Arbor Realty Trust, Inc. (NYSE: ABR), today announced financial

results for the second quarter ended June 30, 2019. Arbor

reported net income for the quarter of $28.9 million, or $0.31 per

diluted common share, compared to $17.2 million, or $0.25 per

diluted common share for the quarter ended June 30, 2018. Adjusted

funds from operations (“AFFO”) for the quarter was $37.9 million,

or $0.33 per diluted common share, compared to $26.4 million, or

$0.29 per diluted common share for the quarter ended June 30,

2018.

1

Agency

Business

Loan

Origination Platform

|

Agency Loan Volume (in thousands) |

| |

|

Quarter Ended |

|

|

|

June 30, 2019 |

|

March 31, 2019 |

| Fannie Mae |

$ |

937,977 |

|

$ |

546,886 |

| Freddie Mac |

|

234,851 |

|

|

192,492 |

|

FHA |

|

|

43,558 |

|

|

1,110 |

| CMBS/Conduit |

|

71,900 |

|

|

105,425 |

| Total

Originations |

$ |

1,288,286 |

|

$ |

845,913 |

| |

|

|

|

|

| Total Loan

Sales |

$ |

923,046 |

|

$ |

1,101,766 |

| |

|

|

|

|

| Total Loan

Commitments |

$ |

1,302,128 |

|

$ |

846,963 |

| |

For the quarter ended

June 30, 2019, the Agency Business generated revenues of $52.7

million, compared to $47.2 million for the first quarter of 2019.

Gain on sales, including fee-based services, net was $14.2 million

for the quarter, reflecting a margin of 1.54% on loan sales,

compared to $16.4 million and 1.49% for the first quarter of 2019.

Income from mortgage servicing rights was $18.7 million for the

quarter, reflecting a rate of 1.44% as a percentage of loan

commitments, compared to $14.2 million and 1.68% for the first

quarter of 2019.

At June 30, 2019,

loans held-for-sale was $601.8 million which was primarily

comprised of unpaid principal balances totaling $597.3 million,

with financing associated with these loans totaling $597.2

million.

Fee-Based

Servicing Portfolio

Our fee-based

servicing portfolio totaled $19.46 billion at June 30, 2019, an

increase of 3% from March 31, 2019, primarily a result of $1.29

billion of new loan originations, net of $635.6 million in

portfolio runoff during the quarter. Servicing revenue, net was

$12.6 million for the quarter and consisted of servicing revenue of

$24.9 million, net of amortization of mortgage servicing rights

totaling $12.3 million.

| |

|

Fee-Based Servicing Portfolio ($ in thousands) |

| |

|

As of June 30, 2019 |

|

As of March 31, 2019 |

| |

|

UPB |

Wtd. Avg.Fee |

Wtd. Avg.Life (in years) |

|

UPB |

Wtd. Avg.Fee |

Wtd. Avg.Life (in years) |

|

Fannie Mae |

|

$ |

14,122,916 |

0.495 |

% |

7.8 |

|

$ |

13,719,351 |

0.507 |

% |

7.6 |

| Freddie Mac |

|

|

4,657,097 |

0.301 |

% |

10.9 |

|

|

4,515,829 |

0.303 |

% |

10.8 |

| FHA |

|

|

684,527 |

0.153 |

% |

19.1 |

|

|

648,583 |

0.155 |

% |

19.6 |

| Total |

|

$ |

19,464,540 |

0.436 |

% |

9.0 |

|

$ |

18,883,763 |

0.446 |

% |

8.7 |

Loans sold under the

Fannie Mae program contain an obligation to partially guarantee the

performance of the loan (“loss-sharing obligations”). At June 30,

2019, the Company’s allowance for loss-sharing obligations was

$34.4 million, representing 0.24% of the Fannie Mae servicing

portfolio.

Structured

Business

Portfolio and Investment

Activity

- Originated 47 loans totaling $1.01 billion, of which 37 were

bridge loans for $942.7 million

- Payoffs and pay downs on 43 loans totaling $503.1 million

At June 30, 2019, the

loan and investment portfolio’s unpaid principal balance, excluding

loan loss reserves, was $3.93 billion, with a weighted average

current interest pay rate of 6.64%, compared to $3.41 billion and

7.05% at March 31, 2019. Including certain fees earned and

costs associated with the loan and investment portfolio, the

weighted average current interest pay rate was 7.34% at June 30,

2019, compared to 7.71% at March 31, 2019.

