Current Report Filing (8-k)

February 13 2020 - 6:03AM

Edgar (US Regulatory)

false0001144980

0001144980

2020-02-07

2020-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 7, 2020

Asbury Automotive Group, Inc.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

|

|

|

|

|

|

|

|

|

001-31262

|

|

01-0609375

|

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

2905 Premiere Parkway NW Suite 300

|

|

|

|

|

Duluth,

|

GA

|

|

30097

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

(770) 418-8200

(Registrant's telephone number, including area code)

None

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Trading

|

|

|

|

Title of each class

|

|

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common stock, $0.01 par value per share

|

|

ABG

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

2020 BofA Real Estate Facility

On February 7, 2020, Asbury Automotive Group, Inc. (the “Company”) and certain of its subsidiaries entered into a new real estate term loan credit agreement (as amended, restated or supplemented from time to time, the “2020 BofA Real Estate Credit Agreement”) with the various financial institutions party thereto, as lenders, certain of the Company’s subsidiaries that own or lease the real estate financed thereunder, as borrowers or guarantors, and Bank of America, as lender, providing for term loans in an aggregate amount not to exceed approximately $280 million, subject to customary terms and conditions (the “2020 BofA Real Estate Facility”). Term loans under our 2020 BofA Real Estate Facility bear interest, at our option, based on (1) LIBOR plus an applicable margin based on a pricing grid ranging from 1.50% per annum to 2.00% per annum based on our consolidated total lease adjusted leverage ratio or (2) the Base Rate (as described below) plus an applicable margin based on a pricing grid ranging from 0.50% per annum to 1.00% per annum based on our consolidated total lease adjusted leverage ratio. The Base Rate is the highest of (i) the Federal Funds rate plus 0.50%, (ii) the Bank of America prime rate, and (iii) one month LIBOR plus 1.0%. We will be required to make 27 consecutive quarterly principal payments of 1.25% of the initial amount of each loan, with a balloon repayment of the outstanding principal amount of loans due on the maturity date. The New BofA Real Estate Facility matures seven years from the initial funding date. Borrowings under the 2020 BofA Real Estate Facility are guaranteed by us and each of our operating dealership subsidiaries that lease the real estate being financed under the 2020 BofA Real Estate Facility, and are collateralized by first priority liens, subject to certain permitted exceptions, on all of the real property financed thereunder.

The representations and covenants expected to be contained in the 2020 BofA Real Estate Credit Agreement are customary for financing transactions of this nature, including, among others, a requirement to comply with a minimum consolidated current ratio, minimum consolidated fixed charge coverage ratio and maximum consolidated total lease adjusted leverage ratio, in each case as set out in the 2020 BofA Real Estate Credit Agreement. In addition, certain other covenants could restrict our ability to incur additional debt, pay dividends or acquire or dispose of assets. The 2020 BofA Real Estate Credit Agreement also provides for events of default that are customary for financing transactions of this nature, including cross-defaults to other material indebtedness. Upon the occurrence of an event of default, we could be required by the 2020 BofA Real Estate Credit Agreement to immediately repay all amounts outstanding thereunder.

In connection with the recently announced acquisition of the Park Place family of dealerships (“Park Place”), we intend to borrow approximately $216 million under the 2020 BofA Real Estate Facility, and have the ability to make one additional draw in an amount up to 80% of the appraised value of a property expected to be acquired at or after the consummation of the acquisition, but not to exceed $64 million.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are furnished as part of this report.

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

|

|

|

|

Credit Agreement, dated February 7, 2020, by and among Asbury Automotive Group, Inc., certain subsidiaries party thereto and Bank of America, N.A.*

|

|

|

*

|

|

Certain exhibits and schedules have been omitted, and the Company agrees to furnish supplementally to the Commission a copy of any omitted exhibits or schedules upon request.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

ASBURY AUTOMOTIVE GROUP, INC.

|

|

|

|

|

|

|

Date: February 12, 2020

|

By:

|

|

/s/ William F Stax

|

|

|

Name:

|

|

William F. Stax

|

|

|

Title:

|

|

Interim Principal Financial Officer, Controller and Chief Accounting Officer

|

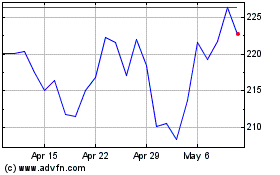

Asbury Automotive (NYSE:ABG)

Historical Stock Chart

From Mar 2024 to Apr 2024

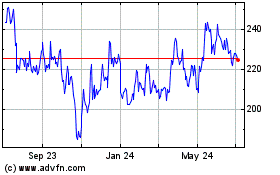

Asbury Automotive (NYSE:ABG)

Historical Stock Chart

From Apr 2023 to Apr 2024