By Jean Eaglesham and Kirsten Grind

State governments struggling with the coronavirus pandemic have

paid tens of millions of dollars to big consulting firms for

help.

The consultants promised to help the states tackle a range of

problems, including delivering medical equipment and staffing call

centers that handle worker benefits. In some cases, states have

seen only modest benefits, if any at all, for the extra cost, The

Wall Street Journal found through interviews and public-records

requests.

Two major consulting firms, McKinsey & Co. and Deloitte

Consulting LLP, together have won coronavirus-related contracts

worth at least $182 million from states, more than double their

tally of federal coronavirus contracts, according to a Journal

analysis of public records and news releases.

The full amount of money received by the firms is likely even

higher -- comprehensive data on states' spending isn't yet

available.

"They're seeing this massive economic opportunity arising from a

grave public health problem and they're stepping in to take

advantage," said Caroline Buckee, an associate professor of

epidemiology at Harvard University's T.H. Chan School of Public

Health.

Consulting firms say they are responding to state governments'

requests for help. Boston Consulting Group, for example, said that

when the pandemic hit, the firm "rapidly mobilized substantial

expertise and resources to help states manage the crisis."

States have been largely left alone by the federal government to

tackle the pandemic and related issues. Their continuing struggles

to enlist consultants to help them -- at a high price to taxpayers

-- shows how challenging that autonomy has been.

"When you're trying to secure a global supply chain, that's not

something a state emergency department normally deals with," said

Jeffrey Stern, who led Virginia's department of emergency

management until June.

California turned to Deloitte to help handle a flood of claims

engulfing its antiquated benefits system -- a system Deloitte has

billed the state millions for over the years, part of more than

$250 million of work for the employment department. This spring,

the firm was awarded a new $5 million contract to help upgrade

systems to pay pandemic benefits. Deloitte also won an $11.1

million, two-month contract to supply call-center staff to quickly

increase the employment department's capacity. In August, the state

increased the contract to $42.6 million.

It didn't fix either problem. The department's two call centers

-- including one partly staffed by Deloitte -- are overwhelmed, an

official state report in September found. And a huge backlog of

unresolved claims, tallying more than a million, was growing by at

least 10,000 every day, the report said.

Jamie Anderson, a 25-year-old single mom and former call-center

worker in Palmdale, Calif., near Los Angeles, said she has spent

hundreds of hours on the phone with the employment department since

losing her job in April. She said she had to wait until September

to get thousands of dollars of benefits she was owed. "I called and

called for weeks and all they did was put me on the call-back

list," she said. "I have no income, I have a child, and I live in a

small city where all the jobs are taken."

Deloitte clearly has "not successfully resolved [the

department's] IT challenges or modernized its system," a letter

from dozens of local lawmakers this year said. David Chiu, a

Democratic member of the state's Assembly, said it is "incredibly

concerning that [the employment department] has continued to go

back to a contractor that has a well-documented history of bungling

unemployment insurance work, not just for California but for other

states."

A Deloitte spokesman said the firm has been "proud to help stand

up, scale and support," state and federal support programs during

the pandemic. The spokesman referenced a September response to

California lawmakers, which said there had been a solid improvement

in the numbers of claimants paid over the past few months.

A spokeswoman for California's employment development department

said it has processed more than 15.2 million claims so far during

the pandemic -- far more than the 3.8 million during 2010, the year

with the highest number of claims during the previous

recession.

New York Gov. Andrew Cuomo's office awarded McKinsey a $9.9

million contract in March to advise the state on issues related to

Covid-19, the illness caused by the new coronavirus. That included

18 weeks of "leadership counseling" at $42,500 a week -- the

contract didn't specify who would be counseled, or what that would

entail.

The work was later reduced to seven weeks at $27,000 a week, as

part of a cost-cutting effort that saw the overall fee

approximately halved, according to a response to a public-records

request. Representatives for Mr. Cuomo didn't respond to requests

for comment.

McKinsey also did work for Massachusetts, some of which appeared

to involve little more than forwarding others' material along.

Researchers at Harvard University prepared reports for the state's

health department tracking population movements. Consultants at

McKinsey used the reports verbatim in material for the governor,

according to a person familiar with the work.

While the researchers were grateful the governor received the

data, they were puzzled why the paid consultants were needed to

share data among state officials, this person said. The office of

Gov. Charlie Baker didn't return a request for comment.

A McKinsey spokesman declined to respond to specific questions

and pointed to its website, where the firm details its Covid-19

work across the U.S. The company says it is supporting leaders and

public servants "with management and organizational expertise, and

analytical capabilities to help inform their decisions."

Consulting firms have been hit hard by a loss of work from

corporate clients because of the pandemic.

For coronavirus work, Deloitte offered a discount on its usual

rates -- 15% on a contract with Ohio, for example -- while McKinsey

in the spring introduced reduced philanthropic fees, according to

contracts.

The costs still appear to be high. Illinois and California are

paying Deloitte $55 an hour -- more than $100,000 a year on a

full-time basis -- for agents doing basic call-center work. That is

more than double what the states pay agents they hire directly to

do similar work, according to copies of the contracts and recent

job advertisements. Permanent staff enjoy benefits. But the

Deloitte rate is higher than at least one other contract for

pandemic call-center work: Nevada is paying call-center operator

Alorica Inc. $33.50 an hour for its agents, the contract shows.

A spokeswoman for Illinois said the Deloitte rate was negotiated

downward to $55 an hour, adding that "the priority was increasing

capacity as quickly as possible."

In Massachusetts, Gov. Baker said in April that the state would

hire Accenture PLC for $28 million to track residents infected with

the virus, a process known as contact tracing.

The consultants produced their own reports, while also

attempting to incorporate a tracking system by San Francisco-based

Salesforce.com Inc. with an existing database used by state health

agencies, according to people familiar with the efforts.

The combination of the different systems initially resulted in a

mess, with some researchers and state officials concerned that

patients' personal medical data could be lost or accessed

improperly, one of these people said.

By July, the contact-tracing effort had been scaled back,

although it has since picked back up again as cases have risen in

Massachusetts, people familiar with the effort said. A spokeswoman

for the governor's office said the state has worked with McKinsey

for several months, "including in helping to develop and refine our

robust public data reporting and strategically increasing our

testing capacity."

An Accenture spokesman said in a written statement the firm was

"proud to be supporting" Massachusetts' contact-tracing effort. The

state agency in charge of contact tracing "continues to work

effectively with local health departments," a spokesman said, using

its own systems complemented by "data-management" services from

Accenture.

Lisa Schwartz and Andrea Fuller contributed to this article.

Write to Jean Eaglesham at jean.eaglesham@wsj.com and Kirsten

Grind at kirsten.grind@wsj.com

(END) Dow Jones Newswires

November 02, 2020 05:44 ET (10:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

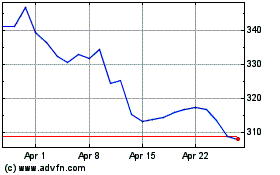

Accenture (NYSE:ACN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Accenture (NYSE:ACN)

Historical Stock Chart

From Apr 2023 to Apr 2024