- Q3 Total Revenues of $1.317 billion, up 7.8% from last year (up

9.3% in constant currency)

- Q3 Net loss of $54.8 million, 45.4% improvement from last year

(45.5% improvement in constant currency)

- Q3 Adjusted EBITDA of $156.5 million, up 9.9% from last year

(up 11.4% in constant currency)

- Q3 Adjusted EBITDA, adjusting 2018 for ASC 842 impact,

increased 31.3% (up 33.1% in constant currency)

- Q3 Total attendance of 87.1 million tickets sold set an

all-time high quarterly record

- Q3 U.S. average ticket price grew 3.3% to $9.45, a 220 basis

point industry outperformance (265 basis point industry

outperformance, excluding AMC)

- Q3 U.S. food and beverage revenues per patron grew 4.7% to a

third quarter record, $5.35

AMC Entertainment Holdings, Inc. (NYSE: AMC) (“AMC” or “the

Company”), today reported results for the third quarter ended

September 30, 2019.

“AMC delivered another quarter of strong results for the third

quarter of 2019, achieving 7.8% year-over-year total revenue growth

to $1.317 billion, driven by record third quarter attendance in

each of our U.S. and international markets. Importantly, total

Adjusted EBITDA grew 31.3% year-over-year after adjusting 2018 for

the non-cash accounting impact of ASC 842 and 33.1% on a constant

currency basis,” said Adam Aron, CEO and President of AMC.

Aron continued, "Our U.S. industry outperformance continued in

the third quarter as we outperformed the industry by 220 basis

points on attendance per screen and 450 basis points of admission

revenue per screen. After excluding AMC’s contribution to the U.S.

industry results, we outperformed the rest of the U.S. industry by

270 basis points on attendance per screen and by 560 basis points

on admissions revenue per screen. Additionally, AMC generated

record third quarter U.S. food and beverage revenues per patron of

$5.35 and international food and beverage revenues per patron, in

constant currency, of $3.77, representing year-over-year growth of

4.7% and 7.4%, respectively.”

Aron concluded, “The power of the AMC platform is clearly

evident in these results, and we are highly encouraged by our

performance in the third quarter as we position ourselves for a

strong finish in 2019. These results further confirm that we are

taking the appropriate actions to achieve the medium and long-term

targets that we outlined in April. AMC is achieving real momentum,

as we gain market share and outperform our industry in attendance

and revenue growth. This is the result of the wholistic and

synergistic impacts of AMC having invested in one theatre

enhancement after another in the largest network of cinemas

globally, combined with world-class marketing activity, and our

being in the midst of nothing less than a digital transformation in

which we are increasingly and continuously engaging with our guests

before, during and after their visits to our theatres. In turn,

this is enabling us to be vividly focused on generating additional

free cash flow, deleveraging our balance sheet and driving

shareholder value.”

Key Financial Results (presented in millions, except

operating data)

Quarter Ended September

30,

Nine Months Ended September

30,

2019

2018

Change

2019

2018

Change

GAAP Results

Revenue

$

1,316.8

$

1,221.4

7.8

%

$

4,023.3

$

4,047.5

(0.6)

%

Net earnings (loss)*

$

(54.8)

$

(100.4)

(45.4)

%

$

(135.6)

$

(60.5)

124.1

%

Net cash provided by operating

activities

$

56.6

$

1.7

N/M

$

210.2

$

298.8

(29.7)

%

Non-GAAP Results**

Total revenues (2019 constant currency

adjusted)

$

1,335.0

$

1,221.4

9.3

%

$

4,092.2

$

4,047.5

1.1

%

Adjusted EBITDA

$

156.5

$

142.4

9.9

%

$

502.3

$

665.1

(24.5)

%

Adjusted EBITDA (2018 Adjusted for ASC

842)

$

156.5

$

119.2

31.3

%

$

502.3

$

594.8

(15.6)

%

Adjusted free cash flow

$

5.1

$

(31.5)

N/M

$

55.4

$

166.5

(66.7)

%

Adjusted free cash flow (2018 Adjusted for

ASC 842)

$

5.1

$

(45.8)

N/M

$

55.4

$

123.2

(55.0)

%

Operating Metrics

Attendance (in thousands)

87,100

82,662

5.4

%

263,880

264,838

(0.4)

%

U.S. markets attendance (in thousands)

61,172

58,935

3.8

%

188,051

190,542

(1.3)

%

International markets attendance (in

thousands)

25,928

23,727

9.3

%

75,829

74,296

2.1

%

Average screens

10,662

10,626

0.3

%

10,674

10,699

(0.2)

%

* Please refer to our form 10-Q filed

today for a discussion of items included in GAAP net earnings

(loss). N/M = Percent change is not meaningful due to magnitude of

improvement.

** Please refer to the tables included

later in this press release for definitions and full

reconciliations of non-U.S. GAAP financial measures.

Selected Third Quarter Financial

Results

- Revenue: Third-quarter total revenues were $1.317

billion, increasing 7.8% on a GAAP basis (increasing 9.3% in

constant currency) from the year-ago quarter. Results were driven

by (i) record setting U.S. and International attendance, up 3.8%

and 9.3%, respectively, (ii) strong food and beverage per patron

growth, up 3.4% (up 4.7% in constant currency) primarily due to

strategic pricing initiatives and (iii) other revenues per patron,

which grew 10.7% (grew 12.6% in constant currency) largely from

increases in online ticketing fees. Total revenues benefited from a

6.1% increase in admissions revenue (up 7.6% in constant currency).

U.S. average ticket price increased by 3.3%, reflecting an increase

in premium format attendance, strategic pricing increases, and a

normalization of results related to the anniversary of our A-List

program and other promotional pricing initiatives, while

international average ticket price declined 5.6% (down 0.6% in

constant currency) due to foreign exchange rates and strategic

pricing initiatives. Given the natural fluctuations in the box

office between quarters and within the year due to the timing of

film releases, the Company’s management focuses on its full-year

results and performance against its disclosed medium to long-term

targets rather than on any particular quarter.

