Wynn Resorts, Limited (NASDAQ: WYNN) (the "Company") today

reported financial results for the quarter ended June 30, 2019.

"We were pleased to deliver year-over-year revenue growth at all

of our properties in the second quarter, with particular strength

in our core mass business in Macau and REVPAR in Las Vegas," said

Matt Maddox, CEO of Wynn Resorts, Limited. "On the development

front, we have made meaningful progress designing and planning the

Crystal Pavilion in Macau, which we believe will be a 'must-see'

tourism destination on Cotai. We also achieved a significant

milestone during the quarter with the successful opening of Encore

Boston Harbor, the East Coast’s first premium integrated resort, on

June 23. Importantly, the opening of Encore Boston Harbor drives a

reduction in our near-term capital expenditures and improvement in

our discretionary free cash flow profile. We are also pleased to

announce a $1.00 per share dividend for the quarter, consistent

with our strategy of capital return to shareholders. We remain

excited about the outlook for the Company and we will continue to

focus on leveraging our premium-focused business model to drive

long-term returns for shareholders."

Operating revenues were $1.66 billion for the second quarter of

2019, an increase of 3.3%, or $52.9 million, from $1.61 billion for

the second quarter of 2018. Operating revenues increased $8.3

million, $3.2 million, and $22.6 million at Wynn Palace, Wynn

Macau, and our Las Vegas Operations, respectively, from the second

quarter of 2018.

On a U.S. generally accepted accounting principles ("GAAP")

basis, net income attributable to Wynn Resorts, Limited was $94.6

million, or $0.88 per diluted share, for the second quarter of

2019, compared to $155.8 million, or $1.44 per diluted share, in

the second quarter of 2018. The change was primarily due to an

increase in pre-opening expenses related to the development of

Encore Boston Harbor. Adjusted net income attributable to Wynn

Resorts, Limited (1) was $153.9 million, or $1.44 per diluted

share, for the second quarter of 2019, compared to $166.2 million,

or $1.53 per diluted share, for the second quarter of 2018.

Adjusted Property EBITDA (2) was $480.6 million for the second

quarter of 2019, an increase of 0.9%, or $4.2 million, from $476.4

million for the second quarter of 2018. Adjusted Property EBITDA

increased $2.9 million and $13.2 million at Wynn Macau and our Las

Vegas Operations, respectively, and decreased $12.1 million at Wynn

Palace.

Wynn Resorts, Limited also announced today that the Company has

approved a cash dividend of $1.00 per share, payable on August 27,

2019 to stockholders of record as of August 16, 2019.

Macau Operations

Wynn Palace

Operating revenues from Wynn Palace were $628.9 million for the

second quarter of 2019, a 1.3% increase from $620.6 million for the

second quarter of 2018. Adjusted Property EBITDA from Wynn Palace

was $167.2 million for the second quarter of 2019, a 6.8% decrease

from $179.3 million for the second quarter of 2018.

Casino revenues from Wynn Palace were $528.5 million for the

second quarter of 2019, a 0.7% increase from $525.0 million for the

second quarter of 2018. Table games turnover in VIP operations was

$13.39 billion, a 4.6% decrease from $14.03 billion for the second

quarter of 2018. VIP table games win as a percentage of turnover

was 3.02%, above the expected range of 2.7% to 3.0% and above the

3.00% experienced in the second quarter of 2018. Table drop in mass

market operations was $1.27 billion, a 4.0% increase from $1.22

billion in the second quarter of 2018. Table games win in mass

market operations was $296.9 million, a 5.8% increase from $280.6

million for the second quarter of 2018. Table games win percentage

in mass market operations was 23.4%, above the 23.0% experienced in

the second quarter of 2018. Slot machine handle was $937.8 million,

a 0.3% decrease from $941.0 million for the second quarter of 2018.

Slot machine win decreased 1.4% to $43.6 million for the second

quarter of 2019, compared to $44.2 million for the second quarter

of 2018.

Non-casino revenues from Wynn Palace were $100.4 million for the

second quarter of 2019, a 5.0% increase from $95.6 million for the

second quarter of 2018. Room revenues were $43.2 million for the

second quarter of 2019, a 6.0% increase from $40.7 million for the

second quarter of 2018. Average daily rate ("ADR") was $265, a 4.1%

increase from $254 for the second quarter of 2018. Occupancy

increased to 97.4% for the second quarter of 2019, from 96.2% for

the second quarter of 2018. Revenue per available room ("REVPAR")

was $258, a 5.3% increase from $245 for the second quarter of

2018.

