Yield10 Bioscience, Inc. (Nasdaq:YTEN), an agricultural bioscience

company, today reported financial results for the three and six

months ended June 30, 2020.

"The Yield10 team has made good progress executing on our

strategic plans for 2020 and beyond," said Oliver Peoples, Ph.D.,

president and chief executive officer of Yield10 Bioscience. "Our

field tests in the U.S. and Canada are progressing on track and

will provide us with agronomic and/or performance data proof points

as well as seed for larger trials planned in 2021. As part of

our business plan to develop Camelina as a commercial crop platform

for producing nutritional oils and PHA biomaterial, we are

developing proprietary double haploid germplasm for deployment of

our performance and product traits in winter and spring varieties

to increase the acreage potential of the crop. In our first

multi-acre planting, we contracted 50 acres in Montana of wild-type

Camelina to gain experience in seed bulk-up, grower contracts,

logistics and handling of harvested seed, including toll crushing,

and to produce quantities of oil and protein meal for customer

sampling."

"We continue to see industry interest in our performance traits

as well as the capabilities enabled by our GRAIN platform. We

recently signed a non-exclusive research license with GDM for

evaluation of seed yield traits in soybean, which will provide

opportunities to explore additional Yield10 commercial crop

performance traits with a leading seed market participant and

potentially provide access to South American acreage in Argentina

and Brazil. Bayer, Forage Genetics and Simplot continue to evaluate

our traits under similar research licenses in soybean, forage

sorghum and potato, respectively. Our internal program testing

traits in corn is progressing toward the creation of hybrids for

field testing. We will continue to identify collaborative

opportunities with the goal of creating revenue generating

partnerships and paths to commercialization of our traits in key

commercial crops. We remain committed to driving the Yield10

business forward and achieving our broad-based milestones in 2020,"

said Dr. Peoples.

Recent Accomplishments Towards Achieving 2020

Milestones

Generate Proof Points for Novel Traits in Camelina and

Canola. Yield10 completed planting of the Company's 2020

Field Tests to evaluate a series of traits in Camelina and canola.

Key studies include the evaluation of C3004 in Camelina as well as

tests of traits to boost seed yield and/or oil content in Camelina

and canola. These studies, for the first time, include field

testing of a novel trait to produce PHA in the seed of Camelina.

The purpose of this activity is to determine the suitability of

these first generation PHA Camelina lines for scale-up and PHA

product prototyping in 2021. Harvest of the test fields is

expected in the third quarter of 2020 and data from the studies

will begin to become available in the fourth quarter of 2020 and

into early 2021.

Use of CRISPR Genome-Editing to Accelerate Development

of Novel Performance Traits. In the second quarter,

Yield10 submitted an "Am I regulated?" letter of inquiry to

USDA-APHIS to confirm the use of CRIPSR genome-edited trait C3007

in canola lines developed for increased oil content does not meet

the definition of a regulated article under 7 CFR Part 340

regulations. Confirmation of the status would allow field testing

of the plants in the U.S. in 2021.

Advance its Camelina Business Plan.

During the 2019/2020 winter season, Yield10 successfully field

tested internally developed double haploid varieties of winter

Camelina as part of a program to develop Camelina as a commercial

crop. Yield10 also planted 50 acres of wild-type spring Camelina as

a means to begin building relationships with growers, developing

agronomic guidelines for successfully growing Camelina, and for

producing Camelina oil and meal for sampling to potential

customers.

Form Agriculture Industry Alliances.

Yield10 recently signed a research agreement with Gibson City,

Illinois-based GDM to evaluate novel yield traits in soybean.

Working with major agricultural companies to test Yield10 traits is

fundamental to Yield10's strategy to create option value for our

traits in key commercial crops. Yield10 and GDM also intend to

explore additional opportunities for collaboration.

Manage its Financial Profile and Strengthen the Balance

Sheet. Yield10's financial results for the six month

period ended June 30, 2020 are on track with internal estimates.

Yield10 strengthened its balance sheet in the first half of 2020

based on approximately $2 million in proceeds from a combination of

capital from warrant exercises and support obtained from sources in

the U.S. and Canada to cover certain payroll-related

expenses. Based on the outlook for spending in the second

half of 2020, the Company is lowering its estimated range of total

net cash usage for 2020, while maintaining a consistent level

of investment in research and development to achieve the Company's

objectives.

