UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

Air Lease Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

1)

|

Amount Previously Paid:

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

Air Lease Corporation Spring 2020 Stockholder Engagement

Forward Looking Statements & Non-GAAP Measures Statements in this presentation that are not historical facts are hereby identified as “forward-looking statements,” including any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance. These statements are often, but not always, made through the use of words or phrases such as “anticipate,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends” and similar words or phrases. Accordingly, these statements are only predictions and involve estimates, known and unknown risks, assumptions and uncertainties that could cause actual results to differ materially from those expressed in them. We wish to caution you that our actual results could differ materially from those anticipated in such forward-looking statements as a result of several factors, including, but not limited to, the following: • our inability to obtain additional financing on favorable terms, if required, to complete the acquisition of sufficient aircraft as currently contemplated or to fund the operations and growth of our business; • our inability to obtain refinancing prior to the time our debt matures; • our inability to make acquisitions of, or lease, aircraft on favorable terms; • our inability to sell aircraft on favorable terms or to predict the timing of such sales; • impaired financial condition and liquidity of our lessees; • changes in overall demand for commercial aircraft leasing and aircraft management services; • deterioration of economic conditions in the commercial aviation industry generally; • potential natural disasters and terrorist attacks and the amount of our insurance coverage, if any, relating thereto; • increased maintenance, operating or other expenses or changes in the timing thereof; • changes in the regulatory environment, including tariffs and other restrictions on trade; • our inability to effectively oversee our managed fleet; • the failure of any manufacturer to meet its contractual aircraft delivery obligations to us, including or as a result of technical or other difficulties with aircraft before or after delivery, resulting in our inability to deliver the aircraft to our lessees and; •other factors affecting our business or the business of our lessees and manufacturers that are beyond our or their control, including natural disasters, pandemics (such as COVID-19) and governmental actions. 2

Forward Looking Statements & Non-GAAP Measures We also refer you to the documents the Company files from time to time with the Securities and Exchange Commission (“SEC”), specifically the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 which contains and identifies important factors that could cause the actual results for the Company on a consolidated basis to differ materially from expectations and any subsequent documents the Company files with the SEC. All forward-looking statements are necessarily only estimates of future results, and there can be no assurance that actual results will not differ materially from expectations, and, therefore, you are cautioned not to place undue reliance on such statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. If any such risks or uncertainties develop, our business, results of operation and financial condition could be adversely affected. The Company has an effective registration statement (including a prospectus) with the SEC. Before you invest in any offering of the Company’s securities, you should read the prospectus in that registration statement and other documents the Company has filed with the SEC for more complete information about the Company and any such offering. You may obtain copies of the Company’s most recent Annual Report on Form 10-K and the other documents it files with the SEC for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Company will arrange to send such information if you request it by contacting Air Lease Corporation, General Counsel and Corporate Secretary, 2000 Avenue of the Stars, Suite 1000N, Los Angeles, California 90067, (310) 553-0555. The Company routinely posts information that may be important to investors in the “Investors” section of the Company’s website at www.airleasecorp.com. Investors and potential investors are encouraged to consult the Company’s website regularly for important information about the Company. The information contained on, or that may be accessed through, the Company’s website is not incorporated by reference into, and is not a part of, this presentation. In addition to financial results prepared in accordance with U.S. generally accepted accounting principles, or GAAP, this presentation contains certain non-GAAP financial measures. Management believes that in addition to using GAAP results in evaluating our business, it can also be useful to measure results using certain non-GAAP financial measures. Investors and potential investors are encouraged to review the reconciliation of non-GAAP financial measures with their most direct comparable GAAP financial results set forth in the Appendix section. Uncertain impact of COVID-19 virus: Epidemic diseases have hindered air travel in the past and the current concern surrounding coronavirus may continue to negatively impact air travel. While air travel has historically proved to be resilient over time, we cannot currently predict the ultimate impact of COVID-19 on our business. The compensation for this year’s proxy statement is based on 2019 financial results, prior to the COVID-19 pandemic. 3

