Amended Current Report Filing (8-k/a)

September 10 2019 - 4:18PM

Edgar (US Regulatory)

0001411579

true

0001411579

2019-08-07

2019-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): August 8, 2019

AMC ENTERTAINMENT HOLDINGS, INC.

(Exact Name of Registrant as Specified in

Charter)

|

Delaware

|

|

001-33892

|

|

26-0303916

|

|

(State or Other Jurisdiction of

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification

|

|

Incorporation)

|

|

|

|

Number)

|

One AMC Way

11500 Ash Street, Leawood, KS 66211

(Address of Principal Executive Offices,

including Zip Code)

(913) 213-2000

(Registrant’s Telephone Number, including

Area Code)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Class A common stock

|

|

AMC

|

|

New York Stock Exchange

|

Explanatory Note

This Current Report Amendment No. 1 on Form 8-K/A

is being furnished to correct the prior year adjusted free cash flow amounts for maintenance capital expenditures.

|

Item 2.02

|

Results of Operations and Financial Condition.

|

On August 8, 2019, we announced

our financial results for the second quarter ended June 30, 2019. On the same day, we filed a Current Report on Form 8-K

furnishing a copy of the press release relating to such financial results. This Current Report Amendment No. 1 on Form 8-K/A

is being furnished to correct the prior year adjusted free cash flow amounts for maintenance capital expenditures. Set forth

below are the corrected amounts and reconciliations.

Key Financial Results (presented

in millions)

|

|

|

Quarter

Ended June 30,

|

|

|

Six

Months Ended June 30,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

Change

|

|

|

2019

|

|

|

2018

|

|

|

Change

|

|

|

Non-GAAP Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted free cash flow

|

|

$

|

100.1

|

|

|

$

|

84.6

|

|

|

|

18.3

|

%

|

|

$

|

50.3

|

|

|

$

|

198.0

|

|

|

|

(74.6

|

)%

|

|

Adjusted free cash flow (2018 Adjusted for ASC

842)

|

|

$

|

100.1

|

|

|

$

|

70.2

|

|

|

|

42.6

|

%

|

|

$

|

50.3

|

|

|

$

|

169.0

|

|

|

|

(70.2

|

)%

|

Reconciliation of Adjusted Free Cash Flow (1)

(dollars in millions)

(unaudited)

|

|

|

Three Months Ended

|

|

|

Six Months Ended

|

|

|

|

|

June 30,

|

|

|

June 30,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

2019

|

|

|

2018

|

|

|

Net cash provided by operating activities

|

|

$

|

152.2

|

|

|

$

|

131.7

|

|

|

$

|

153.6

|

|

|

$

|

297.1

|

|

|

Plus:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Merger, acquisition and transaction costs (2)

|

|

|

3.2

|

|

|

|

4.3

|

|

|

|

6.5

|

|

|

|

9.0

|

|

|

Less:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maintenance capital expenditures (3)

|

|

|

25.7

|

|

|

|

21.2

|

|

|

|

45.0

|

|

|

|

35.8

|

|

|

Landlord contributions (5)

|

|

|

29.6

|

|

|

|

30.2

|

|

|

|

64.8

|

|

|

|

72.3

|

|

|

Adjusted free cash flow (1)

|

|

$

|

100.1

|

|

|

$

|

84.6

|

|

|

$

|

50.3

|

|

|

$

|

198.0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Capital Expenditures

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Growth capital expenditures (4)

|

|

$

|

88.2

|

|

|

$

|

119.9

|

|

|

$

|

158.7

|

|

|

$

|

193.9

|

|

|

Maintenance capital expenditures (3)

|

|

|

25.7

|

|

|

|

21.2

|

|

|

|

45.0

|

|

|

|

35.8

|

|

|

Change in construction payables (6)

|

|

|

1.2

|

|

|

|

(7.3

|

)

|

|

|

26.2

|

|

|

|

11.4

|

|

|

Total capital expenditures

|

|

$

|

115.1

|

|

|

$

|

133.8

|

|

|

$

|

229.9

|

|

|

$

|

241.1

|

|

Starting in the fourth quarter of 2018, AMC began disclosing

a new non-U.S. GAAP financial measure “Adjusted Free Cash Flow” as a measure of our liquidity. We believe this measure

is indicative of our ability to generate cash in excess of maintenance capital expenditures and certain other non-operating costs

and for other uses including repayment of our corporate borrowings and generating cash for growth opportunities.