- Net Loss: Net loss was $54.8 million, improving $45.6

million, or 45.4% on a GAAP basis (improving 45.5% in constant

currency) from the year-ago quarter. The decrease in net loss

included the impact of the 7.8% increase in total revenues, which

helped to drive our operating income higher by $42.7 million along

with the reduction in general and administrative expenses and lower

depreciation and amortization, partially offset by higher rent

expense due primarily to ASC 842.

- Adjusted EBITDA: Total Adjusted EBITDA was $156.5

million, up 9.9% from the year-ago quarter (up 11.4% in constant

currency). Total Adjusted EBITDA grew 31.3% year-over-year (up

33.1% in constant currency), after adjusting the year-ago quarter

for $23.2 million in non-cash accounting impact of ASC 842 for

comparability. U.S. markets Adjusted EBITDA increased 10.8%, while

International markets Adjusted EBITDA increased 7.5% (increase of

13.1% in constant currency). U.S. markets Adjusted EBITDA increased

26.8% year-over-year, and international Adjusted EBITDA increased

46.2% (53.8% in constant currency), after adjusting the year-ago

quarter for $13.3 million and $9.9 million, respectively, in

non-cash accounting impact of ASC 842 for comparability.

- Cash Flow: Net cash provided by operating activities was

$56.6 million, growing $54.9 million compared to the year-ago

quarter, and growing $69.2 million after adjusting for the $14.3

million cash flow classification impact of ASC 842 from financing

activities to operating activities. Adjusted Free Cash Flow was

$5.1 million, growing $36.6 million compared to the year-ago

quarter and growing $50.9 million in the year-ago quarter after

adjusting for the non-cash accounting impact of ASC 842. The

increase in Adjusted Free Cash Flow is primarily related to

increases in net cash provided by operating activities and the

timing of maintenance capital expenditures. Our Adjusted Free Cash

Flow in the third quarter and cash balance at the end of the third

quarter was negatively impacted by the normal seasonal timing of

certain working capital items and is expected to correct itself in

the fourth quarter.

Other Key Highlights

- Industry Performance: In the third quarter of 2019, the

U.S. industry box office generated $2.8 billion in admissions sales

(up 3.6% year-over-year on a 2.4% increase in attendance). AMC

outperformed the U.S. industry on both an attendance per screen and

admissions revenue per screen basis by approximately 220 and 450

basis points, respectively, and after excluding AMC from the U.S.

industry statistics, that outperformance grew to 270 and 560 basis

points, respectively. The third quarter of 2019 marks the sixth

consecutive quarter of attendance per screen industry

outperformance and the third consecutive quarter of industry box

office outperformance. Internationally, the industry box office in

countries served by Odeon grew 13.7%, in constant currency. The

industry box office across Europe benefited from a more family

friendly film slate compared to a year ago.

- AMC Stubs A-List Program: Since its launch in June 2018,

the A-List tier of our successful AMC Stubs loyalty program has

attracted more than 900,000 subscribers, far in excess of initial

internal expectations of 500,000 subscribers in the first year.

During the first quarter of 2019, AMC implemented a 10% membership

price increase in ten states and a 20% price increase in five

states. Based on an average monthly frequency of 2.40x for our

A-List members in the third quarter, their associated full-price

bring-along guest attendance, their food and beverage spend and the

price increases in the first quarter, we believe the A-List program

was profitable in the third quarter and nine-months ended September

30, 2019 compared to our estimated results if the program had not

existed. A-List membership levels continue to exceed our

expectations despite our price increase and competitive

offerings.

- AMC Theatres On Demand: On October 15, 2019, the Company

became the first U.S. theatrical exhibitor to unveil a digital home

streaming service with the launch of AMC Theatres On Demand, with

approximately 2,000 movies, including movies from every major

studio, available for purchase or rent to AMC Stubs members. In

addition, later this fall, AMC Theatres On Demand will also include

movies from AMC Networks (NASDAQ: AMCX) in a first-ever cross

platform marketing partnership. Movies can be purchased or rented

through AMCTheatres.com, the AMC Theatres mobile app, Roku and

SmartTVs with more services and devices to be added in the near

future. AMC Theatres On Demand is yet another benefit for AMC Stubs

members, designed as a low-cost, ancillary service to add

convenience and value for the guest, increase loyalty, augment our

rich consumer database and generate additional earnings.

- Circuit Update: As of September 30, 2019, AMC owned,

operated, or had interests in 634 theatres in the U.S. and 366

theatres internationally. In the third quarter, the Company added

premium recliner seating to nine theatres, including eight in the

U.S. and one internationally, bringing the U.S. penetration of

theatres offering recliner seating to approximately 78% of

addressable theatres, and approximately 9% of addressable European

theatres. Premium large format offerings continue to attract guests

by delivering the best sight and sound experience, and the Company

added 3 new Dolby screens, 1 new IMAX screen and 1 new Prime at AMC

screen during the quarter.

- New Lease Accounting Standard (ASC 842): The Company

adopted ASC 842 on January 1, 2019. As previously disclosed, ASC

842 is an accounting change with no impact on AMC’s business or

total cash flows. While this new rule introduces certain

presentation changes to all three of AMC’s core financial

statements, it does not affect day-to-day operations or cash

generation. As a result of adopting ASC 842, the key changes are as

follows: (i) the Company’s consolidated balance sheet now includes

operating lease right-of-use assets and operating lease liabilities

of $4.8 billion and $5.4 billion, respectively, at September 30,

2019; (ii) the Company’s income statement for the three months

ended September 30, 2019 includes additional rent expense of $28.8

million, a decline in depreciation and amortization of $24.0

million and a decline in interest expense of $6.9 million; and

(iii) the Company’s cash flows provided by operating activities for

the nine months ended September 30, 2019 is lowered by $42.0

million, offset by an equivalent increase in the Company’s cash

flows provided by financing activities.

- Cash Dividend: The Company paid approximately $20.8

million of dividends in the third quarter of 2019. Since its IPO,

AMC has paid $642.8 million in total dividends. Following the

dividend declared on October 24, 2019, the Company will have issued

a dividend in 23 consecutive quarters beginning in the second

quarter of 2014.