Air Lease: Consistent Asset and Revenue Growth and Strong Financial Performance1 Consistent asset and revenue growth under the leadership of our management team Asset Growth ($ in billions) Revenue Growth ($ in billions) 1All information per ALC public filings and unless otherwise noted, as of or for the year ended December 31, 2019. 2Includes 292 owned aircraft, 83 managed aircraft and 413 aircraft on order. 3Includes $14.1 billion in contracted minimum rental payments on the aircraft in our existing fleet and $15.0 billion in minimum future rental payments related to aircraft which will be delivered between 2020 and 2024. Air Lease Corporation is a leading global commercial aircraft leasing company We purchase new commercial jet transport aircraft directly from aircraft manufacturers and lease those aircraft to airlines throughout the world We have a diversified, global customer base with 106 airlines across 59 countries 2010 Founded 2011 IPO 788 Aircraft owned, managed & on order2 $29.1bn Committed minimum future fleet rentals3 2.41x Debt to equity 36.5% Pre-tax profit margin 15% CAGR 13% CAGR

$29.1 billion in total committed minimum future rental payments1 – high revenue clarity 79% of order book placed for aircraft delivering through 2022 – limits placement risk Portfolio credit risk exposure minimized – diversified customer base with 106 airlines in 59 countries Strong balance sheet – low 2.41x D/E leverage, strong unencumbered asset base, 88% of debt at a fixed rate Strong Financial Performance Continued in 2019 2019 Results Revenues Income before taxes Diluted EPS $2.0 billion + 20.1% vs. 2018 $736 million + 14.9% vs. 2018 $5.09 + 10.7% vs. 2018 Note: All information per ALC public filings and unless otherwise noted, as of or for the year ended December 31, 2019. 1Includes $14.1 billion in contracted minimum rental payments on the aircraft in our existing fleet and $15.0 billion in minimum future rental payments related to aircraft we will deliver between 2020 and 2024.

Air Lease 2019 Executive Compensation Program 1On November 6, 2019, Aircastle announced that it entered into a definitive agreement to be acquired by a newly-formed entity controlled by affiliates of Marubeni Corporation and Mizuho Leasing Company. Aircastle expects to complete the merger on or about March 27, 2020, subject to the satisfaction of the remaining customary closing conditions set forth in the merger agreement. 2As reported in March 2020 Proxy Statement. Based on 2019 salary at December 31, 2019. Executive Compensation Program Reflects Our Unique Business and Leadership Team 2019 Executive Compensation Decisions and Outcomes High Levels of Stock Ownership Demonstrate Alignment with Stockholders Significant management stock ownership Mr. Udvar-Házy: 106x base salary2 Mr. Plueger: 30x base salary2 Stock ownership creates strong alignment between our executives and our stockholders We require a small number of extraordinary and talented individuals with industry experience to manage and lead a highly capital-intensive and global business – 2019 Revenue / Employee = $17.2M We are one of only four US listed public aircraft leasing companies1 Base Salaries: All of our NEOs’ (other than the CFO’s) base salary remained unchanged Annual Bonus: Consistent with strong corporate performance, corporate factor used to determine annual incentive compensation was 137% Executive Chairman Compensation: In 2019, the only cash compensation paid to our Executive Chairman was his base salary CEO Compensation: In 2019, approximately 72% of our CEO’s total compensation paid was performance-based and not guaranteed 6

Small, Talented Team Responsible for Managing Complex Business Company/Industry Revenue / Employee (mm) Total Assets / Employee (mm) Net Income / Employee (mm) Air Lease Corporation1 $17.24 $185.55 $4.92 2019 Custom Benchmark2 $7.39 $60.80 $1.77 1 As of December 31, 2019 2 Source: Bloomberg. Reflects custom benchmark group of 18 companies with information available as of March 2020. Compared to other capital intensive businesses similar to ALC, our employees are responsible for significantly more revenue, income and assets Managing this level of assets with a small number of employees requires extraordinarily talented individuals with deep industry experience, and our compensation program is designed to reward these talented employees for delivering long-term shareholder value Annual incentive bonus is highly performance-based with equally weighted top-line and bottom-line performance metrics 50% of LTI payout ties to our book value growth measured at the end of a 3-year performance period (rather than annually as in years prior to 2018) 25% of LTI payout ties to relative Total Stockholder Return (“TSR”) and depends on our ranking within the S&P MidCap 400 Index 7

