Only 19 Stocks in the S&P 500 Are in the Green for the Past Month

March 10 2020 - 4:15PM

Dow Jones News

By Karen Langley

Investors looking for places to hide in the stock-market rout

have few options.

Only 19 stocks in the S&P 500 are up over the past month,

and many of those have something in common: they have seen demand

jump as Americans brace for the quickly spreading coronavirus

epidemic.

The top five performers in the index over the past month through

Tuesday afternoon are Regeneron Pharmaceuticals Inc., up 21%;

Kroger Co., up 13%; Cabot Oil & Gas Co., up 12%; AutoZone Inc.,

up 7.9%; and Newmont Corp., up 7.4%.

Farther down the list of winners: Dollar General Corp., Take-Two

Interactive Software Inc., Campbell Soup Co., Advance Auto Parts

Inc., Clorox Co. and Walmart Inc. Most are getting a bump as

consumers prepare to hunker down at home if the outbreak

accelerates.

The stock moves look like a reaction to "the pantry-loading

that's going on as people are preparing to hunker down, more than

anything on the long-term fundamentals of those businesses," said

Andy Braun, a portfolio manager at Pax World Funds.

The S&P 500 as a whole is down 16% over the past month, and

all 11 sectors are in the red. The breadth of the downturn is wide:

459 of the 505 constituents in the S&P 500 are down at least

10% from their 52-week high, while 311 are down at least 20%,

according to Dow Jones Market Data.

Eight of the 10 biggest decliners in the index are

energy-related stocks, which have tumbled sharply in conjunction

with a plunge in oil prices as the coronavirus zaps demand. The

biggest losers over the past month are Occidental Petroleum Corp.,

off 66%; Apache Corp., off 63%; and Marathon Oil Corp., off

63%.

The only names on that list outside the energy sector: Norwegian

Cruise Line Holdings Ltd., down 61%, and Royal Caribbean Cruises

Ltd., down 53%.

Many of the month's winners sit in the S&P 500's

consumer-staples group, which has posted the smallest losses of the

11 sectors over the past month. The segment is seen as relatively

insulated from economic downturns because consumers rarely put off

purchases of essentials like food and diapers.

Among the other gainers, Regeneron has been racing to develop an

antibody treatment for the virus. Chief Financial Officer Robert

Landry said at a conference last week that the company intends to

have the lead antibodies manufactured and ready for clinical trial

use this summer.

Meanwhile, gas producer Cabot has rallied as investors bet the

drop in crude will reduce the supply of natural gas, thereby

raising prices. Gold miner Newmont has risen alongside the price of

the precious metal as investors have rushed into safe-haven assets.

And Take-Two has gotten a boost from expectations for higher

videogaming demand when consumers are stuck at home.

Write to Karen Langley at karen.langley@wsj.com

(END) Dow Jones Newswires

March 10, 2020 16:00 ET (20:00 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

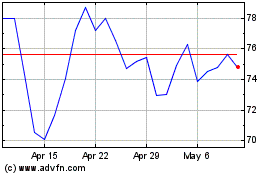

Advance Auto Parts (NYSE:AAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Advance Auto Parts (NYSE:AAP)

Historical Stock Chart

From Apr 2023 to Apr 2024