_________________________________________________________________________________

_________________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 11-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _______

Commission file number: 001-37757

ADIENT US LLC SAVINGS AND INVESTMENT (401k) PLAN

AVANZAR INTERIOR TECHNOLOGIES, LTD. SAVINGS AND INVESTMENT (401k) PLAN

BRIDGEWATER INTERIORS, LLC SAVINGS AND INVESTMENT (401k) PLAN

ADIENT PRODUCTION EMPLOYEES SAVINGS AND INVESTMENT (401k) PLAN

Adient US LLC

49200 Halyard Drive

Plymouth, MI 48170

(Full title of the plans and the address of the plans, if different from that of the issuer named below)

Adient plc

25-28 North Wall Quay, IFSC

Dublin 1, Ireland

(Name of issuer of the securities held pursuant to the plan and the address of its principal executive office)

_________________________________________________________________________________

_________________________________________________________________________________

Adient US LLC Defined Contribution Plans

Financial Statements and Supplemental Schedules

Year Ended December 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

Page

|

|

Report of Independent Registered Public Accounting Firm

|

|

|

|

|

|

|

|

|

|

|

|

Statements of Net Assets Available for Benefits as of December 31, 2019

|

|

|

|

Statements of Net Assets Available for Benefits as of December 31, 2018

|

|

|

|

Statements of Changes in Net Assets Available for Benefits for the year ended December 31, 2019

|

|

|

|

|

|

|

|

Notes to the Financial Statements

|

|

|

|

|

|

|

|

|

|

|

|

Schedule H, Line 4a - Schedule of Delinquent Participant Contributions (Adient US LLC Savings and Investment (401k) Plan)

|

|

|

|

Schedule H, Line 4a - Schedule of Delinquent Participant Contributions (Bridgewater Interiors, LLC Savings and Investment (401k) Plan)

|

|

|

|

Schedule H, Line 4a - Schedule of Delinquent Participant Contributions (Adient Production Employees Savings and Investment (401k) Plan)

|

|

|

|

Schedule H, Line 4i - Schedule of Assets Held at End of Year (Adient US LLC Savings and Investment (401k) Plan)

|

|

|

|

Schedule H, Line 4i - Schedule of Assets Held at End of Year (Avanzar Interior Technologies, Ltd. Savings and Investment (401k) Plan)

|

|

|

|

Schedule H, Line 4i - Schedule of Assets Held at End of Year (Bridgewater Interiors, LLC Savings and Investment (401k) Plan)

|

|

|

|

Schedule H, Line 4i - Schedule of Assets Held at End of Year (Adient Production Employees Savings and Investment (401k) Plan)

|

|

|

|

|

|

|

|

Exhibit Index

|

|

|

|

|

|

|

|

Signature

|

|

|

Report of Independent Registered Public Accounting Firm

To the Plan Administrator and Plan Participants of:

Adient US LLC Savings and Investment (401k) Plan

Avanzar Interior Technologies, Ltd. Savings and Investment (401k) Plan

Bridgewater Interiors, LLC Savings and Investment (401k) Plan

Adient Production Employees Savings and Investment (401k) Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the Adient US LLC Savings and Investment (401k) Plan, the Avanzar Interior Technologies, Ltd. Savings and Investment (401k) Plan, the Bridgewater Interiors, LLC Savings and Investment (401k) Plan, and the Adient Production Employees Savings and Investment (401k) Plan (collectively, the "Plans") as of December 31, 2019 and 2018, and the related statements of changes in net assets available for benefits for the year ended December 31, 2019, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets of the Plans as of December 31, 2019 and 2018, and the changes in its net assets for the year ended December 31, 2019, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

The Plans' management is responsible for these financial statements. Our responsibility is to express an opinion on the Plans' financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plans in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plans are not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plans' internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental information in the accompanying schedules of delinquent participant contributions for the year ended December 31, 2019 for the Adient US LLC Savings and Investment (401k) Plan, the Bridgewater Interiors, LLC Savings and Investment (401k) Plan, and the Adient Production Employees Savings and Investment (401k) Plan and the schedules of assets held at end of year as of December 31, 2019 for the Adient US LLC Savings and Investment (401k) Plan, the Avanzar Interior Technologies, Ltd. Savings and Investment (401k) Plan, the Bridgewater Interiors, LLC Savings and Investment (401k) Plan, and the Adient Production Employees Savings and Investment (401k) Plan have been subjected to audit procedures performed in conjunction with the audits of the Plans' financial statements. The supplemental information is the responsibility of the Plans' management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with Department of Labor’s Rules and Regulations for Reporting under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Plante & Moran, PLLC

We have served as the Plans' auditor since 2018.

Flint, Michigan

June 26, 2020

Adient US LLC Defined Contribution Plans

Statements of Net Assets Available for Benefits

December 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADIENT US LLC SAVINGS AND INVESTMENT (401k) PLAN

|

|

AVANZAR INTERIOR TECHNOLOGIES, LTD. SAVINGS AND INVESTMENT (401k) PLAN

|

|

BRIDGEWATER INTERIORS, LLC SAVINGS AND INVESTMENT (401k) PLAN

|

|

ADIENT PRODUCTION EMPLOYEES SAVINGS AND INVESTMENT (401k) PLAN

|

|

Assets

|

|

|

|

|

|

|

|

|

Participant-directed investments

|

|

|

|

|

|

|

|

|

Plan's interest in Adient US LLC Defined Contribution Plans Master Trust for Employee Savings Plans (Note 3)

|

$

|

853,435,279

|

|

|

|

$

|

21,832,624

|

|

|

|

$

|

65,924,969

|

|

|

|

$

|

20,263,917

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Receivables

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contributions

|

—

|

|

|

|

2,011,232

|

|

|

|

5,489,560

|

|

|

|

2,144,054

|

|

|

Notes receivable from participants

|

21,273,036

|

|

|

|

1,689,397

|

|

|

|

4,468,196

|

|

|

|

1,820,064

|

|

|

Total receivables

|

21,273,036

|

|

|

|

3,700,629

|

|

|

|

9,957,756

|

|

|

|

3,964,118

|

|

|

Net assets available for benefits

|

$

|

874,708,315

|

|

|

|

$

|

25,533,253

|

|

|

|

$

|

75,882,725

|

|

|

|

$

|

24,228,035

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See the notes to the financial statements.