Conference Call / Webcast

Information

The Company will host a conference call via webcast for

investors and other interested parties beginning at 7:30 a.m.

CDT/8:30 a.m. EDT on Thursday, November 7, 2019. To listen to the

conference call via the internet, please visit the investor

relations section of the AMC website at

www.investor.amctheatres.com for a link to the webcast. Investors

and interested parties should go to the website at least 15 minutes

prior to the call to register, and/or download and install any

necessary audio software.

Participants may also listen to the call by dialing (877)

407-3982, or (201) 493-6780 for international participants. An

archive of the webcast will be available on the Company’s website

after the call for a limited time.

About AMC Entertainment Holdings, Inc.

AMC is the largest movie exhibition company in the United

States, the largest in Europe and the largest throughout the world

with approximately 1,000 theatres and 11,000 screens across the

globe. AMC has propelled innovation in the exhibition industry by:

deploying its Signature power-recliner seats; delivering enhanced

food and beverage choices; generating greater guest engagement

through its loyalty and subscription programs, web site and mobile

apps; offering premium large format experiences and playing a wide

variety of content including the latest Hollywood releases and

independent programming. AMC operates among the most productive

theatres in the United States' top markets, having the #1 or #2

market share positions in 21 of the 25 largest metropolitan areas

of the United States. AMC is also #1 or #2 in market share in 12 of

the 15 countries it serves in North America, Europe and the Middle

East. For more information, visit www.amctheatres.com.

Website Information

This press release, along with other news about AMC, is

available at www.amctheatres.com. We routinely post information

that may be important to investors in the Investor Relations

section of our website, www.investor.amctheatres.com. We use this

website as a means of disclosing material, non-public information

and for complying with our disclosure obligations under Regulation

FD, and we encourage investors to consult that section of our

website regularly for important information about AMC. The

information contained on, or that may be accessed through, our

website is not incorporated by reference into, and is not a part

of, this document. Investors interested in automatically receiving

news and information when posted to our website can also visit

www.investor.amctheatres.com to sign up for email alerts.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such as

“forecast,” “plan,” “estimate,” “will,” “would,” “project,”

“maintain,” “intend,” “expect,” “anticipate,” “prospect,”

“strategy,” “future,” “likely,” “may,” “should,” “believe,”

“continue,” “opportunity,” “potential,” and other similar

expressions that predict or indicate future events or trends or

that are not statements of historical matters. These

forward-looking statements are based on information available at

the time the statements are made and/or management’s good faith

belief as of that time with respect to future events, and are

subject to risks, trends, uncertainties and other facts that could

cause actual performance or results to differ materially from those

expressed in or suggested by the forward-looking statements. These

risks, trends, uncertainties and facts include, but are not limited

to, risks related to: motion picture production and performance;

AMC’s lack of control over distributors of films; intense

competition in the geographic areas in which AMC operates; AMC

Stubs A-List may not meet anticipated revenue projections which

could negatively impact projected operating results; increased use

of alternative film delivery methods or other forms of

entertainment; shrinking exclusive theatrical release windows;

general and international economic, political, regulatory and other

risks, including risks related to the United Kingdom’s exit from

the European Union; risks and uncertainties relating to AMC’s

significant indebtedness; AMC’s ability to execute cost cutting and

revenue enhancement initiatives; box office performance;

limitations on the availability of capital; certain covenants in

the agreements that govern AMC’s indebtedness may limit its ability

to take advantage of certain business opportunities; risks relating

to AMC’s inability to achieve the expected benefits and performance

from its recent acquisitions; AMC’s ability to refinance its

indebtedness on favorable terms; optimizing AMC’s theatre circuit

through construction and the transformation of its existing

theatres may be subject to delay and unanticipated costs; failures,

unavailability or security breaches of AMC’s information systems;

risks relating to impairment losses, including with respect to

goodwill and other intangibles, and theatre and other closure

charges; AMC’s ability to utilize net operating loss carryforwards

to reduce its future tax liability or valuation allowances taken

with respect to deferred tax assets; review by antitrust

authorities in connection with acquisition opportunities; risks

relating to unexpected costs or unknown liabilities relating to

recently completed acquisitions; risks relating to the incurrence

of legal liability including costs associated with recently filed

class action lawsuits; general political, social and economic

conditions and risks, trends, uncertainties and other factors

discussed in the reports AMC has filed with the SEC. Should one or

more of these risks, trends, uncertainties or facts materialize, or

should underlying assumptions prove incorrect, actual results may

vary materially from those indicated or anticipated by the

forward-looking statements contained herein. Accordingly, you are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date they are made.

Forward-looking statements should not be read as a guarantee of

future performance or results and will not necessarily be accurate

indications of the times at, or by, which such performance or

results will be achieved. For a detailed discussion of risks,

trends and uncertainties facing AMC, see the section entitled “Risk

Factors” in AMC’s reports on Forms 10-K and Form 10-Q filed with

the SEC, and the risks, trends and uncertainties identified in its

other public filings. AMC does not intend, and undertakes no duty,

to update any information contained herein to reflect future events

or circumstances, except as required by applicable law.

AMC Entertainment Holdings,

Inc.

