1 Subordinated Notes Offering Investor Presentation June 6, 2022 DRAFT – 6/03 Dated June 6, 2022 Filed Pursuant to Rule 433 Registration No. 333 - 236740 Supplementing the Preliminary Prospectus Supplement dated June 6, 2022 (to Prospectus dated February 28, 2020)

2 Forward Looking Statements This presentation may contain various statements about West Bancorporation, Inc . (“WTBA,” the “Company,” “we,” “our,” or “us”) that constitute “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “projects,” “anticipates,” “intends,” “estimates,” “plans,” “potential,” “possible,” “may increase,” “may fluctuate,” “will likely result,” and similar expressions, or future or conditional verbs such as “will,” “should,” “would” and “could,” are generally forward - looking in nature and not historical facts . Forward - looking statements include information about our future financial performance, business strategy, projected plans and objectives and are based on the current beliefs and expectations of management . We believe these forward - looking statements are reasonable, but they are all inherently subject to significant business, economic and competitive risks and uncertainties, many of which are beyond our control . In addition, these forward - looking statements are subject to assumptions about future business strategies and decisions that are subject to change . Actual results may differ from those indicated or implied in the forward - looking statements ; such differences may be material . Prospective investors are cautioned that any forward - looking statements are not guarantees of future performance and involve risks and uncertainties . Investors should not place undue reliance on these forward - looking statements, which speak only as of the date they are made . Important factors currently known to us that could cause actual results to differ materially from those in forward - looking statements include the following : ( i ) the effects of the COVID - 19 pandemic, including its potential effects on the economic environment, our customers and our operations, including due to supply chain disruptions, as well as any changes to federal, state or local government laws, regulations or orders in connection with the pandemic ; (ii) interest rate risk ; (iii) competitive pressures, including from non - bank competitors such as "fintech" companies ; (iv) pricing pressures on loans and deposits ; (v) changes in credit and other risks posed by the Company’s loan and investment portfolios, including declines in commercial or residential real estate values or changes in the allowance for loan losses dictated by new market conditions, accounting standards (including as a result of the future implementation of the current expected credit loss (CECL) accounting standard) or regulatory requirements ; (vi) changes in local, national and international economic conditions, including rising rates of inflation ; (vii) changes in legal and regulatory requirements, limitations and costs ; (viii) changes in customers’ acceptance of the Company’s products and services ; (ix) cyber - attacks ; (x) unexpected outcomes of existing or new litigation involving the Company ; (xi) the monetary, trade and other regulatory policies of the U . S . government, including anticipated rate increases ; (xii) acts of war or terrorism, including the Russian invasion of Ukraine, widespread disease or pandemics, such as the COVID - 19 pandemic, or other adverse external events ; (xiii) developments and uncertainty related to the future use and availability of some reference rates, such as the London Interbank Offered Rate, as well as other alternative reference rates ; (xiv) changes to U . S . tax laws, regulations and guidance ; (xv) liquidity risk due to excess liquidity at the Company’s bank subsidiary ; and (xvi) talent and labor shortages . Management believes that the assumptions underlying our forward - looking statements are reasonable, but any of the assumptions could prove to be inaccurate . Investors are urged to carefully consider the risks described in the Company’s filings with the Securities and Exchange Commission (“SEC”) from time to time, which are available at www . westbankstrong . com and the SEC’s website at www . sec . gov . We undertake no obligation, and specifically disclaim any obligation, to update or revise our forward - looking statements, whether as a result of new information or to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, except as required by federal securities laws .

3 Disclaimers Non - GAAP Financial Information In addition to the results presented in accordance with U . S . General Accepted Accounting Principles (“GAAP”), the Company routinely supplements its evaluation with an analysis of certain non - GAAP financial measures . The Company believes these non - GAAP financial measures, in addition to the related GAAP measures, provide meaningful information to investors to help them understand the Company’s operating performance and trends, and to facilitate comparisons with the performance of peers . These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non - GAAP performance measures that may be presented by other companies . Reconciliations of these non - GAAP financial measures to the most directly comparable GAAP financial measures are included in the Appendix at the end of this presentation on the slides captioned “Reconciliation of Non - GAAP Disclosures . ” None of the non - GAAP financial information that we have included in this presentation is intended to be considered in isolation or as a substitute for any measure prepared in accordance with GAAP . Investors should note that, because there are no standardized definitions for the calculations as well as the results, our calculations may not be comparable to similarly - titled measures presented by other companies . Also, there may be limits in the usefulness of these measures to investors . As a result, we encourage readers to consider our consolidated financial statements in their entirety and not to rely on any single financial measure . No Offer or Solicitation This presentation shall not constitute an offer to sell, or the solicitation of an offer to buy, securities, nor shall there be any offer or sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful . Neither the SEC nor any other regulatory body has approved or disapproved of the securities of the Company or passed upon the accuracy or adequacy of this presentation . Any representation to the contrary is a criminal offense . Except as otherwise indicated, this presentation speaks as to the date hereof . The delivery of this presentation shall not, under any circumstances, create any implication that there has been no change in the affairs of the Company after the date hereof . Registration Statement The Company has filed a registration statement (File No . 333 - 236740 ) (including a base prospectus) and related preliminary prospectus supplement dated June 6 , 2022 with the SEC for the offering to which this communication relates . Before you invest, you should read the prospectus in that registration statement, the related prospectus supplement and other documents that we have filed with the SEC for more complete information about the Company and this offering . You may get these documents for free by visiting the SEC’s website at www . sec . gov . Alternatively, we, the underwriters or any dealers participating in the offering will arrange to send you the base prospectus and the related preliminary prospectus supplement if you request it by calling Piper Sandler & Co . toll free at ( 866 ) 805 - 4128 or emailing fsg - dcm@psc . com . Securities Not FDIC - Insured The securities referenced in this presentation are not savings or deposit accounts and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency or instrumentality .

