By Mike Cherney in Sydney, Ese Erheriene in Hong Kong and Colin Kellaher in New York

Wynn Resorts Ltd. on Tuesday said it has walked away from talks

on a potential deal with Crown Resorts Ltd., citing the Australian

company's premature disclosure of the discussions.

Crown said earlier Tuesday that the Las Vegas gaming giant made

a takeover offer worth about 10 billion Australian dollars (US$7.1

billion), at A$14.75 a share.

Wynn later confirmed in a filing with the U.S. Securities and

Exchange Commission that it was holding talks with Crown on a

potential transaction, but it cautioned that no agreement has been

reached on the structure, value or terms of a deal.

But less than four hours later, Wynn said there will be no

deal.

"Following the premature disclosure of preliminary discussions,

Wynn Resorts has terminated all discussions with Crown Resorts

concerning any transaction," the company said in a one-sentence

statement.

Crown shares surged 19.7% to close at A$14.05 in Australia on

Tuesday.

Shares of Wynn slipped 3.9%, to $139.20, in early U.S. trading

Tuesday.

Article published earlier this morning, will update:

Wynn Resorts Ltd.'s $7.1 billion offer for Australia's Crown

Resorts Ltd. would give the Las Vegas giant a foothold in more

international markets, underscoring casino operators' efforts to

expand beyond the traditional gambling hub of Macau to attract

Asia's lucrative high-rollers.

Wynn currently runs casinos only in the U.S. and Macau, the

semiautonomous Chinese city that is the epicenter of the global

gambling industry. Analysts said entering the Australian market

would complement Wynn's existing business, offering another option

for the company's VIP customers as concerns persist that gambling

spending in Macau could fall owing to a Chinese economic

slowdown.

Macau casinos generate more than five times the annual revenue

of those in Las Vegas. The contribution from high-rollers to global

gambling sits at around 50%, according to data from Union Gaming,

an investment bank focused on the gambling sector. That figure has

trended lower since 2011, when VIP players accounted for roughly

three-quarters of revenue.

A tie-up with Crown would give Wynn properties in Melbourne,

Perth and London, plus a waterfront casino and hotel under

development in Sydney that will cater to VIPs. Crown's properties

offer high-quality, stable cash flows and, in Melbourne and Perth,

have the added benefit of being a regulated monopoly, said Graeme

Ferguson, an analyst at S&P Global Ratings.

"It's not surprising to see consolidation being considered by

major players," Mr. Ferguson said. "Mergers have been happening in

the past few years driven by slow growth and limited new

development opportunities."

Wynn's offer, disclosed Tuesday morning Sydney time, values

Crown at 14.75 Australian dollars (US$10.51) a share, a 26% premium

over Monday's closing price. Crown shareholders would receive 50%

of that amount in cash and 50% in Wynn shares. Discussions are at a

preliminary stage and there is no certainty a deal will be reached,

Crown said.

Crown shares jumped about 20% on Tuesday, closing at

A$14.05.

Wynn confirmed in a regulatory filing that it is in preliminary

discussions with Crown.

Wynn Resorts executives were surprised Crown had revealed that

they were in talks, as Wynn hadn't been ready to do so, said a

person familiar with the matter at subsidiary Wynn Macau.

Company founder Steve Wynn stepped down from Wynn Resorts last

year after a Wall Street Journal investigation detailing

sexual-misconduct allegations about him. An investigation by

Massachusetts regulators revealed last week that Wynn executives

ran a sophisticated coverup to protect Mr. Wynn from the

allegations. Mr. Wynn has said the idea that he ever assaulted a

woman was preposterous.

David Green, a former casino executive turned founder of Newpage

Consulting, said a Crown deal would ensure Wynn is able to expand

regardless of the outcome of regulatory proceedings in

Massachusetts. Wynn plans to open a $2.6 billion resort there in

June, but regulators are reviewing whether it is still suitable for

the company to hold a license following the allegations against Mr.

Wynn.

"Wynn are hedging their bets," Mr. Green said. The Crown deal

would help the company "get a set of assets for not a huge

premium."

China has been at the center of a broader boom in Australian

tourism, which has also benefited casinos. Last year, China

overtook New Zealand to become Australia's largest source of

visitors, according to official data. Tourism Research Australia

expects 11.9% annual growth in Chinese visitors over the next 10

years.

A deal for Crown, if it advances, still holds risks. Before

Tuesday's announcement, Crown shares were down about 20% from their

recent highs, reflecting concerns about main-floor gambling

revenue, the company's efforts to rebuild its VIP business after

employees in China were arrested and sentenced for gambling-related

crimes, and the progress of the new developments in Australia.

In February, Crown Chief Financial Officer Kenneth Barton told

investors on a conference call that high-end visitors to the

company's Melbourne property were being cautious about spending.

Overall, Crown said high-roller spending fell 12% in the six months

ended in December.

"The people at the premium end have been still coming to the

property in broadly the same numbers but spending less," Mr. Barton

said, according to a transcript. "We've seen that also with our VIP

customers at the top end as well. And anecdotally, we've seen

casual restaurants do better than premium restaurants."

Still, some Wynn shareholders cheered the proposed deal. Trip

Miller, managing partner of Gullane Capital Partners, which has 18%

of its $70 million in assets invested in Wynn, said a move into

Australia could serve as a steppingstone to Japan, which recently

legalized casino gambling.

"Crown has a lot of cash and a pretty solid balance sheet and

that would serve Wynn pretty well as they continue to grow," Mr.

Miller said.

Crown's largest shareholder is an investment firm tied to

billionaire James Packer that has a roughly 47% stake. In recent

years, Mr. Packer has debated spinning off parts of the company or

taking it private. Following the arrests of Crown's employees in

China, the company sold off many of its overseas assets to focus on

its Australian operations.

As the threat from online gambling has grown, some casino

companies have shifted focus to travel destinations that are less

reliant on gambling. Crown's Australian rival, Star Entertainment

Group Ltd., is helping to build a casino and resort complex in

Brisbane, which is about a 90-minute flight from Sydney.

Some bankers have said the casino industry is ripe for

deal-making as casinos look to diversify their offerings, improve

margins and lower costs. Just last month Delaware North Cos., based

in Buffalo, N.Y., won regulatory approval to buy a casino in

Darwin, in Australia's Northern Territory. And in February, The

Wall Street Journal reported that billionaire activist investor

Carl Icahn owned a stake in Caesars Entertainment Corp. and planned

to push the casino operator to consider selling itself.

Write to Mike Cherney at mike.cherney@wsj.com, Ese Erheriene at

ese.erheriene@wsj.com and Colin Kellaher at

colin.kellaher@wsj.com

(END) Dow Jones Newswires

April 09, 2019 10:26 ET (14:26 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

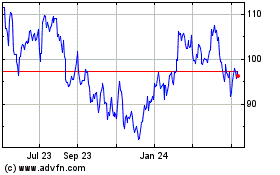

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Apr 2023 to Apr 2024