Wynn Macau

Operating revenues from Wynn Macau were $546.5 million for the

second quarter of 2019, a 0.6% increase from $543.3 million for the

second quarter of 2018. Adjusted Property EBITDA was $175.9 million

for the second quarter of 2019, a 1.7% increase from $172.9 million

for the second quarter of 2018.

Casino revenues from Wynn Macau were $481.2 million for the

second quarter of 2019, a 1.7% increase from $473.3 million for the

second quarter of 2018. Table games turnover in VIP operations was

$9.28 billion, a 33.4% decrease from $13.93 billion for the second

quarter of 2018. VIP table games win as a percentage of turnover

was 3.30%, above the expected range of 2.7% to 3.0% and above the

2.56% experienced in the second quarter of 2018. Table drop in mass

market operations was $1.35 billion, a 4.2% increase from $1.29

billion for the second quarter of 2018. Table games win in mass

market operations was $279.1 million, a 10.7% increase from $252.0

million for the second quarter of 2018. Table games win percentage

in mass market operations was 20.7%, above the 19.5% experienced in

the second quarter of 2018. Slot machine handle was $925.8 million,

a 3.9% decrease from $963.6 million for the second quarter of 2018.

Slot machine win increased 5.9% to $42.8 million for the second

quarter of 2019, compared to $40.4 million for the second quarter

of 2018.

Non-casino revenues from Wynn Macau were $65.3 million for the

second quarter of 2019, a 6.8% decrease from $70.0 million for the

second quarter of 2018. Room revenues were $26.5 million for the

second quarter of 2019, a 2.2% decrease from $27.1 million for the

second quarter of 2018. ADR was $281, a 3.2% increase from $272 for

the second quarter of 2018. Occupancy decreased to 98.9% for the

second quarter of 2019, from 99.4% for the same period of 2018.

REVPAR was $278, a 2.6% increase from the second quarter of

2018.

Las Vegas Operations

Operating revenues from our Las Vegas Operations were $464.1

million for the second quarter of 2019, a 5.1% increase from $441.6

million for the second quarter of 2018. Adjusted Property EBITDA

from our Las Vegas Operations was $137.4 million, a 10.7% increase

from $124.2 million for the second quarter of 2018.

Casino revenues from our Las Vegas Operations were $119.8

million for the second quarter of 2019, a 17.7% increase from

$101.7 million for the second quarter of 2018. Table games drop was

$440.8 million, a 9.2% increase from $403.7 million for the second

quarter of 2018. Table games win was $126.4 million, a 25.2%

increase from $101.0 million for the second quarter of 2018. Table

games win percentage was 28.7%, above the property’s expected range

of 22% to 26% and above the 25.0% experienced in the second quarter

of 2018. Slot machine handle was $811.6 million, a 4.3% increase

from $778.4 million for the second quarter of 2018. Slot machine

win increased 11.6% to $55.1 million, compared to $49.4 million for

the second quarter of 2018.

Non-casino revenues from our Las Vegas Operations were $344.4

million for the second quarter of 2019, a 1.3% increase from $339.8

million for the second quarter of 2018. Room revenues were $127.6

million for the second quarter of 2019, a 7.9% increase from $118.3

million for the second quarter of 2018. ADR was $333, a 6.4%

increase from $313 in the second quarter of 2018. Occupancy

increased to 90.1% for the second quarter of 2019, from 87.7% for

the second quarter of 2018. REVPAR was $300, a 9.5% increase from

$274 for the second quarter of 2018. Food and beverage revenues

decreased 3.3%, to $165.2 million for the second quarter of 2019,

compared to $170.9 million for the second quarter of 2018.

Entertainment, retail and other revenues increased 1.8%, to $51.6

million for the second quarter of 2019, compared to $50.7 million

in the second quarter of 2018.

Encore Boston Harbor

On June 23, 2019, the Company opened Encore Boston Harbor, an

integrated resort in Everett, Massachusetts. Encore Boston Harbor

features a luxury hotel tower with 671 guest rooms and suites,

approximately 210,000 square feet of casino space, 14 food and

beverage outlets, one nightclub, approximately 71,000 square feet

of meeting and convention space, approximately 7,000 square feet of

retail space, and public attractions, including a waterfront park,

floral displays, and water shuttle service to downtown Boston.

