Current Report Filing (8-k)

March 10 2020 - 4:06PM

Edgar (US Regulatory)

FALSE000089707700008970772020-03-102020-03-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 10, 2020 (March 6,2020)

Alamo Group Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

State of Delaware

|

0-21220

|

74-1621248

|

|

(State or other jurisdiction of incorporation)

|

(Commission File No.)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

1627 E. Walnut, Seguin, Texas

|

78155

|

|

(Address of Registrant’s principal executive offices)

|

(Zip Code)

|

(830) 379-1480

Registrant's telephone number, including area code:

|

|

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value

$.10 per share

|

ALG

|

New York Stock Exchange

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of

the Securities Act or Rule 12b-2 of the Securities Exchange Act.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the

extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Entry into a Material Definitive Agreement

On March 6, 2020, Alamo Group Inc. (the “Company”) entered into change in control agreements with its named executive officers and certain of its other senior executive officers (“executive officers”). The intent of these agreements is to provide executive officers with financial security in the event of a change in control to facilitate a transaction which may benefit shareholders but result in job loss to executives. Generally, each of the executive officers is entitled to receive, upon termination of employment within six months preceding or twenty-four months after a change in control of the Company (unless such termination is because of death, disability, for cause, or by the officer other than for "good reason," as defined in the change in control agreements), (a) a lump sum severance payment equal to (i) the executive officers annual base salary in effect immediately prior to the change in control or the date of the executive's termination (whichever is greater) plus (ii) an amount equal to the executive’s target bonus opportunity for the calendar year in which the change in control or the date of the executive's termination occurs (whichever is greater) multiplied by a benefit factor which varies by position as described in the table below (the "Severance Factor"); (b) acceleration of vesting of all time-based equity awards including restricted stock awards (RSAs) and stock options that vest ratably over time; and (c) reimbursement of health care insurance costs for a period of eighteen (18) months following the executive's termination of employment, if COBRA is elected by the executive under the Company's group health plan. The Severance Factor for each named executive officer is set out in the table immediately below:

|

|

|

|

|

|

|

|

NAME

|

SEVERANCE FACTOR

|

|

Ronald A. Robinson

|

3

|

|

Dan E. Malone

|

1.5

|

|

Jeffery A. Leonard

|

2

|

|

Richard H. Raborn

|

2

|

|

Edward T. Rizzuti

|

1.5

|

The events that trigger a change-in-control under these agreements include (i) the acquisition of 50% or more of our outstanding common stock by certain persons, (ii) certain changes in the membership of the Board of Directors of the Company, (iii) certain mergers or consolidations, and (iv) a sale or transfer of all or substantially all of the Company’s assets. The receipt of any and all severance payments pursuant the change in control agreements in place with each of our NEO's is expressly conditioned on each executive's execution (and non-revocation) of a release of claims agreement. The change in control agreements do not apply to performance based equity awards including the Company's performance share unit (PSU) awards.

The summary is qualified in its entirety by the form of change of control agreement attached hereto as exhibit 10.1 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d). Exhibits. The following exhibit is being filed herewith:

|

|

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

10.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

March 10, 2020

|

By: /s/ Edward T. Rizzuti

|

|

|

Edward T. Rizzuti

|

|

|

Vice President, General Counsel & Secretary

|

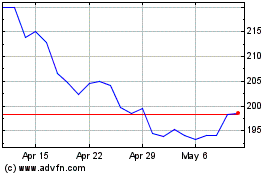

Alamo (NYSE:ALG)

Historical Stock Chart

From Mar 2024 to Apr 2024

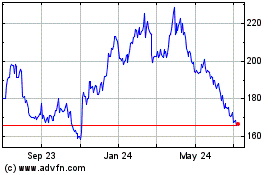

Alamo (NYSE:ALG)

Historical Stock Chart

From Apr 2023 to Apr 2024