4 Issuer • West Bancorporation, Inc. (NASDAQ: WTBA) Terms of the Proposed Offering Offering Type • SEC Registered Term / Maturity • 10 years / 2032 Offering Size • $60.0 Million Denomination • $1,000 Redemption • 5 year non - call period, callable at par thereafter Coupon Structure • 5 year fixed rate, 5 year floating rate Covenants • Consistent with regulatory requirements for Tier 2 Capital Use of Proceeds • General corporate purposes, including providing capital to support organic growth and for investing in the Bank as regulatory capital Rating ¹ • Egan - Jones: BBB+ (1) A rating is not a recommendation to buy, sell or hold securities. Ratings may be subject to revision or withdrawal at any time by the assigning rating organization. Each rating agency has its own methodology for assigning ratings and, accordingly, each rating should be evaluated independently of any other rating Sole Book Running Manager • Security • Subordinated Notes

5 Summary Financial Highlights (Q1 2022) Branch Map • West Bancorporation, Inc . is a publicly - traded financial holding company (NASDAQ : WTBA) established in 1984 whose sole subsidiary is West Bank, which was founded in 1893 • WTBA is one of the strongest performing companies in U . S . community banking, well - versed in providing commercial banking services, including loans and lines of credit and all types of deposit services, to small and medium - sized businesses in its Iowa and Minnesota markets • One of the Company’s key competitive advantages is its client - centric approach to delivering strategic financial solutions for businesses, driven by the establishment of deep customer relationships and extensive experience in its markets • Total Assets: $3.5 billion • Gross Loans: $2.5 billion • Total Deposits: $3.1 billion • Total Equity: $236 million • Market Capitalization: $413 million • Return on Avg. Assets: 1.51% • Return on Avg. Equity: 20.96% • Net Interest Margin: 1 2.85% • Efficiency Ratio: 1 40.14% • NP As / Assets: 0.25% • Total RBC Ratio: 10.72% Note: Financial data as of or for the quarter ended March 31, 2022; market data as of June 3, 2022 (1) Presented on an FTE basis; see Appendix for “Reconciliation of Non - GAAP Financial Measures Overview of West Bancorporation, Inc. (WTBA) WTBA (11 branches) Minneapolis Owatonna Mankato

6 Corporate History Herman & Anna Raaz establish First Valley Junction Savings Bank which eventually becomes West Bank West Bancorporation, Inc. is formed as the holding company of West Bank West Bancorporation, Inc. stock listed on the NASDAQ exchange West Bank builds permanent office building in Rochester, MN Newly constructed St. Cloud, MN building opens; WTBA announces plans to build new headquarters in West Des Moines WTBA expands into the Iowa City and Coralville, IA Markets WTBA enters the Rochester, MN Market WTBA expands into the St. Cloud, Mankato and Owatonna MN Markets 1893 1984 2002 2003 2013 2016 2019 2022

7 Meticulous Growth Strategy with Efficient Operations • Conservative yet opportunistic growth strategy, driven by a combination of ongoing organic loan and core deposit growth from existing footprint • Highly selective new branch development using team lift - outs in their Minnesota markets • Utilizes management’s deep regional expertise in Iowa and Minnesota to partner with the right people • Employs a branch - lite structure in their expansion markets to obtain quick branch level profitability Investment Highlights Impressive Growth in Minnesota • Achieved a positive run rate in less than one year in each expansion market • Since entering the Minnesota market in 2019, WTBA’s Minnesota loans have increased to $398.8 million at March 31, 2022 Attractive Franchise with Impressive Returns and Clean Credit Quality • Long standing and highly respected franchise in Iowa, with a long track record of growth and stability coupled with attractive financial returns • Continues as one of the highest performing and most efficient community banks in its markets, with the rare combination of impressive growth and returns • Disciplined business model highlighted by focus on risk management