Consolidated Statements of

Operations

For the Three and Nine Months Ended

September 30, 2019 and September 30, 2018

(dollars in millions, except share and per

share data)

(unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2019

2018

2019

2018

Revenues

Admissions

$

797.3

$

751.4

$

2,424.3

$

2,522.7

Food and beverage

420.0

384.8

1,281.3

1,236.4

Other theatre

99.5

85.2

317.7

288.4

Total revenues

1,316.8

1,221.4

4,023.3

4,047.5

Operating costs and expenses

Film exhibition costs

416.8

378.8

1,264.6

1,276.7

Food and beverage costs

67.2

63.6

205.1

202.0

Operating expense, excluding depreciation

and amortization below

419.0

400.5

1,259.2

1,236.9

Rent

238.7

203.7

726.6

593.1

General and administrative:

Merger, acquisition and other costs

4.7

18.1

11.2

27.1

Other, excluding depreciation and

amortization below

37.5

48.4

126.9

135.6

Depreciation and amortization

112.1

130.2

337.1

398.4

Operating costs and expenses

1,296.0

1,243.3

3,930.7

3,869.8

Operating income (loss)

20.8

(21.9)

92.6

177.7

Other expense (income):

Other expense (income)

(1.3)

54.1

5.1

57.5

Interest expense:

Corporate borrowings

73.2

64.3

218.7

188.2

Capital and financing lease

obligations

1.8

9.4

6.0

29.5

Non-cash NCM exhibitor services

agreement

10.1

10.3

30.4

31.2

Equity in earnings of non-consolidated

entities

(7.5)

(70.0)

(24.2)

(74.0)

Investment income

(0.5)

(0.7)

(18.7)

(7.4)

Total other expense

75.8

67.4

217.3

225.0

Loss before income taxes

(55.0)

(89.3)

(124.7)

(47.3)

Income tax provision (benefit)

(0.2)

11.1

10.9

13.2

Net loss

$

(54.8)

$

(100.4)

$

(135.6)

$

(60.5)

Diluted loss per share

$

(0.53)

$

(0.82)

$

(1.31)

$

(0.48)

Average shares outstanding diluted (in

thousands)

103,850

123,126

103,826

126,386

Consolidated Balance Sheet Data (at

period end):

(dollars in millions)

(unaudited)

As of

As of

September 30, 2019

December 31, 2018

Cash and cash equivalents

$

100.4

$

313.3

Corporate borrowings

4,731.5

4,723.0

Other long-term liabilities

190.0

963.1

Finance lease liabilities

99.5

560.2

Stockholders' equity

1,183.3

1,397.6

Total assets

13,281.3

9,495.8

Consolidated Other Data:

(in millions, except operating data)

(unaudited)

Three Months Ended

Nine Months Ended

September 30, 2019

September 30,

Consolidated

2019

2018

2019

2018

Net cash provided by operating

activities

$

56.6

$

1.7

$

210.2

$

298.8

Net cash provided by (used in) investing

activities

$

(127.1)

$

67.2

$

(348.4)

$

(114.3)

Net cash used in financing activities

$

(18.4)

$

(37.4)

$

(72.9)

$

(155.3)

Adjusted free cash flow

$

5.1

$

(31.5)

$

55.4

$

166.5

Capital expenditures

$

(118.3)

$

(133.8)

$

(348.2)

$

(374.9)

Screen additions

1

6

38

46

Screen acquisitions

—

8

64

39

Screen dispositions

77

43

181

177

Construction openings (closures), net

(15)

12

(67)

(106)

Average screens

10,662

10,626

10,674

10,699

Number of screens operated

10,945

10,971

10,945

10,971

Number of theatres operated

1,000

1,002

1,000

1,002

Screens per theatre

10.9

10.9

10.9

10.9

Attendance (in thousands)

87,100

82,662

263,880

264,838

Segment Other Data:

(in millions, except per patron amounts

and operating data)

(unaudited)

Three Months Ended

Nine Months Ended

September 30, 2019

September 30,

2019

2018

2019

2018

Other operating data:

Attendance (patrons, in

thousands):

U.S. markets

61,172

58,935

188,051

190,542

International markets

25,928

23,727

75,829

74,296

Consolidated

87,100

82,662

263,880

264,838

Average ticket price (in

dollars):

U.S. markets

$

9.45

$

9.15

$

9.43

$

9.65

International markets

$

8.45

$

8.95

$

8.57

$

9.22

Consolidated

$

9.15

$

9.09

$

9.19

$

9.53

Food and beverage revenues per patron

(in dollars):

U.S. markets

$

5.35

$

5.11

$

5.40

$

5.15

International markets

$

3.59

$

3.51

$

3.50

$

3.42

Consolidated

$

4.82

$

4.66

$

4.86

$

4.67

Average Screen Count (month end

average):

U.S. markets

7,996

7,992

8,001

8,032

International markets

2,666

2,634

2,673

2,667

Consolidated

10,662

10,626

10,674

10,699

Segment Information:

(unaudited, in millions)

Three Months Ended

Nine Months Ended

September 30, 2019

September 30, 2019

2019

2018

2019

2018

Revenues

U.S. markets

$

970.7

$

895.6

$

2,999.1

$

3,007.1

International markets

346.1

325.8

1,024.2

1,040.4

Consolidated

$

1,316.8

$

1,221.4

$

4,023.3

$

4,047.5

Adjusted EBITDA

U.S. markets

$

116.3

$

105.0

$

395.8

$

535.6

International markets

40.2

37.4

106.5

129.5

Consolidated

$

156.5

$

142.4

$

502.3

$

665.1

Capital Expenditures

U.S. markets

$

84.3

$

92.9

$

243.9

$

264.9

International markets

34.0

40.9

104.3

110.0

Consolidated

$

118.3

$

133.8

$

348.2

$

374.9

Reconciliation of Adjusted

EBITDA:

(dollars in millions)

(unaudited)

Three Months Ended

Nine Months Ended

September 30, 2019

September 30, 2019

2019

2018

2019

2018

Net loss

$

(54.8)

$

(100.4)

$

(135.6)

$

(60.5)

Plus:

Income tax provision (benefit)

(0.2)

11.1

10.9

13.2

Interest expense

85.1

84.0

255.1

248.9

Depreciation and amortization

112.1

130.2

337.1

398.4

Certain operating expenses (2)

5.3

6.6

10.1

16.2

Equity in earnings of non-consolidated

entities (3)

(7.5)

(70.0)

(24.2)

(74.0)

Cash distributions from non-consolidated

entities (4)

4.7

3.1

17.0

30.9

Attributable EBITDA (5)

0.9

2.1

3.8

3.7

Investment income

(0.5)

(0.7)

(18.7)

(7.4)

Other expense (income) (6)

(1.5)

54.1

4.6

57.7

Non-cash rent - purchase accounting

(7)

