Current Report Filing (8-k)

May 08 2020 - 8:10AM

Edgar (US Regulatory)

false000091591300009159132020-05-042020-05-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________

FORM 8-K

_________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) May 4, 2020

_________________________________

ALBEMARLE CORPORATION

(Exact name of registrant as specified in charter)

_________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Virginia

|

|

001-12658

|

|

54-1692118

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

4250 Congress Street, Suite 900

Charlotte, North Carolina 28209

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (980) 299-5700

Not Applicable

(Former name or former address, if changed since last report)

_________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $.01 Par Value

|

|

ALB

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As part of the Albemarle Corporation’s (the Company) broad-based efforts to reduce costs and focus on short-term cash management during the current period of uncertainty resulting from the economic downturn in connection with the coronavirus (COVID-19) pandemic, the Company is implementing cost reduction measures including the base salary reductions described below.

The Company’s Chairman, President and Chief Executive Officer (“CEO”), J. Kent Masters; Executive Vice President, Chief Financial Officer, Scott A. Tozier; Executive Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary, Karen G. Narwold; President, Lithium, Eric W. Norris; President, Catalysts, Raphael G. Crawford; President, Bromine Specialties, Netha N. Johnson, Jr; and certain other members of the Company’s senior leadership team will experience temporary base salary reductions of 20% beginning May 11, 2020 and continuing at the reduced amount until December 31, 2020, or such earlier time as the CEO determines. The temporarily adjusted base salaries will not be used to calculate annual cash bonus which are derived based on base salary. Mr. Masters has acknowledged his agreement to the base salary reduction and he and the Company have agreed that these changes will not trigger or otherwise modify any other rights under his employment agreement. None of the other executives have employment agreements.

In addition, the Company’s Board of Directors (the “Board”) has determined that the cash compensation of the non-employee members of the Board, including director retainer fee, Lead Independent Director fee, and each committee Chair fee, shall be temporarily reduced by 20% effective with the non-executive director compensation period beginning on July 1, 2020 and continuing at the reduced amount until December 31, 2020, or such earlier time the Board determines.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On May 5, 2020, the Company held its 2020 Annual Meeting of Shareholders (the “Annual Meeting”). During this meeting, the proposals listed below were submitted to a vote of the shareholders through the solicitation of proxies. The proposals are described in the Company’s 2020 Proxy Statement. The voting results for each proposal are set forth below.

As of the record date for the Annual Meeting, March 5, 2020, there were 106,318,614 shares of common stock outstanding and entitled to vote, of which the holders of 89,707,212 shares of common stock were represented in person or by proxy at the Annual Meeting.

Proposal 1. Advisory vote on executive compensation. The shareholders approved, on a non-binding, advisory basis, the compensation of the Company’s named executive officers, by the votes set forth in the table below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Voted For

|

|

Voted Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

75,354,064

|

|

3,101,302

|

|

237,903

|

|

11,013,943

|

Proposal 2. Election of directors. The shareholders elected all of the nominees for director to serve for a term expiring at the annual meeting of shareholders in 2021, by the votes set forth in the table below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nominees

|

|

Voted For

|

|

Voted Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

Mary Lauren Brlas

|

|

78,296,108

|

|

299,648

|

|

97,513

|

|

11,013,943

|

|

Luther C. Kissam IV

|

|

77,481,786

|

|

962,222

|

|

249,261

|

|

11,013,943

|

|

J. Kent Masters

|

|

76,449,124

|

|

1,822,952

|

|

421,193

|

|

11,013,943

|

|

Glenda J. Minor

|

|

78,322,052

|

|

272,124

|

|

99,093

|

|

11,013,943

|

|

James J. O’Brien

|

|

77,930,911

|

|

595,944

|

|

166,414

|

|

11,013,943

|

|

Diarmuid B. O'Connell

|

|

77,581,036

|

|

943,426

|

|

168,807

|

|

11,013,943

|

|

Dean L. Seavers

|

|

78,254,673

|

|

266,822

|

|

171,774

|

|

11,013,943

|

|

Gerald A. Steiner

|

|

77,582,531

|

|

941,445

|

|

169,293

|

|

11,013,943

|

|

Holly A. Van Duersen

|

|

70,762,827

|

|

7,831,291

|

|

99,151

|

|

11,013,943

|

|

Amb. Alejandro Wolff

|

|

77,371,959

|

|

1,152,402

|

|

168,908

|

|

11,013,943

|

Proposal 3. Ratification of appointment of independent registered public accounting firm. The shareholders ratified the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020, by the votes set forth in the table below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Voted For

|

|

Voted Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

85,322,728

|

|

4,294,697

|

|

89,787

|

|

N/A

|

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Exhibit Description

|

|

104

|

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document.

|

# Management contract or compensatory plan or arrangement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALBEMARLE CORPORATION

|

|

|

|

|

|

|

|

|

|

Date: May 8, 2020

|

|

By:

|

|

/s/ Karen G. Narwold

|

|

|

|

|

|

Karen G. Narwold

|

|

|

|

|

|

Executive Vice President, Chief Administrative Officer and General Counsel

|

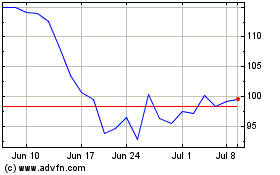

Albemarle (NYSE:ALB)

Historical Stock Chart

From Mar 2024 to Apr 2024

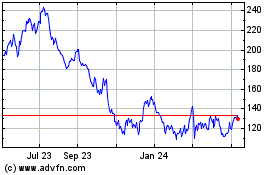

Albemarle (NYSE:ALB)

Historical Stock Chart

From Apr 2023 to Apr 2024