Financial Performance Measures 2019 Target Change versus 2018 Target 2019 Actual Performance Achievement Level Overall Revenue $2,027 23.9% $2,016.9 96% Adjusted Pre-Tax Return on Common Equity* 15.1% 1.3% 15.4%* 147% 2019 Annual Incentives Reward Financial Performance and Strategic Achievements Performance-Based Annual Incentives Strategic Objective Performance Against Strategic Goal Cumulative placement of aircraft through 2022 We ended 2019 with 79% lease placement through 2022, significantly exceeding expectations. 200% 80% 20% We set rigorous targets under our 2019 annual incentive program, which is structured to measure both the financial and strategic achievements that we believe underpin long-term value creation *Adjusted pre-tax return on common equity is a non-GAAP financial measure. See appendix for a reconciliation to its most directly comparable GAAP measure. Total (Company Performance Factor) 137% 8

2019 Long-Term Incentives Equity Mix Key Elements Performance Link Book Value RSUs (50%) Book value is a key value driver of our stockholder value Cliff vest at the end of a 3-year performance period (rather than annually as in years prior to 2018) Book value must increase by more than 20% over the 3-year performance period for any RSUs to vest Book value must increase by 29% for target RSU awards to vest Book Value Appreciation Relative TSR (25%) Focuses executives on actions that will generate sustainable value creation 3-year performance measurement period TSR measured against S&P 400 MidCap Index Time-based RSUs provide a retention incentive Vests in three equal annual installments Total Shareholder Return Time-based RSUs (25%) Share Price Appreciation Time-based RSUs (25%) 2019 Long-Term Incentives Aligned with Performance 75% of CEO’s and Named Executive Officers’ long-term annual equity awards consist of performance-based shares 50% Book Value appreciation RSUs, 25% Relative Total Shareholder Return, 25% Time-Based RSUs 25% of CEO’s and Named Executive Officers’ LTI is time-based 9

Stockholder Engagement To better understand our investors’ perspectives regarding our executive compensation program, for the last several years we have engaged in stockholder outreach, engaging holders of over 40% of outstanding shares after our 2019 proxy statement was filed (none of whom were our employees or directors) The feedback we heard from our stockholders throughout our engagement meetings was shared with the leadership development and compensation committee and entire Board, and was incorporated into 2019 compensation decisions and our 2020 compensation program Demonstrated Responsiveness to Stockholder Feedback What we looked at 2018/2019 Outcomes Executive Chairman’s Annual Bonus Structure of Executive Chairman’s annual bonus changed since 2018 so that, in lieu of cash, he was granted RSUs that cliff vest two years from the date of grant, effectively requiring a three-year vesting period. As a result of this change, the only cash compensation paid to our Executive Chairman in 2018 and 2019 was his base salary. Streamlined Annual Bonus Performance Metrics Reduced the number of operating metrics to two from four since 2018, utilizing equal-weighted top-line and bottom-line performance metrics to further incentivize the achievement of profitable growth for our stockholders and greater transparency. Book Value RSUs Book Value RSUs vest at the end of three years vs. grants prior to 2018 that vested ratably each year over three years Reset actual target book value per share growth in the beginning of 2019 and made target book value growth harder to reach compared to previous years’ grants Increased weighting of Book Value RSUs relative to TSR RSUs Revised terms so that opportunity associated with Book Value RSUs can vary from 0-200% of target As a result of the changes to our Book Value RSUs, all performance-based long-term incentive awards have three-year performance periods where performance is measured at the end of year three 10

