Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

July 08 2021 - 4:29PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus dated July 8, 2021

Filed Pursuant to Rule 433

Relating to Preliminary Prospectus Supplement dated July 8, 2021

Registration Statement No. 333-230423

Affiliated Managers Group, Inc.

$200,000,000

4.200% Junior Subordinated Notes due 2061

Term Sheet

July 8, 2021

The following information relates only to Affiliated Managers Group, Inc.’s offering (the “Offering”) of its 4.200% Junior Subordinated

Notes due 2061 and should be read together with the preliminary prospectus supplement dated July 8, 2021 relating to the Offering and the accompanying prospectus dated March 21, 2019, including the documents incorporated by reference

therein.

|

|

|

|

|

Issuer:

|

|

Affiliated Managers Group, Inc. (NYSE: AMG)

|

|

|

|

|

Title of Security:

|

|

4.200% Junior Subordinated Notes due 2061 (the “Notes”)

|

|

|

|

|

Type of Offering:

|

|

SEC Registered

|

|

|

|

|

Principal Amount:

|

|

$200,000,000

|

|

|

|

|

Expected Ratings (Moody’s / S&P)*:

|

|

Baa1 (Stable) /BBB- (Stable)

|

|

|

|

|

Trade Date:

|

|

July 8, 2021

|

|

|

|

|

Expected Settlement Date:

|

|

July 13, 2021 (T+3)

Under Rule 15c6-1 under the U.S. Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days, unless the parties to a trade expressly agree otherwise.

Accordingly, purchasers who wish to trade Notes on any date prior to two business days before the Expected Settlement Date will be required to specify alternative settlement arrangements to prevent a failed settlement.

|

|

|

|

|

Maturity Date:

|

|

September 30, 2061

|

|

|

|

|

Minimum Denomination / Multiples:

|

|

$25.00 and integral multiples of $25.00 in excess thereof

|

|

|

|

|

|

Interest Payment Dates:

|

|

March 30, June 30, September 30 and December 30 of each year, beginning September 30, 2021

|

|

|

|

|

Coupon:

|

|

4.200%

|

|

|

|

|

Price to Public:

|

|

$25.00 per Note / 100% of principal amount

|

|

|

|

|

Underwriter Purchase Price for Sales to Retail:

|

|

$24.2125 per Note plus accrued interest, if any, from July 13, 2021

|

|

|

|

|

Underwriter Purchase Price for Sales to Institutions:

|

|

$24.50 per Note plus accrued interest, if any, from July 13, 2021

|

|

|

|

|

Over-allotment Option:

|

|

None

|

|

|

|

|

Optional Redemption:

|

|

|

|

|

|

|

Par Call:

|

|

On or after September 30, 2026, in whole or in part, at 100% of the principal amount, plus any accrued and unpaid interest

|

|

|

|

|

Call for Tax Event:

|

|

Prior to September 30, 2026, in whole but not in part, at 100% of the principal amount, plus any accrued and unpaid interest

|

|

|

|

|

Call for Rating Agency Event:

|

|

Prior to September 30, 2026, in whole but not in part, at 102% of the principal amount, plus any accrued and unpaid interest

|

|

|

|

|

Optional Deferral:

|

|

Up to 20 consecutive quarterly periods per deferral period

|

|

|

|

|

Listing:

|

|

The Issuer intends to apply to list the Notes on the New York Stock Exchange and, if approved for listing, expects the Notes to begin trading within 30 days after the Settlement Date.

|

|

|

|

|

Proceeds, Before Expenses:

|

|

$195,590,025

|

|

|

|

|

Use of Proceeds:

|

|

The Issuer intends to use the net proceeds of this Offering for general corporate purposes, which may include the repayment of indebtedness, share repurchases and investments in new and existing investment management

firms.

|

|

|

|

|

CUSIP / ISIN:

|

|

008252 835 / US0082528359

|

|

|

|

|

Joint Book-Running Managers:

|

|

Wells Fargo Securities, LLC

BofA Securities,

Inc.

Morgan Stanley & Co. LLC

RBC Capital Markets,

LLC

|

|

|

|

|

Co-Managers:

|

|

Barclays Capital Inc.

Barrington Research

Associates, Inc.

BNY Mellon Capital Markets, LLC

Citigroup

Global Markets Inc.

Citizens Capital Markets, Inc.

Deutsche

Bank Securities Inc.

Huntington Securities, Inc.

J.P. Morgan

Securities LLC

MUFG Securities Americas Inc.

Siebert Williams

Shank & Co., LLC

U.S. Bancorp Investments, Inc.

|

The Issuer has filed a registration statement including a prospectus and a prospectus supplement with the

SEC for the Offering to which this communication relates. Before you invest, you should read the prospectus and prospectus supplement in that registration statement and other documents the Issuer has filed with the SEC for more complete information

about the Issuer and this Offering. You may obtain these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, any underwriter in the Offering will arrange to send you the prospectus and the prospectus

supplement if you request them by calling Wells Fargo Securities, LLC at 1-800-645-3751; BofA Securities, Inc. at 1-800-294-1322; Morgan Stanley & Co. LLC at 1-866-718-1649; or RBC Capital Markets, LLC at 1-866-375-6829.

|

*

|

A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision

or withdrawal at any time.

|

Any disclaimers or other notices that may appear below are not applicable to this communication and

should be disregarded. Such disclaimers were automatically generated as a result of this communication being sent via email or another communication system.

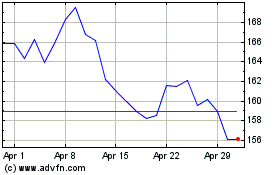

Affiliated Managers (NYSE:AMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

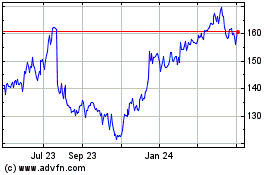

Affiliated Managers (NYSE:AMG)

Historical Stock Chart

From Apr 2023 to Apr 2024