During its eight days of operations in the second quarter of 2019,

Encore Boston Harbor's operating revenues were $18.8 million and

Adjusted Property EBITDA was $0.1 million. The results of Encore

Boston Harbor are presented within Corporate and other for the

second quarter of 2019, and will be reported as a separate segment

beginning in the third quarter of 2019.

Development Projects

We are constructing an approximately 430,000 square foot meeting

and convention facility at Wynn Las Vegas and are reconfiguring the

Wynn Las Vegas golf course, which we closed in the fourth quarter

of 2017. The facility will feature approximately 217,000 square

feet of state-of-the-art meeting and convention space available for

group reservations. Based on current designs, we estimate the total

project budget to be approximately $425 million. As of June 30,

2019, we have incurred $246.6 million in total project costs. We

expect to reopen the golf course in the fourth quarter of 2019 and

open the additional meeting and convention space in the first

quarter of 2020.

Balance Sheet

Our cash and cash equivalents and restricted cash as of June 30,

2019 totaled $1.51 billion.

Total current and long-term debt outstanding at June 30, 2019

was $9.15 billion, comprised of $3.71 billion of Macau related

debt, $3.11 billion of Wynn Las Vegas debt, $983 million of Wynn

America debt, $739 million of Wynn Resorts debt, and $611 million

of debt held by the retail joint venture which we consolidate.

Conference Call and Other Information

The Company will hold a conference call to discuss its results,

including the results of Wynn Las Vegas, LLC, on August 6, 2019 at

1:30 p.m. PT (4:30 p.m. ET). Interested parties are invited to join

the call by accessing a live audio webcast at

http://www.wynnresorts.com.

On August 8, 2019, the Company will make Wynn Las Vegas, LLC

financial information for the quarter ended June 30, 2019 available

to noteholders, prospective investors, broker-dealers and

securities analysts. Please contact our investor relations office

at 702-770-7555 or at investorrelations@wynnresorts.com, to obtain

access to such financial information.

Forward-looking Statements

This release contains forward-looking statements regarding

operating trends and future results of operations. Such

forward-looking statements are subject to a number of risks and

uncertainties that could cause actual results to differ materially

from those we express in these forward-looking statements,

including, but not limited to, controversy, regulatory action,

litigation and investigations related to Stephen A. Wynn and his

separation from the Company, extensive regulation of our business,

pending or future claims and legal proceedings, ability to maintain

gaming licenses and concessions, dependence on key employees,

general global political and economic conditions, adverse tourism

trends, dependence on a limited number of resorts, competition in

the casino/hotel and resort industries, uncertainties over the

development and success of new gaming and resort properties,

construction risks, cybersecurity risk and our leverage and debt

service. Additional information concerning potential factors that

could affect the Company’s financial results is included in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2018 and the Company’s other periodic reports filed with the

Securities and Exchange Commission. The Company is under no

obligation to (and expressly disclaims any such obligation to)

update or revise its forward-looking statements as a result of new

information, future events or otherwise.

Non-GAAP Financial Measures

(1) "Adjusted net income attributable to Wynn Resorts, Limited"

is net income (loss) attributable to Wynn Resorts, Limited before

litigation settlement expense, nonrecurring regulatory expense,

pre-opening expenses, property charges and other, change in

derivatives fair value, change in Redemption Note fair value, gain

on extinguishment of debt, foreign currency remeasurement loss, net

of noncontrolling interests and income taxes calculated using the

specific tax treatment applicable to the adjustments based on their

respective jurisdictions. Adjusted net income (loss) attributable

to Wynn Resorts, Limited and adjusted net income (loss)

attributable to Wynn Resorts, Limited per diluted share are

presented as supplemental disclosures to financial measures in

accordance with GAAP because management believes that these

non-GAAP financial measures are widely used to measure the

performance, and as a principal basis for valuation, of gaming

companies. These measures are used by management and/or evaluated

by some investors, in addition to net income (loss) and earnings

per share computed in accordance with GAAP, as an additional basis

for assessing period-to-period results of our business. Adjusted

net income (loss) attributable to Wynn Resorts, Limited and

adjusted net income (loss) attributable to Wynn Resorts, Limited

per diluted share may be different from the calculation methods

used by other companies and, therefore, comparability may be

limited.

