First quarter GAAP net loss of $17.3 million

or $0.54 per diluted common share and Core Earnings(1) of $10.3

million or $0.32 per diluted common share

Ares Commercial Real Estate Corporation (the “Company”)

(NYSE:ACRE), a specialty finance company engaged in originating and

investing in commercial real estate assets, reported generally

accepted accounting principles (“GAAP”) net loss of $17.3 million

or $0.54 per diluted common share and Core Earnings(1) of $10.3

million or $0.32 per diluted common share for the first quarter of

2020.

“During this unprecedented economic disruption caused by the

COVID-19 pandemic, we have relied on our seasoned team of

professionals and rigorous, credit focused investment philosophy to

manage our existing portfolio and liquidity position,” said Bryan

Donohoe, Chief Executive Officer of ACRE. “We strategically

structured our portfolio to be comprised of 95% senior loans with

62% collateralized by multifamily, office and industrial properties

with limited exposure to hotel and retail properties. As of quarter

end, our portfolio has performed relatively well with no

impairments and we received all loan debt service payments for the

April 2020 payment date.”

“Our funding structure is diversified across ten different

sources of capital with relationship financial institutions that do

not contain margin call provisions based on changes in market

borrowing spreads,” said Tae-Sik Yoon, Chief Financial Officer of

ACRE. “In addition, we have purposefully diversified the

composition of senior loans that we finance with each of our

lenders.”

_________________________________

(1) Core Earnings is a non-GAAP financial

measure. Refer to Schedule I for further details.

COMMON STOCK DIVIDEND

On February 20, 2020, the Company declared a cash dividend of

$0.33 per common share for the first quarter of 2020. The first

quarter 2020 dividend was paid on April 15, 2020 to common

stockholders of record as of March 31, 2020.

ADDITIONAL INFORMATION

The Company issued a presentation of its first quarter 2020

results, which can be viewed at www.arescre.com on the Investor Resources section

of our home page under Events and Presentations. The presentation

is titled “First Quarter 2020 Earnings Presentation.” The Company

also filed its Quarterly Report on Form 10-Q for the quarter ended

March 31, 2020 with the U.S. Securities and Exchange Commission on

May 8, 2020.

CONFERENCE CALL AND WEBCAST INFORMATION

On Friday, May 8, 2020, the Company invites all interested

persons to attend its webcast/conference call at 1:00 p.m. (Eastern

Time) to discuss its first quarter 2020 financial results.

All interested parties are invited to participate via telephone

or the live webcast, which will be hosted on a webcast link located

on the Home page of the Investor Resources section of the Company’s

website at http://www.arescre.com. Please visit the website to test

your connection before the webcast. Domestic callers can access the

conference call by dialing +1 (888) 317-6003. International callers

can access the conference call by dialing +1 (412) 317-6061. All

callers will need to enter the Participant Elite Entry Number

6127925 followed by the # sign and reference “Ares Commercial Real

Estate Corporation” once connected with the operator. All callers

are asked to dial in 10-15 minutes prior to the call so that name

and company information can be collected. For interested parties,

an archived replay of the call will be available through May 21,

2020 at 5:00 p.m. (Eastern Time) to domestic callers by dialing +1

(877) 344-7529 and to international callers by dialing +1 (412)

317-0088. For all replays, please reference conference number

10141810. An archived replay will also be available through May 21,

2020 on a webcast link located on the Home page of the Investor

Resources section of the Company’s website.

ABOUT ARES COMMERCIAL REAL ESTATE CORPORATION

Ares Commercial Real Estate Corporation is a specialty finance

company primarily engaged in originating and investing in

commercial real estate loans and related investments. Through its

national direct origination platform, the Company provides a broad

offering of flexible and reliable financing solutions for

commercial real estate owners and operators. The Company originates

senior mortgage loans, as well as subordinate financings, mezzanine

debt and preferred equity, with an emphasis on providing value

added financing on a variety of properties located in liquid

markets across the United States. Ares Commercial Real Estate

Corporation elected and qualified to be taxed as a real estate

investment trust and is externally managed by a subsidiary of Ares

Management Corporation. For more information, please visit

www.arescre.com. The contents of such

website are not, and should not be deemed to be, incorporated by

reference herein.

