- Quarterly net income was $23.1

million, or $1.02 per share

- Quarter-end Book Value per share was

$39.38

Associated Capital Group, Inc. (“AC” or the “Company”) reported

financial results for the first quarter ended March 31, 2019.

Financial Highlights

($000s except per share data or as noted)

Q1

2019 2018 AUM - end of period (in

millions) $ 1,591 $ 1,560 Revenues 4,652 4,703 Operating loss

before management fee (4,616 ) (4,250 ) Investment and other

non-operating income/(expense), net 38,721 (24,856 ) Income/(loss)

before income taxes 30,845 (29,106 ) Net income/(loss) 23,147

(22,229 ) Net income/(loss) per share – diluted $ 1.02 $ (0.95 )

Shares outstanding at March 31 (thousands)

22,575 23,133

First Quarter Overview

First quarter revenues of $4.7 million were in line with the

prior year quarter. Reflecting $0.3 million higher operating

expenses, the operating loss was $4.6 million for the quarter

compared to an operating loss of $4.3 million in last year’s first

quarter.

Net investment and other non-operating income rose to $38.7

million, a $63.6 million swing from the $24.9 million loss in the

first quarter of 2018, reflecting the mark-to-market increase in

our investment portfolio.

AC recorded an income tax expense in the current quarter of $6.2

million versus a tax benefit of $6.7 million in the comparable

quarter of 2018.

Net income for the first quarter of 2019 was $23.1 million, or

$1.02 per share, compared to a net loss of $22.2 million, or $0.95

per share, in the prior year’s quarter.

Commitment to Community

Continuing with the tradition in place prior to our spin-off

from GAMCO, (y)our Company gives back to the community.

Over our first three years as a public company, AC shareholders

recommended approximately $15 million to charities of their choice

that address a broad range of local, national and international

concerns. Over 95 organizations received support through 2019.

Financial Condition

At March 31, 2019, AC’s book value was $889 million, or $39.38

per share, compared to $866 million, or $38.36 per share, at

December 31, 2018.

First Quarter Results of Operations

Assets Under Management (AUM)

Assets under management at March 31, 2019 were $1.6 billion, an

increase of $31.0 million from March 31, 2018. This increase

reflects $31.8 million of net appreciation offset by $0.8 million

of net capital outflows.

March 31, December

31, March 31, 2019 2018 2018

(in millions) Event Merger Arbitrage $ 1,401 $ 1,342 $ 1,407

Event-Driven Value 127 118 88 Other 63 60 65

Total AUM $ 1,591 $ 1,520 $ 1,560

Revenues

Total operating revenues for the three months ended March 31,

2019 of $4.7 million were unchanged from the comparable prior year

period:

- Investment advisory fees increased to

$2.7 million, up $0.2 million from the prior year period.

- Institutional research services revenue

was $1.9 million, down $0.2 million from the prior year

period.

Incentive fees are not recognized until the measurement period

ends and the fee is crystalized, typically annually on December 31.

If the measurement period had ended on March 31, we would have

recognized $3.7 million of incentive fees versus a negligible

incentive fee in the prior year quarter.

Investment and other non-operating income/(expense),

net

During the quarter, investment and other non-operating

income/(expense), net resulted in a gain of $38.7 million compared

to a loss of $24.9 million in the first quarter of 2018. Portfolio

mark-to-market changes were a gain of $35.0 million and a loss of

$27.5 million in the 2019 and 2018 quarters, respectively. This was

largely driven by investment gains due to the higher market values

in the 2019 quarter, with $10.9 million attributable to the 3

million GAMCO shares held with the remainder from our diverse

portfolio.

Business and Investment Highlights

Event-Driven Asset Management

Our merger arbitrage fund returned +2.04% net of fees (+2.81%

gross) for the first quarter of 2019. Global M&A activity

totaled $959 billion in the first quarter, making it the fourth

highest total for a first quarter on record. Healthcare, financials

and technology were the most active sectors for consolidation in

the first quarter. Our arb team expects dealmaking to remain

vibrant as the drivers for M&A remain, including higher

interest rates that are expected to contribute to wider deal

spreads, and market volatility that creates opportunities to

purchase shares of target companies at more favorable prices.