(2) "Adjusted Property EBITDA" is net income (loss) before

interest, income taxes, depreciation and amortization, litigation

settlement expense, pre-opening expenses, property charges and

other, management and license fees, corporate expenses and other,

stock-based compensation, gain on extinguishment of debt, change in

derivatives fair value, change in Redemption Note fair value and

other non-operating income and expenses. Adjusted Property EBITDA

is presented exclusively as a supplemental disclosure because

management believes that it is widely used to measure the

performance, and as a basis for valuation, of gaming companies.

Management uses Adjusted Property EBITDA as a measure of the

operating performance of its segments and to compare the operating

performance of its properties with those of its competitors, as

well as a basis for determining certain incentive compensation. The

Company also presents Adjusted Property EBITDA because it is used

by some investors to measure a company’s ability to incur and

service debt, make capital expenditures and meet working capital

requirements. Gaming companies have historically reported EBITDA as

a supplement to GAAP. In order to view the operations of their

casinos on a more stand-alone basis, gaming companies, including

Wynn Resorts, Limited, have historically excluded from their EBITDA

calculations pre-opening expenses, property charges, corporate

expenses and stock-based compensation, that do not relate to the

management of specific casino properties. However, Adjusted

Property EBITDA should not be considered as an alternative to

operating income as an indicator of the Company’s performance, as

an alternative to cash flows from operating activities as a measure

of liquidity, or as an alternative to any other measure determined

in accordance with GAAP. Unlike net income, Adjusted Property

EBITDA does not include depreciation or interest expense and

therefore does not reflect current or future capital expenditures

or the cost of capital. The Company has significant uses of cash

flows, including capital expenditures, interest payments, debt

principal repayments, income taxes and other non-recurring charges,

which are not reflected in Adjusted Property EBITDA. Also, Wynn

Resorts’ calculation of Adjusted Property EBITDA may be different

from the calculation methods used by other companies and,

therefore, comparability may be limited.

The Company has included schedules in the tables that accompany

this release that reconcile (i) net income (loss) attributable to

Wynn Resorts, Limited to adjusted net income attributable to Wynn

Resorts, Limited, (ii) operating income (loss) to Adjusted Property

EBITDA, and (iii) net income (loss) attributable to Wynn Resorts,

Limited to Adjusted Property EBITDA.

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per

share data)

(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2019

2018

2019

2018

Operating revenues:

Casino

$

1,142,503

$

1,100,027

$

2,327,604

$

2,342,166

Rooms

198,807

186,051

390,077

376,361

Food and beverage

218,022

214,867

391,241

387,089

Entertainment, retail and other

99,000

104,479

200,956

215,386

Total operating revenues

1,658,332

1,605,424

3,309,878

3,321,002

Operating expenses:

Casino

724,987

707,194

1,475,058

1,471,595

Rooms

66,148

63,675

129,854

126,872

Food and beverage

182,080

168,296

330,841

305,954

Entertainment, retail and other

43,514

46,589

87,558

94,619

General and administrative

202,224

183,631

419,546

353,216

Litigation settlement

—

—

—

463,557

Provision (benefit) for doubtful

accounts

3,581

(1,390

)

9,003

(699

)

Pre-opening

69,883

11,196

97,596

21,541

Depreciation and amortization

140,269

137,870

276,826

274,227

Property charges and other

6,930

8,791

9,704

11,842

Total operating expenses

1,439,616

1,325,852

2,835,986

3,122,724

Operating income

218,716

279,572

473,892

198,278

Other income (expense):

Interest income

6,265

6,861

13,552

14,081

Interest expense, net of amounts

capitalized

(93,149

)

(89,898

)

(186,329

)

(188,125

)

Change in derivatives fair value

(3,304

)

—

(4,813

)

—

Change in Redemption Note fair value

—

—

—

(69,331

)

Gain on extinguishment of debt

—

—

—

2,329

Other

11,715

(957

)

5,357

(10,177

)

Other income (expense), net

(78,473

)

(83,994

)

(172,233

)

(251,223

)

Income (loss) before income

taxes

140,243

195,578

301,659

(52,945

)

Benefit for income taxes

1,991

9,702

306

120,747

Net income

142,234

205,280

301,965

67,802

Less: net income attributable to

noncontrolling interests

(47,683

)

(49,524

)

(102,542

)

(116,353

)