The average balance of

the Company’s loan and investment portfolio during the second

quarter of 2019, excluding loan loss reserves, was $3.62 billion

with a weighted average yield of 8.24%, compared to $3.34 billion

and 7.84% for the first quarter of 2019. The increase in average

yield was primarily due to higher fees on loan payoffs in the

second quarter as compared to the first quarter, largely the result

of default interest received.

At June 30, 2019, the Company’s total loan loss

reserves were $71.1 million on five loans with an aggregate

carrying value before loan loss reserves of $131.3 million. The

Company also had two non-performing loans with a carrying value of

$2.5 million, net of related loan loss reserves of $1.7

million.

Financing

Activity

The Company completed its eleventh

collateralized securitization vehicle (“CLO XI”) totaling $650.0

million of real estate related assets and cash. Investment

grade-rated notes totaling $533.0 million were issued, and the

Company retained subordinate interests in the issuing vehicle of

$117.0 million. The facility has a three-year asset replenishment

period and an initial weighted average interest rate of 1.44% over

LIBOR, excluding fees and transaction costs.

The Company completed

the unwind of CLO VI, redeeming $250.3 million of outstanding notes

repaid with proceeds received from the refinancing of CLO VI’s

outstanding assets primarily within CLO XI, which has an interest

rate 104 basis points lower than CLO VI. As a result of this

transaction, the Company recognized an expense of $1.2 million from

the acceleration of deferred fees.

The balance of debt

that finances the Company’s loan and investment portfolio at June

30, 2019 was $3.62 billion with a weighted average interest rate

including fees of 4.96% as compared to $3.13 billion and a rate of

5.22% at March 31, 2019. The average balance of debt that finances

the Company’s loan and investment portfolio for the second quarter

of 2019 was $3.35 billion, as compared to $2.96 billion for the

first quarter of 2019. The average cost of borrowings for the

second quarter was 5.35%, compared to 5.24% for the first quarter

of 2019. The increase in average costs was primarily due to the

acceleration of fees related to the early repayment of debt.

The Company is subject to various financial

covenants and restrictions under the terms of its collateralized

securitization vehicles and financing facilities. The Company

believes it was in compliance with all financial covenants and

restrictions as of June 30, 2019 and as of the most recent

collateralized securitization vehicle determination dates in July

2019.

Capital

Markets

The Company issued 9.2

million shares of our common stock receiving net proceeds of $115.6

million. The proceeds were primarily used to make investments and

for general corporate purposes.

Dividends

The Company announced

today that its Board of Directors has declared a quarterly cash

dividend of $0.29 per share of common stock for the quarter ended

June 30, 2019, representing an increase of 4% over the prior

quarter dividend of $0.28 per share and 16% from a year ago. The

dividend is payable on September 3, 2019 to common stockholders of

record on August 15, 2019. The ex-dividend date is August 14,

2019.

The Company also

announced today that its Board of Directors has declared cash

dividends on the Company's Series A, Series B and Series C

cumulative redeemable preferred stock reflecting accrued dividends

from June 1, 2019 through August 31, 2019. The dividends are

payable on September 3, 2019 to preferred stockholders of record on

August 15, 2019. The Company will pay total dividends of $0.515625,

$0.484375 and $0.53125 per share on the Series A, Series B and

Series C preferred stock, respectively.

Earnings

Conference Call

The Company will host

a conference call today at 10:00 a.m. Eastern Time. A live webcast

of the conference call will be available at www.arbor.com in the

investor relations area of the website. Those without web access

should access the call telephonically at least ten minutes prior to

the conference call. The dial-in numbers are (866) 516-5034 for

domestic callers and (678) 509-7613 for international callers.

Please use participant passcode 6947538.

After the live

webcast, the call will remain available on the Company's website

through August 31, 2019. In addition, a telephonic replay of

the call will be available until August 9, 2019. The replay dial-in

numbers are (855) 859-2056 for domestic callers and (404) 537-3406

for international callers. Please use passcode 6947538.

About Arbor

Realty Trust, Inc.

