Current Report Filing (8-k)

March 22 2021 - 9:01AM

Edgar (US Regulatory)

0000766421false00007664212021-03-182021-03-1800007664212020-07-232020-07-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

March 18, 2021

(Date of earliest event reported)

ALASKA AIR GROUP, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

|

|

|

|

|

|

|

|

|

|

1-8957

|

|

91-1292054

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19300 International Boulevard

|

Seattle

|

Washington

|

|

98188

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(206) 392-5040

(Registrant's Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Ticker Symbol

|

Name of each exchange on which registered

|

|

Common stock, $0.01 par value

|

ALK

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

This document is also available on our website at http://investor.alaskaair.com

ITEM 5.02 Departure of Directors or Certain Officers; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b) Departure of Director or Certain Officers

On February 17, 2021, Gary L. Beck, announced his intention to retire from his positions as executive vice president and chief operating officer (“COO”) of Alaska Airlines, Inc., a wholly-owned subsidiary of Alaska Air Group, Inc. (the “Company”), and as a member of the Company’s management executive committee effective April 3, 2021. Mr. Beck will remain employed through February 12, 2022 as Special Advisor to Benito “Ben” Minicucci, whom the Company announced will become the CEO of the Company and Alaska Airlines on March 31, 2021.. Mr. Beck has served as a pilot and in numerous executive capacities in the airline industry over 47 years and has been in his current position at Alaska Airlines since 2019.

(c) Appointment of Certain Officers and Compensatory Arrangements of Certain Officers

On March 18, 2021, the Company’s Board of Directors elected Ms. Constance von Muehlen to succeed Mr. Beck as executive vice president and COO of Alaska Airlines effective April 3, 2021. As the Company’s principal operating officer, Ms. von Muehlen will serve on the management executive committee. A copy of the press release announcing this election is attached as Exhibit 99.1 and is incorporated by reference.

Ms. von Muehlen, age 53, has served as Alaska Airlines’ senior vice president of maintenance and engineering since January 2019. In 2018, she served as chief operating officer at Horizon Air Industries, Inc. Ms. von Muehlen also previously served as Alaska Airlines’ managing director of airframe, engine and component maintenance (2012-2017). Before joining Alaska Airlines in 2011, she spent 20 years in aviation maintenance leadership roles at Pratt and Whitney and Air Canada. She also served tours of duty as a Blackhawk helicopter pilot in Germany, Iraq, Turkey and South Korea as a captain in the U.S. Army.

There are no arrangements or understandings between Ms. von Muehlen and any other person pursuant to which she was appointed to serve as executive vice president and COO. There are no family relationships between Ms. von Muehlen and any director or executive officer of the Company, and she has no direct or indirect material interest in any “related party” transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Compensation Arrangement with Ms. von Muehlen

On March 17, 2021, in connection with Ms. von Muehlen’s election as executive vice president and COO, the compensation and leadership development committee (“Committee”) of the Company’s board of directors approved an increase in her annual base salary from $300,000 to $400,000 and in her target annual cash incentive opportunity from 65% of base salary to 85% of base salary.

The Committee also approved and granted Ms. von Muehlen a long-term incentive award under the Company’s 2016 Performance Incentive Plan at a target value of $1 million (as opposed to the target equity value of 100% of her base salary for the equity award she was granted in February 2020). One-half of the award is made up of performance stock units (“PSUs”), 25% is in the form of restricted stock units (“RSUs”), and 25% is in the form of incentive stock options. The RSUs cliff vest on the third anniversary of the grant, the PSUs vest based on the results of goals set for a three-year performance period, and the options vest at the rate of 25% per year over a four-year term.

Ms. von Muehlen may not realize the full value of her COO compensation package during any period in which executive compensation limitations under the CARES Act apply. The Company will continue to monitor and administer its executive compensation program in accordance with CARES Act requirements.

ITEM 7.01. Regulation FD Disclosure

On March 22, 2021, the Company issued a press release announcing the retirement of Gary Beck and the succession of Constance von Muehlen as Alaska Airlines’ executive vice president and COO effective April 3, 2021. The press release is furnished as Exhibit 99.1.

ITEM 8.01. Other Items

Payroll Support Program Funding

On March 19, 2021, Alaska Airlines and Horizon Air Industries, Inc. accepted the second partial disbursement for funds through an extension of the Payroll Support Program (PSP) of the CARES Act. Of the $266 million in funds received,

approximately $50 million takes the form of a senior term loan with a 10-year term, bearing an interest rate of 1% in years 1–5, and SOFR + 2% in years 6–10. The loan is prepayable at par at any time. As additional taxpayer protection required under the PSP, we granted the Treasury Department 154,647 warrants to purchase Alaska Air Group (ALK) common stock at a strike price of $52.25, based on the closing price on December 24, 2020. The warrants are non-voting, freely transferable, and may be settled as net shares or in cash at Alaska’s option.

364-day Senior Secured Term Loan Extension

On March 16, 2021, the Company extended the maturity of the 364-day Senior Secured Term Loan agreement (the Loan Agreement) into 2022, which was previously due to expire on March 25, 2021. Upon extension of the Loan Agreement, the Company increased the outstanding balance from $371 million to $425 million.

ITEM 9.01 Financial Statements and Other Exhibits

|

|

|

|

|

|

|

|

|

|

|

|

|

Press Release dated March 22, 2021

|

|

104

|

|

Cover Page Interactive Data File - embedded within the Inline XBRL Document

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

ALASKA AIR GROUP, INC.

Registrant

Date: March 22, 2021

/s/ KYLE B. LEVINE

Kyle B. Levine

Senior Vice President, Legal, General Counsel and Corporate Secretary

/s/ CHRISTOPHER M. BERRY

Christopher M. Berry

Vice President Finance and Controller

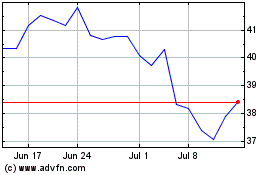

Alaska Air (NYSE:ALK)

Historical Stock Chart

From Mar 2024 to Apr 2024

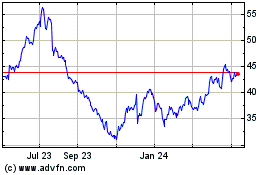

Alaska Air (NYSE:ALK)

Historical Stock Chart

From Apr 2023 to Apr 2024