Institutional Research

In the first quarter, G.research, our institutional research

services business, in cooperation with Gabelli Funds, concluded its

29th annual Pump, Valve, & Water Systems conference on February

28, 10th annual Specialty Chemicals on March 13 and 5th annual

Waste & Environmental Services on March 26. During the second

quarter of 2019, we hosted the 13th annual

Buffett/Berkshire-related Omaha Research Trip on May 3-4 and will

host the 11th annual Entertainment & Broadcasting Conference on

June 6, 2019. If you’re interested in joining please contact C.V.

McGinity at CMcGinity@gabelli.com or call him directly at (914) 921

7732.

In addition, G.research continues to sponsor non-deal roadshows

providing corporate management access to our institutional

clients.

For frequent, real-time updates from our research team on social

media platforms, we invite you to visit GabelliTV, our online

portal, at YouTube (www.youtube.com/GabelliTV) or Facebook

(www.facebook.com/GabelliTV).

Shareholder Compensation

During the first quarter, AC repurchased approximately 10,000

shares at an average investment of $40.03 per share, for a total

outlay of $0.4 million.

At March 31, 2019, there were 3.6 million Class A shares and

19.0 million Class B shares outstanding, of which a private company

controlled by our Executive Chairman owns approximately 18.4

million Class B shares.

Since the spin-off of the Company from GAMCO, we have returned

approximately $103 million to shareholders through share

repurchases and exchange offers representing approximately three

million shares.

About Associated Capital Group, Inc.

The Company has been publicly traded since November 30, 2015

following its spin-off from GAMCO Investors, Inc. Our focus is on

merger arbitrage and the creation of private equity. In concert

with this we have created a special purpose acquisition vehicle

(“SPAC”) in Italy.

The Company operates its investment management business via

Gabelli & Company Investment Advisers, Inc. (“GCIA”

f/k/a Gabelli Securities, Inc.), its 100% owned subsidiary. GCIA

and its wholly-owned subsidiary, Gabelli & Partners,

collectively serve as general partners or investment managers to

investment funds including limited partnerships, offshore companies

and separate accounts. The Company primarily manages assets in

equity event-driven strategies, across a range of risk and event

arbitrage portfolios and earns management and incentive fees from

its advisory activities. GCIA is registered with the Securities and

Exchange Commission as an investment advisor under the Investment

Advisers Act of 1940, as amended.

The Company operates its institutional research services

business through G.research, LLC, an indirect wholly-owned

subsidiary of the Company. G.research is a broker-dealer registered

under the Securities Exchange Act of 1934, as amended, that

provides institutional research services and acts as an

underwriter.

The Company also derives investment income/(loss) from

proprietary trading of assets awaiting deployment in its operating

businesses.

NOTES ON NON-GAAP FINANCIAL MEASURES

Operating Loss Before Management Fee

Operating loss before management fee expense is used by

management to evaluate its business operations. We believe

this measure is useful in illustrating the operating results of the

Company as management fee expense is based on pre-tax income before

management fee expense, which includes non-operating items

including investment gains and losses from the Company’s

proprietary investment portfolio and interest expense. The

reconciliation of operating loss before management fee expense to

operating loss is provided below.

Q1 (In thousands)

2019

2018 Operating loss before management fee $(4,616) $(4,250)

Deduct: management fee expense 3,260 - Operating loss $(7,876)

$(4,250)

Table I

ASSOCIATED CAPITAL GROUP, INC. UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (Dollars in

thousands) March 31, December 31,

March 31, 2019 2018 2018

ASSETS Cash and cash equivalents $ 396,020 $ 409,564

$ 283,972 Investments 495,806 439,876 549,255 Investment in GAMCO

stock (3,016,501, 3,016,501 and 3,726,250 shares, respectively)

61,838 50,949 92,523 Receivable from brokers 26,980 24,629 18,535

Deferred tax assets, net 6,871 9,422 1,241 Other receivables 2,671

15,425 4,280 Other assets 4,510 4,568 5,537

Total assets $ 994,696 $ 954,433 $ 955,343

LIABILITIES AND EQUITY Payable to brokers $

17,423 $ 5,511 $ 5,621 Income taxes payable and deferred tax

liabilities, net 7,222 3,577 - Compensation payable 7,511 11,388

2,982 Securities sold short, not yet purchased 17,118 9,574 5,211

Accrued expenses and other liabilities 5,637 8,335

3,131 Sub-total 54,911 38,385 16,945

Redeemable noncontrolling interests (a) 50,781 49,800

50,604 Equity 889,004 866,248 927,794 4% PIK

Note due from GAMCO - - (40,000 ) Total equity

889,004 866,248 887,794 Total

liabilities and equity $ 994,696 $ 954,433 $ 955,343 (a)

Represents third-party capital balances in consolidated

investment funds.