Arbor Realty Trust, Inc. (NYSE:ABR) is a

nationwide real estate investment trust and direct lender,

providing loan origination and servicing for multifamily, seniors

housing, healthcare and other diverse commercial real estate

assets. Headquartered in New York, Arbor manages a

multibillion-dollar servicing portfolio, specializing in

government-sponsored enterprise products. Arbor is a Fannie Mae

DUS® lender and Freddie Mac Optigo Seller/Servicer. Arbor’s product

platform also includes CMBS, bridge, mezzanine and preferred equity

lending. Rated by Standard and Poor’s and Fitch Ratings, Arbor is

committed to building on its reputation for service, quality and

customized solutions with an unparalleled dedication to providing

our clients excellence over the entire life of a loan.

Safe Harbor

Statement

Certain items in this

press release may constitute forward-looking statements within the

meaning of the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995. These statements are based on

management’s current expectations and beliefs and are subject to a

number of trends and uncertainties that could cause actual results

to differ materially from those described in the forward-looking

statements. Arbor can give no assurance that its expectations will

be attained. Factors that could cause actual results to

differ materially from Arbor’s expectations include, but are not

limited to, continued ability to source new investments, changes in

interest rates and/or credit spreads, changes in the real estate

markets, and other risks detailed in Arbor’s Annual Report on Form

10-K for the year ended December 31, 2018 and its other reports

filed with the SEC. Such forward-looking statements speak only as

of the date of this press release. Arbor expressly disclaims any

obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in Arbor’s expectations with regard thereto or

change in events, conditions, or circumstances on which any such

statement is based.

1. Non-GAAP

Financial Measures

During the quarterly

earnings conference call, the Company may discuss non-GAAP

financial measures as defined by SEC Regulation G. In addition, the

Company has used non-GAAP financial measures in this press release.

A supplemental schedule of non-GAAP financial measures and the

comparable GAAP financial measure can be found on page 11 of this

release.

|

Contacts: |

|

|

Arbor Realty Trust, Inc.Paul Elenio, Chief Financial Officer

516-506-4422pelenio@arbor.com |

Investors:The Ruth GroupJanhavi

Mohite646-536-7026jmohite@theruthgroup.com |

|

Media:Bonnie Habyan, Chief Marketing

Officer516-506-4615bhabyan@arbor.com |

|

|

|

|

|

|

|

ARBOR REALTY TRUST, INC. AND

SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF INCOME - (UNAUDITED) |

|

($ in thousands—except share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Quarter Ended |