6.1

—

19.5

—

General and administrative

expense—unallocated:

Merger, acquisition and other costs

(8)

4.7

18.1

11.2

27.1

Stock-based compensation expense (9)

2.1

4.2

11.5

10.9

Adjusted EBITDA(1)

$

156.5

$

142.4

$

502.3

$

665.1

Rent

$

238.7

$

203.7

$

726.6

$

593.1

_________________________

1)

We present Adjusted EBITDA as a supplemental measure of our

performance. We define Adjusted EBITDA as net earnings (loss) plus

(i) income tax provision (benefit), (ii) interest expense and (iii)

depreciation and amortization, as further adjusted to eliminate the

impact of certain items that we do not consider indicative of our

ongoing operating performance and to include attributable EBITDA

from equity investments in theatre operations in international

markets and any cash distributions of earnings from other equity

method investees. These further adjustments are itemized above. You

are encouraged to evaluate these adjustments and the reasons we

consider them appropriate for supplemental analysis. In evaluating

Adjusted EBITDA, you should be aware that in the future we may

incur expenses that are the same as or similar to some of the

adjustments in this presentation. Our presentation of Adjusted

EBITDA should not be construed as an inference that our future

results will be unaffected by unusual or non-recurring items.

Adjusted EBITDA is a non-U.S. GAAP financial measure commonly used

in our industry and should not be construed as an alternative to

net earnings (loss) as an indicator of operating performance (as

determined in accordance with U.S. GAAP). Adjusted EBITDA may not

be comparable to similarly titled measures reported by other

companies. We have included Adjusted EBITDA because we believe it

provides management and investors with additional information to

measure our performance and estimate our value.

Adjusted EBITDA has important limitations as an analytical tool,

and you should not consider it in isolation, or as a substitute for

analysis of our results as reported under U.S. GAAP. For example,

Adjusted EBITDA:

- does not reflect our capital expenditures, future requirements

for capital expenditures or contractual commitments;

- does not reflect changes in, or cash requirements for, our

working capital needs;

- does not reflect the significant interest expenses, or the cash

requirements necessary to service interest or principal payments,

on our debt;

- excludes income tax payments that represent a reduction in cash

available to us;

- does not reflect any cash requirements for the assets being

depreciated and amortized that may have to be replaced in the

future; and

- does not reflect the impact of divestitures that were required

in connection with recently completed acquisitions.

2)

Amounts represent preopening expense related to temporarily

closed screens under renovation, theatre and other closure expense

for the permanent closure of screens including the related

accretion of interest, non-cash deferred digital equipment rent

expense, and disposition of assets and other non-operating gains or

losses included in operating expenses. The Company has excluded

these items as they are non-cash in nature, include components of

interest cost for the time value of money or are non-operating in

nature.

3)

For the three and nine months ended September 30, 2019, the

Company recorded $6.5 million and $21.1 million, respectively, in

earnings from DCIP. For the three months ended September 30, 2018,

the Company recorded equity in earnings related to its sale of all

remaining NCM units of $28.9 million and a gain of $30.1 million

related to the Screenvision merger. Equity in earnings of

non-consolidated entities also includes loss on the surrender

(disposition) of a portion of the Company’s investment in NCM of

$1.1 million during the nine months ended September 30, 2018.

Equity in earnings of non-consolidated entities for the nine months

ended September 30, 2018 includes a lower of carrying value

impairment loss on the held-for-sale portion of NCM of $16.0

million.

4)

Includes U.S. non-theatre distributions from equity method

investments and International non-theatre distributions from equity

method investments to the extent received. The Company believes

including cash distributions is an appropriate reflection of the

contribution of these investments to its operations.

5)

Attributable EBITDA includes the EBITDA from minority equity

investments in theatre operators in certain international markets.

See below for a reconciliation of the Company’s equity (earnings)

loss of non-consolidated entities to attributable EBITDA. Because

these equity investments are in theatre operators in regions where

the Company holds a significant market share, the Company believes

attributable EBITDA is more indicative of the performance of these

equity investments and management uses this measure to monitor and

evaluate these equity investments. The Company also provides

services to these theatre operators including information

technology systems, certain on-screen advertising services and our

gift card and package ticket program. As these investments relate

only to our Nordic acquisition, the second quarter of 2017

represents the first time the Company has made this adjustment and

does not impact prior historical presentations of Adjusted

EBITDA.

Reconciliation of Attributable EBITDA

(Unaudited)

Three Months Ended

Nine Months Ended

September 30, 2019

September 30, 2019

2019

2018

2019

2018

Equity in earnings of non-consolidated

entities

$

(7.5)

$

(70.0)

$

(24.2)

$

(74.0)

Less:

Equity in earnings of non-consolidated

entities excluding international theatre JV's

(7.4)

(68.5)

(23.2)

(72.1)

Equity in loss of International theatre

JV's

0.1

1.5

1.0

1.9

Income tax provision

0.1

0.1

0.2

0.2

Investment income

(0.1)

(0.1)

(0.6)

(0.3)

Interest expense

—

—

0.1

—

Depreciation and amortization

0.5

0.6

2.8

1.9

Other expense

0.3

—

0.3

—

Attributable EBITDA

$

0.9

$

2.1

$

3.8

$

3.7

6)

Other expense (income) for the three months ended September 30,

2019 includes income of $8.5 million due to the increase in fair

value of the derivative asset related to the Company’s Convertible

Notes due 2024, expense of $5.7 million as a result of the decrease

in fair value of its derivative liability, and loss on Pound

sterling forward contract of $0.7 million. Other expense for the

nine months ended September 30, 2019 includes $16.6 million of fees

related to modifications of term loans income and $1.7 million loss

on GBP forward contract, partially offset by income of $14.9

million due to the decrease in fair value of the derivative

liability related to the Company’s Convertible Notes due 2024.

During the three months ended September 30, 2018, the Company

recorded expense of $54.1 million as a result of an increase in

fair value of the derivative liability for the Convertible Notes

due 2024. Other expense (income) for the three and nine months

ended September 30, 2018 includes financing losses and financing

related foreign currency transaction losses.

