mining operations, producing materials for

infrastructure and energy storage solutions while reducing the CO2

footprint of both suppliers and customers. AMG Clean Energy

Materials segment spans the vanadium, lithium, and tantalum value

chains. AMG Critical Materials Technologies segment combines AMG’s

leading vacuum furnace technology line with high-purity materials

serving global leaders in the aerospace sector. AMG Critical

Minerals segment consists of AMG’s mineral processing operations in

antimony, graphite, and silicon metal.

With approximately 3,000 employees, AMG operates

globally with production facilities in Germany, the United Kingdom,

France, the United States, China, Mexico, Brazil, India, Sri Lanka,

and Mozambique, and has sales and customer service offices in

Russia and Japan (www.amg-nv.com).

For further information, please

contact:AMG Advanced

Metallurgical Group

N.V. +1

610 975

4979Michele

Fischermfischer@amg-nv.com

Disclaimer

Certain statements in this press release are not

historical facts and are “forward looking”. Forward looking

statements include statements concerning AMG’s plans, expectations,

projections, objectives, targets, goals, strategies, future events,

future revenues or performance, capital expenditures, financing

needs, plans and intentions relating to acquisitions, AMG’s

competitive strengths and weaknesses, plans or goals relating to

forecasted production, reserves, financial position and future

operations and development, AMG’s business strategy and the trends

AMG anticipates in the industries and the political and legal

environment in which it operates and other information that is not

historical information. When used in this press release, the words

“expects,” “believes,” “anticipates,” “plans,” “may,” “will,”

“should,” and similar expressions, and the negatives thereof, are

intended to identify forward looking statements. By their very

nature, forward looking statements involve inherent risks and

uncertainties, both general and specific, and risks exist that the

predictions, forecasts, projections and other forward looking

statements will not be achieved. These forward looking statements

speak only as of the date of this press release. AMG expressly

disclaims any obligation or undertaking to release publicly any

updates or revisions to any forward looking statement contained

herein to reflect any change in AMG's expectations with regard

thereto or any change in events, conditions, or circumstances on

which any forward looking statement is based.

- New Financing Structure PR

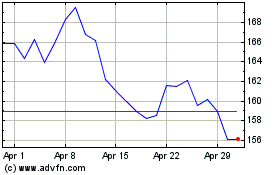

Affiliated Managers (NYSE:AMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

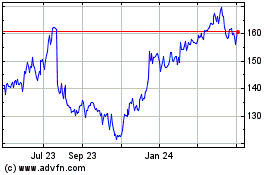

Affiliated Managers (NYSE:AMG)

Historical Stock Chart

From Apr 2023 to Apr 2024