|

|

1)

|

We present “Adjusted Free Cash Flow” as a supplemental measure of our liquidity. Management uses this measure and

we believe it is helpful to investors as an indication of our ability to generate cash in-excess-of maintenance capital expenditures

and certain other non-operating and costs and for other uses including repayment of our corporate borrowings and generating cash

for growth opportunities. Adjusted Free Cash Flow is a non-U.S. GAAP financial measure and is defined as net cash provided by operating

activities, plus merger, acquisition and transaction costs, less maintenance capital expenditures and landlord contributions. Adjusted

free cash flow does not represent the residual cash flow available for discretionary expenditures. It should be considered in addition

to, not a substitute for or superior to net cash provided by operating activities. The term adjusted free cash flow may differ

from similar measures reported by other companies. Also provided is a reconciliation of Capital Expenditures disclosed in the Consolidated

Statement of Cash Flows made up of growth capital expenditures, maintenance capital expenditures and change in construction payables

as further explanation of the components of adjusted free cash flow.

|

|

|

2)

|

Merger, acquisition and transition costs are excluded as they are non-operating.

|

|

|

3)

|

Maintenance capital expenditures are amounts required to keep our existing theatres in compliance with regulatory requirements

and in a sustainable good operating condition, including expenditures for repair of HVAC, sight and sound systems, compliance with

ADA requirements and technology upgrades of existing systems.

|

|

|

4)

|

Growth capital expenditures are investments that enhance the guest experience and grow revenues and profits and include initiatives

such as theatre remodels, acquisitions, newly built theatres, premium large formats, enhanced food and beverage offerings and service

models and technology that enable efficiencies and additional revenue opportunities. We did not deduct these from adjusted free

cash flow because they are discretionary, and the related benefits may not be fully reflected in our net cash provided by operating

activities.

|

|

|

5)

|

Landlord contributions represent reimbursements in our strategic growth initiatives by our landlords.

|

|

|

6)

|

Change in construction payables are changes in amounts accrued for capital expenditures and are not deducted or added back

to Adjusted Free Cash Flow as they fluctuate significantly from period to period based on the timing of actual payments.

|

|

|

|

Quarter Ended June 30,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

Change

|

|

|

Adjusted free cash flow

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted free cash flow (as reported)

|

|

$

|

100.1

|

|

|

$

|

84.6

|

|

|

|

18.3

|

%

|

|

Adjustment to cash flow used in operating activities (a)

|

|

|

—

|

|

|

|

(14.4

|

)

|

|

|

|

|

|

Adjusted free cash flow (post-ASC 842)

|

|

|

100.1

|

|

|

|

70.2

|

|

|

|

42.6

|

%

|

|

Impact of ASC 842 on Adjusted free cash flow

|

|

$

|

(14.0

|

)

|

|

$

|

(14.4

|

)

|

|

|

|

|

(a) Adjustments for principal payments for build-to-suit financing lease obligations that previously were reported in net cash used in financing activities

|

|

|

Six Months Ended June 30,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

Change

|

|

|

Adjusted free cash flow

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted free cash flow (as reported)

|

|

$

|

50.3

|

|

|

$

|

198.0

|

|

|

|

(74.6

|

)%

|

|

Adjustment to cash flow used in operating activities (a)

|

|

|

—

|

|

|

|

(29.0

|

)

|

|

|

|

|

|

Adjusted free cash flow (post-ASC 842)

|

|

|

50.3

|

|

|

|

169.0

|

|

|

|

(70.2

|

)%

|

|

Impact of ASC 842 on Adjusted free cash flow

|

|

$

|

(28.0

|

)

|

|

$

|

(29.0

|

)

|

|

|

|

|

(a) Adjustments for principal payments for build-to-suit financing lease obligations that previously were reported in net cash used in financing activities

The information furnished

pursuant to Item 2.02 of this Current Report on Form 8-K, including the exhibits, shall not be deemed to be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that

section, and shall not be deemed to be incorporated by reference into any of our filings under the Securities Act of 1933, as amended,

or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and regardless of any general

incorporation language in such filings, except to the extent expressly set forth by specific reference in such a filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, as amended, the Registrant has du1y caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

AMC ENTERTAINMENT HOLDINGS, INC.

|

|

Date: September 10, 2019

|

By:

|

/s/ Craig R. Ramsey

|

|

|

|

Craig R. Ramsey

|

|

|

|

Executive Vice President and Chief Financial Officer

|

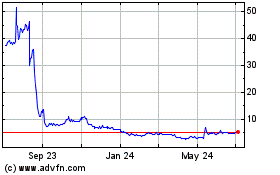

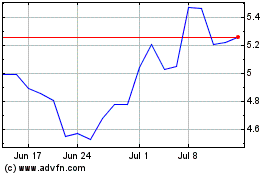

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Apr 2023 to Apr 2024