Demonstrated Responsiveness to Stockholder Feedback Changes to our executive compensation program continue to provide for more at risk compensation, including more being delivered in equity and subject to long-term Company performance What we looked at 2018/2019 Outcomes Developed Custom Benchmark Group In 2018, developed a new more refined benchmark group consisting of 18 companies across diversified financial services and real estate investment trusts. For 2020, we revised the benchmark group to remove two companies because they no longer met our qualitative and quantitative factors. Based on a study prepared by the leadership development and compensation committee’s independent compensation consultant using 2018 data available from our custom benchmark group, the total direct 2019 compensation paid to our Chief Executive Officer and our Executive Chairman approximated the median total direct compensation paid by the custom benchmark group members to their similarly situated executive officers, while the total direct compensation paid to our other NEOs was either slightly above or slightly below the median total direct compensation paid by the custom benchmark group members to their similarly situated executive officers CEO Compensation 70% of Chief Executive Officer’s 2019 target compensation at risk and subject to Company performance 11

Significant Improvement in Shareholder Support Based on feedback received during shareholder outreach over the past few years, we modified our compensation program to reflect investor priorities The changes made to our compensation program have resonated with our investors and as a result, the 2019 advisory vote on named executive officer compensation rose to 96% approval, up from 70% approval the year prior 2018 2019 96% 70% Advisory Vote on Named Executive Officer Compensation 12

In February 2020, the leadership development and compensation committee established the 2020 Executive Compensation Program The 2020 Program is a continuation of the 2019 program and the leadership development and compensation committee retained key components, including the following: Executive Chairman’s annual bonus paid in RSUs with effective 3-year vesting Utilization of Custom Benchmark Group, refined to exclude 2 companies in 2020 because they no longer met quantitative/qualitative factors, to determine competitiveness of our compensation and any necessary adjustments Direct 2019 compensation paid to our CEO and Executive Chairman approximated the median total direct compensation paid by the custom benchmark group members to their similarly situated executive officers Rigorous targets set under our 2020 annual incentive program structured to measure both financial and strategic achievement Performance measures: Overall Revenue, Adjusted Pre-Tax Return on Common Equity Strategic Objective: Cumulative Placement of Aircraft through 2023 75% of RSUs consist of performance-based shares (Book Value and TSR) Air Lease 2020 Executive Compensation Program 13

Limited Direct Public Company Peers Limited direct company peers Only one files a full suite of SEC disclosures, including a proxy statement Companies in the aircraft leasing business include: Privately owned companies Subsidiaries of larger companies, including aircraft manufacturers, banks, financial institutions, other leasing companies, aircraft brokers and airlines Of the over one hundred companies in the aircraft leasing business… …in 2019 only 4 were stand-alone public companies listed in the US… AL 2019 common stock price performance2 (1) On November 6, 2019, Aircastle announced that it entered into a definitive agreement to be acquired by a newly-formed entity controlled by affiliates of Marubeni Corporation and Mizuho Leasing Company. Aircastle expects to complete the merger on or about March 27, 2020, subject to the satisfaction of the remaining customary closing conditions set forth in the merger agreement. (2) Price performance reflects AL closing common stock price between December 31, 2018 and December 31, 2019. 1 14

Custom Benchmark Group In 2018, the leadership development and compensation committee adopted a new custom benchmark group consisting of 18 companies across diversified financial services and real estate investment trusts based on quantitative and qualitative factors, including company size, business model and financial profile, which remained the same for 2019 Total direct compensation paid to our CEO and Executive Chairman approximated median total direct compensation paid by custom benchmark group members (1) As of December 31, 2019, from Bloomberg. (2) Based on applicable company’s most recent publicly reported information. (3) Removed from the 2020 Custom Benchmark Group because they no longer met quantitative and qualitative factors 1 2019 Custom Benchmark Group 2 Company Trading Symbol Market Cap ($MM)(1) Employees(2) Sector 3 Aircastle Limited AYR $2,405 111 Financing/Leasing 4 Affiliated Managers Group, Inc. AMG 4957 4000 Investment Management 5 Artisan Partners Asset Management Inc. APAM 2514.6 425 Investment Management 6 Brightsphere Investment Group (3) BSIG 880 836 Investment Management 7 Chimera Investment Corporation CIM 3845.8 39 REIT 8 CIT Group Inc. (3) CIT 4323.1000000000004 3609 Financing/Leasing 9 Eaton Vance Corp. EV 5178.6000000000004 1871 Investment Management 10 Empire State Realty Trust, Inc. ESRT 2539 831 REIT 11 Extra Space Storage Inc. EXR 13681 4048 REIT 12 Federal Realty Investment Trust FRT 9724.4 313 REIT 13 GATX Corporation GATX 2886 2165 Financing/Leasing 14 Healthpeak Properties, Inc. PEAK 17415 204 REIT 15 Host Hotels & Resorts, Inc. HST 13234 175 REIT 16 Invesco Ltd. IVZ 8150 8821 Investment Management 17 Kennedy-Wilson Holdings, Inc. KW 3173 318 REIT 18 Kilroy Realty Corporation KRC 8895 267 REIT 19 Legg Mason, Inc. LM 3117 3246 Investment Management 20 W.P. Carey Inc. WPC 13789 204 REIT 21 Median $4,640.5 628 22 Average $6,705.9722222222226 1749.0555555555557 23 Air Lease Corp. $5,386 117 Financing/Leasing 15