Adient US LLC Defined Contribution Plans

Statements of Net Assets Available for Benefits

December 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADIENT US LLC SAVINGS AND INVESTMENT (401k) PLAN

|

|

AVANZAR INTERIOR TECHNOLOGIES, LTD. SAVINGS AND INVESTMENT (401k) PLAN

|

|

BRIDGEWATER INTERIORS, LLC SAVINGS AND INVESTMENT (401k) PLAN

|

|

ADIENT PRODUCTION EMPLOYEES SAVINGS AND INVESTMENT (401k) PLAN

|

|

Assets

|

|

|

|

|

|

|

|

|

Participant-directed investments

|

|

|

|

|

|

|

|

|

Plan's interest in Adient US LLC Defined Contribution Plans Master Trust for Employee Savings Plans (Note 3)

|

$

|

691,633,971

|

|

|

|

$

|

16,527,552

|

|

|

|

$

|

50,527,850

|

|

|

|

$

|

15,072,356

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Receivables

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contributions

|

20,481,933

|

|

|

|

1,887,125

|

|

|

|

5,397,864

|

|

|

|

2,046,403

|

|

|

Notes receivable from participants

|

19,921,036

|

|

|

|

1,393,088

|

|

|

|

4,050,679

|

|

|

|

1,352,692

|

|

|

Total receivables

|

40,402,969

|

|

|

|

3,280,213

|

|

|

|

9,448,543

|

|

|

|

3,399,095

|

|

|

Net assets available for benefits

|

$

|

732,036,940

|

|

|

|

$

|

19,807,765

|

|

|

|

$

|

59,976,393

|

|

|

|

$

|

18,471,451

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See the notes to the financial statements.

Adient US LLC Defined Contribution Plans

Statements of Changes in Net Assets Available for Benefits

Year Ended December 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADIENT US LLC SAVINGS AND INVESTMENT (401k) PLAN

|

|

AVANZAR INTERIOR TECHNOLOGIES, LTD. SAVINGS AND INVESTMENT (401k) PLAN

|

|

BRIDGEWATER INTERIORS, LLC SAVINGS AND INVESTMENT (401k) PLAN

|

|

ADIENT PRODUCTION EMPLOYEES SAVINGS AND INVESTMENT (401k) PLAN

|

|

|

|

|

|

|

|

|

|

|

Additions

|

|

|

|

|

|

|

|

|

|

Plan's interest in Adient US LLC Defined Contribution Plans Master Trust for Employee Savings Plans investment income (See Note 3)

|

$

|

159,010,929

|

|

|

|

$

|

4,132,742

|

|

|

|

$

|

12,270,213

|

|

|

|

$

|

3,528,723

|

|

|

Interest on notes receivable from participants

|

918,648

|

|

|

|

72,360

|

|

|

|

193,217

|

|

|

|

65,747

|

|

|

Contributions:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Participants

|

35,910,277

|

|

|

|

1,749,551

|

|

|

|

3,950,104

|

|

|

|

1,725,596

|

|

|

Participants rollovers

|

7,370,226

|

|

|

|

—

|

|

|

|

138,507

|

|

|

|

301,957

|

|

|

Employer

|

36,657,523

|

|

|

|

2,011,232

|

|

|

|

5,489,560

|

|

|

|

2,144,054

|

|

|

Total additions

|

239,867,603

|

|

|

|

7,965,885

|

|

|

|

22,041,601

|

|

|

|

7,766,077

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deductions

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distributions and withdrawals

|

95,053,182

|

|

|

|

2,147,138

|

|

|

|

5,966,916

|

|

|

|

1,865,889

|

|

|

Administrative expenses

|

1,088,661

|

|

|

|

89,391

|

|

|

|

192,326

|

|

|

|

111,082

|

|

|

Total deductions

|

96,141,843

|

|

|

|

2,236,529

|

|

|

|

6,159,242

|

|

|

|

1,976,971

|

|

|

|

|

|

|

|

|

|

|

|

Net increases before other changes

|

143,725,760

|

|

|

|

5,729,356

|

|

|

|

15,882,359

|

|

|

|

5,789,106

|

|

|

Transfers (to) from other plans, net

|

(1,054,385)

|

|

|

|

(3,868)

|

|

|

|

23,973

|

|

|

|

(32,522)

|

|

|

Net increase

|

142,671,375

|

|

|

|

5,725,488

|

|

|

|

15,906,332

|

|

|

|

5,756,584

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits, beginning of year

|

732,036,940

|

|

|

|

19,807,765

|

|

|

|

59,976,393

|

|

|

|

18,471,451

|

|

|

Net assets available for benefits, end of year

|

$

|

874,708,315

|

|

|

|

$

|

25,533,253

|

|

|

|

$

|

75,882,725

|

|

|

|

$

|

24,228,035

|

|

|

|

|

|

|

|

|

|

|

See the notes to the financial statements.

Adient US LLC Defined Contribution Plans

Notes to the Financial Statements

December 31, 2019

Note 1 - Description of the Plans

The accompanying financial statements comprise employee savings plans of Adient US LLC (the “Company”) or its affiliates that participate in the Adient US LLC Defined Contribution Master Trust for Employee Savings Plans (the “Master Trust”).

The following description of the Adient US LLC Savings and Investment (401k) Plan, the Avanzar Interior Technologies, Ltd. Savings and Investment (401k) Plan, the Bridgewater Interiors, LLC Savings and Investment (401k) Plan, and the Adient Production Employees Savings and Investment (401k) Plan (collectively the "Plans") provide only general information. Participants should refer to the respective Plan Document for a more complete description of each of the Plans' provisions.

The Plans are subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA).

On July 24, 2015, Johnson Controls, Inc. (“Johnson Controls”) announced its intent to separate its automotive seating and interiors business into an independent, publicly traded company-Adient plc (“Adient”). The separation occurred on October 31, 2016, at which date Johnson Controls transferred its automotive seating and interiors businesses, including its ownership of the Plans, to Adient and its affiliates. Through October 31, 2016, the Plans were administered by the Johnson Controls Employee Benefit Policy Committee. Effective October 31, 2016, the plan administration transferred to the Adient Employee Benefit Policy Committee.

