Current Report Filing (8-k)

August 22 2019 - 5:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): August 22, 2019 (August 16, 2019)

AAC HOLDINGS, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Nevada

|

|

001-36643

|

|

35-2496142

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

200 Powell Place

Brentwood, Tennessee

(Address of Principal Executive Offices)

|

|

37027

(Zip Code)

|

(615) 732-1231

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.001 par value per share

|

|

AAC

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☒

|

Item 3.01.

|

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

|

On August 16, 2019, AAC Holdings, Inc. (the “Company”) received a written notice (the

“Notice”) from the New York Stock Exchange (the “NYSE”) indicating that the Company is not in compliance with the NYSE’s continued listing requirements in Section 802.01E (SEC Annual and Quarterly Report Timely Filing

Criteria) of the NYSE Listed Company Manual (the “NYSE Manual”) as a result of the Company’s delay in filing its Quarterly Report on Form 10-Q for the period ended June 30, 2019 (the

“Q2 2019 Form 10-Q”) with the United States Securities and Exchange Commission (the “SEC”).

The Company is diligently working to finalize its Q2 2019 Form 10-Q and expects to do so shortly, although no assurances as to timing may be

made. The Company issued a press release on August 22, 2019, a copy of which is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this “Report”).

The NYSE informed the Company that it will monitor the status of the Company’s Q2 2019 Form 10-Q and related public disclosures for up to

a six (6) month period from its due date. If the Company does not file its Q2 2019 Form 10-Q with the SEC within six (6) months of its due date (the “Extension Period”), the NYSE may, in its sole discretion, allow the

Company’s common stock to trade for up to an additional six (6) months (the “Additional Extension Period”) depending upon the Company’s specific circumstances. The Notice also states that the NYSE may commence delisting

proceedings at any time during the Extension Period or the Additional Extension period, if applicable, if the circumstances warrant.

|

Item 7.01

|

Regulation FD Disclosure.

|

The information disclosed under Item 3.01 of this Report is incorporated by reference into this Item 7.01.

|

Item 9.01

|

Exhibits and Financial Statements.

|

Forward Looking Statements

This Report contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements are made only as of the

date of this Report. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “may,” “potential,”

“predicts,” “projects,” “should,” “will,” “would,” and similar expressions intended to identify forward-looking statements, although not all forward-looking statements contain these words.

Forward-looking statements may include information concerning the Company’s possible or assumed future results of operations, including descriptions of the Company’s revenue, profitability, outlook and overall business strategy. These

statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results and performance to be materially different from the information contained in the forward-looking statements. These risks,

uncertainties and other factors include, without limitation: (i) the Company’s inability to effectively operate its facilities; (ii) the Company’s reliance on its sales and marketing program to continuously attract and enroll

clients; (iii) a reduction in reimbursement rates by certain third-party payors for inpatient and outpatient services and point-of-care and definitive lab testing;

(iv) the Company’s failure to successfully achieve growth or projected financial results related to acquisitions and de novo projects; (v) risks associated with estimates of the value of the Company’s accounts receivable or

deterioration in the collectability of accounts receivable; (vi) the possibility that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of an acquisition; (vii) a disruption in the Company’s

ability to perform diagnostic laboratory services; (viii) maintaining compliance with applicable regulatory authorities, licensure and permits to operate the Company’s facilities and laboratories; (ix) a disruption in the

Company’s business and reputational and economic risks associated with civil claims by various parties; (x) inability to meet the covenants in the Company’s loan documents or lack of borrowing capacity, including the Company’s

inability to enter into forbearance agreements and amendments with its lenders with respect to certain events of default; (xi) the Company’s inability to successfully raise capital in order to meet its liquidity needs; (xii) inability

to effectively integrate acquired facilities; and (xiii) general economic conditions, as well as other risks discussed in the “Risk Factors” section of the Company’s most recently filed Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other filings with the SEC. As a result of these factors, we cannot assure that the forward-looking statements in this Report will

prove to be accurate. Investors should not place undue reliance upon forward-looking statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

AAC HOLDINGS, INC.

|

|

|

|

|

By:

|

|

/s/ Andrew W. McWilliams

|

|

|

|

Andrew W. McWilliams

|

|

|

|

Chief Financial Officer

|

Date: August 22, 2019

Ares Acquisition (NYSE:AAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

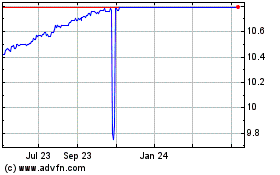

Ares Acquisition (NYSE:AAC)

Historical Stock Chart

From Apr 2023 to Apr 2024