Environmental Sustainability Understandably, environmental sustainability continues to be a focus of the investor community ALC is at the forefront of environmental sustainability as we have aircraft on order that are an estimated 20%+ more fuel-efficient than predecessor aircraft When they are delivered, many of our new aircraft will serve to replace those older jets and, in turn, reduce emissions and noise pollution In response to our shareholder discussions, we introduced additional information on our website to make our commitment to environmental sustainability more accessible We are dedicated to further enhancing our website disclosure related to environmental sustainability going forward 16

Strength of ALC Leadership A successful 30+ year partnership Mr. Udvar-Házy founded Air Lease in February 2010, serving as CEO & Chairman He is a pioneer in the aircraft leasing industry, and co-founded the business that became International Lease Finance Corporation (ILFC) in 1973, serving as CEO & Chairman Steven Udvar-Házy Executive Chairman John L. Plueger Chief Executive Officer & President Mr. Plueger joined Air Lease as its President, COO, and Board member in April 2010, shortly after the Company was formed He has more than 30 years of aviation industry and aircraft leasing experience, 23 of which were with ILFC, where he served on its Board, and as President and COO In his full-time Executive Chairman role, Mr. Udvar-Házy leverages his long-standing industry relationships to work closely with our airline customers, OEMs and financiers to modernize and grow airline fleets We believe that their partnership, experience, and knowledge are unmatched in the industry In his role as CEO & President, Mr. Plueger drives our strategic business priorities and is responsible for growing our business across all constituencies and continuing to build stockholder value Mr. Udvar-Házy and Mr. Plueger have worked together for over 30 years, first building ILFC into one of the largest aircraft leasing companies in the world, and now establishing Air Lease as a market leader 17

Steven F. Udvar-Házy Exec. Chairman John L. Plueger CEO Robert Milton LID Matthew J. Hart Cheryl Gordon Krongard Marshall O. Larsen Susan McCaw Ian M. Saines Former Chairman & CEO, Ace Aviation Holdings* Retired President & COO, Hilton Hotels Corporation Retired Senior Partner, Apollo Management Retired Chairman, President & CEO, Goodrich Corporation President, SRM Investments Chief Executive, Funds Management Challenger Limited Joined Board 2010 2010 2010 2010 2013 2014 2019 2010 Executive Leadership Experience Airline Industry / Aviation Financial / Capital Allocation Expertise International Experience Risk Management / Oversight Expertise Other Public Company Boards SkyWest Spirit AeroSystems Holdings Cathay Pacific Airways Limited American Airlines Group American Homes 4 Rent Xerox Holdings Becton, Dickinson and Company United Technologies Lionsgate Entertainment *A holding company for Air Canada Highly Engaged Board with Extensive Industry Relevant Experience Strong Board evaluation and succession processes ensure the Board is comprised of Directors with the necessary skills and balance of perspectives to oversee our unique business Denotes independent directors 18