Adient US LLC Savings and Investment (401k) Plan ("ASIP")

General - In anticipation of the separation from Johnson Controls, the ASIP was established effective as of July 1, 2016. All U.S. automotive seating and interior employees (including retirees and terminated vested participants) who were participants in the Johnson Controls Savings and Investment 401(k) Plan (the “JCI Plan”) automatically became participants in the ASIP and were thereafter excluded from participation in the JCI Plan on July 1, 2016. Plan assets of those former JCI Plan participants were transferred to the ASIP at that time. The ASIP is sponsored by the Company.

Contributions - Participants can generally defer an amount up to twenty-five percent (25%) of their gross annual compensation as contributions. The Company remitted certain employee contributions related to the 2018 and 2019 plan year after the Department of Labor's required timeframe. The Company remitted the 2018 plan year contributions and related lost earnings during 2018 and 2019. The Company plans to remit the 2019 plan year contributions and related lost earnings during 2020.

The Company may make matching contributions to the ASIP on behalf of the participants based on specific eligibility rules as listed in their benefit schedule and the ASIP plan document. Matching contributions are based on the participant's location or position as outlined in the ASIP plan document. A participant may also be eligible to receive a retirement income contribution ("RIC") from the Company. Eligibility for RIC is dependent upon the participant's locations and is generally computed based on the participant's age and years of service.

Avanzar Interior Technologies, Ltd. Savings and Investment (401k) Plan ("AVSIP")

General - The AVSIP is a defined contribution plan adopted effective September 1, 2005 for participation by eligible employees of Avanzar Interior Technologies, Ltd. ("Avanzar"). The AVSIP is sponsored by Avanzar.

Contributions - Participants can generally defer an amount up to twenty-five percent (25%) of their gross annual compensation as contributions.

Avanzar may make matching contributions to the AVSIP on behalf of the participants. Matching contributions are determined in the discretion of Avanzar. A participant may also be eligible to receive a RIC from Avanzar. The RIC is computed based on the participant's age and years of service.

Bridgewater Interiors, LLC Savings and Investment (401k) Plan ("BSIP")

General - The BSIP is a defined contribution plan adopted effective January 1, 1999 for participation by eligible employees of Bridgewater Interiors, LLC ("Bridgewater"). The BSIP is sponsored by Bridgewater.

Adient US LLC Defined Contribution Plans

Notes to the Financial Statements

December 31, 2019

Contributions - Participants can generally defer an amount up to twenty-five percent (25%) of their gross annual compensation as contributions. Bridgewater remitted certain employee contributions related to the 2019 plan year after the Department of Labor's required timeframe. Bridgewater plans to remit the 2019 plan year contributions and related lost earnings during 2020.

Bridgewater may make matching contributions to the BSIP on behalf of the participants as determined in Bridgewater's discretion. During 2019, Bridgewater matching contributions were based on the participant's before-tax contributions, not to exceed 6% of compensation. A participant may also be eligible to receive a retirement income contribution ("RIC") from Bridgewater. The RIC is equal to 3% of each eligible participant's eligible earnings.

Adient Production Employees Savings and Investment (401k) Plan ("APSIP")

General - The APSIP, formerly the Johnson Creek Savings and Investment Plan, and more recently known as the Johnson Controls Automotive Systems Group Production Employees Savings and Investment 401(K) Plan, is a defined contribution plan adopted effective September 1, 1998 for participation by eligible Adient US LLC production employees at designated facilities.

Contributions - Participants can generally defer an amount up to twenty-five percent (25%) of their gross annual compensation as contributions. The Company remitted certain employee contributions related to the 2019 plan year after the Department of Labor's required timeframe. The Company plans to remit the 2019 plan year contributions and related lost earnings during 2020.

The Company may make matching contributions to the APSIP on behalf of the participants based on specific eligibility rules as listed in their benefit schedule and the APSIP plan document. Matching contributions are based on the participant's location as outlined in the APSIP plan document. A participant may also be eligible to receive a retirement income contribution ("RIC") from the Company. The RIC is computed based on the participant's location.

Participant Accounts - Participant recordkeeping is performed by Fidelity Workplace Services. Participant and employer contributions are deposited in the investment funds of the participant's choice. Participants may reallocate their account balances among the available investment funds at any time in increments of one percent (1%). However, participants can reallocate deposits out of the Fixed Income Fund no more than once each calendar quarter in order to maximize the rate of return for that fund and allocations may not be made to the Johnson Controls International plc ("JCI plc") Stock Fund, which is a sell-only fund.

Vesting and Forfeiture - Participants are immediately vested in their contributions plus actual earnings (losses) thereon. A participant's interest in employer contributions plus actual earnings (losses) thereon vest in accordance with vesting requirements specified within their benefit schedule and respective plan document, generally over a two to five-year period. A participant becomes fully vested on termination of service due to death, total and permanent disability or retirement.

If employment terminates other than by reason of retirement, death or total and permanent disability and the participant is not reemployed by the respective Plan sponsor or its affiliates within 72 months of that date, the participant's interest in the non-vested portion of the employer contributions is forfeited. Forfeited amounts in each respective plan may be applied to reduce future employer contributions to the respective plan.

Payment of Benefits - On termination of service, a participant may elect to receive a lump-sum amount equal to the value of the participant's interest in his or her account. Activity for any participants in the ASIP who have elected to receive dividends on Adient ordinary shares paid in the form of cash instead of purchasing additional shares is reported in the statement of changes in net assets available for benefits. There were no such cash dividends paid during 2019.

Notes Receivable from Participants - Participants may borrow from their accounts a minimum of $1,000 up to a maximum of $50,000 or fifty percent (50%) of their account balance, whichever is less. Loans are subject to certain limitations based on the Plan document. Only two loans per participant may be outstanding at any time. Each loan may be for a term up to five years. Regular payroll deductions are required to repay a loan. Each loan's interest rate is fixed at the prime rate at the beginning of the calendar quarter in which it is issued. At termination, participants may continue to make monthly loan payments until the balances of any loans are paid off. The notes receivable from participants are measured at their unpaid principal balances plus accrued but unpaid interest. At the time of borrowing, the assets of the participant are sold proportionally to finance the loan. Participant notes receivable are written off when deemed uncollectible.

Adient US LLC Defined Contribution Plans

Notes to the Financial Statements

December 31, 2019

Administrative Expenses - Certain administrative expenses are paid by the Plans, as allowed by Plan provisions, with all remaining expenses paid by the respective plan sponsor.