7)

Reflects amortization of certain intangible assets reclassified

from depreciation and amortization to rent expense, due to the

adoption of ASC 842.

8)

Merger, acquisition and transition costs are excluded as they

are non-operating in nature.

9)

Stock-based compensation expense is non-cash or non-recurring

expense included in General and Administrative: Other.

Reconciliation of Adjusted Free Cash

Flow (1)

(dollars in millions)

(unaudited)

Three Months Ended

Nine Months Ended

September 30, 2019

September 30,

2019

2018

2019

2018

Net cash provided by operating

activities

$

56.6

$

1.7

$

210.2

$

298.8

Plus:

Merger, acquisition and other costs(2)

4.7

18.1

11.2

27.1

Less:

Maintenance capital expenditures(3)

32.0

23.5

77.0

59.3

Landlord contributions(5)

24.2

27.8

89.0

100.1

Adjusted free cash flow (1)

$

5.1

$

(31.5)

$

55.4

$

166.5

Reconciliation of Capital Expenditures

Capital expenditures

Growth capital expenditures(4)

$

88.1

$

118.0

$

246.8

$

311.9

Maintenance capital expenditures(3)

32.0

23.5

77.0

59.3

Change in construction payables(6)

(1.8)

(7.7)

24.4

3.7

Total capital expenditures

$

118.3

$

133.8

$

348.2

$

374.9

Starting in the fourth quarter of 2018, AMC began disclosing a new

non-U.S. GAAP financial measure “Adjusted Free Cash Flow” as a

measure of our liquidity. We believe this measure is indicative of

our ability to generate cash in excess of maintenance capital

expenditures and certain other non-operating costs and for other

uses including repayment of our corporate borrowings and generating

cash for growth opportunities. 1)

We present “Adjusted Free Cash Flow” as a supplemental measure

of our liquidity. Management uses this measure and we believe it is

helpful to investors as an indication of our ability to generate

cash in-excess-of maintenance capital expenditures and certain

other non-operating and costs and for other uses including

repayment of our corporate borrowings and generating cash for

growth opportunities. Adjusted Free Cash Flow is a non-U.S. GAAP

financial measure and is defined as net cash provided by operating

activities, plus merger, acquisition and other costs, less

maintenance capital expenditures and landlord contributions.

Adjusted free cash flow does not represent the residual cash flow

available for discretionary expenditures. It should be considered

in addition to, not a substitute for or superior to net cash

provided by operating activities. The term adjusted free cash flow

may differ from similar measures reported by other companies. Also

provided is a reconciliation of Capital Expenditures disclosed in

the Consolidated Statement of Cash Flows made up of growth capital

expenditures, maintenance capital expenditures and change in

construction payables as further explanation of the components of

adjusted free cash flow.

2)

Merger, acquisition and other costs are excluded as they are

non-operating.

3)

Maintenance capital expenditures are amounts required to keep

our existing theatres in compliance with regulatory requirements

and in a sustainable good operating condition, including

expenditures for repair of HVAC, sight and sound systems,

compliance with ADA requirements and technology upgrades of

existing systems.

4)

Growth capital expenditures are investments that enhance the

guest experience and grow revenues and profits and include

initiatives such as theatre remodels, acquisitions, newly built

theatres, premium large formats, enhanced food and beverage

offerings and service models and technology that enable

efficiencies and additional revenue opportunities. We did not

deduct these from adjusted free cash flow because they are

discretionary, and the related benefits may not be fully reflected

in our net cash provided by operating activities.

5)

Landlord contributions represent reimbursements in our strategic

growth initiatives by our landlords.

6)

Change in construction payables are changes in amounts accrued

for capital expenditures and are not deducted or added back to

Adjusted Free Cash Flow as they fluctuate significantly from period

to period based on the timing of actual payments.

Reconciliation of Consolidated Adjusted

EBITDA and Adjusted Free Cash Flow Under ASC 842

(dollars in millions)

(Unaudited)

Quarter Ended September

30,

2019

2018

Change

Total Adjusted EBITDA

Total Adjusted EBITDA (as reported)

$

156.5

$

142.4

9.9

%

Certain adjustments to rent expense

(a)

—

(23.2)

Total Adjusted EBITDA (post-ASC 842)

156.5

119.2

31.3

%

Impact of ASC 842 on Adjusted EBITDA

$

(22.7)

$

(23.2)

(a) The adjustments for certain rent

expense items include cash rent for legacy build-to-suit financing

lease obligations of $21.4 million and deferred rent related to

deferred gain amortization of $1.8 million.

Nine Months Ended September

30,

2019

2018

Change

Total Adjusted EBITDA

Total Adjusted EBITDA (as reported)

$

502.3

$

665.1

(24.5)

%

Certain adjustments to rent expense

(a)

—

(70.3)

Total Adjusted EBITDA (post-ASC 842)

502.3

594.8

(15.6)

%

Impact of ASC 842 on Adjusted EBITDA

$

(68.1)

$

(70.3)

(a) The adjustments for certain rent

expense items include cash rent for legacy build-to-suit financing

lease obligations of $65.9 million and deferred rent related to

deferred gain amortization of $4.4 million.

Reconciliation of net earnings to

Adjusted EBITDA for 2018 (adjusted for ASC 842 (see footnotes

above):

(In millions)

Three Months

Nine Months

Ended

Ended

September 30, 2018

September 30, 2018

Net loss

$

(99.5)

(55.6)

Plus:

Income tax provision

11.1

13.2

Interest expense

76.9

226.3

Depreciation and amortization

103.7

316.7

Certain operating expenses (2)

6.6

16.2

Equity in loss of non-consolidated

entities (3)

(70.0)

(74.0)

Cash distributions from non-consolidated

entities (4)

3.1

30.9

Attributable EBITDA (5)

2.1

3.7

Investment income

(0.7)

(7.4)

Other expense (6)

54.1

57.7

Non-cash rent - purchase accounting

(7)

9.5

29.1

General and administrative

expense—unallocated:

Merger, acquisition and other costs

(8)

18.1

27.1

Stock-based compensation expense (9)

4.2

10.9

Adjusted EBITDA (1)

$

119.2

$

594.8

Quarter Ended September

30,

2019

2018

Change

Adjusted free cash flow

Adjusted free cash flow (as reported)

$

5.1

$

(31.5)

*

%

Adjustment to cash flow used in operating

activities (a)

—

(14.3)

Adjusted free cash flow (post-ASC 842)

5.1

(45.8)

*

%

Impact of ASC 842 on Adjusted free cash

flow

$

(14.0)

$

(14.3)

_________________________

(a) Adjustments for principal payments for

build-to-suit financing lease obligations that previously were

reported in net cash used in financing activities.