Net income (loss) attributable to Wynn

Resorts, Limited

$

94,551

$

155,756

$

199,423

$

(48,551

)

Basic and diluted income (loss) per common

share:

Net income (loss) attributable to Wynn

Resorts, Limited:

Basic

$

0.88

$

1.44

$

1.87

$

(0.46

)

Diluted

$

0.88

$

1.44

$

1.86

$

(0.46

)

Weighted average common shares

outstanding:

Basic

106,876

107,792

106,834

105,195

Diluted

107,141

108,405

107,089

105,195

Dividends declared per common share:

$

1.00

$

0.75

$

1.75

$

1.25

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

RECONCILIATION OF NET INCOME

(LOSS) ATTRIBUTABLE TO WYNN RESORTS, LIMITED

TO ADJUSTED NET INCOME

ATTRIBUTABLE TO WYNN RESORTS, LIMITED

(in thousands, except per

share data)

(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2019

2018

2019

2018

Net income (loss) attributable to Wynn

Resorts, Limited

$

94,551

$

155,756

$

199,423

$

(48,551

)

Litigation settlement expense

—

—

—

463,557

Nonrecurring regulatory expense

—

—

35,000

—

Pre-opening expenses

69,883

11,196

97,596

21,541

Property charges and other

6,930

8,791

9,704

11,842

Change in derivatives fair value

3,304

—

4,813

—

Change in Redemption Note fair value

—

—

—

69,331

Gain on extinguishment of debt

—

—

—

(2,329

)

Foreign currency remeasurement (gain)

loss

(11,715

)

957

(5,357

)

10,177

Income tax impact on adjustments

(10,351

)

(8,558

)

(13,043

)

(117,386

)

Noncontrolling interests impact on

adjustments

1,303

(1,934

)

(1,647

)

(5,002

)

Adjusted net income attributable to

Wynn Resorts, Limited

$

153,905

$

166,208

$

326,489

$

403,180

Adjusted net income attributable to

Wynn Resorts, Limited per diluted share

$

1.44

$

1.53

$

3.05

$

3.81

Weighted average common shares outstanding

- diluted

107,141

108,405

107,089

105,812

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

RECONCILIATION OF OPERATING

INCOME (LOSS) TO ADJUSTED PROPERTY EBITDA

(in thousands)

(unaudited)

Three Months Ended June 30,

2019

Operating income

(loss)

Pre-opening expenses

Depreciation and

amortization

Property charges and

other

Management and license

fees

Corporate expenses and

other

Stock-based

compensation

Adjusted Property

EBITDA

Macau Operations:

Wynn Palace

$

76,044

$

—

$

66,227

$

(1,409

)

$

23,628

$

1,447

$

1,228

$

167,165

Wynn Macau

128,264

—

21,924

2,061

19,649

1,847

2,128

175,873

Other Macau

(3,687

)

—

1,116

2

—

2,291

278

—

Total Macau Operations

200,621

—

89,267

654

43,277

5,585

3,634

343,038

Las Vegas Operations

60,207

—

44,237

6,274

21,457

3,640

1,584

137,399

Corporate and other

(42,112

)

69,883

6,765

2

(64,734

)

26,070

4,272

146

Total

$

218,716

$

69,883

$

140,269

$

6,930

$

—

$

35,295

$

9,490

$

480,583

Three Months Ended June 30,

2018

Operating income

(loss)

Pre-opening expenses

Depreciation and

amortization

Property charges and

other

Management and license

fees

Corporate expenses and

other

Stock-based

compensation

Adjusted Property

EBITDA

Macau Operations:

Wynn Palace

$

82,501

$

—

$

64,457

$

5,633

$

23,663

$

2,020

$

991

$

179,265

Wynn Macau

126,268

—

21,604

721

20,488

2,224

1,623

172,928

Other Macau

(3,176

)

—

1,105

54

—

1,848

169

—

Total Macau Operations

205,593

—

87,166

6,408

44,151

6,092

2,783

352,193

Las Vegas Operations

51,150

2

47,579

429

20,299

3,702

996

124,157

Corporate and other

22,829

11,194

3,125

1,954

(64,450

)

19,785

5,563

—

Total

$

279,572

$

11,196

$

137,870

$

8,791

$

—

$

29,579

$

9,342

$

476,350

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

RECONCILIATION OF OPERATING

INCOME (LOSS) TO ADJUSTED PROPERTY EBITDA

(in thousands)