8 Market Branch Dep. In Dep. / Dep. Percent 2022 2010-2022 2022-2027 2022 2022-2027 Rank Count Market Branch Market of Dep. Total Pop. Pop. ∆ Proj. Pop. ∆ Median Proj. HH MSA (#) (#) ($MM) ($MM) Share (%) (%) (000s) (%) (%) HH Inc. ($) Inc. ∆ ( %) Des Moines-West Des Moines, IA 4 7 ¹ 2,190 313 8.2 77.5 728.7 20.1 5.0 75,962 7.2 Iowa City, IA 4 1 373 373 6.7 13.2 180.0 18.0 4.9 72,888 12.9 Rochester, MN 14 1 134 134 1.9 4.7 227.6 10.0 4.0 86,743 13.0 St. Cloud, MN 16 1 117 117 1.7 4.1 205.9 8.9 3.9 71,308 10.7 Steele (Owatonna), MN ² 13 1 8 8 0.8 0.3 37.0 1.1 1.8 75,175 11.1 Mankato, MN 20 1 6 6 0.2 0.2 104.5 8.0 3.7 70,410 9.0 WTBA Totals / Weighted Averages 12 2,828 236 100.0 1,483.7 18.8 4.9 75,859 8.4 National Aggregates 334,279.7 8.3 3.2 72,465 12.1 Demographic InformationJune 30, 2021 WTBA Deposit Market Share Position Des Moines - West Des Moines, IA Iowa City, IA • Founded in 1893, West Bank is the oldest business in West Des Moines, IA • Major center for the insurance industry as well as a sizable financial services base • Strong markets with a diverse mix of employers and an unemployment rate of 3.1% ³ • The economy is based on a thriving local commerce, a major university, and a number of national and international businesses • It is the education, health care and tech capital of Iowa and is consistently ranked in the top places to live in U.S. by various magazines • Low unemployment rate of 2.6% ³ Note: Demographic information is estimated per Claritas ; deposit market share information as of June 30, 2021 and per FDIC (1) WTBA closed one branch in the Des Moines - West Des Moines, IA MSA in May of 2022 (2) Non - MSA County (3) As of March 31, 2022; Source: U.S. Bureau of Labor Statistics Source: S&P Global Market Intelligence Market Overview

9 St. Cloud, MN Owatonna, MN Mankato, MN • WTBA finished the construction of its St. Cloud building in April of 2022 • St. Cloud is in a central location in the State with an economy based on manufacturing, agriculture, national and international industry, and a vibrant urban center with a strong mix of retail sales, restaurants and services • Low unemployment rate of 3.0% ³ • WTBA opened its Owatonna branch in May of 2019 • Owatonna is the economic center of Southern Minnesota • Federated Insurance and Viracon are the largest employers of Owatonna, both of which are headquartered in Owatonna • Low unemployment rate of 2.5 % ³ • WTBA opened its Mankato branch in May of 2019 • Healthcare, education, the retail/hospitality industry and agriculture are major players in the local economy and continue to contribute to its stability and diversity • Low unemployment rate of 2.2% ³ 1) Source: Minnesota Department of Employment and Economic Development 2) Demographic information is estimated per Claritas 3) As of March 31, 2022; Source: U.S. Bureau of Labor Statistics Source: S&P Global Market Intelligence per FDIC Market Overview (cont.) Rochester, MN • Rochester is known for being the home of the Mayo Clinic, providing approximately 35,000 jobs to the local community ¹ • The median household income is $86,743 ² • Low unemployment rate of 2.4% ³

10 Harlee Olafson EVP & Chief Risk Officer Harlee Olafson joined West Bank in August 2010 as Chief Risk Officer and has over 40 years experience in the financial services industry. He was previously Area Business Banking Manager for Wells Fargo in Southern, Minnesota. He has also served as Bank President in Mankato, Minnesota as well as Lead President of the Wells Fargo Southern Minnesota Group. Experienced Management Team Dave Nelson President & Chief Executive Officer David D. Nelson has served as a Director of West Bank since 2010. Mr. Nelson joined the Company on April1, 2010, as Chief Executive Officer and President and as Chairman and Chief Executive Officer of West Bank. Mr. Nelson has more than 35 years of experience in commercial banking. Nelson has an MBA from Drake University and has been very active throughout his career in various roles with our industry’s trade associations at both the State and Federal levels. Prior to joining the Company, he was the President of Southeast Minnesota Business Banking and President of Wells Fargo Bank Rochester in Rochester, Minnesota for 15 years. While in Rochester Nelson was awarded the Mayor’s Medal of Honor for community leadership. Prior to Rochester, Nelson was a Commercial Banker in Mankato, Minnesota for 10 years. He has strong backgrounds in customer relationship building, credit and leadership development. He currently serves as a Board member of the American Bankers Association. Jane Funk EVP, Treasurer & Chief Financial Officer Ms. Funk is Executive Vice President, Treasurer and Chief Financial Officer of the Company and Director, Executive Vice President and Chief Financial officer of West Bank. Ms. Funk joined West Bank in 2014 and has over 30 years of combined experience in the financial services industry and public accounting. Ms. Funk is a CPA and a member of the Iowa Society of Certified Public Accountants and the American Institute of Certified Public Accountants. Ms. Funk currently serves on the West Bank women's leadership committee, Women's Impact Network. She also serves on the Board of Directors of the Des Moines Pastoral Counseling Center.

