Current Report Filing (8-k)

August 27 2021 - 4:29PM

Edgar (US Regulatory)

false000182139300018213932021-08-272021-08-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

FORM 8-K

________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): August 27, 2021 (August 25, 2021)

|

|

|

|

|

|

|

|

THE AARON'S COMPANY, INC.

|

(Exact name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Georgia

|

|

1-39681

|

|

85-2483376

|

|

(State or other Jurisdiction of Incorporation)

|

|

(Commission File

Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

400 Galleria Parkway SE

|

Suite 300

|

Atlanta

|

Georgia

|

|

30339-3194

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (678) 402-3000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock, $0.50 Par Value

|

AAN

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 5.02. DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS

On August 25, 2021, at the 2021 Annual Meeting of Shareholders (the “Annual Meeting”) of The Aaron's Company, Inc. (the “Company”) in Atlanta, Georgia, the shareholders of the Company, upon the recommendation of the Company’s Board of Directors, approved The Aaron's Company, Inc. Amended and Restated 2020 Equity and Incentive Plan (the “Amended and Restated 2020 Plan”). The Amended and Restated 2020 Plan became effective upon such shareholder approval.

The Amended and Restated 2020 Plan amends and restates in its entirety The Aaron’s Company, Inc. 2020 Equity and Incentive Plan (the “Original 2020 Plan”). In terms of material changes from the Original 2020 Plan:

•The Amended and Restated 2020 Plan increases the number of shares of the Company’s common stock available for awards under the plan by 3,475,000 shares to a total of 6,775,000 shares.

•The Amended and Restated 2020 Plan extends the term under which awards may be granted under the plan until August 24, 2031.

•The Amended and Restated 2020 Plan includes a one-year minimum vesting requirement for all awards granted under it, subject to limited exceptions, as further described in the Amended and Restated 2020 Plan. The Original 2020 Plan only included a minimum vesting requirement with respect to performance shares and performance units, which minimum vesting requirement could be overridden in the discretion of the Compensation Committee of the Company’s Board of Directors (the “Compensation Committee”).

•The Amended and Restated 2020 Plan now provides that dividends and dividend equivalents on all unvested awards granted under the Amended and Restated 2020 Plan will be subject to the same restrictions on vesting and payment as the awards to which they relate. The Original 2020 Plan limited this requirement to only certain types of awards. The Amended and Restated 2020 Plan does not allow for dividends or dividend equivalents on option or stock appreciation right awards.

•The Amended and Restated 2020 Plan includes language clarifying that certain awards can provide for continued vesting (in addition to accelerated vesting) upon the occurrence of specified events.

•The Amended and Restated 2020 Plan clarifies that the Compensation Committee may provide for the repayment to the Company of cash received with respect to an award under the plan in the event a participant engages in certain detrimental activity, as further described in the Amended and Restated 2020 Plan.

In addition to the changes described above, the Amended and Restated 2020 Plan includes various non-substantive conforming and clarifying changes.

The description of the Amended and Restated 2020 Plan is qualified in its entirety by reference to the full text of the Amended and Restated 2020 Plan, attached as Appendix A to the Company’s Definitive Proxy Statement on Schedule 14A filed with the United States Securities and Exchange Commission (the “Commission”) on July 14, 2021, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

ITEM 5.07. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

As described above, the Company held the Annual Meeting on August 25, 2021 in Atlanta, Georgia. As of June 21, 2021, the record date for the Annual Meeting, there were 33,861,982 shares of the Company’s common stock outstanding and entitled to vote at the Annual Meeting. A total of 31,048,098 shares of the Company’s common stock were represented at the Annual Meeting in person or by proxy, which was 91.69% of the aggregate number of shares of common stock entitled to vote at the Annual Meeting. At the Annual Meeting, the Company’s shareholders took the actions listed below and elected each of the director nominees to serve as directors until the expiration of such director’s term at the Company’s 2024 annual meeting of shareholders and until such director’s successor is duly elected and qualified, or until such director’s earlier resignation, removal from office or death, having cast the following votes:

Proposal 1 – Election of directors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

Non-Votes

|

|

Hubert L. Harris, Jr.

|

28,674,459

|

|

|

365,274

|

|

|

9,325

|

|

|

1,999,040

|

|

|

John W. Robinson III

|

28,996,157

|

|

|

50,786

|

|

|

2,115

|

|

|

1,999,040

|

|

Proposal 2 – Approval of a non-binding, advisory resolution to approve the Company’s executive compensation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

Non-Votes

|

|

28,216,785

|

|

810,741

|

|

21,532

|

|

1,999,040

|

Proposal 3 – Approval of a non-binding, advisory recommendation to the Board of Directors of the Company regarding the frequency of the advisory vote on executive compensation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One Year

|

|

Two Years

|

|

Three Years

|

|

Abstain

|

|

27,538,187

|

|

13,922

|

|

1,477,901

|

|

19,048

|

Proposal 4 – Adopt and approve The Aaron's Company, Inc. Amended and Restated 2020 Equity and Incentive Plan

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

Non-Votes

|

|

27,145,564

|

|

1,883,746

|

|

19,748

|

|

1,999,040

|

Proposal 5 – Ratification of the appointment of Ernst and Young LLP as the Company's independent registered public accounting firm for 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

Non-Votes

|

|

29,970,647

|

|

1,076,689

|

|

762

|

|

—

|

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits:

|

|

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

|

|

|

|

|

|

Exhibit 104

|

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THE AARON'S COMPANY, INC.

|

|

|

|

By:

|

/s/ C. Kelly Wall

|

|

Date:

|

August 27, 2021

|

|

C. Kelly Wall

Chief Financial Officer

|

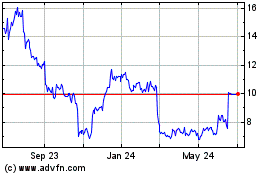

Aarons (NYSE:AAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

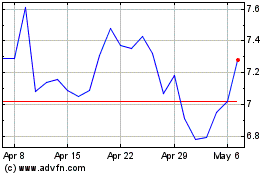

Aarons (NYSE:AAN)

Historical Stock Chart

From Apr 2023 to Apr 2024