* Increase over 100%.

Nine Months Ended September

30,

2019

2018

Change

Adjusted free cash flow

Adjusted free cash flow (as reported)

$

55.4

$

166.5

(66.7)

%

Adjustment to cash flow used in operating

activities (a)

—

(43.3)

Adjusted free cash flow (post-ASC 842)

55.4

123.2

(55.0)

%

Impact of ASC 842 on Adjusted free cash

flow

$

(42.0)

$

(43.3)

_________________________

(a) Adjustments for principal payments for

build-to-suit financing lease obligations that previously were

reported in net cash used in financing activities.

Select Consolidated Constant Currency

financial data (see Note 10):

Three and Nine Months Ended September

30, 2019

(dollars in millions)

(unaudited)

Three Months Ended

Nine Months Ended

September 30, 2019

September 30, 2019

Constant Currency (10)

Constant Currency (10)

US

International

Total

US

International

Total

Revenues

Admissions

$

578.1

$

230.7

$

808.8

$

1,774.1

$

693.9

$

2,468.0

Food and beverage

327.0

97.8

424.8

1,015.7

283.0

1,298.7

Other theatre

65.6

35.8

101.4

209.3

116.2

325.5

Total revenues

970.7

364.3

1,335.0

2,999.1

1,093.1

4,092.2

Operating costs and expenses

Film exhibition costs

321.7

100.1

421.8

989.2

294.0

1,283.2

Food and beverage costs

46.5

21.8

68.3

145.6

63.5

209.1

Operating expense

303.7

121.3

425.0

910.2

372.2

1,282.4

Rent

174.9

67.0

241.9

531.1

208.3

739.4

General and administrative:

Merger, acquisition and other costs

2.3

2.6

4.9

5.8

5.9

11.7

Other

22.1

16.3

38.4

74.4

56.1

130.5

Depreciation and amortization

84.3

29.4

113.7

252.2

90.7

342.9

Operating costs and expenses

955.5

358.5

1,314.0

2,908.5

1,090.7

3,999.2

Operating income (loss)

15.2

5.8

21.0

90.6

2.5

93.0

Other expense (income)

(1.6)

0.4

(1.2)

4.6

0.6

5.2

Interest expense

83.0

2.2

85.2

248.7

6.8

255.5

Equity in earnings of non-consolidated

entities

(7.2)

(0.5)

(7.7)

(23.2)

(1.3)

(24.5)

Investment income

(0.4)

—

(0.4)

(5.7)

(14.8)

(20.5)

Total other expense

73.8

2.1

75.9

224.4

(8.7)

215.7

Loss before income taxes

(58.6)

3.7

(54.9)

(133.8)

11.2

(122.7)

Income tax provision (benefit)

(0.4)

0.2

(0.2)

8.9

2.3

11.2

Net income (loss)

$

(58.2)

$

3.5

$

(54.7)

$

(142.7)

$

8.9

$

(133.9)

Attendance

61,172

25,928

87,100

188,051

75,829

263,880

Average Screens

7,996

2,666

10,662

8,001

2,673

10,674

Average Ticket Price

$

9.45

$

8.90

$

9.29

$

9.43

$

9.15

$

9.35

Reconciliation of Consolidated Constant

Currency Adjusted EBITDA (see Note 10):

Three and Nine Months Ended September

30, 2019

(dollars in millions)

(unaudited)

Three Months Ended

Nine Months Ended

September 30, 2019

September 30, 2019

Constant Currency (10)

Constant Currency (10)

Net loss

$

(54.7)

$

(133.9)

Plus:

Income tax benefit

(0.2)

11.2

Interest expense

85.2

255.5

Depreciation and amortization

113.7

342.9

Certain operating expenses (2)

5.4

10.3

Equity in earnings of non-consolidated

entities (3)

(7.7)

(24.5)

Cash distributions from non-consolidated

entities (4)

4.7

17.1

Attributable EBITDA (5)

0.9

4.1

Investment income

(0.4)

(20.5)

Other expense (income) (6)

(1.5)

4.6

Non-cash rent expense - purchase

accounting (7)

6.2

19.9

General and administrative

expense—unallocated:

Merger, acquisition and other costs

(8)

4.9

11.7

Stock-based compensation expense (9)

2.1

11.7

Adjusted EBITDA (1)

$

158.6

$

510.1

Adjusted EBITDA (in millions) (1)

U.S. markets

$

116.3

$

395.8

International markets

42.3

114.3

Total Adjusted EBITDA

$

158.6

$

510.1

1)

We present Adjusted EBITDA as a supplemental measure of our

performance. We define Adjusted EBITDA as net earnings (loss) plus

(i) income tax provision (benefit), (ii) interest expense and (iii)

depreciation and amortization, as further adjusted to eliminate the

impact of certain items that we do not consider indicative of our

ongoing operating performance and to include attributable EBITDA

from equity investments in theatre operations in international

markets and any cash distributions of earnings from other equity

method investees. These further adjustments are itemized above. You

are encouraged to evaluate these adjustments and the reasons we

consider them appropriate for supplemental analysis. In evaluating

Adjusted EBITDA, you should be aware that in the future we may

incur expenses that are the same as or similar to some of the

adjustments in this presentation. Our presentation of Adjusted

EBITDA should not be construed as an inference that our future

results will be unaffected by unusual or non-recurring items.