(unaudited)

(continued)

Six Months Ended June 30,

2019

Operating income

(loss)

Pre-opening expenses

Depreciation and

amortization

Property charges and

other

Management and license

fees

Corporate expenses and

other

Stock-based

compensation

Adjusted Property

EBITDA

Macau Operations:

Wynn Palace

$

201,835

$

—

$

132,293

$

(289

)

$

50,848

$

2,731

$

2,333

$

389,751

Wynn Macau

246,661

—

43,836

2,454

38,635

3,342

4,834

339,762

Other Macau

(6,990

)

—

2,233

8

—

4,204

545

—

Total Macau Operations

441,506

—

178,362

2,173

89,483

10,277

7,712

729,513

Las Vegas Operations

99,131

—

88,827

6,784

40,178

7,605

3,176

245,701

Corporate and other

(66,745

)

97,596

9,637

747

(129,661

)

79,962

8,610

146

Total

$

473,892

$

97,596

$

276,826

$

9,704

$

—

$

97,844

$

19,498

$

975,360

Six Months Ended June 30,

2018

Operating income

(loss)

Pre-opening expenses

Depreciation and

amortization

Property charges and

other

Management and license

fees

Corporate expenses and other

(1)

Stock-based

compensation

Adjusted Property

EBITDA

Macau Operations:

Wynn Palace

$

201,972

$

—

$

128,881

$

6,660

$

47,888

$

3,472

$

2,303

$

391,176

Wynn Macau

285,729

—

43,774

1,489

43,854

4,088

3,816

382,750

Other Macau

(7,146

)

—

2,211

63

—

4,538

334

—

Total Macau Operations

480,555

—

174,866

8,212

91,742

12,098

6,453

773,926

Las Vegas Operations

123,024

8

93,362

1,758

40,338

6,650

1,613

266,753

Corporate and other

(405,301

)

21,533

5,999

1,872

(132,080

)

499,397

8,580

—

Total

$

198,278

$

21,541

$

274,227

$

11,842

$

—

$

518,145

$

16,646

$

1,040,679

(1) Corporate expenses and other includes the litigation

settlement expense of $463.6 million in the first quarter of

2018.

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

RECONCILIATION OF NET INCOME

(LOSS) ATTRIBUTABLE TO WYNN RESORTS, LIMITED TO

ADJUSTED PROPERTY

EBITDA

(in thousands)

(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2019

2018

2019

2018

Net income (loss) attributable to Wynn

Resorts, Limited

$

94,551

$

155,756

$

199,423

$

(48,551

)

Net income attributable to noncontrolling

interests

47,683

49,524

102,542

116,353

Litigation settlement expense

—

—

—

463,557

Pre-opening expenses

69,883

11,196

97,596

21,541

Depreciation and amortization

140,269

137,870

276,826

274,227

Property charges and other

6,930

8,791

9,704

11,842

Corporate expenses and other

35,295

29,579

97,844

54,588

Stock-based compensation

9,490

9,342

19,498

16,646

Interest income

(6,265

)

(6,861

)

(13,552

)

(14,081

)

Interest expense, net of amounts

capitalized

93,149

89,898

186,329

188,125

Change in derivatives fair value

3,304

—

4,813

—

Change in Redemption Note fair value

—

—

—

69,331

Gain on extinguishment of debt

—

—

—

(2,329

)

Other

(11,715

)

957

(5,357

)

10,177

Benefit for income taxes

(1,991

)

(9,702

)

(306

)

(120,747

)

Adjusted Property EBITDA

$

480,583

$

476,350

$

975,360

$

1,040,679

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

SUPPLEMENTAL DATA

SCHEDULE

(dollars in thousands, except

for win per unit per day, ADR and REVPAR)

(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2019

2018

2019

2018

Macau Operations:

Wynn Palace:

VIP:

Average number of table games

112

115

112

115

VIP turnover

$

13,388,646

$

14,029,065

$

26,015,909

$

29,414,898

VIP table games win (1)

$

404,408

$

420,181

$

897,592

$

820,072

VIP table games win as a % of turnover

3.02

%

3.00

%

3.45

%

2.79

%

Table games win per unit per day

$

39,827

$

40,036

$

44,464

$

39,289

Mass market:

Average number of table games

214

211

212

211

Table drop (2)

$

1,267,153

$

1,218,863

$

2,571,076

$

2,436,064

Table games win (1)

