Current Report Filing (8-k)

November 16 2020 - 7:27AM

Edgar (US Regulatory)

☐000134630200013463022020-11-162020-11-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 16, 2020 (November 13, 2020)

XERIS PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-38536

|

20-3352427

|

(State or other jurisdiction of

incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

180 N. LaSalle Street, Suite 1600

Chicago, Illinois 60601

(Address of principal executive offices, including zip code)

(844) 445-5704

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.0001 per share

|

XERS

|

The Nasdaq Global Select Market

|

|

|

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

|

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.02 – Unregistered Sales of Equity Securities

On November 13, 2020, Xeris Pharmaceuticals, Inc. (the “Company”) entered into separate, privately negotiated exchange agreements (the “Exchange Agreements”) with certain holders of the Company’s 5.00% Convertible Senior Notes due 2025 (the “Notes”). Pursuant to the Exchange Agreements, the Company will exchange approximately $30.7 million in aggregate principal amount of the Notes for 10,435,199 newly issued shares of the Company’s common stock (the “Common Stock”). The transactions are subject to customary closing conditions and are expected to close on November 18, 2020. The shares of Common Stock will be issued in private placements exempt from registration in reliance on Section 3(a)(9) of the Securities Act of 1933, as amended (the “Securities Act”).

This Current Report on Form 8-K does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall it constitute an offer to sell, solicitation or sale in any jurisdiction in which such offer, solicitation or sale would be unlawful. These securities have not been registered under the Securities Act or any state securities laws and, unless so registered, may not be offered or sold in the United States or to U.S. persons except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and applicable state laws.

Forward-Looking Statements

This Current Report on Form 8-K contains certain forward-looking statements within the meaning of the federal securities laws that involve material risks, assumptions and uncertainties. Many possible events or factors could affect our future results and performance, such that our actual results and performance may differ materially from those that may be described or implied in the forward-looking statements. As such, no forward-looking statement can be guaranteed. The factors that could cause actual results to differ from what is described herein, include, but are not limited to, financial market conditions and actions by the counterparties to the Exchange Agreements. The Company is subject to additional risks and uncertainties described in the Company’s annual report on Form 10-K and subsequent quarterly reports on Form 10-Q. You are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s analysis and expectations only as of the date of this Form 8-K. Except as required by law, we undertake no obligation to publicly release the results of any revision or update of these forward-looking statements, whether as a result of new information, future events or otherwise.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

10.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: November 16, 2020

|

|

Xeris Pharmaceuticals, Inc.

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Barry M. Deutsch

|

|

|

|

|

|

Barry M. Deutsch

|

|

|

|

|

|

Chief Financial Officer

|

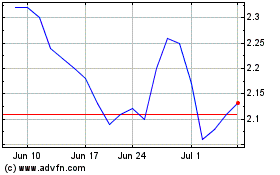

Xeris Biopharma (NASDAQ:XERS)

Historical Stock Chart

From Mar 2024 to Apr 2024

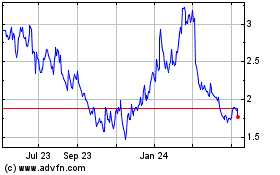

Xeris Biopharma (NASDAQ:XERS)

Historical Stock Chart

From Apr 2023 to Apr 2024