Statement of Changes in Beneficial Ownership (4)

March 17 2020 - 4:35PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

KESSLER DOUGLAS A |

2. Issuer Name and Ticker or Trading Symbol

ASHFORD HOSPITALITY TRUST INC

[

AHT

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

CEO and President |

|

(Last)

(First)

(Middle)

14185 DALLAS PARKWAY,, SUITE 1100 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

3/13/2020 |

|

(Street)

DALLAS, TX 75254

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 3/13/2020 | | F(1) | | 26275 | D | $1.12 (1) | 1392818 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Performance Stock Units (2020) (2) | $0.00 (2) | | | | | | | 12/31/2022 | 12/31/2022 | Common Stock | 225000 (3) | | 225000 (3) | D | |

| Performance Stock Units (2019) (2) | $0.00 (2) | | | | | | | 12/31/2021 | 12/31/2021 | Common Stock | 237643 (3) | | 237643 (3) | D | |

| Performance Stock Units (2018) (2) | $0.00 (2) | | | | | | | 3/13/2021 | 3/13/2021 | Common Stock | 200321 (3) | | 200321 (3) | D | |

| Performance Stock Units (2017) (2) | $0.00 (2) | | | | | | | 3/23/2020 | 3/23/2020 | Common Stock | 173000 (3) | | 173000 (3) | D | |

| Common Limited Partnership Units (4) | $0.00 (4) | | | | | | | (4) | (5) | Common Stock | 1109780 (4) | | 1109780 (6) | D | |

| Explanation of Responses: |

| (1) | Represents shares of common stock forfeited to the Issuer to satisfy certain tax-withholding obligations of the Reporting Person arising as a result of the vesting of restricted stock held by the Reporting Person. Represents the closing price of the common stock on March 12, 2020, the last trading day before the date of forfeiture. |

| (2) | Each performance stock unit ("Performance Stock Unit") award represents a right to receive between zero (0) and two (2) shares of the Issuer's common stock if and when the applicable vesting criteria have been achieved. |

| (3) | Represents the target number of common stock shares that may be issued pursuant to the award of Performance Stock Units. The actual number of shares of common stock to be issued upon vesting can range from 0% to 200% of the target number of Performance Stock Units reported, based on achievement of specified relative and total stockholder returns of the Issuer. Assuming continued service through the vesting date and achievement of the specified relative and total stockholder returns, the Performance Stock Units, as adjusted, will generally vest on March 23, 2020 (with respect to the 2017 grant), March 13, 2021 (with respect to the 2018 grant), December 31, 2021 (with respect to the 2019 grant) and December 31, 2022 (with respect to the 2020 grant). One-third of the Performance Stock Units granted in 2020 will be eligible to vest (at up to 200% of target) based on performance during the first year of the performance period. |

| (4) | Common Limited Partnership Units of Ashford Hospitality Limited Partnership, the Issuer's operating subsidiary (the "Subsidiary") ("Common Units"). Common Units are redeemable for cash or, at the option of the Issuer, convertible into shares of the Issuer's common stock on a 1-for-1 basis. |

| (5) | The Common Units do not expire. |

| (6) | Reflects the aggregate number of Common Units currently held by the Reporting Person, some of which may have been converted from special long-term incentive partnership units of the Subsidiary by the Reporting Person since the Reporting Person's most recent Form 4 or Form 5 filing. See Footnote 4 discussing the convertibility of the Common Units. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

KESSLER DOUGLAS A

14185 DALLAS PARKWAY,

SUITE 1100

DALLAS, TX 75254 |

|

| CEO and President |

|

Signatures

|

| /s/ Douglas Kessler | | 3/17/2020 |

| **Signature of Reporting Person | Date |

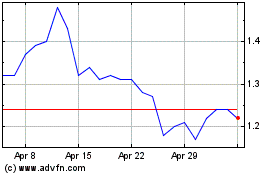

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

From Apr 2023 to Apr 2024