Current Report Filing (8-k)

August 27 2020 - 4:37PM

Edgar (US Regulatory)

0000845877falseX100008458772020-08-272020-08-270000845877us-gaap:CommonClassAMember2020-08-272020-08-270000845877us-gaap:CommonClassCMember2020-08-272020-08-270000845877us-gaap:SeriesAPreferredStockMember2020-08-272020-08-270000845877us-gaap:SeriesCPreferredStockMember2020-08-272020-08-270000845877us-gaap:SeriesDPreferredStockMember2020-08-272020-08-270000845877us-gaap:SeriesEPreferredStockMember2020-08-272020-08-270000845877us-gaap:SeriesFPreferredStockMember2020-08-272020-08-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 27, 2020

FEDERAL AGRICULTURAL MORTGAGE CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federally chartered instrumentality

of the United States

|

|

001-14951

|

|

52-1578738

|

|

|

|

|

|

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

1999 K Street, N.W., 4th Floor,

|

|

|

|

20006

|

|

Washington,

|

DC

|

|

|

|

|

(Address of Principal Executive Offices)

|

|

|

|

(Zip Code)

|

Registrant’s telephone number, including area code (202) 872-7700

No change

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading symbol

|

|

Exchange on which registered

|

|

Class A voting common stock

|

|

AGM.A

|

|

New York Stock Exchange

|

|

Class C non-voting common stock

|

|

AGM

|

|

New York Stock Exchange

|

|

5.875% Non-Cumulative Preferred Stock, Series A

|

|

AGM.PRA

|

|

New York Stock Exchange

|

|

6.000% Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series C

|

|

AGM.PRC

|

|

New York Stock Exchange

|

|

5.700% Non-Cumulative Preferred Stock, Series D

|

|

AGM.PRD

|

|

New York Stock Exchange

|

|

5.750% Non-Cumulative Preferred Stock, Series E

|

|

AGM.PRE

|

|

New York Stock Exchange

|

|

5.250% Non-Cumulative Preferred Stock, Series F

|

|

AGM.PRF

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On August 27, 2020, the Board of Directors (“Board”) of the Federal Agricultural Mortgage Corporation (“Farmer Mac”) declared a quarterly dividend on each of Farmer Mac’s three classes of common stock – Class A Voting Common Stock, Class B Voting Common Stock, and Class C Non-Voting Common Stock. The quarterly dividend of $0.80 per share of common stock will be payable on September 30, 2020 to holders of record of Farmer Mac’s common stock as of September 16, 2020.

Also on August 27, 2020, the Board declared a dividend on each of Farmer Mac’s five classes of preferred stock – 5.875% Non-Cumulative Preferred Stock, Series A (“Series A Preferred Stock”), 6.000% Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series C (“Series C Preferred Stock”), 5.700% Non-Cumulative Preferred Stock, Series D (“Series D Preferred Stock”), 5.750% Non-Cumulative Preferred Stock, Series E (“Series E Preferred Stock”), and 5.250% Non-Cumulative Preferred Stock, Series F (“Series F Preferred Stock”). The quarterly dividend of $0.375 per share of Series C Preferred Stock, $0.35625 per share of Series D Preferred Stock, and $0.359375 per share of Series E Preferred Stock is for the period from but not including July 17, 2020 to and including October 17, 2020. The dividend of $0.2078125 per share of Series F Preferred Stock is for the period from but not including August 20, 2020, the issuance date, to and including October 17, 2020. The dividend on each of the Series C Preferred Stock, Series D Preferred Stock, Series E Preferred Stock, and Series F Preferred Stock will be payable on October 17, 2020 to holders of record of those classes of preferred stock, respectively, as of October 2, 2020.

On August 20, 2020, Farmer Mac called for redemption all of Farmer Mac’s outstanding 2,400,000 shares of Series A Preferred Stock on September 19, 2020 (the “Redemption Date”). Information about the redemption call was previously disclosed in Farmer Mac’s Current Report on Form 8-K filed on August 20, 2020. On August 27, 2020, the Board declared a dividend of $0.2530 per share of Series A Preferred Stock called for redemption for the period from but not including July 17, 2020 to and including the Redemption Date. The preferred stock dividends on the shares of the Series A Preferred Stock that are redeemed will be payable on the Redemption Date as part of the redemption price to holders of record of the Series A Preferred Stock as of the Redemption Date.

Each share of Series A Preferred Stock, Series C Preferred Stock, Series D Preferred Stock, Series E Preferred Stock, and Series F Preferred Stock has a par value and liquidation preference of $25.00 per share.

Information about the dividends declared by the Board on August 27, 2020 is also included in the press release attached to this report as Exhibit 99 and is incorporated by reference into this report. All references to www.farmermac.com in Exhibit 99 are inactive textual references only, and the information contained on Farmer Mac’s website is not incorporated by reference into this report.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

104

|

Cover Page Inline Interactive Data File - the cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document included as Exhibit 101

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

FEDERAL AGRICULTURAL MORTGAGE CORPORATION

By: /s/ Stephen P. Mullery

Name: Stephen P. Mullery

Title: Executive Vice President – General Counsel

Dated: August 27, 2020

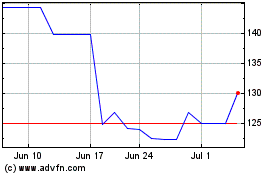

Federal Agricultural Mor... (NYSE:AGM.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

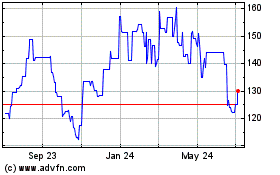

Federal Agricultural Mor... (NYSE:AGM.A)

Historical Stock Chart

From Apr 2023 to Apr 2024