11 Experienced Management Team (cont.) Brad Peters EVP; Minnesota Group President, West Bank Mr. Peters is Executive Vice President of the Company and Executive Vice President and Minnesota Group President of West Bank. He joined West Bank in 2019 with over 30 years of experience in commercial banking. He was previously the Executive Vice President / Group President at Bremer Bank where he was responsible for new market expansion and oversight of the South Central Minnesota, Southeast Minnesota, Twin Cities and Wisconsin regions. Mr. Peters currently serves on the Minnesota State University College of Business Advisory Council. Brad Winterbottom EVP; President, West Bank Mr. Winterbottom is Executive Vice President of the Company and President of West Bank. He has served as a Director of the Bank since 2000. Mr. Winterbottom joined the Bank in 1992 and has served as an executive and policy marker since 1998. Mr. Winterbottom has more than 40 years of experience in commercial banking. He currently serves on the Blank Childrens Hospital Board (past chair), Ellipsis Executive Board (past chair), Community Bankers of Iowa Board (past chair), and is the Honorary Chairman of Variety, the Children's Charity. Todd Mather SVP; Chief Credit Officer, West Bank Mr. Mather serves as Vice President and Chief Credit Officer for West Bank. He joined West Bank in 2019. Prior to West Bank, he spent 8 years at Bremer Bank as a Senior Credit Director and Group Senior Credit Manager. Mr. Mathers also spent 14 years at Wells Fargo in various commercial banking roles.

12 Business Line Overview (1) As of March 31, 2022 • Commercial real estate lending • Construction and development financing • Commercial and industrial lending • Letters of credit • Full suite of deposit and treasury management services Business and Commercial Banking • Estate administration • Conservatorships • Personal trusts • Charitable trusts • Agency accounts • Trust assets under management and custody of $472 million 1 Investment Management and Trust Services • Online and mobile delivery channels • Full suite of personal checking and savings options • Home equity lines of credit • Mortgage lending • Credit cards • Personal loans Personal Banking Product Offerings

13 90.9% 96.4% 84.4% 81.4% 80.4% 0% 20% 40% 60% 80% 100% 2018 2019 2020 2021 2022Q1 Gross Loans / Deposits (%) $1,722 $1,942 $2,281 $2,456 $2,485 4.61% 4.77% 4.24% 4.13% 3.88% $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 2018 2019 2020 2021 2022Q1 Loans HFI ($MM) Yield on Loans (%) $2,297 $2,474 $3,186 $3,500 $3,547 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 2018 2019 2020 2021 2022Q1 Total Assets ($MM) $1,895 $2,015 $2,701 $3,016 $3,091 0.92% 1.28% 0.50% 0.28% 0.28% $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 2018 2019 2020 2021 2022Q1 Total Deposits ($MM) Cost of Deposits (%) Total Assets Loans HFI Total Deposits Gross Loans / Deposits Balance Sheet Metrics Note: Dollars in millions

14 15.68% 14.34% 15.49% 20.33% 20.96% 10.98% 11.41% 9.57% 11.74% 10.59% 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 2018 2019 2020 2021 2022Q1 WTBA ROAE (%) Peer ROAE (%) 1.31% 1.20% 1.19% 1.52% 1.51% 1.19% 1.38% 1.17% 1.21% 1.21% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 2018 2019 2020 2021 2022Q1 WTBA ROAA (%) Peer ROAA (%) 48.3% 51.0% 42.0% 40.9% 40.1% 58.3% 57.5% 56.3% 57.6% 60.6% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 2018 2019 2020 2021 2022Q1 WTBA Efficiency Ratio (%) Peer Efficiency Ratio (%) 3.06% 2.95% 3.20% 3.05% 2.85% 3.78% 3.76% 3.40% 3.37% 3.23% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 2018 2019 2020 2021 2022Q1 WTBA Net Interest Margin (%) Peer Net Interest Margin (%) Return on Average Assets Net Interest Margin 1 Return on Average Equity Efficiency Ratio 1 Earnings and Profitability Note: WTBA peer medians; peer group as defined in Proxy Statement filed March 10, 2022, excluding merger targets: NCBS, PEBO, GABC, FMBH, MOFG, CFB, FMCB, MBWM, THFF, EQBK, FMNB, HBIA, SMBC, CIVB, MCBC, BFC, FBIZ, ISBA, and LCNB; Financial data as of March 31, 2022 (1) Presented on an FTE basis; see Appendix for “Reconciliation of Non - GAAP Financial Measures”