COVID-19 Impact on Operations. The Company has

implemented business continuity plans to address the COVID-19

pandemic and minimize disruptions on ongoing operations. To date,

despite the pandemic, we have been able to move forward with the

operational steps required to execute our 2020 field trials in

Canada and the United States. It is possible, however, that

any potential future closures of our research facilities, if they

continued for an extended time period, could adversely impact our

anticipated time frames for completing field trials and other work

we have planned to accomplish during 2020.

SECOND QUARTER 2020 FINANCIAL OVERVIEW

Cash Position

Yield10 Bioscience is managed with an emphasis on cash flow and

deploys its financial resources in a disciplined manner to achieve

its key strategic objectives.

Net cash used by operating activities during the second quarter

of 2020 was $2.0 million compared to $1.8 million used in the

second quarter of 2019. Yield10 ended the second quarter of

2020 with $8.5 million in unrestricted cash, cash equivalents and

short-term investments. The Company is reducing its previous

guidance for anticipated total net cash usage during the full year

2020 from a range of $9.0 - $9.5 million to a range of $8.5 - $9.0

million, primarily as a result of expenditure reductions resulting

from the impact of the COVID-19 pandemic. We have delayed

plans to hire a small number of additional staff and have

significantly reduced our travel and certain other general business

expenses.

The Company's present capital resources are expected to fund its

planned operations into the second quarter of 2021. Yield10's

ability to continue operations after its current cash resources are

exhausted depends on its ability to obtain additional financing,

including public or private equity financing, secured or unsecured

debt financing, and receipt of additional government research

grants, as well as licensing or other collaborative

arrangements.

Operating Results

Grant revenue for the second quarter of 2020 was $0.2 million,

compared to $0.3 million recorded during the second quarter of

2019. Research and development expenses were consistent at $1.2

million for both the second quarter of 2020 and the second quarter

of 2019. General and administrative expenses increased from

$1.0 million during the second quarter of 2019 to $1.2 million

during the second quarter of 2020, primarily as a result of

increased employee compensation and benefits as well as legal and

accounting expenses incurred related to the Company's securities

and financial statement filings.

Yield10 reported a loss from operations of $2.1 million for the

quarter ended June 30, 2020 as compared to a loss from

operations of $1.9 million for the same quarter of 2019. The

Company reported a total net loss after income tax expense of $1.8

million, or $0.92 per share for the three months ended

June 30, 2020, in comparison to a total net loss after income

taxes of $1.9 million, or $5.99 per share, for the second quarter

of 2019. During the three months ended June 30, 2020 the

Company recognized $0.3 million in loan forgiveness income related

to a Paycheck Protection Program Loan ("PPP Loan") issued to the

Company under the Coronavirus Aid, Relief and Economic Security Act

("CARES Act"). Yield10 utilized the entire PPP Loan amount of

$0.3 million for qualifying payroll and other expenses during the

second quarter and considers it reasonably certain that it will

meet all of the conditions for loan forgiveness under the CARES

Act.

For the six months ending June 30, 2020, the Company

reported a net operating loss after taxes of $5.4 million, or $2.95

per share compared to a net operating loss after taxes of $4.1

million, or $14.36 per share for the six months ending

June 30, 2019. Year to date grant revenue earned

through June 30, 2020 and June 30, 2019 was $0.4 million

for both six-month periods. Research and development expenses

were $2.6 million during the six months ended June 30,

2020, compared to $2.4 million for the six months ended

June 30, 2019, and general and administrative expenses were

$2.6 million and $2.2 million during the six months ended

June 30, 2020 and June 30, 2019, respectively.

Reverse Stock Split

Yield10 completed a 1-for-40 reverse stock split of its common

stock on January 15, 2020, in order to regain compliance with the

Nasdaq Stock Market minimum bid price qualification of $1.00 per

share as required by Nasdaq Listing Rule 5550(a)(2). In

accordance with applicable accounting guidance, all share amounts,

per share data, share prices and conversion rates set forth in the

Company's condensed consolidated financial statements for the three

and six months ending June 30, 2020 and June 30, 2019,

including those presented in this earnings release, have been

retroactively adjusted to reflect the reverse stock split.

