Current Report Filing (8-k)

October 30 2019 - 6:06AM

Edgar (US Regulatory)

FALSE000089707700008970772019-10-292019-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 29, 2019 (October 24, 2019)

Alamo Group Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

State of Delaware

|

0-21220

|

74-1621248

|

|

(State or other jurisdiction of incorporation)

|

(Commission File No.)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

1627 E. Walnut, Seguin, Texas

|

78155

|

|

(Address of Registrant’s principal executive offices)

|

(Zip Code)

|

(830) 379-1480

Registrant's telephone number, including area code:

|

|

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value

$.10 per share

|

ALG

|

New York Stock Exchange

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of

the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of

1934 (§240.12b-2 of this chapter).Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the

extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Second Amended and Restated Credit Agreement

On October 24, 2019, the Company, as Borrower, and each of its domestic subsidiaries as guarantors, entered into a Second Amended and Restated Credit Agreement (the “Credit Agreement”) with Bank of America, N.A., as Administrative Agent. The Credit Agreement provides Borrower with the ability to request loans and other financial obligations in an aggregate amount of up to $650,000,000. Pursuant to the Credit Agreement, Borrower has borrowed $300,000,000 pursuant to a Term Facility repayable with interest quarterly at a percentage of the initial principal amount of the Term Facility of 5.0% per year with the remaining principal due in 5 years. Up to $350,000,000 is available under the Credit Agreement pursuant to a Revolver Facility which terminates in 5 years. Loan proceeds under the Credit Agreement are to be used: (i) to finance Borrowers recently announced purchase of Morbark LLC and its affiliated entities, and (ii) to finance other working capital needs and general corporate purposes of Borrower and its subsidiaries. The Credit Agreement provides that advances are unsecured, and is subject to customary affirmative and negative covenants.

The above description is qualified in its entirety by reference to the Credit Agreement, which is filed herewith as Exhibit 10.1 and is incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets.

On September 11, 2019, Alamo Group Inc. (the “Company”), and Alamo Acquisition Corporation, an indirect wholly-owned subsidiary of the Company, entered into a definitive Securities Purchase Agreement to acquire 100% of the equity interests in Morbark Holdings Group, LLC (“Morbark”) and its direct and indirect subsidiaries (the "Morbark Acquisition"). Sellers include Stellex Capital Partners, LP and certain of its affiliates and certain members of Morbark management (collectively, the “Sellers”). The total consideration for the purchase is approximately $352,000,000 subject to certain adjustments. Morbark and its wholly-owned subsidiaries are leading manufacturers of equipment and aftermarket parts for forestry, tree maintenance, biomass, land management and recycling markets.

On October 24, 2019, the Company and Sellers completed the Morbark Acquisition. Total consideration paid in the Morbark Acquisition was approximately $352 million in cash on a cash free, debt free basis, subject to certain closing adjustments. The Company financed the Morbark Acquisition with new borrowings under the Credit Agreement.

There are no material relationships between the Sellers and Company or any of their respective affiliates, members, managers, directors or officers or any associate of any such member, manager, director or officer, other than with respect to the Securities Purchase Agreement and the ancillary agreements referred to therein and the transactions contemplated thereby.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information provided in Items 1.01 and 2.01 of this report are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(a) Financial Statements of Business Acquired.

The financial statements, to the extent required by this Item with respect to the Morbark Acquisition, will be filed by amendment to this report no later than 71 calendar days after the date on which this report was required to be filed pursuant to Item 2.01.

(b) Pro Forma Financial Information.

The pro forma financial information, to the extent required by this Item with respect to the Morbark Acquisition, will be filed by amendment to this report no later than 71 calendar days after the date on which this report was required to be filed pursuant to Item 2.01.

(d) Exhibits:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

|

|

104

|

|

Cover Page Interactive Data File - Inline XBRL for the cover page of this Current Report on Form 8-K

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

October 29, 2019

|

By: /s/ Edward T. Rizzuti

|

|

|

Edward T. Rizzuti

|

|

|

Vice President, General Counsel & Secretary

|

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

|

|

104

|

|

Cover Page Interactive Data File - Inline XBRL for the cover page of this Current Report on Form 8-K

|

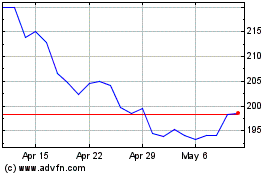

Alamo (NYSE:ALG)

Historical Stock Chart

From Mar 2024 to Apr 2024

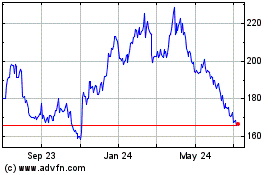

Alamo (NYSE:ALG)

Historical Stock Chart

From Apr 2023 to Apr 2024