15 $34,992 $38,406 $39,054 $43,380 $42,648 1.61% 1.61% 1.43% 1.33% 1.22% $0 $10,000 $20,000 $30,000 $40,000 $50,000 2018 2019 2020 2021 2022Q1 Annualized Compensation & Benefits ($000) Occupancy ($000) Other Noninterest Expense ($000) Noninterest Expense / Avg. Assets (%) $7,752 $8,318 $9,602 $9,729 $9,556 0.36% 0.35% 0.35% 0.30% 0.27% $0 $2,000 $4,000 $6,000 $8,000 $10,000 2018 2019 2020 2021 2022Q1 Annualized Trust Revenue ($000) Service Charges on Deposits ($000) Other Noninterest Income ($000) Noninterest Income / Avg. Assets (%) Noninterest Income Noninterest Expense Noninterest Income and Noninterest Expense Note: Dollars in thousands; financial data as of March 31, 2022 (1) Presented on an FTE basis; see Appendix for “Reconciliation of Non - GAAP Financial Measures” • Other noninterest income includes debit card usage fees, BOLI income and loan swap fees • Other noninterest expense includes software costs, FDIC insurance, professional fees and directors fees • Focused on controlling noninterest expenses and have obtained a MRQ efficiency ratio of 40.1% ¹

16 • Legal lending limit of $54.3 million • No subprime lending • No specialty or niche lending • Loan participations make up less than 2.5% of the loan portfolio • Disciplined underwriting • Experienced loan committee • Banker’s compensation is not tied to the size of their portfolio, but the development of strong, comprehensive relationships Note: As of March 31, 2022 Strong Underwriting Risk Management Practices Quarterly Semi - Annually Annually • Stress tests for LTV and DSC • 80% of loan portfolio value is reviewed by external, independent 3 rd party • Formal internal reviews conducted by the credit department of all credit relationships over $1.0 million Credit Culture Overview

17 1-4 Family $75,191 Multifamily 302,407 Owner-Occupied RE 311,005 Construction & Development 388,424 Non Owner-Occupied RE 941,589 Commercial & Industrial 466,874 Consumer & Other 4,068 Gross Loans & Leases $2,489,558 1 - 4 Family , 3.0% Multifamily , 12.2% Owner - Occupied RE , 12.5% Construction & Development , 15.6% Non Owner - Occupied RE , 37.9% Commercial & Industrial , 18.8% Consumer & Other , 0.2% Note: Dollars in thousands; as of March 31, 2022 1) Amounts do not include unamortized fees and costs of approximately 4.2 million Loan Composition ¹ Loan Portfolio Overview Loan Portfolio: Overview • Focused on small and medium sized business • Over 90 % of loan collateral is located in Iowa and Minnesota • Loans outside of Iowa and Minnesota are to borrowers who have a primary business presence in our primary market areas • C&I portfolio is well diversified by industry – Top 4 industries are Manufacturing, Construction Services, Transportation and Equipment / Vehicle Sales – Average C&I loan balance is $ 369 thousand – No substandard or impaired C&I loans – Watch classified C&I loans total $ 259 thousand (one loan) • Portfolio has strong primary borrowers with consistent global cash flows or liquidity

18 Note: Data as of March 31, 2022 Loan Portfolio: CRE and C&D Portfolio Details • CRE / Bank Level RBC ratio: 444.3% • The four largest CRE concentration types include multifamily, warehouse, hotels and office and have average WALTVs of 55% - 68% and DSC ratios of 1.20 to 2.25 • Predominately strong global cash flows • Solid monitoring procedures in place CRE Composition C&D Composition • C&D / Bank Level RBC ratio: 105.0% • C&D WALTV: 63% • Full time employee who performs monthly inspections • Independent monthly inspections on larger commercial projects • Approximately 72% of the portfolio is in commercial properties • Approximately 28% of the portfolio in residential properties • Strong, experienced customer base that is well capitalized Multi - Family Dwelling (5+ units) , 19.6% Warehouse and Mini - Storage , 14.1% Hotel , 11.9% Office (includes strip offices) , 9.6% Medical / Dental / Nursing Home , 7.1% Mixed Use (Multi - story, with residential units, plus retail and/or commercial) , 6.0% Retail - Stand Alone , 5.6% Retail - Strip , 5.0% Independent Senior Living , 4.5% Convenience Stores , 3.8% Manufacturing Plant , 2.7% Auto Dealers , 2.1% Fitness Centers , 1.4% Restaurants & Bars , 1.2% Other , 5.4%