Conference Call Information

Yield10 Bioscience management will host a conference call today

at 4:30 p.m. (ET) to discuss the second quarter 2020 results. The

Company also will provide an update on the business and answer

questions from the investor community. A live webcast of the call

with slides can be accessed through the Company's website at

www.yield10bio.com in the investor relations events section.

To participate in the call, dial toll-free 877-709-8150 or

201-689-8354 (international).

To listen to a telephonic replay of the conference call, dial

toll-free 877-660-6853 or 201-612-7415 (international) and enter

pass code 13707134. The replay will be available until August 25,

2020. In addition, the webcast will be archived on the Company's

website in the investor relations events section.

About Yield10 Bioscience

Yield10 Bioscience, Inc. is an agricultural bioscience company

developing crop innovations to improve crop yields and enhance

sustainable global food security. The Company utilizes its

proprietary “GRAIN“ (Gene Ranking Artificial Intelligence Network)

gene discovery platform to identify gene targets to improve yield

performance and value in major commercial food and feed crops.

Yield10 uses its Camelina oilseed platform to rapidly evaluate and

field test new trait leads enabling the translation of promising

new traits into the major commercial crops. As a path toward

commercialization, Yield10 is pursuing a partnering approach with

agricultural companies to drive new traits into development in

crops such as canola, soybean and corn. The Company is also

developing Camelina as a platform crop for producing nutritional

oils and specialty products such as PHA biomaterials for use in

water treatment and bioplastic applications. Yield10 is

headquartered in Woburn, MA and has an Oilseeds Center of

Excellence in Saskatoon, Canada.

For more information about the company, please visit

www.yield10bio.com, or follow the Company on Twitter, Facebook and

LinkedIn. (YTEN-E)

Safe Harbor for Forward-Looking Statements

This press release contains forward-looking statements which are

made pursuant to the safe harbor provisions of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. The forward-looking

statements in this release do not constitute guarantees of future

performance. Investors are cautioned that statements in this press

release which are not strictly historical statements, including,

without limitation, expectations regarding Yield10’s cash position,

cash forecasts and runway, ability to obtain sufficient financing

to continue operating, expectations related to research and

development activities, collaborations, intellectual property, the

expected regulatory path for traits, reproducibility of data from

field tests, the timing of completion of additional greenhouse and

field test studies, the signing of research licenses and

collaborations, the potential impact on operations of the COVID-19

pandemic, and value creation as well as the overall progress of

Yield10 Bioscience, Inc., constitute forward-looking statements.

Such forward-looking statements are subject to a number of risks

and uncertainties that could cause actual results to differ

materially from those anticipated, including the risks and

uncertainties detailed in Yield10 Bioscience’s filings with the

Securities and Exchange Commission. Yield10 Bioscience assumes no

obligation to update any forward-looking information contained in

this press release or with respect to the announcements described

herein.

Contacts:

Yield10 Bioscience:Lynne H. Brum, (617) 682-4693,

LBrum@yield10bio.com

Investor Relations:Bret Shapiro, (561) 479-8566,

brets@coreir.com Managing Director, CORE IR

Media Inquiries:Eric Fischgrund,

eric@fischtankpr.com FischTank PR

(FINANCIAL TABLES FOLLOW)

| YIELD10

BIOSCIENCE, INC. |

| CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

UNAUDITED |

| (In

thousands, except share and per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months