FORWARD-LOOKING STATEMENTS

Statements included herein or on the webcast / conference call

may constitute “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995, Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities and Exchange Act of 1934, as amended, which relate to

future events or the Company’s future performance or financial

condition. These statements are not guarantees of future

performance, condition or results and involve a number of risks and

uncertainties. Actual results may differ materially from those in

the forward-looking statements as a result of a number of factors,

including the returns on current and future investments, rates of

repayments and prepayments on the Company’s mortgage loans,

availability of investment opportunities, the Company’s ability to

originate additional investments and completion of pending

investments, the availability of capital, the availability and cost

of financing, market trends and conditions in the Company’s

industry and the general economy, the level of lending and

borrowing spreads and interest rates, commercial real estate loan

volumes, the impact of the COVID-19 pandemic and the pandemic's

impact on the U.S. and global economy, and the risks described from

time to time in the Company’s filings with the Securities and

Exchange Commission (the "SEC"), including, but not limited to, the

risk factors described in Part I, Item 1A. Risk Factors in the

Company's Annual Report on Form 10-K, filed with the SEC on

February 20, 2020, and the risk factors described in Part II -

Other Information, Item 1A. Risk Factors in the Company's Quarterly

Report on Form 10-Q filed with the SEC on May 8, 2020. Any

forward-looking statement, including any contained herein, speaks

only as of the time of this press release and Ares Commercial Real

Estate Corporation undertakes no duty to update any forward-looking

statements made herein or on the webcast/conference call.

Projections and forward-looking statements are based on

management’s good faith and reasonable assumptions, including the

assumptions described herein.

ARES COMMERCIAL REAL ESTATE

CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(in thousands, except share

and per share data)

As of

March 31, 2020

December 31, 2019

(unaudited)

ASSETS

Cash and cash equivalents

$

74,498

$

5,256

Restricted cash

379

379

Loans held for investment ($425,817 and

$515,896 related to consolidated VIEs, respectively)

1,870,639

1,682,498

Current expected credit loss reserve

(29,143

)

—

Loans held for investment, net of current

expected credit loss reserve

1,841,496

1,682,498

Real estate owned, net

37,907

37,901

Other assets ($1,010 and $1,309 of

interest receivable related to consolidated VIEs, respectively;

$131,183 and $41,104 of other receivables related to consolidated

VIEs, respectively)

147,075

58,100

Total assets

$

2,101,355

$

1,784,134

LIABILITIES AND STOCKHOLDERS'

EQUITY

LIABILITIES

Secured funding agreements

$

990,564

$

728,589

Notes payable and secured borrowings

65,047

54,708

Secured term loan

109,378

109,149

Collateralized loan obligation

securitization debt (consolidated VIE)

443,558

443,177

Due to affiliate

2,836

2,761

Dividends payable

11,057

9,546

Other liabilities ($691 and $718 of

interest payable related to consolidated VIEs, respectively)

12,850

9,865

Total liabilities

1,635,290

1,357,795

STOCKHOLDERS' EQUITY

Common stock, par value $0.01 per share,

450,000,000 shares authorized at March 31, 2020 and December 31,

2019 and 33,398,952 and 28,865,610 shares issued and outstanding at

March 31, 2020 and December 31, 2019, respectively

329

283

Additional paid-in capital

496,689

423,619

Accumulated earnings (deficit)

(30,953

)

2,437

Total stockholders' equity

466,065

426,339

Total liabilities and stockholders'

equity

$

2,101,355

$

1,784,134

ARES COMMERCIAL REAL ESTATE

CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except share

and per share data)

For the three months ended

March 31,

2020

2019

(unaudited)

(unaudited)

Revenue:

Interest income from loans held for

investment

$

31,448

$

27,986

Interest expense

(15,534

)

(15,740

)

Net interest margin

15,914

12,246

Revenue from real estate owned

5,220

1,911

Total revenue

21,134

14,157

Expenses:

Management and incentive fees to

affiliate

1,773

1,574

Professional fees

903

478

General and administrative expenses

868

1,120

General and administrative expenses

reimbursed to affiliate

1,051

659

Expenses from real estate owned

6,676

1,687

Total expenses

11,271

5,518

Provision for current expected credit

losses

27,117

—

Income (loss) before income

taxes

(17,254

)

8,639

Income tax expense, including excise

tax

9

96

Net income (loss) attributable to

common stockholders

$

(17,263

)

$

8,543

Earnings (loss) per common

share:

Basic and diluted earnings (loss) per

common share

$

(0.54

)

$

0.30

Weighted average number of common

shares outstanding:

Basic weighted average shares of common

stock outstanding

31,897,952

28,561,827

Diluted weighted average shares of common

stock outstanding

31,897,952

28,780,980

Dividends declared per share of common

stock (1)

$

0.33

$

0.33

(1) There is no assurance dividends will

continue at these levels or at all.

SCHEDULE I

Reconciliation of Net Income (Loss) to

Non-GAAP Core Earnings

The Company believes the disclosure of Core Earnings provides

useful information to investors regarding the calculation of

incentive fees the Company pays to its manager, Ares Commercial

Real Estate Management LLC, and the Company’s financial

performance. Core Earnings is an adjusted non-GAAP measure that

helps the Company evaluate its financial performance excluding the

effects of certain transactions and GAAP adjustments that it

believes are not necessarily indicative of its current loan

origination portfolio and operations. The presentation of this

additional information is not meant to be considered in isolation

or as a substitute for financial results prepared in accordance

with GAAP. Core Earnings is a non-GAAP measure and is defined as

net income (loss) computed in accordance with GAAP, excluding

non-cash equity compensation expense, the incentive fee,

depreciation and amortization (to the extent that any of the

Company’s target investments are structured as debt and the Company

forecloses on any properties underlying such debt), any unrealized

gains, losses or other non-cash items recorded in net income (loss)

for the period, regardless of whether such items are included in

other comprehensive income or loss, or in net income (loss),

one-time events pursuant to changes in GAAP and certain non-cash

charges after discussions between the Company’s external manager

and the Company’s independent directors and after approval by a

majority of the Company’s independent directors.

Reconciliation of net income (loss) attributable to common

stockholders, the most directly comparable GAAP financial measure,

to Core Earnings is set forth in the table below for the three and

twelve months ended March 31, 2020 ($ in thousands):

For the three months ended

March 31, 2020

For the twelve months ended

March 31, 2020

Net income (loss) attributable to common

stockholders

$

(17,263

)

$

11,186

Stock-based compensation

225

1,613

Incentive fees to affiliate

—

1,052

Depreciation of real estate owned

221

834

Provision for current expected credit

losses

27,117

27,117

Core Earnings

$

10,300

$

41,802

Net income (loss) attributable to common

stockholders

$

(0.54

)

$

0.38

Stock-based compensation

0.01

0.05

Incentive fees to affiliate

—

0.04

Depreciation of real estate owned

0.01

0.03

Provision for current expected credit

losses

0.85

0.92

Basic Core Earnings per common

share

$

0.32

$

1.42

Net income (loss) attributable to common

stockholders

$

(0.54

)

$

0.38

Stock-based compensation

0.01

0.05

Incentive fees to affiliate

—

0.04

Depreciation of real estate owned

0.01

0.03

Provision for current expected credit

losses

0.84

0.91

Diluted Core Earnings per common

share

$

0.32

$

1.41

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200508005121/en/

INVESTOR RELATIONS Ares Commercial Real Estate

Corporation Carl Drake or Veronica Mendiola Mayer (888) 818-5298

iracre@aresmgmt.com

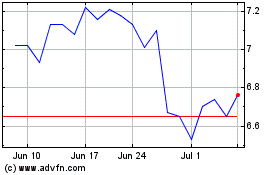

Ares Commercial Real Est... (NYSE:ACRE)

Historical Stock Chart

From Mar 2024 to Apr 2024

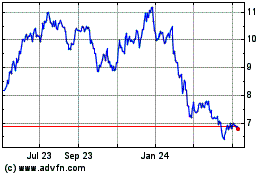

Ares Commercial Real Est... (NYSE:ACRE)

Historical Stock Chart

From Apr 2023 to Apr 2024