19 ($509) $54 ($201) ($428) ($9) (0.03)% 0.00 % (0.01)% (0.02)% (0.00)% 2018 2019 2020 2021 2022Q1 WTBA NCOs (Recoveries) ($000) WTBA NCOs / Average Loans (%) • Conservative underwriting continues to result in pristine credit quality performance • No loans greater than 30 days past due for the past 3 quarter - ends • Loan ratings as of March 31, 2022: – Pass: 97.2% – Watch: 2.4% – Substandard: 0.4% • All COVID - 19 loan modifications and deferrals expired in 2021 • The Company had $9.4 million of PPP loans loans outstanding as of March 31, 2022 which represents 0.38% of gross loans • The Company will adopt CECL beginning on January 1, 2023 $1,928 $538 $16,194 $8,948 $8,800 0.08% 0.02% 0.51% 0.26% 0.25% 2018 2019 2020 2021 2022Q1 WTBA NPAs ($000) WTBA NPAs / Assets (%) $16,689 $17,235 $29,436 $28,364 $27,623 0.97% 0.89% 1.29% 1.15% 1.11% 2018 2019 2020 2021 2022Q1 WTBA Reserves ($000) WTBA Reserves / Loans (%) Non - Performing Assets 1 Net Charge - Offs (Recoveries) Additional Loan and Credit Information Note: Dollars in thousands (1) NPAs defined as Nonaccrual Loans + TDR + OREO Credit Quality Loan Loss Reserves

20 0.92% 1.28% 0.50% 0.28% 0.28% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 2018 2019 2020 2021 2022Q1 Cost of Deposits (%) Deposit Portfolio Deposit Composition Cost of Total Deposits Additional Deposit Information Note: Dollars in thousands; as of March 31, 2022 (1) Core deposits equates to total deposits less brokered deposits Non-Interest Bearing Demand $710,697 Transaction Accounts 554,235 MMDA & Savings 1,632,690 Time Deposits < $250K 147,144 Time Deposits > $250K 46,486 Total Deposits $3,091,252 Non - Interest Bearing Demand , 23.0% Transaction Accounts , 17.9% MMDA & Savings , 52.8% Time Deposits < $250K , 4.8% Time Deposits > $250K , 1.5% • Intensely loyal customer base with long standing relationships • Core deposits / total deposits: 96.2% ¹ • Brokered deposits / total deposits: 3.8% • Total public funds deposits of $658 million or 21.3% of total deposits • Top 10 deposit relationships total $912 million or 29.5% of total deposits – These relationships include commercial businesses, individuals and public entities (cities and school districts) with long - term stable relationships with West Bank

21 TX , 30.2% PA , 9.5% FL , 9.1% MI , 6.6% CO , 4.1% MA , 3.8% OH , 3.7% CA , 3.5% VA , 3.1% WA , 3.0% 16 Other , 23.4% Investment Portfolio ( Book Value) Investment Portfolio Detail Municipal Securities Geography & Ratings Note: Dollars in thousands; as of March 31, 2022 Securities Portfolio Collateralized Mortgage Obligations , 44.5% State and Poltical Subdivisions , 28.5% Mortgage Backed Securities , 21.0% Collateralized Loan Obligations , 4.4% Corporate Notes , 1.6% Book Fair Unrealized Book Value Value Gain /(Loss) TEY Yield Sector ($000) ($000) ($000) (%) (%) Collateralized Mortgage Obligations $382,410 $357,777 ($24,633) 1.64 1.64 State and Poltical Subdivisions 244,668 223,036 (21,632) 2.37 2.05 Mortgage Backed Securities 180,495 166,111 (14,384) 1.52 1.52 Collateralized Loan Obligations 37,907 37,707 (200) 1.77 1.77 Corporate Notes 13,750 13,281 (469) 3.26 3.26 Total Securities $859,230 $797,912 ($61,318) 1.86 1.76 • All of WTBA’s securities are accounted for using the available - for - sale method • 100% of the mortgage backed securities are composed of Freddie Mac, Fannie Mae or Ginnie Mae securities • 68.7% of WTBA’s securities are unpledged and unencumbered

22 Funding and Liquidity Note: Dollars in thousands; as of March 31, 2022 1) The Company has an interest rate swap with a notional amount of $20 million which converts the variable rate trust preferred securities coupon to a fixed rate of 4.81%; the swap matures in September 2026 • Holding company level cash of $4.6 million • Term loan of $40.0 million – Rate: Wall Street Journal Prime Rate less 100bps – Quarterly principal payments of $1.25 million beginning May 2023, with the remaining balance due February 2027 – Secured by 100% of West Bank’s stock – No penalty for prepayment of principal unless prepayment is pursuant to a refinancing with another institution • Trust preferred securities of $20.6 million – Rate: 3 month LIBOR + 305bps 1 – Maturity: July 18, 2033 • The ability of West Bank to pay dividends is governed by federal and state law • Under Iowa law, West Bank may generally pay dividends out of retained earnings • As of March 31, 2022, West Bank reported retained earnings of $179.5 million • West Bank would not declare a dividend that reduced bank level capital levels below the required level to be well - capitalized; as of March 31, 2022 that amount is $123.0 million Additional Sources of Funding Holding Company Detail West Bank Dividend Capacity Current Total Line Available Balance Amount Funding Source ($000) ($000) ($000) FHLB Advances $125,000 $673,148 $548,148 Excess FNMA and GNMA REMIC, FNMA and GNMA Pools -- 276,473 276,473 Fed Funds Line -- 67,000 67,000 Federal Reserve Bank -- 14,983 14,983 Subsidiary Term Loan 11,486 11,486 -- HoldCo Term Loan 40,000 40,000 -- Total Non-Depository Funding $176,486 $1,083,090 $906,604