Appendix

Appendix Non-GAAP reconciliations 1Adjusted pre-tax profit margin is adjusted net income before income taxes divided by total revenues, excluding insurance recovery on settlement. 2 Adjusted diluted earnings per share before income taxes is adjusted net income before income taxes plus assumed conversion of convertible senior notes divided by weighted average diluted common shares outstanding. Air Lease Corporation and Subsidiaries QUARTERLY CONSOLIDATED STATEMENTS OF INCOME (In thousands, except share amounts) Year Ended December 31, (in thousands, except share and per share data) 2019 2018 2017 2016 2015 Reconciliation of net income available to common stockholders to adjusted net incomebefore income taxes: Net income available to common stockholders $,575,163 $,510,835 $,756,152 $,374,925 $,253,391 Amortization of debt discounts and issuance costs 36,691 32,706 29,454 30,942 30,507 Stock-based compensation 20,745 17,478 19,804 16,941 17,022 Settlement 0 0 0 0 72,000 Insurance recovery on settlement 0 -,950 -5,250 -4,500 Provision for income taxes ,148,564 ,129,303 -,146,622 ,205,313 ,139,562 Adjusted net income before income taxes $,781,163 $,690,322 $,657,838 $,622,871 $,507,982 Assumed conversion of convertible senior notes 0 6,219 5,842 5,780 5,806 Adjusted net income before income taxes plus assumed conversions $,781,163 $,696,541 $,663,680 $,628,651 $,513,788 Reconciliation of denominator of adjusted pre-tax profit margin: Total revenues $2,016,904 $1,679,702 $1,516,380 $1,419,055 $1,222,840 Insurance recovery on settlement $0 $0 $-,950 $-5,250 $-4,500 Total revenues, excluding insurance recovery on settlement $2,016,904 $1,679,702 $1,515,430 $1,413,805 $1,218,340 Adjusted pre-tax profit margin1 0.38730797301210174 0.41097885220116426 0.43409329365262667 0.44056358550153663 0.41694600850337343 Weighted-average diluted common shares outstanding ,113,086,323 ,112,363,331 ,111,657,564 ,110,798,727 ,110,628,865 Adjusted diluted earnings per share before income taxes2 $6.9076699929486614 $6.1990063288529598 $5.9438875094928632 $5.6738106747381671 $4.6442490393442979 20 20

Appendix Non-GAAP reconciliations 1Adjusted pre-tax return on common equity is adjusted net income before income taxes divided by average common shareholders’ equity. Air Lease Corporation and Subsidiaries QUARTERLY CONSOLIDATED STATEMENTS OF INCOME (In thousands, except share amounts) Year Ended December 31, (in thousands, except percentage data) 2019 2018 2017 2016 2015 Reconciliation of net income available to common stockholders to adjusted net income before income taxes: Net income available to common stockholders $,575,163 $,510,835 $,756,152 $,374,925 $,253,391 Amortization of debt discounts and issuance costs 36,691 32,706 29,454 30,942 30,507 Stock-based compensation 20,745 17,478 19,804 16,941 17,022 Settlement 0 0 0 0 72,000 Insurance recovery on settlement 0 0 -,950 -5,250 -4,500 Provision for income taxes ,148,564 ,129,303 -,146,622 ,205,313 ,139,562 Adjusted net income before income taxes $,781,163 $,690,322 $,657,838 $,622,871 $,507,982 Reconciliation of denominator of adjusted pre-tax return on common equity: Beginning common shareholders' equity $4,806,900 $4,127,442 $3,382,187 $3,019,912 $2,772,062 Ending common shareholders' equity $5,373,544 $4,806,900 $4,127,442 $3,382,187 $3,019,912 Average common shareholders' equity $5,090,222 $4,467,171 $3,754,814.5 $3,201,049.5 $2,895,987 Adjusted pre-tax return on common equity1 0.154 0.15453225318663646 0.17519853510739344 0.19458337023529315 0.17540893657326501 21

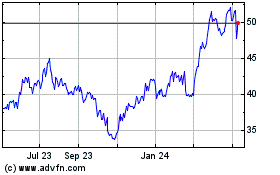

Air Lease (NYSE:AL)

Historical Stock Chart

From Mar 2024 to Apr 2024

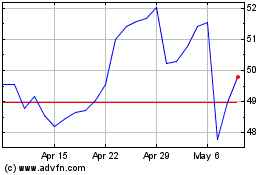

Air Lease (NYSE:AL)

Historical Stock Chart

From Apr 2023 to Apr 2024