|

Six Months Ended |

| |

|

|

June 30, |

|

June 30, |

|

|

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

| |

|

|

|

|

|

|

|

|

|

| Interest

income |

|

$ |

82,171 |

|

|

$ |

59,295 |

|

|

$ |

153,448 |

|

|

$ |

110,908 |

|

| Interest

expense |

|

|

48,284 |

|

|

|

37,884 |

|

|

|

90,149 |

|

|

|

71,271 |

|

| |

Net interest income |

|

|

33,887 |

|

|

|

21,411 |

|

|

|

63,299 |

|

|

|

39,637 |

|

| |

|

|

|

|

|

|

|

|

|

|

Other revenue: |

|

|

|

|

|

|

|

|

| Gain on sales,

including fee-based services, net |

|

|

14,211 |

|

|

|

15,622 |

|

|

|

30,600 |

|

|

|

33,815 |

|

| Mortgage servicing

rights |

|

|

18,709 |

|

|

|

17,936 |

|

|

|

32,941 |

|

|

|

37,571 |

|

| Servicing revenue,

net |

|

|

12,612 |

|

|

|

10,871 |

|

|

|

26,164 |

|

|

|

20,418 |

|

| Property operating

income |

|

|

3,147 |

|

|

|

2,964 |

|

|

|

5,950 |

|

|

|

5,874 |

|

| Other income,

net |

|

|

1,393 |

|

|

|

(470 |

) |

|

|

(734 |

) |

|

|

2,408 |

|

| |

Total other revenue |

|

|

50,072 |

|

|

|

46,923 |

|

|

|

94,921 |

|

|

|

100,086 |

|

| |

|

|

|

|

|

|

|

|

|

| Other

expenses: |

|

|

|

|

|

|

|

|

| Employee

compensation and benefits |

|

|

29,022 |

|

|

|

26,815 |

|

|

|

60,786 |

|

|

|

56,309 |

|

| Selling and

administrative |

|

|

10,481 |

|

|

|

8,873 |

|

|

|

20,242 |

|

|

|

17,789 |

|

| Property operating

expenses |

|

|

2,691 |

|

|

|

2,856 |

|

|

|

5,086 |

|

|

|

5,652 |

|

| Depreciation and

amortization |

|

|

1,909 |

|

|

|

1,845 |

|

|

|

3,821 |

|

|

|

3,691 |

|

| Impairment loss on

real estate owned |

|

|

1,000 |

|

|

|

2,000 |

|

|

|

1,000 |

|

|

|

2,000 |

|

| Provision for loss

sharing (net of recoveries) |

|

|

368 |

|

|

|

348 |

|

|

|

822 |

|

|

|

821 |

|

| Provision for loan

losses (net of recoveries) |

|

|

- |

|

|

|

(2,127 |

) |

|

|

- |

|

|

|

(1,802 |

) |

|

|

Total other expenses |

|

|

45,471 |

|

|

|

40,610 |

|

|

|

91,757 |

|

|

|

84,460 |

|

|

|

|

|

|

|

|

|

|

|

|

| Income before

extinguishment of debt, income from |

|

|

|

|

|

|

|

|

| |

equity affiliates and income

taxes |

|

|

38,488 |

|

|

|

27,724 |

|

|

|

66,463 |

|

|

|

55,263 |

|

| Loss on

extinguishment of debt |

|

|

- |

|

|

|

- |

|

|

|

(128 |

) |

|

|

- |

|

| Income from equity

affiliates |

|

|

3,264 |

|

|

|

1,387 |

|

|

|

5,415 |

|

|

|

2,132 |

|

| (Provision for)

benefit from income taxes |

|

|

(4,350 |

) |

|

|

(4,499 |

) |

|

|

(4,341 |

) |

|

|

4,285 |

|

| |

|

|

|

|

|

|

|

|

|

| Net income |

|

|

37,402 |

|

|

|

24,612 |

|

|

|

67,409 |

|

|

|

61,680 |

|

| |

|

|

|

|

|

|

|

|

|

| Preferred stock

dividends |

|

|

1,888 |

|

|

|

1,888 |

|

|

|

3,777 |

|

|

|

3,777 |

|

| Net income

attributable to noncontrolling interest |

|

|

6,598 |

|

|

|

5,557 |

|

|

|

12,066 |

|

|

|

14,547 |

|

| Net income

attributable to common stockholders |

|

$ |

28,916 |

|

|

$ |

17,167 |

|

|

$ |

51,566 |

|

|

$ |

43,356 |

|

| |

|

|

|

|

|

|

|

|

|

| Basic earnings per

common share |

|

$ |

0.32 |

|

|

$ |

0.26 |

|

|

$ |

0.59 |

|

|

$ |

0.68 |

|

| Diluted earnings

per common share |

|

$ |

0.31 |

|

|

$ |

0.25 |

|

|

$ |

0.57 |

|

|

$ |

0.66 |

|

| |

|

|

|

|

|

|

|

|

|

| Weighted average

shares outstanding: |

|

|

|

|

|

|

|

|

| |

Basic |

|

|

89,955,923 |

|

|

|

65,683,057 |

|

|

|

87,567,171 |

|

|

|

63,773,306 |

|

| |

Diluted |

|

|

113,624,384 |

|

|

|

90,055,170 |

|

|

|

110,779,680 |

|

|

|

87,420,543 |

|

| |

|

|

|

|

|

|

|

|

|

| Dividends declared

per common share |

|

$ |

0.28 |

|

|

$ |

0.25 |

|

|

$ |

0.55 |

|

|

$ |

0.46 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

ARBOR REALTY TRUST, INC. AND

SUBSIDIARIES |

|

CONSOLIDATED BALANCE SHEETS |

|

($ in thousands—except share and per share data) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