Table

II ASSOCIATED CAPITAL GROUP, INC. UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Amounts in

thousands, except per share data) For the quarter

ended March 31, 2019 2018 Investment

advisory and incentive fees $ 2,733 $ 2,529 Institutional research

services 1,913 2,152 Other revenues 6 22

Total revenues 4,652 4,703

Compensation costs 5,896 6,324 Stock-based compensation 415

72 Other operating expenses 2,957 2,557

Total expenses 9,268 8,953

Operating loss before management fee (4,616 ) (4,250

) Investment gain/(loss) 34,979 (27,530 ) Interest and

dividend income from GAMCO - 590 Interest and dividend income, net

3,742 2,084 Investment and other

non-operating income/(expense), net 38,721

(24,856 ) Gain/(loss) before management fee and income taxes

34,105 (29,106 ) Management fee 3,260 -

Income/(loss) before income taxes 30,845 (29,106 ) Income tax

expense/(benefit) 6,191 (6,734 ) Net

income/(loss) 24,654 (22,372 ) Net income/(loss) attributable to

noncontrolling interests 1,507 (143 ) Net

income/(loss) attributable to Associated Capital Group, Inc. $

23,147 $ (22,229 ) Net income/(loss) per share

attributable to Associated Capital Group, Inc.: Basic $ 1.02 $

(0.95 ) Diluted 1.02 (0.95 ) Weighted average shares

outstanding: Basic 22,584 23,508 Diluted 22,584 23,508

Actual shares outstanding - end of period 22,575 23,133

SPECIAL NOTE REGARDING FORWARD-LOOKING INFORMATION

The financial results set forth in this press release are

preliminary. Our disclosure and analysis in this press release,

which do not present historical information, contain

“forward-looking statements” within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements convey our current expectations or forecasts of future

events. You can identify these statements because they do not

relate strictly to historical or current facts. They use words such

as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,”

“believe,” and other words and terms of similar meaning. They also

appear in any discussion of future operating or financial

performance. In particular, these include statements relating to

future actions, future performance of our products, expenses, the

outcome of any legal proceedings, and financial results. Although

we believe that we are basing our expectations and beliefs on

reasonable assumptions within the bounds of what we currently know

about our business and operations, the economy and other

conditions, there can be no assurance that our actual results will

not differ materially from what we expect or believe. Therefore,

you should proceed with caution in relying on any of these

forward-looking statements. They are neither statements of

historical fact nor guarantees or assurances of future

performance.

Forward-looking statements involve a number of known and unknown

risks, uncertainties and other important factors, some of which are

listed below, that are difficult to predict and could cause actual

results and outcomes to differ materially from any future results

or outcomes expressed or implied by such forward-looking

statements. Some of the factors that could cause our actual results

to differ from our expectations or beliefs include a decline in the

securities markets that adversely affect our assets under

management, negative performance of our products, the failure to

perform as required under our investment management agreements, and

a general downturn in the economy that negatively impacts our

operations. We also direct your attention to the more specific

discussions of these and other risks, uncertainties and other

important factors contained in our Form 10 and other public

filings. Other factors that could cause our actual results to

differ may emerge from time to time, and it is not possible for us

to predict all of them. We do not undertake to update publicly any

forward-looking statements if we subsequently learn that we are

unlikely to achieve our expectations whether as a result of new

information, future developments or otherwise, except as may be

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190507006131/en/

Kenneth D. MasielloChief Accounting Officer(203)

629-2726Associated-Capital-Group.com

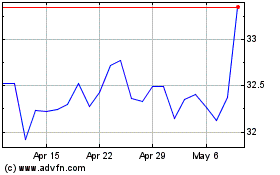

Associated Capital (NYSE:AC)

Historical Stock Chart

From Mar 2024 to Apr 2024

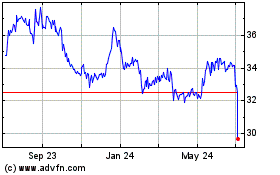

Associated Capital (NYSE:AC)

Historical Stock Chart

From Apr 2023 to Apr 2024