By Craig Karmin and Konrad Putzier

Lawmakers and businesses are pushing the U.S. government to

offer debt relief to hundreds of small hotel owners who borrowed

with the help of bond markets.

But the biggest beneficiaries of any assistance could be large

real estate owners affiliated with properties that owe troubled

hotel debt, according to an analysis by hotel union Unite Here

International, which analyzed public filings and data from research

firm Trepp LLC as of June 16.

The hotel owner with the most money in these troubled commercial

mortgage-backed-securities (CMBS) loans is Monty Bennett. The

Dallas businessman is affiliated with companies including Ashford

Hospitality Trust and Braemar Hotels & Resorts that had loans

valued at nearly $2.3 billion with special servicers, according to

the Unite Here's analysis of the Trepp data.

Meanwhile, Colony Capital Inc., a $50 billion private-equity

firm run by Thomas Barrack, owed about $2 billion, according to the

analysis.

The third-biggest hotel borrower named in the analysis was the

real-estate firm Hospitality Investors Trust Inc. with $723 million

owed in loans with special servicers. Brookfield Asset Management,

an investment firm with more than $500 billion assets under

management, is a stakeholder in the firm and appointed two board

members. Hospitality Investors Trust recently reached an agreement

with lenders for the debt that was in special servicing, according

to a securities filing.

Treasury Secretary Steven Mnuchin acknowledged the CMBS issue at

a recent Senate hearing and suggested that the administration might

need to come back to Congress to work on a potential fix. Fed

Chairman Jerome Powell indicated in House testimony that the issue

might be better addressed by Congress.

The hotel industry was among the hardest hit by the pandemic,

causing thousands of properties to close and occupancy rates to

fall below 25%, according to data tracker STR. Occupancy levels

nationwide have been rising for weeks and are now back above 40%.

But it is still well below that mark in resort hot spots like

Orlando, Fla., and Hawaii, and lower in big cities such as Boston

and Chicago.

Representatives of the real-estate companies either declined to

comment or didn't respond to requests for comment.

Last month in a webinar interview, Mr. Bennett made a case for

government aid for the lodging business. "The hotel industry needs

help, " he said. "And giving hoteliers debt on top of the debt that

they already can't repay seems foolish. The industry needs grants

along the lines of what the airline industry has received."

Mr. Bennett's companies were also among the biggest

beneficiaries of the government's Paycheck Protection Program,

receiving more than $68 million in assistance. He ultimately

decided to return the money after the Treasury Department said that

borrowers with access to capital markets or other sources of funds

didn't qualify for government assistance.

Hotel operators involved in the CMBS financing market have some

particular challenges because the market wasn't designed to provide

borrowers with temporary payment relief. Those who need to pause

payments must work with special servicers, which are hired to

negotiate on behalf of the bondholders that own the loans.

The two biggest borrowers represented about 31% of the $14

billion of hotel CMBS debt with special servicers as of May, the

Unite Here analysis shows. A representative for the union said it

was important to determine who would benefit from any government

relief on CMBS debt.

More than half of the hotel debt is owed by asset managers,

public companies or other large firms, the union analysis added,

which suggests any government bailout effort could potentially

steer much of the assistance toward companies with more financial

flexibility.

It couldn't be determined if the Federal Reserve and Treasury

will enact specific relief for borrowers who used the CMBS market,

or if they do, how they will handle larger borrowers versus smaller

ones.

The majority of the troubled hotel loans tracked by Trepp --

more than 200 -- had balances of $20 million or less, a sign that

most of the borrowers are smaller businesses. These firms often

don't have the resources to work through their obligations during

this difficult period without government assistance.

"Only 20% of hotels with CMBS loans have been able to obtain any

debt relief," said Chip Rogers, chief executive of the American

Hotel & Lodging Association. "The impact has been most

significant for our small business operators who represent 61% of

all hotel properties in the U.S."

Rep. Van Taylor (R., Texas), who is leading the bipartisan group

of lawmakers in the effort to get aid for hotel borrowers, said:

"These industries don't need a bailout, but they do need

flexibility and support to keep their doors open, provide millions

of jobs in communities across the country, and drive their local

economies."

Cecil P. Staton, CEO of the Asian American Hotel Owners

Association, said his organization supports government aid related

to troubled CMBS loans.

"The hotel industry is comprised primarily of small-business

owners, and the pandemic's economic impact is leaving them

struggling to stay current on their debt obligations," he said.

"The impact of these potential delinquencies and foreclosures would

have a disastrous ripple effect on employees, vendors, and local

governments' tax revenues."

Write to Craig Karmin at craig.karmin@wsj.com and Konrad Putzier

at konrad.putzier@wsj.com

(END) Dow Jones Newswires

June 29, 2020 10:34 ET (14:34 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

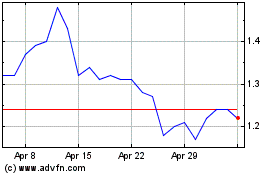

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

From Apr 2023 to Apr 2024