June 30, |

|

December 31, |

|

|

|

|

|

|

|

2019 |

|

|

|

2018 |

|

| |

|

|

|

|

(Unaudited) |

|

|

|

Assets: |

|

|

|

|

| Cash and cash

equivalents |

|

$ |

198,917 |

|

|

$ |

160,063 |

|

| Restricted

cash |

|

|

316,455 |

|

|

|

180,606 |

|

|

Loans and investments, net |

|

|

3,836,554 |

|

|

|

3,200,145 |

|

|

Loans held-for-sale, net |

|

|

601,827 |

|

|

|

481,664 |

|

| Capitalized

mortgage servicing rights, net |

|

|

276,648 |

|

|

|

273,770 |

|

| Securities held to

maturity, net |

|

|

86,017 |

|

|

|

76,363 |

|

| Investments in

equity affiliates |

|

|

31,159 |

|

|

|

21,580 |

|

| Real estate owned,

net |

|

|

13,382 |

|

|

|

14,446 |

|

| Due from related

party |

|

|

16,986 |

|

|

|

1,287 |

|

| Goodwill and other

intangible assets |

|

|

113,364 |

|

|

|

116,165 |

|

| Other

assets |

|

|

110,421 |

|

|

|

86,086 |

|

| Total

assets |

|

$ |

5,601,730 |

|

|

$ |

4,612,175 |

|

| |

|

|

|

|

|

|

|

|

Liabilities and Equity: |

|

|

|

|

| Credit facilities

and repurchase agreements |

|

$ |

1,621,678 |

|

|

$ |

1,135,627 |

|

|

Collateralized loan obligations |

|

|

1,875,444 |

|

|

|

1,593,548 |

|

|

Debt fund |

|

|

68,422 |

|

|

|

68,183 |

|

| Senior unsecured

notes |

|

|

210,963 |

|

|

|

122,484 |

|

| Convertible senior

unsecured notes, net |

|

|

253,729 |

|

|

|

254,768 |

|

| Junior

subordinated notes to subsidiary trust issuing preferred

securities |

|

|

140,587 |

|

|

|

140,259 |

|

| Due to related

party |

|

|

7,219 |

|

|

|

- |

|

| Due to

borrowers |

|

|

92,296 |

|

|

|

78,662 |

|

| Allowance for

loss-sharing obligations |

|

|

34,417 |

|

|

|

34,298 |

|

| Other

liabilities |

|

|

110,997 |

|

|

|

118,780 |

|

| Total

liabilities |

|

|

4,415,752 |

|

|

|

3,546,609 |

|

| |

|

|

|

|

|

|

|

| Equity: |

|

|

|

|

| |

Arbor Realty

Trust, Inc. stockholders' equity: |

|

|

|

|

| |

|

Preferred stock,

cumulative, redeemable, $0.01 par value: 100,000,000 |

|

|

|

|

| |

|

|

shares authorized; special

voting preferred shares; 20,484,094 and |

|

|

|

|

| |

|

|

20,653,584 shares issued and

outstanding, respectively; 8.25% Series A, |

|

|

|

|

|

|

| |

|

|

$38,787,500 aggregate

liquidation preference; 1,551,500 shares issued and |

|

|

|

|

|

|

| |

|

|

outstanding; 7.75% Series B,

$31,500,000 aggregate liquidation preference; |

|

|

|

|

|

|

| |

|

|

1,260,000 shares issued and

outstanding; 8.50% Series C, $22,500,000 |

|

|

|

|

|

|

| |

|

|

aggregate liquidation

preference; 900,000 shares issued and outstanding |

|

|

89,501 |

|

|

|

89,502 |

|

| |

|

Common stock,

$0.01 par value: 500,000,000 shares authorized; 94,225,567 |

|

|

|

|

|

|

| |

|

|

and 83,987,707 shares issued

and outstanding, respectively |

|

|

942 |

|

|

|

840 |

|

| |

|

Additional paid-in

capital |

|

|

998,897 |

|

|

|

879,029 |

|

| |

|

Accumulated

deficit |

|

|

(72,321 |

) |

|

|

(74,133 |

) |

| Total Arbor Realty

Trust, Inc. stockholders’ equity |

|

|

1,017,019 |

|

|

|

895,238 |

|

| |

|

|

|

|

|

|

|

| Noncontrolling

interest |

|

|

168,959 |

|

|

|

170,328 |

|

| Total equity |

|

|

1,185,978 |

|

|

|

1,065,566 |

|

| |

|

|

|

|

|

|

|

| Total liabilities

and equity |

|

$ |

5,601,730 |

|

|

$ |

4,612,175 |

|

| |

|

|

|

|

|

|

|

|

|

|

ARBOR REALTY TRUST, INC. AND

SUBSIDIARIES |

|

STATEMENT OF INCOME SEGMENT INFORMATION -

(Unaudited) |

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Quarter Ended June 30, 2019 |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

