Associated Capital Group Acquires London Headquarters Building

March 03 2020 - 9:55AM

Business Wire

Associated Capital Group (NYSE: AC) announced today that its UK

subsidiary, Associated Property International Limited, has

completed the purchase of a townhouse in St. James, London. The

building will serve as the European headquarters for the firm,

together with its UK affiliated company, Gabelli Asset Management

UK, Limited. The townhouse is a Grade II Listed Building forming a

portion of a terrace constructed in c. 1685 during the reign of

Charles II.

Gabelli Asset Management has had a physical presence in London

since 2000, occupying properties in each of Knightsbridge, Mayfair,

and latterly St. James. The decision to purchase a permanent office

location underscores the firm’s long term commitment to the UK and

European financial markets. Coming only one month after the

finalization of Brexit, the transaction is an indication of our

confidence in the continued central role London will play in the

global financial services industry. In May 2011, the firm

established an office in Tokyo to underscore our commitment of

global research, marketing and client service in Japan.

Associated Capital and Gabelli Asset Management UK look forward

to welcoming our investors and partners to the new offices with the

confidence that we will be able to best serve your financial goals

now and in the future. Doug Jamieson, President of Associated

Capital, said, “We are pleased to have a permanent home in London

that will benefit our staff and clients, alike. The acquisition of

a Listed London property offers a clear indication of our

intentions to grow our UK and European businesses from an

already-strong base.”

About Associated Capital Group, Inc.

Associated Capital Group, Inc. (NYSE: AC), based in Greenwich

Connecticut, is a diversified global financial services company

that provides alternative investment management through Gabelli

& Company Investment Advisers, Inc. (“GCIA” f/k/a Gabelli

Securities, Inc.). The proprietary capital is earmarked for our

direct investment business that invests in new and existing

businesses. The direct investment business is developing along

three core pillars: Gabelli Private Equity Partners, LLC (“GPEP”),

formed in August 2017 with $150 million of authorized capital as a

“fund-less” sponsor; the SPAC business (Gabelli special purpose

acquisition vehicles), launched in April 2018; and Gabelli

Principal Strategies Group, LLC (“GPS”) created to pursue strategic

operating initiatives.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200303005652/en/

Douglas R. Jamieson President & CEO (203) 629-2726

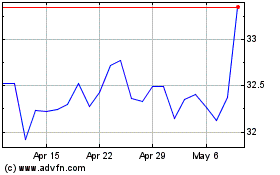

Associated Capital (NYSE:AC)

Historical Stock Chart

From Mar 2024 to Apr 2024

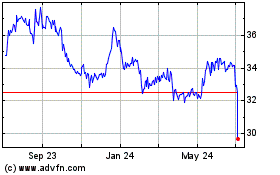

Associated Capital (NYSE:AC)

Historical Stock Chart

From Apr 2023 to Apr 2024