23 Interest Rate Sensitivity Interest Rate Sensitivity Note: As of March 31, 2022 Net Interest Income Impact (%) Interest Rate Change Next 12 Months Next 24 Months +300 bp (1.26%) 0.64% +200 bp (0.79%) 0.97% +100 bp (0.46%) 0.63% 0 bp 0.00% 0.00% -100 bp 0.75% (1.35%) • WTBA views its interest rate position as neutral • Approximately 35% of WTBA’s loans mature or reprice within the next 12 months

24 10.68% 10.62% 10.27% 9.92% 9.81% 11.25% 10.96% 10.50% 11.13% 10.98% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 2018 2019 2020 2021 2022Q1 WTBA Tier 1 Capital Ratio (%) Bank Tier 1 Capital Ratio (%) 9.74% 9.53% 8.66% 8.49% 8.39% 10.26% 9.83% 8.86% 9.53% 9.39% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 2018 2019 2020 2021 2022Q1 WTBA Leverage Ratio (%) Bank Leverage Ratio (%) 11.50% 11.40% 11.45% 10.89% 10.72% 12.07% 11.74% 11.69% 12.10% 11.88% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 2018 2019 2020 2021 2022Q1 WTBA Total Capital Ratio (%) Bank Total Capital Ratio (%) 8.32% 8.56% 7.02% 7.44% 6.67% 9.65% 9.67% 7.87% 9.03% 8.22% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 2018 2019 2020 2021 2022Q1 WTBA TCE / TA (%) Bank TCE / TA (%) Historic Capital Ratios Tangible Common Equity / Tangible Assets Tier 1 Capital Ratio Tier 1 Leverage Ratio Total Risk Based Capital Ratio

25 Dollars in thousands As of Pro Forma $60 Million Consolidated March 31, 2022 Subordinated Debt Offering Total Assets $3,547,069 $3,605,719 Deposits 3,091,252 3,091,252 FHLB Advances 125,000 125,000 Long-term Debt 1 51,486 51,486 Trust Preferred 20,468 20,468 Subordinated Debt 2 0 58,650 Other Liabilities 22,383 22,383 Total Liabilities 3,310,589 3,369,239 Preferred Equity 0 0 Common Equity 236,480 236,480 Total Equity 236,480 236,480 Total Liabilities & Equity $3,547,069 $3,605,719 Consolidated Capital Ratios Tang. Common Equity / Tang. Assets 6.67% 6.56% Tier 1 Leverage Ratio 8.39% 8.27% CET1 Ratio 9.16% 9.12% Tier 1 RBC Ratio 9.81% 9.79% Total RBC Ratio 10.72% 12.65% Bank Level Capital Ratios Tier 1 Leverage Ratio 9.39% 10.85% CET1 Ratio 10.98% 12.85% Tier 1 RBC Ratio 10.98% 12.85% Total RBC Ratio 11.88% 13.75% CRE / Total Bank RBC 444% 382% ADC / Total Bank RBC 105% 90% Note: Assumes a $60.0 million subordinated debt offering, 1.50% underwriting fee, $450 thousand in fixed offering costs and 100% of net proceeds down - streamed to West Bank; assumes a 20% risk weighting on adjustments (1) Includes $40.0 million holding company term loan and $11.5 million subsidiary term loan (2) Presented net of estimated issuance costs Pro Forma Capital Ratios

26 Double Leverage and Interest Coverage Note: Assumes a $60.0 million subordinated debt offering, 1.50% underwriting fee, $450 thousand in fixed offering costs and 100% of net proceeds down - streamed to West Bank (1) Interest coverage calculation assumes $60.0 million gross offering with an assumed 5.00% coupon for illustrative purposes Dollars in thousands Calculation of Double Leverage For the Year Ended December 31, Quarter Ended March 31, 2022 2019 2020 2021 Reported Pro Forma Equity Investment in Subsidiaries $239,766 $251,100 $316,769 $292,080 $350,730 Consolidated Equity 211,820 223,695 260,328 236,480 236,480 Double Leverage Ratio 113.2% 112.3% 121.7% 123.5% 148.3% Calculation of Interest Coverage ¹ For the Year Ended December 31, Quarter Ended March 31, 2022 2019 2020 2021 Reported Pro Forma Deposit Interest $25,214 $11,256 $7,948 $2,151 $2,151 Subordinated Debt Interest - Proposed Offering -- -- -- -- 750 Trust Preferred Interest 1,023 1,016 1,008 248 248 Other Borrowing Interest 6,008 5,128 3,265 888 888 Total Interest Expense 32,245 17,400 12,221 3,287 4,037 Pre-Tax Income 35,742 41,381 62,908 16,305 15,555 Interest Coverage (including deposit expense) 2.1x 3.4x 6.1x 6.0x 4.9x Interest Coverage (excluding deposit expense) 6.1x 7.7x 15.7x 15.4x 9.2x