Note 2 - Summary of Significant Accounting Policies

Basis of Presentation - The financial statements of the Plans are prepared on the accrual basis of accounting.

Use of Estimates - The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Master Trust - Contributions are invested in accordance with the participant's election in one or more investments, which are held in the Master Trust (See Note 3).

Investment Valuation - All investments of the Master Trust, except the Fixed Income Fund, are stated at fair value. The Fixed Income Fund is a synthetic guaranteed investment contract ("synthetic GIC") which is stated at contract value. The synthetic GIC is fully benefit responsive. Contract value, as reported to the Plans by Fidelity Fund and Investment Operations, represents contributions made under the contract, plus interest at the contract rate, less participant withdrawals and administrative expenses. Each participating plan's interest in the Master Trust is based on account balances of the participants and their elected investment options. Investment income and administrative expenses relating to the Master Trust are allocated to the individual plans based upon average monthly balances invested by each plan. See Note 4 for further discussion of fair value measurements.

Transfer of Assets - The Plans permit the transfer of assets among investment options held by the Master Trust, subject to certain trading restrictions imposed on some of the investment options.

Investment Contracts - The Fixed Income Fund is a synthetic GIC which consists of wrap contracts paired with underlying investments owned by the Master Trust, including a common collective trust fund that invests in short to intermediate-term fixed-income securities and a short-term investment fund. The Master Trust purchases wrapper contracts from insurance companies and financial institutions.

A synthetic GIC credits a stated interest rate. Investment gains and losses are amortized over the expected duration of the covered investments through the calculation of the interest rate on a prospective basis. The synthetic GIC provides for a variable crediting rate, which resets on a monthly basis and is calculated by Fidelity Fund and Investment Operations. The monthly crediting rate does not include the short-term investments (e.g., short-term interest fund) used for benefit-responsive events. The issuer of the wrap contract provides assurance that future adjustments to the crediting rate cannot result in a crediting rate less than zero. The actual interest rate of the fund is impacted by the current yield of the short-term investments.

The crediting rate is primarily based on the current yield-to-maturity of the covered investments, plus or minus amortization of the difference between the market value and contract value of the covered investments over the duration of the covered investments at the time of computation.

The crediting rate is most impacted by the change in the annual effective yield to maturity of the underlying securities, but is also affected by the differential between the contract value and the market value of the covered investments. This difference is amortized over the duration of the covered investments. Depending on the change in duration from reset period to reset period, the magnitude of the impact to the crediting rate of the contract to market difference is heightened or lessened.

Certain events limit the ability of the Master Trust to transact at contract value with the insurance companies and the financial institution issuers. Such events include the following: (i) material amendments to the plan documents (including complete or partial plan termination or merger with another plan); (ii) changes to the Plans' prohibition on competing investment options or deletion of equity wash provisions; (iii) bankruptcy of the plan sponsor or other plan sponsor events (e.g., divestitures or spin-offs of a subsidiary) which cause a significant withdrawal from the Plans; (iv) the failure of the trust to qualify for exemption

Adient US LLC Defined Contribution Plans

Notes to the Financial Statements

December 31, 2019

from federal income taxes or any required prohibited transaction exemption under ERISA; (v) any change in law, regulation, ruling, administrative or judicial position, or accounting requirement, applicable to the Fixed Income Fund or the Plans; or (vi) the delivery of any communication to plan participants designed to influence a participant not to invest in the Fixed Income Fund.

The plan administrator does not believe that the occurrence of any such event, which would limit the Master Trust’s ability to transact at contract value, is probable.

The wrap contracts generally impose conditions on both the Master Trust and the issuers. If an event of default occurs and is not cured, the non-defaulting party may terminate the contract. The following may cause the Master Trust to be in default: a breach of material obligation under the contract; a material misrepresentation; or a material amendment to the plan agreement. The issuer may be in default if it breaches a material obligation under the investment contract; makes a material misrepresentation; has a decline in its long-term credit rating below a threshold set forth in the contract; is acquired or reorganized and the successor issuer does not satisfy the investment or credit guidelines applicable to issuers. If, in the event of default of an issuer, the Master Trust were unable to obtain a replacement investment contract, withdrawing plans may experience losses if the value of the Master Trust’s assets no longer covered by the contract is below contract value. The Master Trust may seek to add additional issuers over time to diversify the Master Trust’s exposure to such risk, but there is no assurance the Master Trust may be able to do so. The combination of the default of an issuer and an inability to obtain a replacement agreement could render the Master Trust unable to achieve its objective of maintaining a stable contract value. The terms of an investment contract generally provide for settlement of payments only upon termination of the contract or total liquidation of the covered investments. Generally, payments will be made pro-rata, based on the percentage of investments covered by each issuer. Contract termination occurs whenever the contract value or market value of the covered investments reaches zero or upon certain events of default.

If the contract terminates due to issuer default (other than a default occurring because of a decline in its rating), the issuer will generally be required to pay to the Master Trust the excess, if any, of contract value over market value on the date of termination. If a wrap contract terminates due to a decline in the ratings of the issuer, the issuer may be required to pay to the Master Trust the cost of acquiring a replacement contract (i.e., replacement cost) within the meaning of the contract. If the contract terminates when the market value equals zero, the issuer will pay the excess of contract value over market value to the Master Trust to the extent necessary for the Master Trust to satisfy outstanding contract value withdrawal requests. Contract termination also may occur by either party upon election and notice.

Benefit Payments - Benefits are recorded when paid.

Risks and Uncertainties - The Plans' investments are exposed to various risks, such as interest rate, market and credit risks. Due to the level of risk associated with certain investments and the level of uncertainty related to changes in the values of investments, it is at least reasonably possible that changes in risks in the near term would materially affect participants' account balances and the amounts reported in the statements of net assets available for benefits and the statements of changes in net assets available for benefits. The outbreak of the coronavirus (COVID-19) pandemic has adversely affected, and may continue to adversely affect, economic activity globally, nationally and locally. Following the COVID-19 outbreak in March 2020, the values of investment securities have experienced significant volatility. These economic and market conditions and other effects of the COVID-19 pandemic may continue to adversely affect the Plans. The extent of the adverse impact to the amounts reported in the 2019 statements of net assets available for benefits will depend on future developments that are highly uncertain and cannot be accurately predicted.

