Current Report Filing (8-k)

January 08 2021 - 6:04AM

Edgar (US Regulatory)

false00015002170001509570 0001500217 2021-01-08 2021-01-08 0001500217 aat:AmericanAssetsTrustLPMember 2021-01-08 2021-01-08

SECURITIES AND EXCHANGE COMMISSION

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 8, 2021

American Assets Trust, Inc.

American Assets Trust, L.P.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Maryland (American Assets Trust, Inc.)

Maryland (American Assets Trust, L.P.)

|

|

001-35030

(American Assets Trust, Inc.)

(American Assets Trust, L.P.)

|

|

27-3338708

(American Assets Trust, Inc.)

27-3338894

(American Assets Trust, L.P.)

|

(State or other jurisdiction

|

|

|

|

|

|

|

|

|

11455 El Camino Real, Suite 200

San Diego, California 92130

|

|

|

(Address of principal executive offices)

|

|

|

Registrant’s telephone number, including area code:

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

American Assets Trust, Inc.

|

|

Common Stock, par value $0.01 per share

|

|

|

|

|

American Assets Trust, L.P.

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Results of Operations and Financial Condition.

|

For the Three-Month Period Ended December 31, 2020

As of January 5, 2021, American Assets Trust, Inc. (the “Company”) had billed its tenants approximately $79.7 million (composed primarily of base rent and cost reimbursements) for the three-month period ended December 31, 2020 and collected approximately $72.9 million, or 91.5% thereof, which compares favorably to the Company’s collection performance for the three-month period ended September 30, 2020. As of that date, the Company had provided

adjustments (which includes rent deferrals and other monetary lease concessions) to its tenants for amounts billed for such period in the amount of approximately $2.0 million, or 2.5% of the total amount originally billed for such period. As a result, as of January 5, 2021, the Company had billings of approximately $4.8 million outstanding for the three-month period ended December 31, 2020, representing 6.1% of the total amount originally billed for such period.

For the Three-Month Period Ended September 30, 2020

As of December 26, 2020, the Company had billed its tenants approximately $81.9 million (composed primarily of base rent and cost reimbursements) for the three-month period ended September 30, 2020 and collected approximately $73.7 million, or 90.0% thereof, which compares favorably to the Company’s collection performance for the three-month period ended June 30, 2020. As of that date, the Company had provided

adjustments (which includes rent deferrals and other monetary lease concessions) to its tenants for amounts billed for such period in the amount of approximately $3.9 million, or 4.8% of the total amount originally billed for such period. As a result, as of December 26, 2020, the Company had billings of approximately $4.3 million outstanding for the three-month period ended September 30, 2020, representing 5.3% of the total amount originally billed for such period.

For the Three-Month Period Ended June 30, 2020

As of August 23, 2020, the Company had billed its tenants approximately $82.1 million (composed primarily of base rent and cost reimbursements) for the three-month period ended June 30, 2020 and collected approximately $68.5 million, or 83.4% thereof. As of that date, the Company had provided

adjustments (which includes rent deferrals and other monetary lease concessions) to its tenants for amounts billed for such period in the amount of approximately $4.6 million, or 5.6% of the total amount originally billed for such period. As a result, as of August 23, 2020, the Company had billings of approximately $9.0 million outstanding for the three-month period ended June 30, 2020, representing 10.9% of the total amount originally billed for such period.

Additional information regarding the Company’s collection performance for the three-month periods ended June 30, 2020, September 30, 2020 and December 31, 2020 is attached hereto as Exhibit 99.1. Exhibit 99.1 is being furnished pursuant to Item 2.02 and shall not be deemed “filed” for any purpose, including for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. Such information shall not be incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

The information regarding the Company’s collection performance for the three-month periods ended June 30, 2020, September 30, 2020 and December 31, 2020 set forth in Item 2.02 above is incorporated herein by reference.

|

|

Financial Statements and Exhibits.

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

American Assets Trust, Inc.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

|

|

|

|

|

|

|

|

Adam Wyll

|

|

|

|

|

|

|

|

Executive Vice President and Chief Operating Officer

|

|

January 8, 2021

|

|

|

|

|

|

|

|

|

|

|

|

American Assets Trust, L.P.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

|

|

|

|

|

|

|

|

Adam Wyll

|

|

|

|

|

|

|

|

Executive Vice President and Chief Operating Officer

|

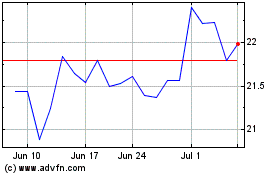

American Assets (NYSE:AAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

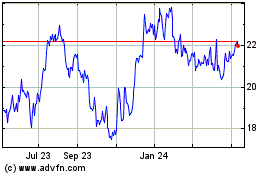

American Assets (NYSE:AAT)

Historical Stock Chart

From Apr 2023 to Apr 2024