Ended |

|

Six Months

Ended |

| |

June 30, |

June 30, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

|

Revenue: |

|

|

|

|

|

|

|

|

Grant revenue |

$ |

221 |

|

|

$ |

318 |

|

|

$ |

400 |

|

|

$ |

442 |

|

|

Total revenue |

221 |

|

|

318 |

|

|

400 |

|

|

442 |

|

| |

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

Research and development |

1,179 |

|

|

1,191 |

|

|

2,639 |

|

|

2,414 |

|

|

General and administrative |

1,179 |

|

|

1,025 |

|

|

2,566 |

|

|

2,211 |

|

|

Total expenses |

2,358 |

|

|

2,216 |

|

|

5,205 |

|

|

4,625 |

|

|

Loss from operations |

(2,137 |

) |

|

(1,898 |

) |

|

(4,805 |

) |

|

(4,183 |

) |

| |

|

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

Change in fair value of warrants |

— |

|

|

— |

|

|

(957 |

) |

|

— |

|

|

Loan forgiveness income |

333 |

|

|

— |

|

|

333 |

|

|

— |

|

|

Other income (expense), net |

15 |

|

|

27 |

|

|

48 |

|

|

52 |

|

|

Total other income (expense) |

348 |

|

|

27 |

|

|

(576 |

) |

|

52 |

|

| Net loss

from operations before income tax expense |

(1,789 |

) |

|

(1,871 |

) |

|

(5,381 |

) |

|

(4,131 |

) |

|

Income tax expense |

(7 |

) |

|

— |

|

|

(15 |

) |

|

— |

|

| Net

loss |

$ |

(1,796 |

) |

|

$ |

(1,871 |

) |

|

$ |

(5,396 |

) |

|

$ |

(4,131 |

) |

| |

|

|

|

|

|

|

|

| Basic and

diluted net loss per share |

$ |

(0.92 |

) |

|

$ |

(5.99 |

) |

|

$ |

(2.95 |

) |

|

$ |

(14.36 |

) |

| |

|

|

|

|

|

|

|

| Number of

shares used in per share calculations: |

|

|

|

|

|

|

|

|

Basic and diluted |

1,957,927 |

|

|

312,342 |

|

|

1,827,526 |

|

|

287,592 |

|

| YIELD10

BIOSCIENCE, INC. |

| CONDENSED

CONSOLIDATED BALANCE SHEETS |

|

UNAUDITED |

| (In

thousands, except share and per share amounts) |

|

|

|

|

|

|

|

|

|

| |

June

30, |

|

December

31, |

| |

2020 |

2019 |

|

Assets |

|

|

|

| Current

Assets: |

|

|

|

|

Cash and cash equivalents |

$ |

3,290 |

|

|

$ |

5,417 |

|

|

Short-term investments |

5,211 |

|

|

5,700 |

|

|

Accounts receivable |

13 |

|

|

72 |

|

|

Unbilled receivables |

59 |

|

|

20 |

|

|

Prepaid expenses and other current assets |

417 |

|

|

475 |

|

|

Total current assets |

8,990 |

|

|

11,684 |

|

| Restricted

cash |

254 |

|

|

332 |

|

| Property and

equipment, net |

978 |

|

|

1,243 |

|

| Right-of-use

assets |

2,879 |

|

|

3,141 |

|

| Other

assets |

265 |

|

|

318 |

|

|

Total assets |

$ |

13,366 |

|

|

$ |

16,718 |

|

| |

|

|

|

|

Liabilities, Convertible Preferred Stock and Stockholders’

(Deficit) Equity |

|

|

|

| Current

Liabilities: |

|

|

|

|

Accounts payable |

$ |

150 |

|

|

$ |

279 |

|

|

Accrued expenses |

882 |

|

|

1,326 |

|

|

Lease liabilities |

430 |

|

|

602 |

|

|

Total current liabilities |

1,462 |

|

|

2,207 |

|

| Lease

liabilities, net of current portion |

3,400 |

|

|

3,619 |

|

| Warrant

liability |

— |

|

|

14,977 |

|

| Other

long-term liabilities |

17 |

|

|

— |

|

|

Total liabilities |

4,879 |

|

|

20,803 |

|

| Commitments

and contingencies |

|

|

|

| Series B

Convertible Preferred Stock ($0.01 par value per share): 0 shares

and 5,750 shares issued and outstanding at June 30, 2020 and

December 31, 2019, respectively |

— |

|

|

— |

|

|

Stockholders’ Equity (Deficit): |

|

|

|

|

Series A Convertible Preferred Stock ($0.01 par value per share); 0

shares and 796 shares issued and outstanding at June 30, 2020 and

December 31, 2019, respectively |

— |

|

|

— |

|

|

Common stock ($0.01 par value per share); 60,000,000 shares

authorized at June 30, 2020 and December 31, 2019; 1,972,798 and

933,423 shares issued and outstanding at June 30, 2020 and

December 31, 2019, respectively |

20 |

|

|

9 |

|

| Additional

paid-in capital |

378,924 |

|

|

360,926 |

|

| Accumulated

other comprehensive loss |

(167 |

) |

|

(126 |

) |

| Accumulated

deficit |

(370,290 |

) |

|

(364,894 |

) |

|

Total stockholders’ equity (deficit) |

8,487 |

|

|

(4,085 |

) |

|

Total liabilities, convertible preferred stock and stockholders’