New Accounting Pronouncement -

During 2019, the Plans adopted Accounting Standards Update (ASU) No. 2017-06, Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), and Health and Welfare Benefit Plans (Topic 965) - Employee Benefit Plan Master Trust Reporting. As a result of the adoption of ASU No. 2017-06 additional disclosures related to the Plans' interest in the Master Trust have been made. This standard was adopted retrospectively and had no impact on the Plans' net assets or changes in net assets.

Adient US LLC Defined Contribution Plans

Notes to the Financial Statements

December 31, 2019

Note 3 - Master Trust

Employee benefit plans participating in the Master Trust as of December 31, 2019 and 2018 include the following defined contribution plans:

|

|

|

|

|

|

|

|

|

|

|

q

|

|

Adient US LLC Savings and Investment (401k) Plan

|

|

|

|

|

|

q

|

|

Avanzar Interior Technologies, Ltd. Savings and Investment (401k) Plan

|

|

|

|

|

|

q

|

|

Bridgewater Interiors, LLC Savings and Investment (401k) Plan

|

|

|

|

|

|

q

|

|

Adient Production Employees Savings and Investment (401k) Plan

|

|

|

|

|

All transfers to, withdrawals from or other transactions regarding the Master Trust shall be conducted in such a way that the proportionate interest in the Master Trust of each plan and the fair market value of that interest may be determined at any time.

Adient US LLC Defined Contribution Plans

Notes to the Financial Statements

December 31, 2019

A summary of the net assets of the Master Trust and dollar amounts of each plan's interest in the Master Trust as of December 31, 2019 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Master Trust Balances

|

|

Adient US LLC Savings and Investment (401k) Plan

|

|

Avanzar Interior Technologies, Ltd. Savings and Investment (401k) Plan

|

|

Bridgewater Interiors, LLC Savings and Investment (401k) Plan

|

|

Adient Production Employees Savings and Investment (401k) Plan

|

|

Investments - Fair Value:

|

|

|

|

|

|

|

|

|

|

|

|

Mutual Funds

|

|

$

|

176,193,442

|

|

|

|

$

|

166,803,210

|

|

|

|

$

|

2,369,474

|

|

|

|

$

|

5,666,422

|

|

|

|

$

|

1,354,336

|

|

|

Employer Stock Funds:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

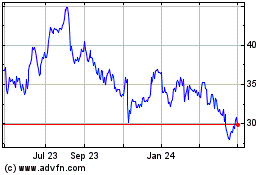

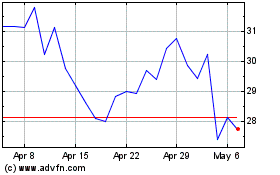

Adient Ordinary Shares

|

|

22,769,163

|

|

|

|

20,635,558

|

|

|

|

663,803

|

|

|

|

1,278,642

|

|

|

|

191,160

|

|

|

JCI plc Ordinary Shares

|

|

36,187,464

|

|

|

|

32,607,651

|

|

|

|

1,048,362

|

|

|

|

2,054,813

|

|

|

|

476,638

|

|

|

Interest Bearing Cash

|

|

2,239,767

|

|

|

1,982,886

|

|

|

|

53,091

|

|

|

|

156,291

|

|

|

|

47,499

|

|

|

Other Common Stock

|

|

30,878,689

|

|

|

|

28,375,724

|

|

|

|

445,400

|

|

|

|

1,667,797

|

|

|

|

389,768

|

|

|

Common Collective Trust Funds

|

|

631,236,470

|

|

|

|

545,934,706

|

|

|

|

16,741,698

|

|

|

|

51,943,530

|

|

|

|

16,616,536

|

|

|

Interest Bearing Cash

|

|

1,110,130

|

|

|

|

982,808

|

|

|

|

26,314

|

|

|

|

77,465

|

|

|

|

23,543

|

|

|

Total Investments at Fair Value

|

|

900,615,125

|

|

|

|

797,322,543

|

|

|

|

21,348,142

|

|

|

|

62,844,960

|

|

|

|

19,099,480

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments at Contract Value - Fixed Income Fund

|

|

60,841,664

|

|

|

|

56,112,736

|

|

|

|

484,482

|

|

|

|

3,080,009

|

|

|

|

1,164,437

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Master Trust Net Assets

|

|

$

|

961,456,789

|

|

|

|

$

|

853,435,279

|

|

|

|

$

|

21,832,624

|

|

|

|

$

|

65,924,969

|

|

|

|

$

|

20,263,917

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adient US LLC Defined Contribution Plans

Notes to the Financial Statements

December 31, 2019

A summary of the net assets of the Master Trust and dollar amounts of each plan's interest in the Master Trust as of December 31, 2018 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Master Trust Balances

|

|

Adient US LLC Savings and Investment (401k) Plan

|

|

Avanzar Interior Technologies, Ltd. Savings and Investment (401k) Plan

|

|

Bridgewater Interiors, LLC Savings and Investment (401k) Plan

|

|

Adient Production Employees Savings and Investment (401k) Plan

|

|

Investments - Fair Value:

|

|

|

|

|

|

|

|

|

|

|

|

Mutual Funds

|

|

176,030,010

|

|

|

|

$

|

167,365,547

|

|

|

|

$

|

2,107,959

|

|

|

|

$

|

5,413,098

|

|

|

|

$

|

1,143,406

|

|

|

Employer Stock Funds:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adient Ordinary Shares

|

|

9,620,126

|

|

|

|

8,762,525

|

|

|

|

303,409

|

|

|

|

474,169

|

|

|

|

80,023

|

|

|

JCI plc Ordinary Shares

|

|

32,250,559

|

|

|

|

29,060,059

|

|

|

|

947,286

|

|

|

|

1,870,861

|

|

|

|

372,353

|

|

|

Interest Bearing Cash

|

|

1,789,795

|

|

|

|

1,595,072

|

|

|

|

40,138

|

|

|

|

119,681

|

|

|

|

34,904

|

|

|

Other Common Stock

|

|

20,443,461

|

|

|

|

18,723,708

|

|

|

|

347,848

|

|

|

|

1,110,446

|

|

|

|

261,459

|

|

|

Common Collective Trust Funds

|

|

470,974,148

|

|

|

|

408,235,199

|

|

|

|

12,200,817

|

|

|

|

38,562,430

|

|

|

|

11,975,702

|

|

|

Interest Bearing Cash

|

|

745,048

|

|

|

|

663,989

|

|

|

|

16,709

|

|

|

|

49,820

|

|

|

|

14,530

|

|

|

Total Investments at Fair Value

|

|

711,853,147

|

|

|

|

634,406,099

|

|

|

|

15,964,166

|

|

|

|

47,600,505

|

|

|

|

13,882,377

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments at Contract Value - Fixed Income Fund

