Current Report Filing (8-k)

June 01 2020 - 4:21PM

Edgar (US Regulatory)

0001670541FALSE00016705412020-05-282020-05-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): May 28, 2020

ADIENT PLC

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Ireland

|

001-37757

|

98-1328821

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification Number)

|

|

|

|

|

|

25-28 North Wall Quay, IFSC

Dublin 1, Ireland D01 H104

|

|

(Address of principal executive offices)

|

Registrant’s telephone number, including area code: 734-254-5000

Not Applicable

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of class

|

|

Trading symbol(s)

|

|

Name of exchange on which registered

|

|

Ordinary Shares, par value $0.001

|

|

ADNT

|

|

New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrants under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

|

|

|

|

|

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

|

On May 28, 2020, the Compensation Committee of the Board of Directors of Adient plc (“Adient”) approved, pursuant to Adient’s 2016 Omnibus Incentive Plan, a form of Restricted Shares or Restricted Share Unit Award Agreement (the “RSU Agreement”). The RSU Agreement will be used to grant restricted stock unit awards to certain Adient employees, including Adient’s executive officers, with a grant date fair value in an amount equal to 10-30% of the recipient’s salary for fiscal year 2020. The restricted stock unit awards are being granted in lieu of 10-30% of salary and other compensatory benefits that are being foregone by each recipient from the time period beginning July 1, 2020 through June 30, 2021. The restricted stock unit awards granted under the RSU Agreement are expected to have a grant date of July 1, 2020 and will vest in two tranches. One half of the restricted stock unit awards will vest on the date that is six months from the grant date, and the remaining half will vest on the date that is one year from the grant date (subject to pro rata or full continued vesting upon certain retirements, other terminations of employment, death or disability). The foregoing description of the RSU Agreement is not complete and is qualified in its entirety by the RSU Agreement that is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated by reference herein.

As part of Adient’s efforts to align its cost structure to lower expected sales, Cathleen A. Ebacher, Adient’s Vice President, General Counsel and Secretary, departed the company effective May 31, 2020. Adient wishes Ms. Ebacher well and thanks her for her years of service to the company. Ms. Ebacher’s separation from employment was deemed to be without cause for purposes of the Key Executive Severance and Change of Control Agreement between Ms. Ebacher and Adient, effective January 17, 2017 (the “Severance Agreement”), and, as a result, she is entitled to receive the severance benefits provided by the Severance Agreement as described in Adient’s definitive proxy statement on Schedule 14A filed with the Securities Exchange Commission on January 28, 2020. Under the terms of the Severance Agreement, Ms. Ebacher’s entitlement to severance is conditioned on her execution and non-revocation of a release of claims, and her compliance with restrictive covenants set forth in the Severance Agreement. No new compensatory arrangements were entered into with Ms. Ebacher in connection with her departure, and no existing arrangements were modified.

|

|

|

|

|

|

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

EXHIBIT INDEX

|

|

|

|

Exhibit No.

|

|

Exhibit Description

|

|

|

|

|

|

10.1

|

|

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (the Cover Page Interactive Data File is embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

ADIENT PLC

|

|

|

Date: June 1, 2020

|

By:

|

/s/ Jeffrey M. Stafeil

|

|

|

Name:

|

Jeffrey M. Stafeil

|

|

|

Title:

|

Executive Vice President and Chief Financial Officer

|

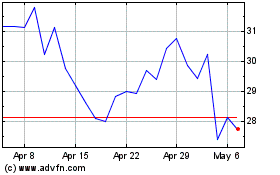

Adient (NYSE:ADNT)

Historical Stock Chart

From Mar 2024 to Apr 2024

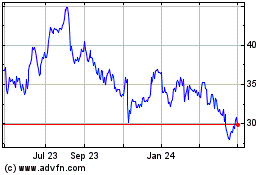

Adient (NYSE:ADNT)

Historical Stock Chart

From Apr 2023 to Apr 2024