StructuredBusiness |

|

AgencyBusiness |

|

Other /Eliminations (1) |

|

Consolidated |

| |

|

|

|

|

|

|

|

|

|

| Interest

income |

|

$ |

76,144 |

|

$ |

6,027 |

|

|

$ |

- |

|

|

$ |

82,171 |

|

| Interest

expense |

|

|

44,716 |

|

|

3,568 |

|

|

|

- |

|

|

|

48,284 |

|

|

|

Net interest income |

|

|

31,428 |

|

|

2,459 |

|

|

|

- |

|

|

|

33,887 |

|

| |

|

|

|

|

|

|

|

|

|

|

Other revenue: |

|

|

|

|

|

|

|

|

| Gain on sales,

including fee-based services, net |

|

|

- |

|

|

14,211 |

|

|

|

- |

|

|

|

14,211 |

|

| Mortgage servicing

rights |

|

|

- |

|

|

18,709 |

|

|

|

- |

|

|

|

18,709 |

|

| Servicing

revenue |

|

|

- |

|

|

24,936 |

|

|

|

- |

|

|

|

24,936 |

|

| Amortization of

MSRs |

|

|

- |

|

|

(12,324 |

) |

|

|

- |

|

|

|

(12,324 |

) |

| Property operating

income |

|

|

3,147 |

|

|

- |

|

|

|

- |

|

|

|

3,147 |

|

| Other income,

net |

|

|

290 |

|

|

1,103 |

|

|

|

- |

|

|

|

1,393 |

|

| |

Total other revenue |

|

|

3,437 |

|

|

46,635 |

|

|

|

- |

|

|

|

50,072 |

|

| |

|

|

|

|

|

|

|

|

|

| Other

expenses: |

|

|

|

|

|

|

|

|

| Employee

compensation and benefits |

|

|

6,815 |

|

|

22,207 |

|

|

|

- |

|

|

|

29,022 |

|

| Selling and

administrative |

|

|

5,328 |

|

|

5,153 |

|

|

|

- |

|

|

|

10,481 |

|

| Property operating

expenses |

|

|

2,691 |

|

|

- |

|

|

|

- |

|

|

|

2,691 |

|

| Depreciation and

amortization |

|

|

509 |

|

|

1,400 |

|

|

|

- |

|

|

|

1,909 |

|

| Impairment loss on

real estate owned |

|

|

1,000 |

|

|

- |

|

|

|

- |

|

|

|

1,000 |

|

| Provision for loss

sharing (net of recoveries) |

|

|

- |

|

|

368 |

|

|

|

- |

|

|

|

368 |

|

|

|

Total other expenses |

|

|

16,343 |

|

|

29,128 |

|

|

|

- |

|

|

|

45,471 |

|

|

|

|

|

|

|

|

|

|

|

|

| Income before

income from equity affiliates and |

|

|

|

|

|

|

|

|

| |

income taxes |

|

|

18,522 |

|

|

19,966 |

|

|

|

- |

|

|

|

38,488 |

|

| Income from equity

affiliates |

|

|

3,264 |

|

|

- |

|

|

|

- |

|

|

|

3,264 |

|

| Provision for

income taxes |

|

|

- |

|

|

(4,350 |

) |

|

|

- |

|

|

|

(4,350 |

) |

| |

|

|

|

|

|

|

|

|

|

| Net income |

|

|

21,786 |

|

|

15,616 |

|

|

|

- |

|

|

|

37,402 |

|

| |

|

|

|

|

|

|

|

|

|

| Preferred stock

dividends |

|

|

1,888 |

|

|

- |

|

|

|

- |

|

|

|

1,888 |

|

| Net income

attributable to noncontrolling interest |

|

- |

|

|

- |

|

|

|

6,598 |

|

|

|

6,598 |

|

| Net income

attributable to common stockholders |

|

$ |

19,898 |

|

$ |

15,616 |

|

|

$ |

(6,598 |

) |

|

$ |

28,916 |

|

| |

|

|

|

|

|

|

|

|

|

| (1) Includes

certain income or expenses not allocated to the two reportable

segments. Amount reflects income attributable to the noncontrolling

interest holders. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

ARBOR REALTY TRUST, INC. AND

SUBSIDIARIES |

|

BALANCE SHEET SEGMENT INFORMATION - (Unaudited) |

|

(in thousands) |

| |

|

|

|

|

|

|

| |

|

June 30, 2019 |

| |

|

StructuredBusiness |

|

AgencyBusiness |

|

Consolidated |

| Assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

116,282 |

|

$ |

82,635 |

|

$ |

198,917 |

| Restricted cash |

|

|

315,195 |

|

|

1,260 |

|

|

316,455 |

|

Loans and investments, net |

|

|

3,836,554 |

|

|

- |

|

|

3,836,554 |

|

Loans held-for-sale, net |

|

|

- |

|

|

601,827 |

|

|

601,827 |

| Capitalized

mortgage servicing rights, net |

|

- |

|

|

276,648 |

|

|

276,648 |

| Securities held to maturity,

net |

|

|

10,000 |

|

|

76,017 |

|

|

86,017 |

| Investments in equity

affiliates |

|

|

31,159 |

|

|

- |

|

|

31,159 |

| Goodwill and other intangible

assets |

|

|

12,500 |

|

|

100,864 |

|

|

113,364 |

| Other assets |

|

|

110,205 |

|

|

30,584 |

|

|

140,789 |

|

Total assets |

|

$ |

4,431,895 |

|

$ |

1,169,835 |

|

$ |

5,601,730 |

| |

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

| Debt obligations |

|

$ |

3,573,659 |

|

$ |

597,164 |

|

$ |

4,170,823 |

| Allowance for loss-sharing

obligations |

|

|

- |

|

|

34,417 |

|

|

34,417 |

| Other liabilities |

|

|

162,859 |

|

|

47,653 |

|

|

210,512 |

|

Total liabilities |

|

$ |

3,736,518 |

|

$ |

679,234 |

|

$ |

4,415,752 |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

ARBOR REALTY TRUST, INC. AND SUBSIDIARIES |

|

Supplemental Schedule of Non-GAAP Financial Measures -

(Unaudited) |

|

Funds from Operations ("FFO") and Adjusted Funds from Operations

("AFFO") |

|

($ in thousands—except share and per share data) |

|

|

| |

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

Six Months Ended |

|

June 30, |

June 30, |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

| Net income attributable to

common stockholders |

$ |

28,916 |

|

|

$ |

17,167 |

|

|

$ |

51,566 |

|

|

$ |

43,356 |

|

| |

|

|

|

|

|

|

|

| Adjustments: |

|

|

|

|

|

|

|

|

Net income attributable to noncontrolling interest |

|

6,598 |

|

|

|

5,557 |

|

|

|

12,066 |

|

|

|

14,547 |

|

|

Impairment loss on real estate owned |

|

1,000 |

|

|

|

2,000 |

|

|

|

1,000 |

|

|

|

2,000 |

|

|

Depreciation - real estate owned |

|

176 |

|

|

|

178 |

|

|

|

350 |

|

|

|

356 |

|

|

Depreciation - investments in equity affiliates |

|

128 |

|

|

|

125 |

|

|

|

252 |

|

|

|

250 |

|

| |

|

|

|

|

|

|

|

| Funds from operations

(1) |

$ |

36,818 |

|

|

$ |

25,027 |

|

|

$ |

65,234 |

|

|

$ |

60,509 |

|

| |

|

|

|

|

|

|

|

| Adjustments: |

|

|

|

|

|

|

|

|

Income from mortgage servicing rights |

|

(18,709 |

) |

|

|

(17,936 |

) |

|

|

(32,941 |

) |

|

|

(37,571 |

) |

|

Impairment loss on real estate owned |

|

(1,000 |

) |

|

|

(2,000 |

) |

|

|

(1,000 |

) |

|

|

(2,000 |

) |

|

Deferred tax provision (benefit) |

|

918 |

|

|

|

185 |

|

|

|

(3,250 |

) |

|

|

(13,135 |

) |

|

Amortization and write-offs of MSRs |

|

16,914 |

|

|

|

17,203 |

|

|

|

33,654 |

|

|

|

33,879 |

|

|

Depreciation and amortization |

|

2,549 |

|

|

|

2,255 |

|

|

|

5,113 |

|

|

|

4,511 |

|

|

Net (gain) loss on changes in fair value of derivatives |

|

(1,103 |

) |

|

|

587 |

|

|

|

1,362 |

|

|

|

(2,057 |

) |

|

Stock-based compensation |

|

1,502 |

|