|

|

61,908,582

|

|

|

|

57,227,872

|

|

|

|

563,386

|

|

|

|

2,927,345

|

|

|

|

1,189,979

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Master Trust Net Assets

|

|

$

|

773,761,729

|

|

|

$

|

691,633,971

|

|

|

$

|

16,527,552

|

|

|

$

|

50,527,850

|

|

|

$

|

15,072,356

|

|

|

|

|

|

|

|

|

|

|

|

|

|

During the year ended December 31, 2019, the Master Trust investment income was comprised of the following:

|

|

|

|

|

|

|

|

|

|

|

Net realized and unrealized gains

|

|

$

|

166,307,202

|

|

|

Dividend, interest and other income

|

|

12,635,405

|

|

|

Net Investment Income

|

|

$

|

178,942,607

|

|

During 2019, there was approximately $20 million of purchases and $14 million of sales related to Adient ordinary shares in the Master Trust, which is considered to be a related party transaction. During 2018, there was approximately $13 million of both purchases and sales related to Adient plc ordinary shares in the Master Trust, which is considered to be a related party transaction.

Note 4 - Fair Value Measurements

Accounting standards require certain assets and liabilities to be reported at fair value in the financial statements and provide a framework for establishing that fair value. The framework for determining fair value is based on a hierarchy that prioritizes the inputs and valuation techniques used to measure fair value.

In determining fair value, various valuation techniques are utilized and observable inputs are prioritized. The availability of observable inputs varies from instrument and depends on a variety of factors including the type of instrument, whether the instrument is actively traded, and other characteristics particular to the transaction. For many financial instruments, pricing inputs are readily observable in the market, the valuation methodology used is widely accepted by market participants, and the

Adient US LLC Defined Contribution Plans

Notes to the Financial Statements

December 31, 2019

valuation does not require significant management discretion. For other financial instruments, pricing inputs are less observable in the marketplace and may require management judgment.

The inputs used to measure fair value are assessed using a three-tier hierarchy based on the extent to which inputs used in measuring fair value are observable in the market. Level 1 inputs include quoted prices in active markets for identical instruments and are the most observable. Level 2 inputs include quoted prices for similar assets and inputs such as interest rates and yield curves that are observable at commonly quoted intervals. Level 3 inputs are not observable in the market and include management's judgments about the assumptions market participants would use in pricing the asset. In instances where inputs used to measure fair value fall into different levels of the fair value hierarchy, fair value measurements in their entirety are categorized based on the lowest level input that is significant to the valuation. The Master Trust's assessment of the significance of particular inputs to these fair value measurements requires judgment and considers factors specific to each asset.

Following is a description of the valuation methodologies used to value the underlying investments in the Master Trust:

Mutual Funds and Common Stock - The fair value for Mutual Funds and Common Stock are determined by direct quoted market prices.

Employer Stock Funds - The Adient Stock Fund and JCI plc Stock Fund are unitized accounts that are comprised of Adient and JCI plc ordinary shares, respectively, except for a small portion of the funds that is invested in interest bearing cash to provide liquidity for daily activities. Adient and JCI plc ordinary shares are valued based on direct quoted market prices and interest bearing cash is based on outstanding balances.

Interest Bearing Cash - These investments are valued at fair value based on their outstanding balances.

Common Collective Trusts - Common collective trusts are valued at the net asset value ("NAV") provided by the administrator of the fund using the practical expedient approach and therefore is not assigned to a level in the hierarchy table. The NAV is based on the fair value of the underlying assets owned by the fund. The common collective trusts are not subject to restrictions regarding redemptions and there are no unfunded commitments to the funds.

Master Trust Assets measured at fair value on a recurring basis as of December 31, 2019 are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets Measured at Fair Value at December 31, 2019

|

|

|

|

|

|

|

|

Total

|

|

Level 1

|

|

Level 2

|

|

Investments at Fair Value:

|

|

|

|

|

|

|

|

Mutual Funds

|

|

$

|

176,193,442

|

|

|

$

|

176,193,442

|

|

|

$

|

—

|

|

|

Adient Ordinary Shares

|

|

22,769,163

|

|

|

22,769,163

|

|

|

—

|

|

|

JCI plc Ordinary Shares

|

|

36,187,464

|

|

|

36,187,464

|

|

|

—

|

|

|

Other Common Stock

|

|

30,878,689

|

|

|

30,878,689

|

|

|

—

|

|

|

Interest Bearing Cash

|

|

3,349,897

|

|

|

—

|

|

|

3,349,897

|

|

|

Total investments at fair value

|

|

$

|

269,378,655

|

|

|

$

|

266,028,758

|

|

|

$

|

3,349,897

|

|

|

|

|

|

|

|

|

|

|

Investments Measured at NAV:

|

|

|

|

|

|

|

|

Common Collective Trust Funds

|

|

631,236,470

|

|

|

|

|

|

|

Total Investments at NAV

|

|

631,236,470

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Master Trust Investments at Fair Value

|

|

$

|

900,615,125

|

|

|

|

|

|

Adient US LLC Defined Contribution Plans

Notes to the Financial Statements

December 31, 2019

Master Trust Assets measured at fair value on a recurring basis as of December 31, 2018 are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets Measured at Fair Value at December 31, 2018

|

|

|

|

|

|

|

|

Total

|

|

Level 1

|

|

Level 2

|

|

Investments at Fair Value:

|

|

|

|

|

|

|

|

Mutual Funds

|

|

$

|

176,030,010

|

|

|

$

|

176,030,010

|

|

|

$

|

—

|

|

|

Adient Ordinary Shares

|

|

9,620,126

|

|

|

9,620,126

|

|

|

—

|

|

|

JCI plc Ordinary Shares

|

|

32,250,559

|

|

|

32,250,559

|

|

|

—

|

|

|

Other Common Stock

|

|

20,443,461

|

|

|

20,443,461

|

|

|

—

|

|

|

Interest Bearing Cash

|

|

2,534,843

|

|

|

—

|

|

|

2,534,843

|

|

|

Total investments at fair value

|

|

$

|

240,878,999

|

|

|

$

|

238,344,156

|

|

|

$

|

2,534,843

|

|

|

|

|

|

|

|

|

|

|

Investments Measured at NAV:

|

|

|

|

|

|

|

|

Common Collective Trust Funds

|

|

470,974,148

|

|

|

|

|

|

|

Total Investments at NAV

|

|

470,974,148

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Master Trust Investments at Fair Value

|

|

$

|

711,853,147

|

|

|

|

|

|

Note 5 - Tax Status

Adient US LLC Savings and Investment (401k) Plan

The ASIP does not have a determination letter, however, the Plan administrator believes that the ASIP is currently designed and being operated in compliance with the applicable requirements of the Internal Revenue Code ("IRC"). The ASIP was formed effective July 1, 2016; therefore, all plan years are subject to tax examination.

Avanzar Interior Technologies, Ltd. Savings and Investment (401k) Plan

The Internal Revenue Service (IRS) has determined and informed the Company by a letter dated August 7, 2014, that the AVSIP is designed in accordance with applicable sections of the IRC. The AVSIP has been amended since receiving the determination letter. However, the Plan administrator believes that the AVSIP is currently designed and being operated in compliance with the applicable requirements of the IRC. The Plan Sponsor believes it is no longer subject to income tax examinations for years prior to 2016.

Bridgewater Interiors, LLC Savings and Investment (401k) Plan

The IRS has determined and informed the Company by a letter dated August 1, 2017, that the BSIP is designed in accordance with applicable sections of the IRC. The BSIP has been amended since receiving the determination letter. However, the Plan administrator believes that the BSIP is currently designed and being operated in compliance with the applicable requirements of the IRC. The Plan Sponsor believes it is no longer subject to income tax examinations for years prior to 2016.

Adient Production Employees Savings and Investment (401k) Plan

The IRS has determined and informed the Company by a letter dated February 9, 2012, that the APSIP is designed in accordance with applicable sections of the IRC. The APSIP has been amended since receiving the determination letter. However, the Plan administrator believes that the APSIP is currently designed and being operated in compliance with the applicable requirements of the IRC. The Plan Sponsor believes it is no longer subject to income tax examinations for years prior to 2016.

Adient US LLC Defined Contribution Plans

Notes to the Financial Statements

December 31, 2019

Note 6 - Plan Termination

Although it has not expressed any intent to do so, the Company has the right under each Plan to discontinue its contributions at any time and to terminate each Plan subject to the provisions of ERISA. In the event any of the Plans terminate, affected participants of the terminated Plan will become 100% vested in their accounts.

Note 7 - Party-in-Interest Transactions

Transactions involving the Adient Stock Fund, notes receivable from participants and the funds administered by Fidelity Management Trust Company, or its affiliates, trustee of the Plans, are considered party-in-interest transactions.

Note 8 - Subsequent Events

Subsequent to year-end, the Plans’ investment portfolio incurred a significant decline in fair value during the timeframe in which there was an overall decline in financial markets resulting from the COVID-19 pandemic. However, because the values of individual investments fluctuate with market conditions, and due to market volatility, the amount of losses that will be recognized in subsequent periods, if any, cannot be determined.

In addition, effective March 27, 2020, the Company implemented the Coronavirus Aid, Relief, and Economic Security Act ("CARES Act"). The provisions implemented through the CARES Act include an allowance for a distribution of up to $100,000 that is exempt from the 10% early withdrawal penalty, an increase in the participant loan limits to the lesser of $100,000 or the participant's entire vested balance, and a 1-year extension on the due date of any participant loans currently due between March 27, 2020 and December 31, 2020. The impact of the CARES Act on the plans is unknown.

Effective May 16, 2020, the Company matching contribution and RIC were suspended for the remainder of plan year 2020 for all non-bargained employees in the ASIP. The suspension of the matching contribution and RIC is one of the actions taken by the Company to maintain adequate liquidity during 2020 in response to adverse impact from the COVID-19 pandemic.

Note 9 - Reconciliation to Form 5500

Adient US LLC Savings and Investment (401k) Plan

The net assets on the financial statements differ from the net assets on Form 5500 due to the synthetic GICs held in the Master Trust being recorded at contract value on the financial statements and at fair value on Form 5500. Accordingly, the net assets on the financial statements as of December 31, 2019 and 2018 were $852,097 lower and $446,397 higher, respectively, compared to those on the Form 5500. The net increase was $1,298,494 lower on the financial statements compared to that on the Form 5500 for the year ended December 31, 2019.

Avanzar Interior Technologies, Ltd. Savings and Investment (401k) Plan

The net assets on the financial statements differ from the net assets on Form 5500 due to the synthetic GICs held in the Master Trust being recorded at contract value on the financial statements and at fair value on Form 5500. Accordingly, the net assets on the financial statements as of December 31, 2019 and 2018 were $7,357 lower and $4,395 higher, respectively, compared to those on the Form 5500. The net increase was $11,752 lower on the financial statements compared to that on the Form 5500 for the year ended December 31, 2019.

Adient US LLC Defined Contribution Plans

Notes to the Financial Statements

December 31, 2019

Bridgewater Interiors, LLC Savings and Investment (401k) Plan

The net assets on the financial statements differ from the net assets on Form 5500 due to the synthetic GICs held in the Master Trust being recorded at contract value on the financial statements and at fair value on Form 5500. Accordingly, the net assets on the financial statements as of December 31, 2019 and 2018 were $46,771 lower and $22,834 higher, respectively, compared to those on the Form 5500. The net increase was $69,605 lower on the financial statements compared to that on the Form 5500 for the year ended December 31, 2019.