equity (deficit) |

$ |

13,366 |

|

|

$ |

16,718 |

|

| |

|

|

|

|

|

|

|

| YIELD10

BIOSCIENCE, INC. |

| CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

UNAUDITED |

| (In

thousands) |

|

|

|

|

|

|

|

|

|

| |

Six Months Ended June 30, |

| |

2020 |

|

2019 |

| Cash

flows from operating activities |

|

|

|

| Net

loss |

$ |

(5,396 |

) |

|

$ |

(4,131 |

) |

| Adjustments

to reconcile net loss to cash used in operating activities: |

|

|

|

|

Depreciation |

91 |

|

|

100 |

|

| Change in

fair value of warrants |

957 |

|

|

— |

|

| Loss on

disposal of fixed assets |

206 |

|

|

— |

|

| Charge for

401(k) company common stock match |

66 |

|

|

49 |

|

| Stock-based

compensation |

297 |

|

|

275 |

|

| Non-cash

lease expense |

262 |

|

|

299 |

|

| Deferred tax

provision |

27 |

|

|

— |

|

| Changes in

operating assets and liabilities: |

|

|

|

|

Accounts receivables |

59 |

|

|

(54 |

) |

|

Unbilled receivables |

(39 |

) |

|

(37 |

) |

|

Prepaid expenses and other assets |

84 |

|

|

(10 |

) |

|

Accounts payable |

(129 |

) |

|

(62 |

) |

|

Accrued expenses |

(390 |

) |

|

(102 |

) |

|

Lease liabilities |

(391 |

) |

|

(404 |

) |

|

Other liabilities |

17 |

|

|

— |

|

|

Net cash used for operating activities |

(4,279 |

) |

|

(4,077 |

) |

| |

|

|

|

| Cash

flows from investing activities |

|

|

|

| Purchase of

property and equipment |

(42 |

) |

|

(13 |

) |

| Proceeds

from sale of property and equipment |

10 |

|

|

— |

|

| Purchase of

short-term investments |

(503 |

) |

|

(998 |

) |

| Proceeds

from the sale and maturity of short-term investments |

999 |

|

|

2,746 |

|

|

Net cash provided by investing activities |

464 |

|

|

1,735 |

|

| |

|

|

|

| Cash

flows from financing activities |

|

|

|

| Proceeds

from warrants exercised |

1,658 |

|

|

— |

|

| Proceeds

from registered direct offering, net of issuance costs |

— |

|

|

2,583 |

|

| Taxes paid

on employees' behalf related to vesting of stock awards |

— |

|

|

(4 |

) |

|

Net cash provided by financing activities |

1,658 |

|

|

2,579 |

|

| |

|

|

|

| Effect of

exchange rate changes on cash, cash equivalents and restricted

cash |

(48 |

) |

|

(8 |

) |

| |

|

|

|

| Net

(decrease) increase in cash, cash equivalents and restricted

cash |

(2,205 |

) |

|

229 |

|

| Cash, cash

equivalents and restricted cash at beginning of period |

5,749 |

|

|

3,355 |

|

| Cash, cash

equivalents and restricted cash at end of period |

$ |

3,544 |

|

|

$ |

3,584 |

|

|

|

|

|

|

|

|

|

|

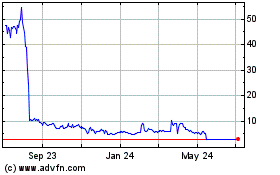

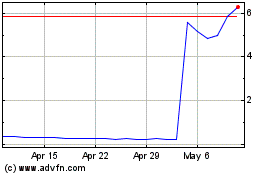

Yield10 Bioscience (NASDAQ:YTEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Yield10 Bioscience (NASDAQ:YTEN)

Historical Stock Chart

From Apr 2023 to Apr 2024