|

|

1,100 |

|

|

|

5,258 |

|

|

|

3,645 |

|

| |

|

|

|

|

|

|

|

| Adjusted funds from

operations (1) |

$ |

37,889 |

|

|

$ |

26,421 |

|

|

$ |

73,430 |

|

|

$ |

47,781 |

|

| |

|

|

|

|

|

|

|

| Diluted FFO per share

(1) |

$ |

0.32 |

|

|

$ |

0.28 |

|

|

$ |

0.59 |

|

|

$ |

0.69 |

|

| |

|

|

|

|

|

|

|

| Diluted AFFO per share

(1) |

$ |

0.33 |

|

|

$ |

0.29 |

|

|

$ |

0.66 |

|

|

$ |

0.55 |

|

| |

|

|

|

|

|

|

|

| Diluted weighted average

shares outstanding (1) |

|

113,624,384 |

|

|

|

90,055,170 |

|

|

|

110,779,680 |

|

|

|

87,420,543 |

|

| |

|

|

|

|

|

|

|

|

(1) Amounts are attributable to common stockholders and OP Unit

holders. The OP Units are redeemable for cash, or at the Company's

option for shares of the Company's common stock on a one-for-one

basis. |

| |

|

|

|

|

|

|

|

|

The Company is presenting FFO and AFFO because management believes

they are important supplemental measures of the Company’s operating

performance in that they are frequently used by analysts, investors

and other parties in the evaluation of REITs. The National

Association of Real Estate Investment Trusts, or NAREIT, defines

FFO as net income (loss) attributable to common stockholders

(computed in accordance with GAAP), excluding gains (losses) from

sales of depreciated real properties, plus impairments of

depreciated real properties and real estate related depreciation

and amortization, and after adjustments for unconsolidated

ventures. |

|

|

|

The Company defines AFFO as funds from operations adjusted for

accounting items such as non-cash stock-based compensation expense,

income from mortgage servicing rights ("MSRs"), changes in fair

value of certain derivatives that temporarily flow through

earnings, amortization and write-offs of MSRs, deferred taxes and

the amortization of the convertible senior notes conversion option.

The Company also adds back one-time charges such as acquisition

costs and impairment losses on real estate and gains (losses) on

sales of real estate. The Company is generally not in the business

of operating real estate property and has obtained real estate by

foreclosure or through partial or full settlement of mortgage debt

related to the Company's loans to maximize the value of the

collateral and minimize the Company's exposure. Therefore,

the Company deems such impairment and gains (losses) on real estate

as an extension of the asset management of its loans, thus a

recovery of principal or additional loss on the Company's initial

investment. |

|

|

|

FFO and AFFO are not intended to be an indication of the Company's

cash flow from operating activities (determined in accordance with

GAAP) or a measure of its liquidity, nor is it entirely indicative

of funding the Company's cash needs, including its ability to make

cash distributions. The Company’s calculation of FFO and AFFO

may be different from the calculations used by other companies and,

therefore, comparability may be limited. |

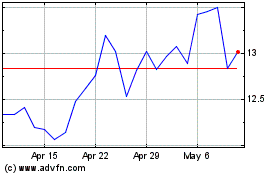

Arbor Realty (NYSE:ABR)

Historical Stock Chart

From Mar 2024 to Apr 2024

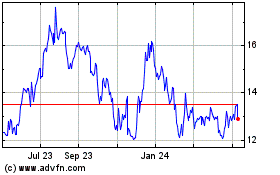

Arbor Realty (NYSE:ABR)

Historical Stock Chart

From Apr 2023 to Apr 2024