Adient Production Employees Savings and Investment (401k) Plan

The net assets on the financial statements differ from the net assets on Form 5500 due to the synthetic GICs held in the Master Trust being recorded at contract value on the financial statements and at fair value on Form 5500. Accordingly, the net assets on the financial statements as of December 31, 2019 and 2018 were $17,683 lower and $9,282 higher, respectively, compared to those on the Form 5500. The net increase was $26,965 lower on the financial statements compared to that on the Form 5500 for the year ended December 31, 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adient US LLC Defined Contribution Plans

|

|

|

|

|

|

|

|

|

|

Schedule H, Line 4a - Schedule of Delinquent Participant Contributions

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, 2019

|

|

|

|

|

|

|

|

|

|

Adient US LLC Savings and Investment (401k) Plan

Plan #001, EIN: 38-3380735

|

|

Total That Constitute Nonexempt Prohibited Transactions

|

|

|

|

|

|

Total Fully Corrected Under VFCP and PTE 2002-51

|

|

Participant Contributions Transferred Late to Plan

|

|

Contributions Not Corrected:

|

|

Contributions Corrected Outside VFCP:

|

|

Contributions Pending Correction in VFCP

|

|

|

|

Check here if late Participant Loan Repayments are included: x

|

|

$

|

1,272

|

|

|

$

|

782

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adient US LLC Defined Contribution Plans

|

|

|

|

|

|

|

|

|

|

Schedule H, Line 4a - Schedule of Delinquent Participant Contributions

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, 2019

|

|

|

|

|

|

|

|

|

|

Bridgewater Interiors, LLC Savings and Investment Plan (401k) Plan

Plan #002, EIN: 38-3406010

|

|

Total That Constitute Nonexempt Prohibited Transactions

|

|

|

|

|

|

Total Fully Corrected Under VFCP and PTE 2002-51

|

|

Participant Contributions Transferred Late to Plan

|

|

Contributions Not Corrected:

|

|

Contributions Corrected Outside VFCP:

|

|

Contributions Pending Correction in VFCP

|

|

|

|

Check here if late Participant Loan Repayments are included: ☐

|

|

$

|

26

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adient US LLC Defined Contribution Plans

|

|

|

|

|

|

|

|

|

|

Schedule H, Line 4a - Schedule of Delinquent Participant Contributions

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, 2019

|

|

|

|

|

|

|

|

|

|

Adient Production Employees Savings and Investment (401k) Plan

Plan #003, EIN: 38-3380735

|

|

Total That Constitute Nonexempt Prohibited Transactions

|

|

|

|

|

|

Total Fully Corrected Under VFCP and PTE 2002-51

|

|

Participant Contributions Transferred Late to Plan

|

|

Contributions Not Corrected:

|

|

Contributions Corrected Outside VFCP:

|

|

Contributions Pending Correction in VFCP

|

|

|

|

Check here if late Participant Loan Repayments are included: ☐

|

|

$

|

6

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adient US LLC Defined Contribution Plans

|

|

|

|

|

|

|

|

|

|

Schedule H, 4i - Schedule of Assets Held at End of Year

|

|

|

|

|

|

|

|

|

|

December 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

(a)(b)

|

|

(c)

|

|

(d)

|

|

(e)

|

|

|

|

Identity of Issue, Borrower, Lessor or Similar Party

|

|

Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par or Maturity Value

|

|

Cost

|

|

Current Value

|

|

|

|

Adient US LLC Savings and Investment (401k) Plan

|

|

|

|

|

|

|

|

|

|

|

|

Plan #001, EIN: 38-3380735

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Participant

|

|

Participant notes receivable bearing interest at rates of 3.25% - 5.75%

|

|

N/A

|

|

|

21,273,036

|

|

|

*

|

Represents a party-in-interest

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adient US LLC Defined Contribution Plans

|

|

|

|

|

|

|

|

|

|

Schedule H, 4i - Schedule of Assets Held at End of Year

|

|

|

|

|

|

|

|

|

|

December 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

(a)(b)

|

|

(c)

|

|

(d)

|

|

(e)

|

|

|

|

Identity of Issue, Borrower, Lessor or Similar Party

|

|

Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par or Maturity Value

|

|

Cost

|

|

Current Value

|

|

|

|

Avanzar Interior Technologies, Ltd. Savings and Investment Plan (401k) Plan

|

|

|

|

|

|

|

|

|

|

Plan #001, EIN: 20-1818668

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Participant

|

Participant notes receivable bearing interest at rates of 3.25% - 5.50%

|

|

|

N/A

|

|

1,689,397

|

|

|

*

|

Represents a party-in-interest

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adient US LLC Defined Contribution Plans

|

|

|

|

|

|

|

|

|

|

Schedule H, 4i - Schedule of Assets Held at End of Year

|

|

|

|

|

|

|

|

|

|

12/31/2019

|

|

|

|

|

|

|

|

|

|

|

|

(a)(b)

|

|

(c)

|

|

(d)

|

|

(e)

|

|

|

|

Identity of Issue, Borrower, Lessor or Similar Party

|

|

Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par or Maturity Value

|

|

Cost

|

|

Current Value

|

|

|

|

Bridgewater Interiors, LLC Savings and Investment (401k) Plan

|

|

|

|

|

|

|

|

|

|

Plan #002, EIN: 38-3406010

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Participant

|

|

Participant notes receivable bearing interest at rates of 3.25% - 5.50%

|

|

N/A

|

|

|

4,468,196

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Represents a party-in-interest

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adient US LLC Defined Contribution Plans

|

|

|

|

|

|

|

|

|

|

Schedule H, 4i - Schedule of Assets Held at End of Year

|

|

|

|

|

|

|

|

|

|

12/31/2019

|

|

|

|

|

|

|

|

|

|

|

|

(a)(b)

|

|

(c)

|

|

(d)

|

|

(e)

|

|

|

|

Identity of Issue, Borrower, Lessor or Similar Party

|

|

Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par or Maturity Value

|

|

Cost

|

|

Current Value

|

|

|

|

Adient Production Employees Savings and Investment (401k) Plan

|

|

|

|

|

|

|

|

|

|

Plan #003, EIN: 38-3380735

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Participant

|

|

Participant notes receivable bearing interest at rates of 3.25% - 5.50%

|

|

N/A

|

|

|

1,820,064

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Represents a party-in-interest

|

|

|

|

|

|

|

|

Adient US LLC Defined Contribution Plans

Exhibit Index

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

23.1

|

|

|

|

|

|

|

|

|

23.2

|

|

|

|

|

|

|

|

|

23.3

|

|

|

|

|

|

|

|

|

23.4

|

|

|

|

|

|

|

|

Adient US LLC Defined Contribution Plans

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|