27 Summary Note: Financial data for the quarter ended March 31, 2022 (1) Presented on an FTE basis; see Appendix for “Reconciliation of Non - GAAP Financial Measures” Meaningfully Sized Commercial Bank with Strong Profitability With 1.51% ROAA, a 40.1% efficiency ratio ¹ and $3.5 billion in assets, WTBA is one of the most profitable, efficient and sizeable community banks in the U.S. Risk Management Focused Business Model Solid organic growth and pristine credit metrics drive strong profitability Highly Experienced Management Team With an average across the C - suite of well over 30 years in banking, WTBA’s team has a deep understanding of risk management policies and procedures Scalable Growth Strategy Proven and successful expansion centers around hiring the right people in the right markets, not on M&A strategies carrying inherently more risk Relationship Based Approach WTBA continues to place an emphasis on small and medium sized businesses and on local, low cost, core deposits

28 Appendix

29 Appendix Reconciliation of Non - GAAP Financial Measures (1) Computed on a tax - equivalent basis using a federal income tax rate of 21 percent, adjusted to reflect the effect of the nondeduc tible interest expense associated with owning tax - exempt securities and loans. Management believes the presentation of this non - GAAP measure provides supplemental useful information for proper understanding of the financial results, as it enhances the comparability of income arising from taxable and nontaxable sources (2) The efficiency ratio expresses noninterest expense as a percent of fully taxable equivalent net interest income and nonintere st income, excluding specific noninterest income and expenses. Management believes the presentation of this non - GAAP measure provides supplemental useful information for proper unde rstanding of the Company’s financial performance. It is a standard measure of comparison within the banking industry. A lower ratio is more desirable Note: Dollars in thousands For the Quarter Ended, 12/31/2018 12/31/2019 12/31/2020 12/31/2021 9/30/2021 12/31/2021 3/31/2022 Reconciliation of net interest income and annualized net interest margin on an FTE basis to GAAP: Net interest income (GAAP) $62,058 $66,430 $82,833 $95,059 $24,486 $24,602 $23,828 Tax-equivalent adjustment 1 1,528 834 707 1,202 306 397 329 Net interest income on an FTE basis (non-GAAP) $63,586 $67,264 $83,540 $96,261 $24,792 $24,999 $24,157 Average interest-earning assets $2,075,372 $2,277,461 $2,614,342 $3,152,138 $3,212,283 $3,309,625 $3,432,114 Net interest margin on an FTE basis (non-GAAP) 3.06% 2.95% 3.20% 3.05% 3.06% 3.00% 2.85% For the Quarter Ended, 12/31/2018 12/31/2019 12/31/2020 12/31/2021 9/30/2021 12/31/2021 3/31/2022 Reconciliation of efficiency ratio on an FTE basis to GAAP: Net interest income on an FTE basis $63,586 $67,264 $83,540 $96,261 $24,792 $24,999 $24,157 Noninterest income 7,752 8,318 9,602 9,729 2,401 2,348 2,389 Adjustment for (gains) losses, net 263 87 (77) (51) (11) 0 0 Adjustment for (gains) losses on disposal of premises and equipment, net 109 (307) 9 84 0 55 18 Adjusted income $71,710 $75,362 $93,074 $106,023 $27,182 $27,402 $26,564 Noninterest expense $34,992 $38,406 $39,054 $43,380 $10,712 $11,871 $10,662 Adjustment for write-down of premises ($333) $0 $0 $0 $0 $0 $0 Adjusted Expense $34,659 $38,406 $39,054 $43,380 $10,712 $11,871 $10,662 Efficiency ratio on an adjusted and FTE basis (non-GAAP) 2 48.3% 51.0% 42.0% 40.9% 39.4% 43.3% 40.1% For the Year Ended, For the Year Ended,

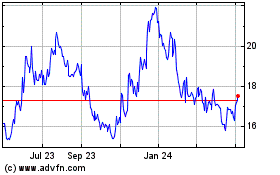

West Bancorporation (NASDAQ:WTBA)

Historical Stock Chart

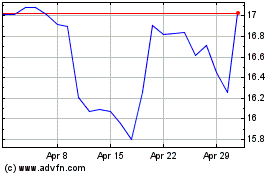

From Mar 2024 to Apr 2024

West Bancorporation (NASDAQ:WTBA)

Historical Stock Chart

From Apr 2023 to Apr 2024