UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

Supplement No. 1 to Definitive Proxy Statement dated March 26, 2021

Alaska Air Group, Inc. (the “Company”) is filing this amendment and supplement (this “Supplement”) dated April 12, 2021 to its proxy statement dated March 26, 2021 (the “Proxy Statement”) in connection with the Company’s Annual Meeting of Stockholders to be held on May 6, 2021, to qualify the disclosure on director attendance and correct typographical errors:

Qualification to Director Attendance Disclosure

The director attendance disclosure on page 25 indicates each director except one attended at least 75% of all board and applicable committee meetings during 2020. It should be noted that Mr. Knight was appointed to the board on October 21, 2020 serving for less than a quarter of the fiscal year and attended one of the two 2020 board meetings held after his appointment (Mr. Knight’s absence was for a special telephonic meeting). Thus, Mr. Knight’s attendance was below the 75% threshold for the year.

Typographical Errors

Footnote 2 to the Summary Compensation Table on page 56 of the Proxy Statement. This update adjusts the amounts disclosed as reductions to compensation related expenses pertaining to Mr. Minicucci’s Performance Stock Units (PSUs). As corrected, footnote 2 is:

(2) The amounts reported in Stock Awards and Option Awards columns of the Summary Compensation Table above reflect the fair value of these awards on the grant date as determined under the principles used to calculate the value of equity awards for purposes of the Company’s financial statements (disregarding any estimate of forfeitures related to service-based vesting conditions). For a discussion of the assumptions and methodologies used to value the awards reported in these columns, please see the discussion of stock awards and option awards contained in Note 13 (Stock-Based Compensation Plans) to the Company’s Consolidated Financial Statements, included as part of the Company’s 2020 Annual Report filed on Form 10-K with the SEC and incorporated herein by reference. For more information about the stock awards and option awards granted in 2020 to the NEOs, please see the discussion under 2020 Grants of Plan-Based Awards below. Due to the impact of the COVID-19 pandemic on the Company and in light of CARES Act compensation limits, it is possible that the NEOs will not realize the full value of these grants. For PSU grants that are based on reaching certain ROIC targets, the Company’s financial statements reflect increases and reductions in compensation-related expense based on the determination of the number of awards that will ultimately vest. As a result of the impact of the COVID-19 pandemic on the Company’s financial results, it has been determined that all ROIC-based PSU awards granted in 2018, 2019 and 2020 will not meet threshold metrics for each award and will therefore not vest. Any previously recognized compensation expense for these awards was reversed in the Company’s 2020 financial statements as that was the time it was determined the portion of the awards with the ROIC component would have no value. The grant date fair value of these awards is included in the table above, however the value of the ROIC component of the PSUs will not be realized by the NEOs. As a result, the following reductions to compensation related expense were made for each of the NEOs as follows: Mr. Tilden – ($1,163,385) for 2020, ($1,093,412) for 2019 and ($642,401) for 2018; Mr. Tackett – ($508,848) for 2020, ($395,892) for 2019 and ($133,140) for 2018; Mr. Minicucci – ($727,156) for 2020, ($747,914) for 2019 and ($416,063) for 2018; Mr. Harrison – ($508,848) for 2020, ($528,233) for 2019 and ($303,226) for 2018; and Mr. Beck ($472,506) for 2020.

Footnote 2 to the 2020 Grants of Plan Based Awards on page 59 of the Proxy Statement. This update adjusts the amounts disclosed as reductions to compensation related expenses pertaining to Mr. Minicucci’s Performance Stock Units (PSUs). As corrected, footnote 2 is:

(2) The amounts reported in this column reflects the fair value of these awards on the grant date as determined under the principles used to calculate the value of equity awards for purposes of the Company’s financial statements and may or may not be representative of the value eventually realized by the executive. For a discussion of the assumptions and methodologies used to value the awards reported in this column, please see the discussion of stock awards and option awards contained in Note 12 (Stock-Based Compensation Plans) to the Company’s Consolidated Financial Statements, included as part of the Company’s 2020 Annual Report filed on Form 10-K with the SEC and incorporated herein by reference. PSU awards with ROIC targets are initially recorded and reported at target fair value but adjusted in accordance with GAAP based on expected and ultimate results. All 2018, 2019 and 2020 ROIC-based PSU awards have been written to $0 value in accordance with GAAP as the ROIC threshold goals for each award are not likely to be met due to the impact of the COVID-19 pandemic on the Company. As a result, any previously recognized compensation expense for these awards was reversed in the Company’s 2020 financial statements as that was the time it was determined the portion of the awards with the ROIC component would have no value. The grant date fair value of these awards is included in the table above, however the value of the ROIC component of the PSUs will not be realized by the participants. As a result, the following reductions to compensation expense were made for each of the NEOs as follows: Mr. Tilden – ($1,163,385); Mr. Tackett – ($508,848); Mr. Minicucci – ($727,156); Mr. Harrison – ($508,848); and Mr. Beck ($472,506).

Footnote 12 to the 2020 Outstanding Equity Awards at 2020 Fiscal Year End on page 61 of the Proxy Statement. This update adjusts the amounts disclosed as reductions to compensation related expenses pertaining to Mr. Minicucci’s Performance Stock Units (PSUs). As corrected, footnote 12 is:

(12) The PSUs reported in this column are eligible to vest based on the Company’s performance over three-year periods as described in the Compensation Discussion and Analysis above. The PSUs granted on 2/14/19 are eligible to vest based on the goals set for a three-year performance period ending 12/31/21 and the PSUs granted on 2/11/20 are eligible to vest based on the goals set for a three-year performance period ending 12/31/22. Due to the impact of the COVID-19 pandemic on the Company, for the purposes of the Company’s financial statements, the grant date fair value amounts of the portion of the PSUs awarded in 2020, 2019 and 2018 to the ROIC performance metric were reduced as follows: Mr. Tilden – ($1,163,385) for 2020, ($1,093,412) for 2019 and ($642,401) for 2018; Mr. Tackett – ($508,848) for 2020, ($395,892) for 2019 and ($133,140) for 2018; Mr. Minicucci – ($727,156) for 2020, ($747,914) for 2019 and ($416,063) for 2018; Mr. Harrison – ($508,848) for 2020, ($528,233) for 2019 and ($303,226) for 2018; and Mr. Beck ($472,506) for 2020.