$

296,852

$

280,568

$

612,320

$

590,728

Table games win %

23.4

%

23.0

%

23.8

%

24.2

%

Table games win per unit per day

$

15,232

$

14,632

$

15,929

$

15,482

Average number of slot machines

1,099

1,069

1,095

1,065

Slot machine handle

$

937,842

$

940,972

$

1,912,890

$

1,999,068

Slot machine win (3)

$

43,567

$

44,164

$

94,968

$

99,949

Slot machine win per unit per day

$

436

$

454

$

479

$

518

Room statistics:

Occupancy

97.4

%

96.2

%

97.3

%

96.5

%

ADR (4)

$

265

$

254

$

268

$

253

REVPAR (5)

$

258

$

245

$

261

$

244

Wynn Macau:

VIP:

Average number of table games

110

112

111

113

VIP turnover

$

9,275,628

$

13,928,463

$

19,469,660

$

31,015,918

VIP table games win (1)

$

305,809

$

357,166

$

601,107

$

802,355

VIP table games win as a % of turnover

3.30

%

2.56

%

3.09

%

2.59

%

Table games win per unit per day

$

30,560

$

35,044

$

29,824

$

39,295

Mass market:

Average number of table games

205

204

206

203

Table drop (2)

$

1,347,435

$

1,293,154

$

2,699,128

$

2,615,969

Table games win (1)

$

279,127

$

252,038

$

543,669

$

508,519

Table games win %

20.7

%

19.5

%

20.1

%

19.4

%

Table games win per unit per day

$

14,929

$

13,577

$

14,608

$

13,808

Average number of slot machines

827

922

827

930

Slot machine handle

$

925,784

$

963,635

$

1,720,151

$

1,966,454

Slot machine win (3)

$

42,815

$

40,426

$

80,709

$

82,191

Slot machine win per unit per day

$

569

$

482

$

539

$

488

Room statistics:

Occupancy

98.9

%

99.4

%

99.1

%

99.2

%

ADR (4)

$

281

$

272

$

285

$

282

REVPAR (5)

$

278

$

271

$

283

$

279

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

SUPPLEMENTAL DATA

SCHEDULE

(dollars in thousands, except

for win per unit per day, ADR and REVPAR)

(unaudited)

(continued)

Three Months Ended June

30,

Six Months Ended June

30,

2019

2018

2019

2018

Las Vegas Operations:

Average number of table games

238

236

238

237

Table drop (2)

$

440,766

$

403,730

$

844,839

$

940,311

Table games win (1)

$

126,395

$

100,987

$

237,765

$

255,420

Table games win %

28.7

%

25.0

%

28.1

%

27.2

%

Table games win per unit per day

$

5,832

$

4,694

$

5,517

$

5,950

Average number of slot machines

1,789

1,820

1,798

1,825

Slot machine handle

$

811,639

$

778,447

$

1,600,949

$

1,522,580

Slot machine win (3)

$

55,128

$

49,418

$

109,672

$

98,681

Slot machine win per unit per day

$

339

$

298

$

337

$

299

Room statistics:

Occupancy

90.1

%

87.7

%

86.3

%

85.8

%

ADR (4)

$

333

$

313

$

335

$

326

REVPAR (5)

$

300

$

274

$

290

$

280

(1) Table games win is shown before discounts, commissions and

the allocation of casino revenues to rooms, food and beverage and

other revenues for services provided to casino customers on a

complimentary basis.

(2) In Macau, table drop is the amount of cash that is deposited

in a gaming table’s drop box plus cash chips purchased at the

casino cage. In Las Vegas, table drop is the amount of cash and net

markers issued that are deposited in a gaming table’s drop box.

(3) Slot machine win is calculated as gross slot machine win

minus progressive accruals and free play.

(4) ADR is average daily rate and is calculated by dividing

total room revenues including complimentaries (less service

charges, if any) by total rooms occupied.

(5) REVPAR is revenue per available room and is calculated by

dividing total room revenues including complimentaries (less

service charges, if any) by total rooms available.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190806005825/en/

Vincent Zahn 702-770-7555 investorrelations@wynnresorts.com

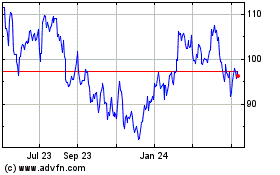

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Apr 2023 to Apr 2024