Adjusted EBITDA is a non-U.S. GAAP financial measure commonly used

in our industry and should not be construed as an alternative to

net earnings (loss) as an indicator of operating performance (as

determined in accordance with U.S. GAAP). Adjusted EBITDA may not

be comparable to similarly titled measures reported by other

companies. We have included Adjusted EBITDA because we believe it

provides management and investors with additional information to

measure our performance and estimate our value.

Adjusted EBITDA has important limitations

as analytical tools, and you should not consider it in isolation,

or as a substitute for analysis of our results as reported under

U.S. GAAP. For example,

Adjusted EBITDA:

- does not reflect our capital expenditures, future requirements

for capital expenditures or contractual commitments;

- does not reflect changes in, or cash requirements for, our

working capital needs;

- does not reflect the significant interest expenses, or the cash

requirements necessary to service interest or principal payments,

on our debt;

- excludes income tax payments that represent a reduction in cash

available to us;

- does not reflect any cash requirements for the assets being

depreciated and amortized that may have to be replaced in the

future; and

- does not reflect the impact of divestitures that were required

in connection with recently completed acquisitions.

2)

Amounts represent preopening expense related to temporarily

closed screens under renovation, theatre and other closure expense

for the permanent closure of screens including the related

accretion of interest, non-cash deferred digital equipment rent,

and disposition of assets and other non-operating gains or losses

included in operating expenses. We have excluded these items as

they are non-cash in nature, include components of interest cost

for the time value of money or are non-operating in nature.

3)

During the three and nine months ended September 30, 2019, the

Company recorded $6.5 million and $21.1 million, respectively, in

earnings from DCIP. During the three months ended September 30,

2018, we recorded equity in earnings related to our sale of all

remaining NCM units of $28.9 million and a gain of $30.1 million

related to the Screenvision merger. Equity in loss of

non-consolidated entities also includes loss on the surrender

(disposition) of a portion of our investment in NCM of $1.1 million

during the nine months ended September 30, 2018. Equity in

(earnings) loss of non-consolidated entities includes a lower of

carrying value or fair value impairment loss of the held-for sale

portion of our investment in NCM of $16.0 million for the nine

months ended September 30, 2018.

4)

Includes U.S. non-theatre distributions from equity method

investments and International non-theatre distributions from equity

method investments to the extent received. We believe including

cash distributions is an appropriate reflection of the contribution

of these investments to our operations.

5)

Attributable EBITDA includes the EBITDA from equity investments

in theatre operators in certain international markets. See below

for a reconciliation of our equity (earnings) loss of

non-consolidated entities to attributable EBITDA. Because these

equity investments are in theatre operators in regions where we

hold a significant market share, we believe attributable EBITDA is

more indicative of the performance of these equity investments and

management uses this measure to monitor and evaluate these equity

investments. We also provide services to these theatre operators

including information technology systems, certain on-screen

advertising services and our gift card and package ticket program.

As these investments relate only to our Nordic acquisition, the

second quarter of 2017 represents the first time we have made this

adjustment and does not impact prior historical presentations of

Adjusted EBITDA.

Reconciliation of Constant Currency

Attributable EBITDA (Unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2019

2019

(In millions)

Constant Currency

Constant Currency

Equity in earnings of non-consolidated

entities

$

(7.7)

$

(24.5)

Less:

Equity in earnings of non-consolidated

entities excluding international theatre JV's

(7.6)

(23.4)

Equity in earnings of International

theatre JV's

0.1

1.1

Income tax provision

0.1

0.1

Investment income

(0.1)

(0.6)

Interest expense

—

0.2

Depreciation and amortization

0.5

3.0

Other expense

0.3

0.3

Attributable EBITDA

$

0.9

$

4.1

6)

Other expense (income) for the three months ended September 30,

2019 includes income of $8.5 million due to the increase in fair

value of the derivative asset related to the Company’s Convertible

Notes due 2024, expense of $5.7 million as a result of the decrease

in fair value of its derivative liability, and loss on Pound

sterling forward contract of $0.7 million. Other expense for the

nine months ended September 30, 2019 includes $16.6 million of fees

related to modifications of term loans income and $1.7 million loss

on GBP forward contract, partially offset by income of $14.9

million due to the decrease in fair value of the derivative

liability related to the Company’s Convertible Notes due 2024.

During the three months ended September 30, 2018, the Company

recorded expense of $54.1 million as a result of an increase in

fair value of the derivative liability for the Convertible Notes

due 2024. Other expense (income) for the three and nine months

ended September 30, 2018 includes financing losses and financing

related foreign currency transaction losses.

7)

Reflects amortization of certain intangible assets reclassified

from depreciation and amortization to rent expense, due to the

adoption of ASC 842.

8)

Merger, acquisition and transition costs are excluded as it is

non-operating in nature.

9)

Stock-based compensation expense is Non-cash or non-recurring

expense included in General and Administrative: Other.

10)

The International segment information for the three and nine

months ended September 30, 2019 has been adjusted for constant

currency. Constant currency amounts, which are non-GAAP

measurements were calculated using the average exchange rate for

the corresponding period for 2018. We translate the results of our

international operating segment from local currencies into U.S.

dollars using currency rates in effect at different points in time

in accordance with U.S. GAAP. Significant changes in foreign

exchange rates from one period to the next can result in meaningful

variations in reported results. We are providing constant currency

amounts for our international operating segment to present a

period-to-period comparison of business performance that excludes

the impact of foreign currency fluctuations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191107005322/en/

INVESTOR RELATIONS: John Merriwether, 866-248-3872

InvestorRelations@amctheatres.com

MEDIA CONTACTS: Ryan Noonan, (913) 213-2183

rnoonan@amctheatres.com

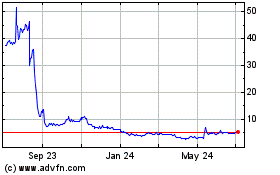

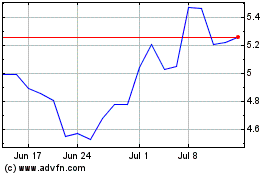

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Apr 2023 to Apr 2024