To update the description of 2019 PSU performance measurements within the Long-Term Equity-Based Incentive Compensation section on page 48, 49 and 50. As corrected, is:

PSUs Granted in 2020. For the PSU awards granted to the NEOs in February 2020 with a January 1, 2020 through December 31, 2022 performance period, the vesting of 25% of the target number of stock units subject to the award will be determined in accordance with the chart below based on the Company’s TSR rank versus the following peer group of airlines: Delta Air Lines, United Airlines, American Airlines, Southwest Airlines, JetBlue Airlines, and

Hawaiian Airlines. The vesting of 75% of the target number of stock units subject to the award will be determined based on the Company’s return on invested capital (ROIC) performance for the three-year period as measured against goals set by the Committee. The Committee believes that measuring the Company’s performance relative to other major airlines and the use of appropriate ROIC goals encourages executives to manage the Company in such a way as to maintain sustainable growth and to attract a broader range of investors. Therefore, the Committee set ROIC as the primary performance measure (with 75% weight versus 50% weight in 2018) for the PSU awards granted in 2020 and 2019 to provide additional incentive for executives to support and drive long-term stockholder value. Given the nature of the airline business and the importance of out-performing our peers, the Committee retained relative TSR as a performance metric for the 2020 PSU awards. The Committee believes measuring TSR on a relative basis rather than on an absolute basis provides a more relevant reflection of the Company’s performance by mitigating the impact of various macro-economic factors, such as rising fuel costs, that tend to affect the entire industry. The percentage of the PSUs that vest range from 0% to 200% of the target number of units subject to the award, depending on the results of the Company’s goals for the performance period. The payout percentages are interpolated for performance results falling between the levels identified below. The Committee retains discretion to reduce vesting percentages below the level that would otherwise be paid. The Company does not issue dividend equivalents on unvested PSUs.

PSUs Granted Before 2020. In February 2017, the Committee approved grants of PSUs to the NEOs for the January 1, 2017 through December 31, 2019 performance period. In February 2020, the Committee approved a payout of these PSUs at a rate of 79.0%. Such performance stock awards were based 50% on the Company’s TSR performance relative to the following airline peer group (excluding certain companies that ceased being publicly traded during the performance period): Air Canada, Allegiant Travel Co., American Airlines Group, Delta Air Lines, Hawaiian Holdings, JetBlue Airways, Republic Airways Holdings, SkyWest, Southwest Airlines, Spirit Airlines, and United Continental Holdings. The Company’s TSR performance ranked 8th among these 11 peers, resulting in a 60% payout for that metric. The PSU awards granted in 2017 were also based 50% on achievement of the Company’s ROIC goals set by the Committee (maximum payout if ROIC was 20% or above, target payout for ROIC of 13%, and threshold payout for ROIC of 10% or below). The Company’s average ROIC during the 2017-2019 performance period was 11.4%, resulting in a 128% payout for that metric.

The Committee also made grants in 2018 and 2019 with three-year performance periods beginning in January of each respective year.

For the PSU awards granted in February 2018 to NEOs with a January 1, 2018 through December 31, 2020 performance period, the vesting of 25% of the stock units subject to the award is determined based on the Company’s TSR rank versus the same airline peer group as that used for the 2017 awards, except that Republic Airways Holdings was excluded as it ceased being a publicly traded company during the performance period. The vesting of 25% of the stock units subject to the award is determined based on the Company’s TSR rank relative to S&P 500 companies. The vesting of 50% of the stock units subject to the award is determined based on the Company’s ROIC performance for the three-year period as measured against goals set by the Committee. In early 2021, the Committee determined that the ROIC portion of these awards would not vest given the substantial loss in 2020 as a result of the COVID-19 pandemic on demand for air travel and approved payouts of 22.5% of target for these PSU awards based solely on relative TSR performance for the three-year period.

The PSU awards granted in 2019 are scheduled to vest at the end of the January 1, 2019 through December 31, 2021 performance period. The PSU awards granted in 2019 were based 25% on the Company’s TSR performance relative to S&P 500 companies and 75% on the Company’s ROIC goals set by the Committee. As noted previously, we expect the portion of these awards allocated to the ROIC metric will vest at 0% given the substantial loss in 2020 as a result of the COVID-19 pandemic on demand for air travel and have reduced the ROIC portion of their value to $0 for accounting purposes in accordance with GAAP.

This Supplement should be read in conjunction with the Proxy Statement. Except as specifically corrected by this Supplement, all information in the Proxy Statement remains unchanged.

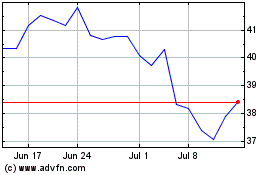

Alaska Air (NYSE:ALK)

Historical Stock Chart

From Mar 2024 to Apr 2024

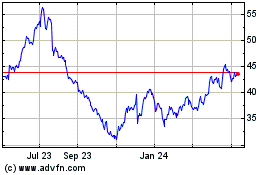

Alaska Air (NYSE:ALK)

Historical Stock Chart

From Apr 2023 to Apr 2024